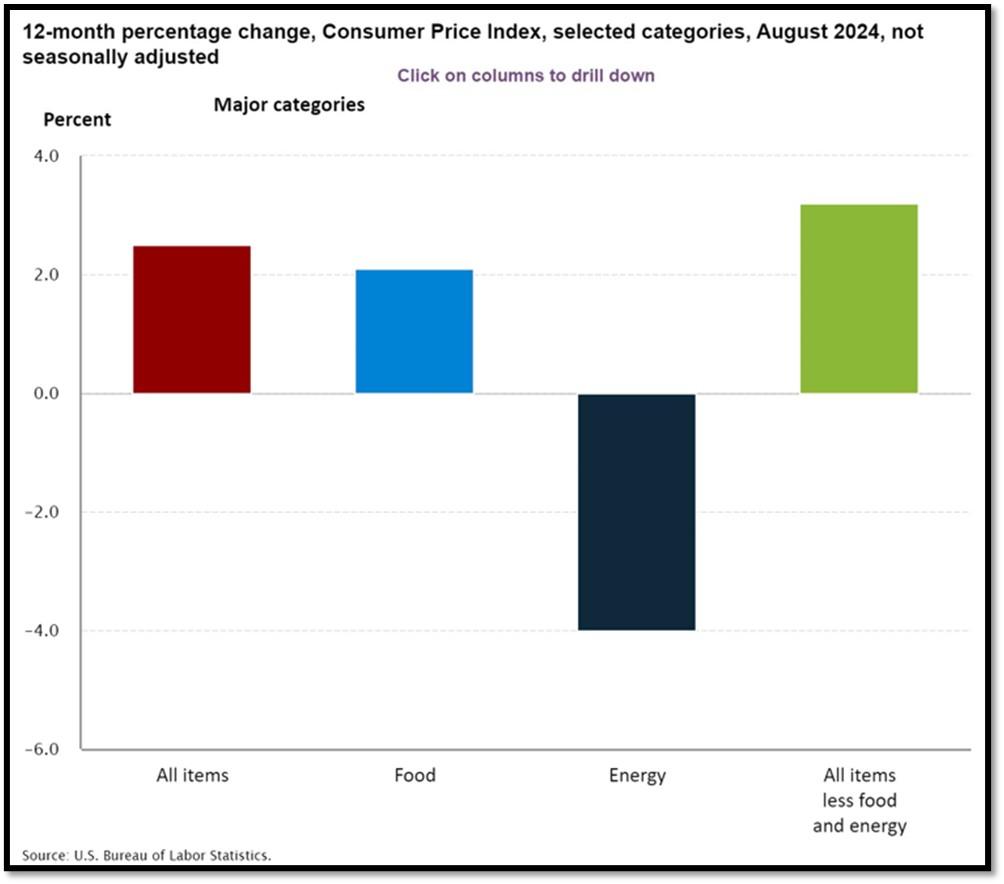

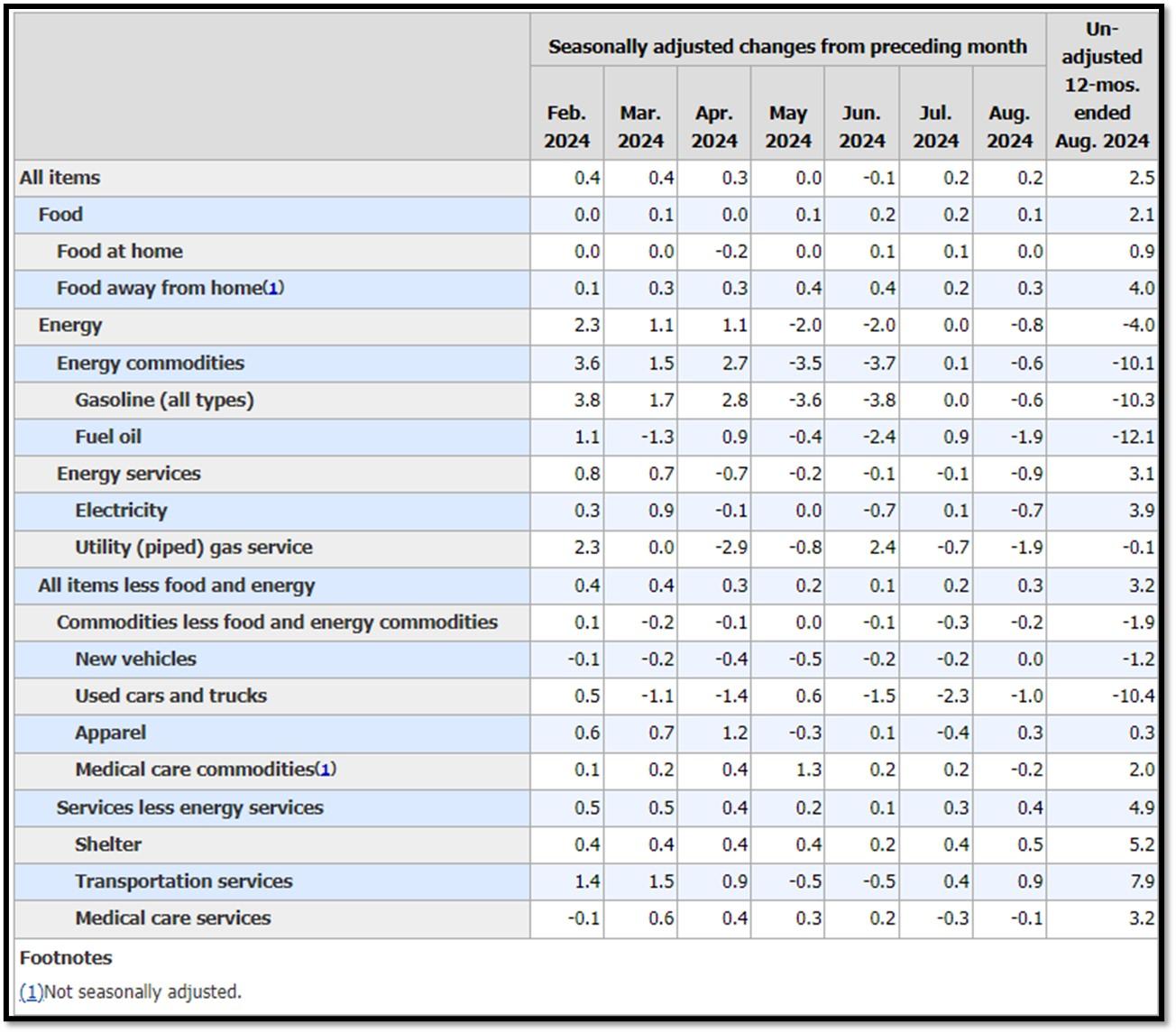

1. The most recent CPI report disappointed investors and traders for a couple of key reasons.

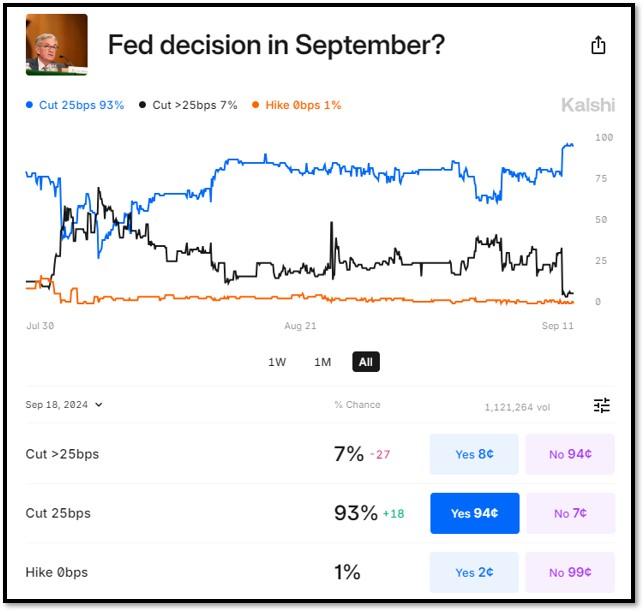

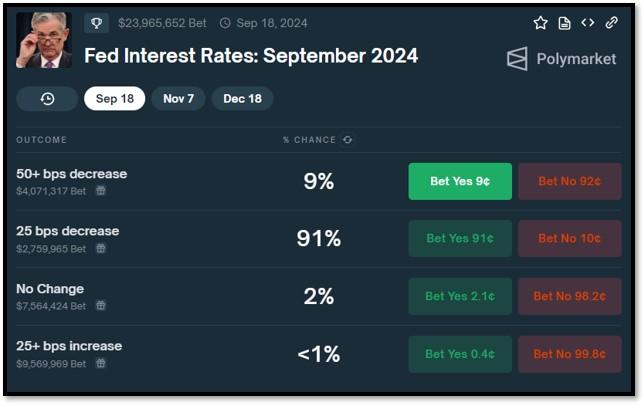

Although overall inflation has been moderating, with the year-over-year CPI increasing by 2.5%, the monthly core inflation (which excludes food and energy) rose 0.3%—slightly higher than expected. (See item 5K further below for additional information on the latest CPI data) This uptick in core inflation signals that inflationary pressures, particularly in housing and services, are stickier than anticipate. Investors were hoping for a more significant decline, which would have led the Federal Reserve to be more aggressive with rate cuts. Instead, the data dashed hopes of a larger 50-basis point rate cut, and markets now expect a smaller 25-basis point cut. The persistence of core inflation, coupled with rising energy prices, has led to uncertainty about how quickly inflation will cool down, leaving traders with less confidence in rapid monetary easing. The latest inflation data for August, combined with the “Not Extremely Bad” jobs data, provides insights into the current interest rate cut probabilities for September. Below are snapshots of the interest rate cut probabilities from Kalshi and Polymarket as of the time of writing. Kalshi and Polymarket are platforms that allow users to trade on the outcomes of real-world events, offering a unique way to participate in “event-driven” markets. While both platforms focus on prediction markets, they differ in structure, regulatory approach, and offerings. Click onto the reference link for additional information. REF: Kalshi, Polymarket

2. This week, I would like to shine a spotlight on Utility companies.

Under the current macro-economic setup with interest rates possibly coming down 2% to 3% by the first quarter of next year, utility companies perform well in a low-interest-rate environment for several key reasons:

- Attractive Dividends: With lower bond yields, utilities’ stable, high dividends appeal to income-seeking investors.

- Lower Borrowing Costs: Cheaper financing allows utilities to fund infrastructure projects and expansion more easily.

- Defensive Nature: Utilities provide essential services, ensuring steady cash flows, making them safe investments in uncertain times.

- Bond Proxies: Utilities offer predictable returns, making them a popular alternative to bonds when interest rates are low.

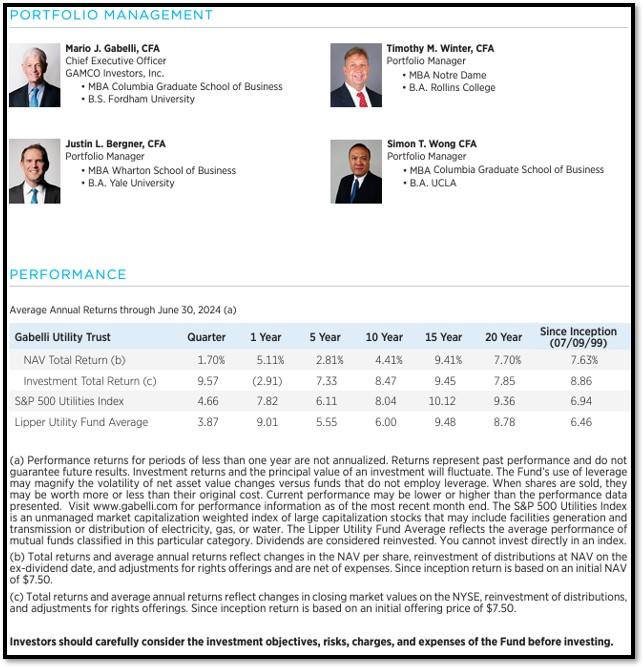

Lower rates boost utility stocks by reducing costs and increasing investor demand for stable income. One specific closed-end fund I have been using in our investment strategies is The Gabelli Utility Trust (ticker symbol: GUT). GUT’s primary objective is long-term growth of capital and income. Investments will be made primarily in foreign and domestic companies involved in providing products, services, or equipment for the generation or distribution of electricity, gas, water, and telecommunications services. Annual distribution rate for GUT is 10.71% according to Morningstar. As long as rates are coming down, I like GUT. Click onto the reference links for additional information. Below is a snapshot of the Gabelli Utility Trust’s Portfolio Management Team and its recent performance history. Reach out to me directly if you have any questions. REF: Morningstar, Gabelli_Website

With the current macro-economic backdrop, below are areas we currently favor:

- Fixed Income – Short-term (Low-Beta)

- Fixed Income – Adding Duration, preferred stocks & High Yield as Opportunistic Allocation (Low-Beta)

- Businesses that contribute to and benefit from AI & Automation (Market-Risk)

- Mid Cap Stocks, Small Cap Stocks & European Stocks (Market-Risk)

- Industrials (Market-Risk)

- Clean Energy / Solar / Utilities (Market-Risk)

- Healthcare & Biotechnology (Market-Risk)

- Gold (Market-Risk)

3. This week, ARK CEO/CIO, Cathie Wood was joined by ARK Research Associate Jozef Soja and Associate Portfolio Manager Nicholas Grous to discuss shifts in the AI market and where value can be captured.

Cathie also broke down surprising economic trends, from surging retail sales to a cooling housing market. Cathie further discussed fiscal policy, monetary policy, market signals, economic indicators, and innovation. One of the most profound pieces of information from this conversation is the example Jozef brought up about how Amazon realized $260 million in savings by using their Artificial Intelligence (A.I.) platform to update codes for some of their Java applications — a task that typically requires 4.5 thousand developer hours to accomplish. This is just the beginning of how companies are harnessing A.I. to increase productivity. Eventually, we expect much more revenue to be generated as A.I. tools enhancements achieve scale. Click onto picture below to access video. REF: ARK Invest, Video

4. World Watch

4A. To address the economic downturn and the challenges of an aging population, the Chinese government is working on raising the retirement age, which is currently one of the lowest globally.

The retirement age in China is 60 for men, 55 for female white-collar workers, and 50 for female blue-collar workers. The proposed changes are part of a broader effort to relieve pressure on the pension system, which is facing deficits as life expectancy continues to rise. China is preparing to raise retirement age by five years.

The increase in retirement age is seen as necessary to extend the working years of employees, allowing them to contribute to the economy and alleviate some of the strain on the pension system. China’s aging population is growing rapidly, with the number of people over 60 expected to exceed 400 million by 2035. This demographic shift is causing concern as the ratio of workers supporting retirees is projected to decrease sharply, placing further strain on social services. The reforms, expected to be implemented gradually by 2029, are intended to ensure that China’s workforce remains robust and that the pension system can remain sustainable. However, concerns have been raised about potential impacts on youth employment and the ability of older workers to continue in the workforce. Click onto pictures below to access videos. REF: WSJ

4B. If you’re interested in foldable smartphones, you’re not alone.

Foldable mobile phone technology made its commercial debut in 2019 with the release of Samsung’s Galaxy Fold. Since then, other manufacturers, including Google, Motorola, OnePlus, and most recently Huawei, have entered the foldable market. These devices use flexible OLED displays, which allow them to fold and unfold, offering a larger screen when opened and a compact form when closed. Unlike traditional glass screens, these displays are made from thin, flexible materials that can bend without breaking. The two main types of foldable phones are horizontally folding models (like a book) and vertically folding or flip-style designs. Recently, Huawei’s Mate X3 smartphone received over 2.7 million pre-orders, showcasing the growing demand for foldable devices. While there are ongoing rumors that Apple is developing its own foldable iPhone, as of now, no official product has been released. Click onto pictures below to access videos. REF: CNBC, Techradar

4C. The three companies recently added to the S&P 500 index, effective September 23, 2024, are Palantir Technologies, Dell Technologies, and Erie Indemnity.

These additions are part of a quarterly rebalancing to ensure that the index reflects the current market capitalization of large-cap companies.

- Palantir Technologies is known for its big data analytics and artificial intelligence (AI) capabilities, primarily serving government and defense sectors. Its stock surged following the announcement of its inclusion.

- Dell Technologies is a major player in IT infrastructure, benefiting from the increased demand for AI servers, which has boosted its stock performance significantly this year.

- Erie Indemnity is a lesser-known but high-performing property and casualty insurance firm, whose strong market presence has contributed to its inclusion.

These companies are replacing American Airlines, Etsy, and Bio-Rad Laboratories, which will be moved to other indices, such as the S&P MidCap 400 and the S&P SmallCap 60. Click onto picture below to access video. REF: S&P Global

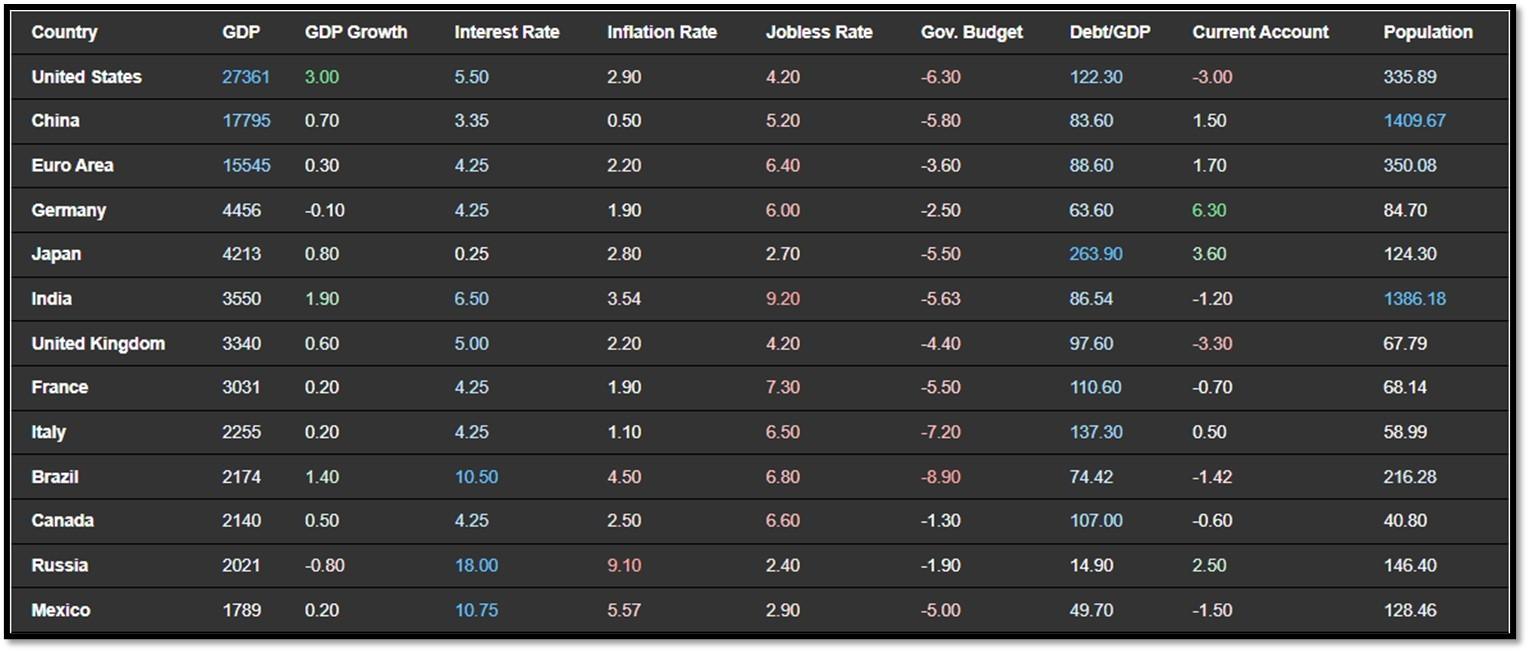

4D. Below is an updated snapshot of the current global state of economy according to TradingEconomics as of 9/9/2024. REF: TradingEconomics

- The unemployment rate in the United States eased to 4.2% in August of 2024 from the October 2021 high of 4.3% in the prior month, aligning with market expectations.

- The Brazilian GDP expanded by 1.4% from the previous quarter in the three months ending June of 2024, gaining traction following the upwardly revised 1% expansion in the first quarter, and well above the market consensus of a 0.9% increase.

- The Bank of Canada cut its key interest rate by 25bps to 4.25% in its September 2024 meeting, as expected, to mark the third consecutive 25bps slash after having left the hiking cycle’s terminal rate of 5% for 10 months.

- The unemployment rate in Canada rose to 6.6% in August of 2024 from 6.4% in the earlier month, the highest since October of 2021, and surpassing market expectations of 6.5%.

5. Quant & Technical Corner –

Below is a selection of quantitative & technical data we monitor on a regular basis to help gauge the overall financial market conditions and the investment environment.

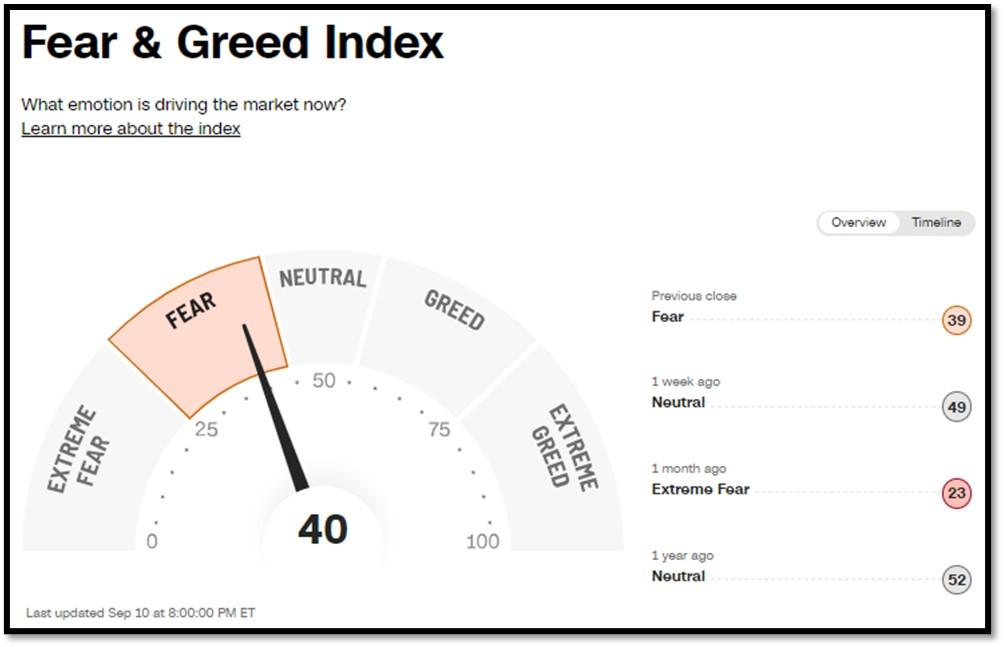

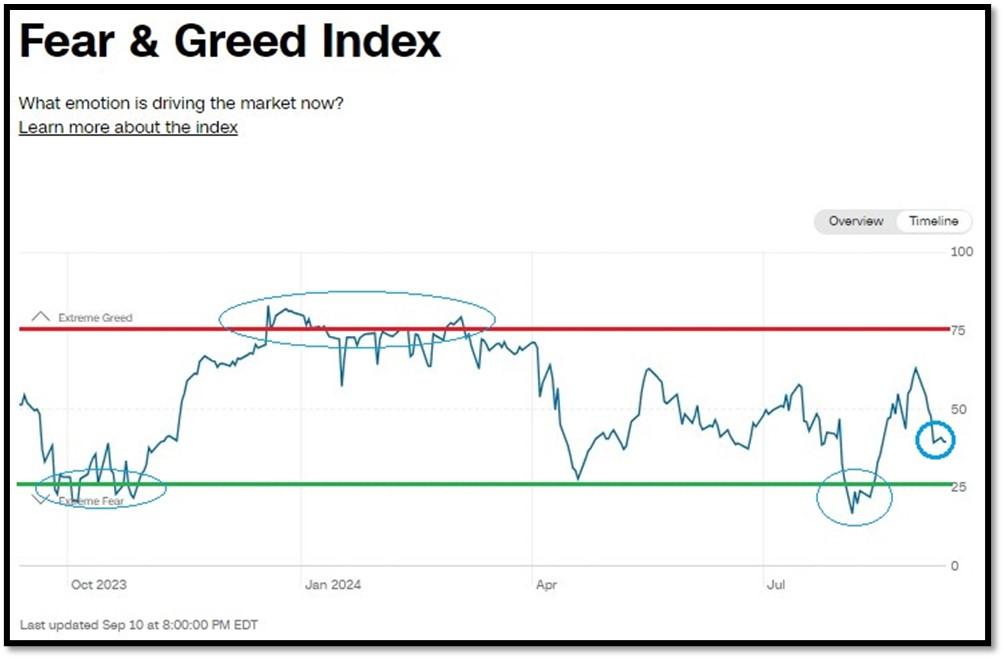

5A. Most recent read on the Fear & Greed Index with data as of 9/10/2024 – 8:00 PM-ET is 40 (Fear).

Last week’s data was 49 (Neutral) (1-100). CNNMoney’s Fear & Greed index looks at 7 indicators (Stock Price Momentum, Stock Price Strength, Stock Price Breadth, Put and Call Options, Junk Bond Demand, Market Volatility, and Safe Haven Demand). Keep in mind this is a contrarian indicator! REF: Fear&Greed via CNNMoney

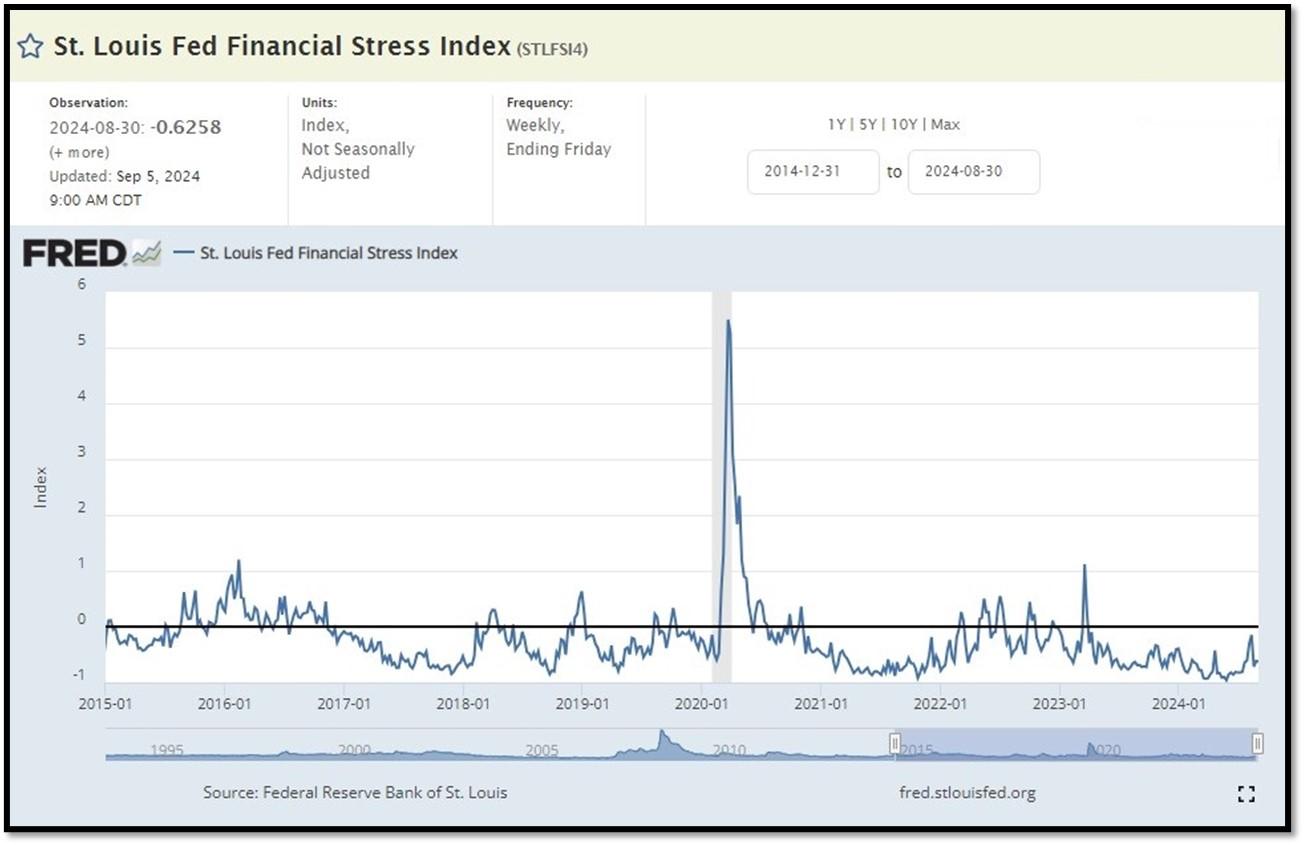

5B. St. Louis Fed Financial Stress Index’s

(STLFSI4) most recent read is at –0.6258 as of September 5, 2024. A big spike up from previous readings reflecting the recent turmoil in the banking sector. Previous week’s data was -0.6143. This weekly index is not seasonally adjusted. The STLFSI4 measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. REF: St. Louis Fed

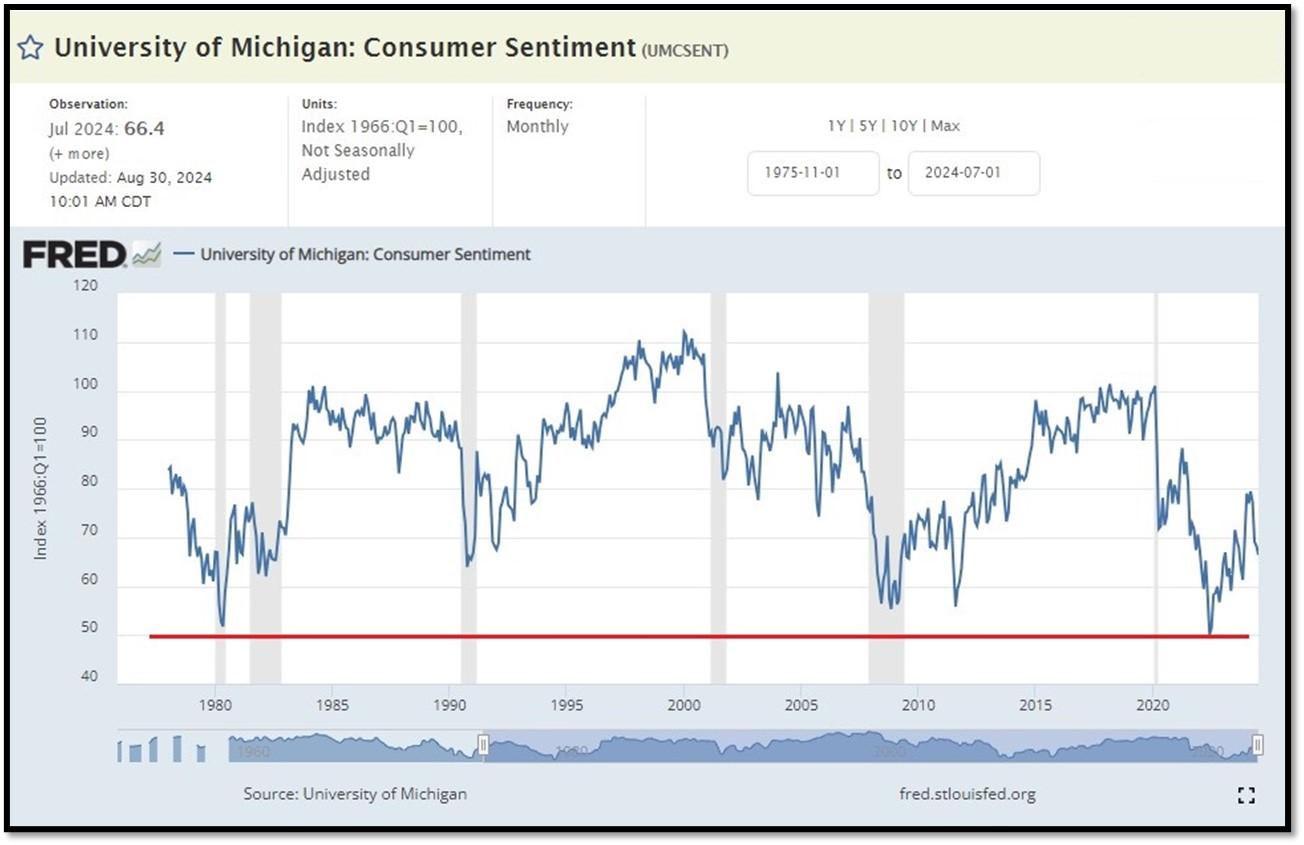

5C. University of Michigan, University of Michigan: Consumer Sentiment

For June [UMCSENT] at 66.4 (last month’s data at 68.2), retrieved from FRED, Federal Reserve Bank of St. Louis, August 30, 2024. Back in June 2022, Consumer Sentiment hit a low point going back to April 1980. REF: UofM

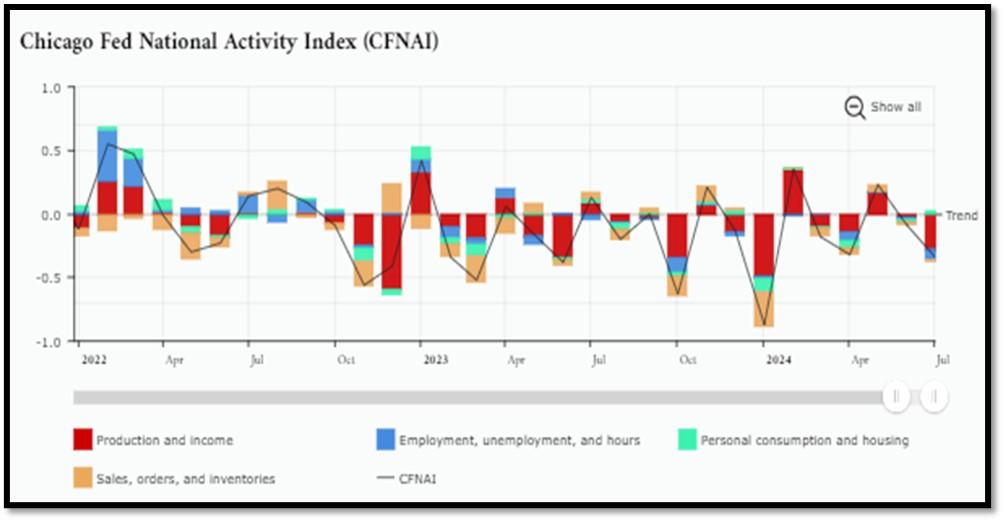

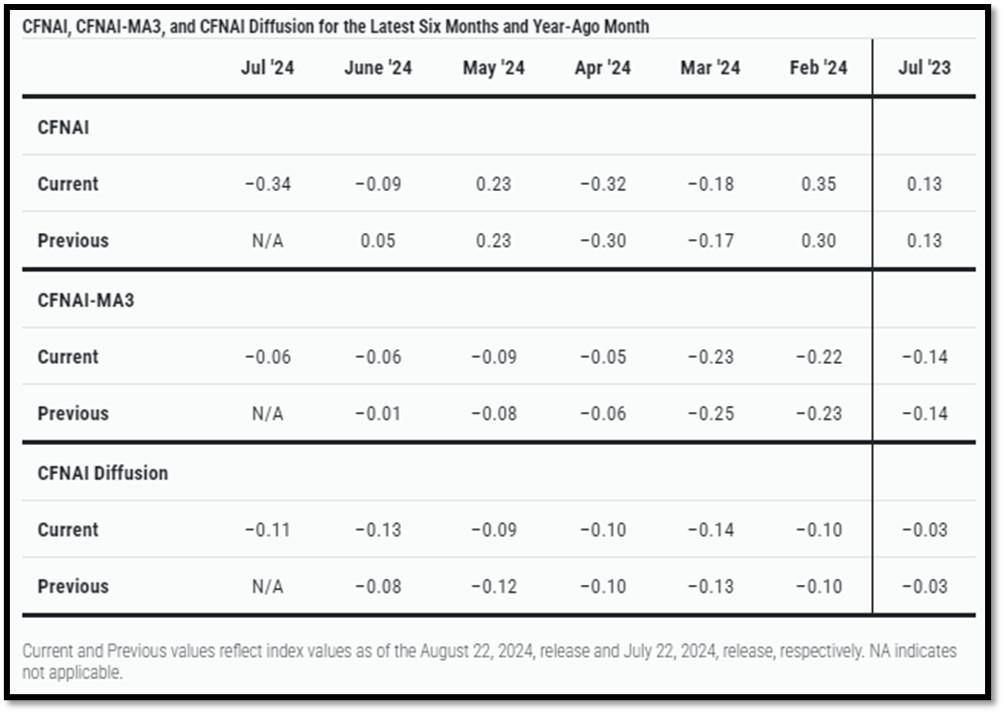

5D. The Chicago Fed National Activity Index (CFNAI)

decreased to –0.34 in July from –0.09 in June. Two of the four broad categories of indicators used to construct the index decreased from June, and three categories made negative contributions in July. The index’s three-month moving average, CFNAI-MA3, was unchanged at –0.06 in July. REF: ChicagoFed, July’s Report

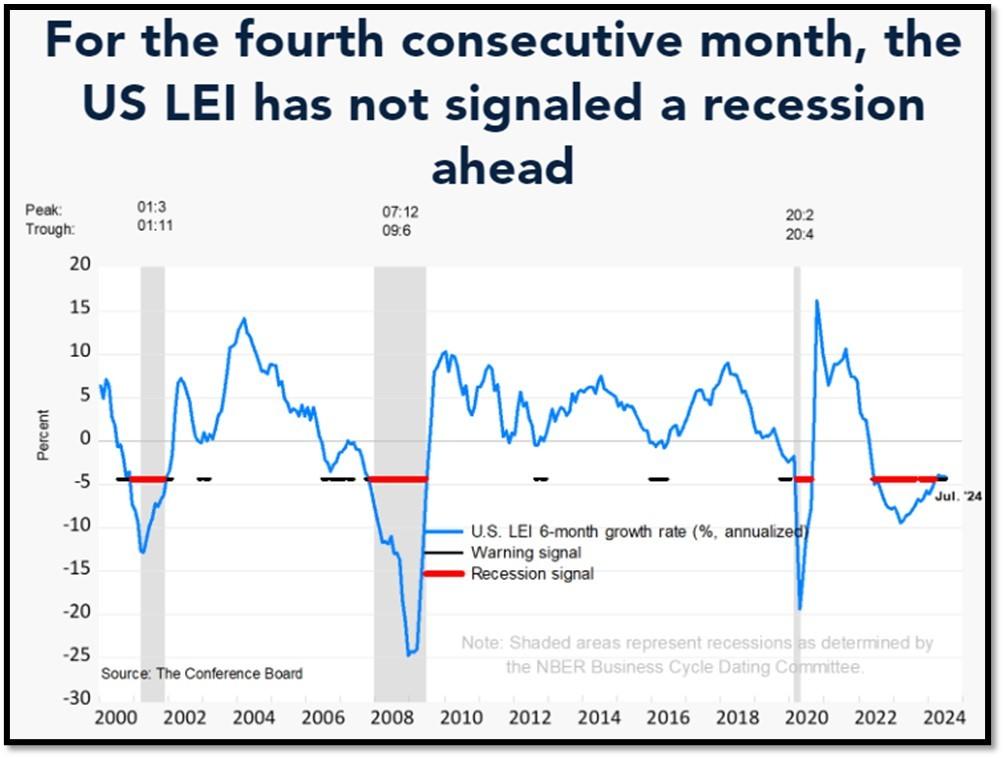

5E. (08/19/2024) The Conference Board Leading Economic Index (LEI)

For the U.S. fell by 0.6 percent in July 2024 to 100.4 (2016=100), following a decline of 0.2 percent in June. Over the six-month period ending in July 2024, the LEI fell by 2.1 percent, a smaller rate of decline than its −3.1 percent over the six-month period between July 2023 and January 2024. The composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component. The CEI is highly correlated with real GDP. The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. Shaded areas denote recession periods or economic contractions. The dates above the shaded areas show the chronology of peaks and troughs in the business cycle. The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers’ new orders for nondefense capital goods excluding aircraft orders; Building permits for new private housing units; S&P 500® Index of Stock Prices; Leading Credit Index™; Interest rate spread (10-year Treasury bonds less federal funds rate); Average consumer expectations for business conditions. REF: ConferenceBoard, LEI Report for July (Released on 8/30/2024)

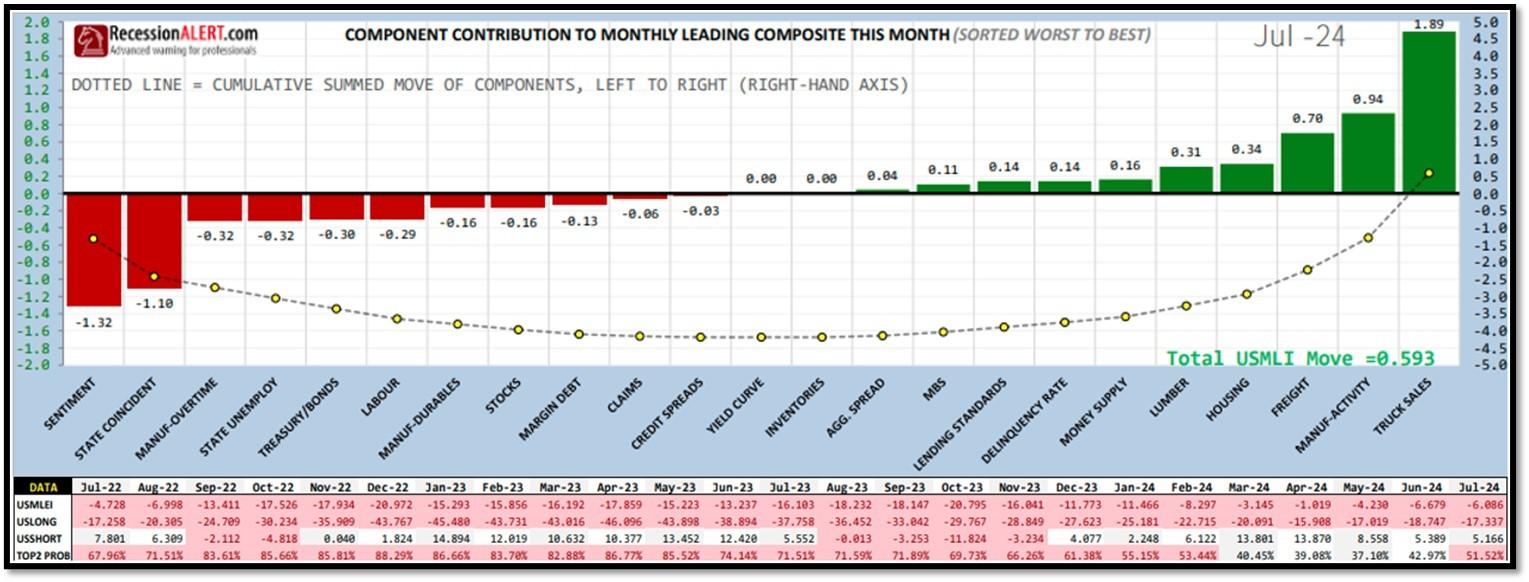

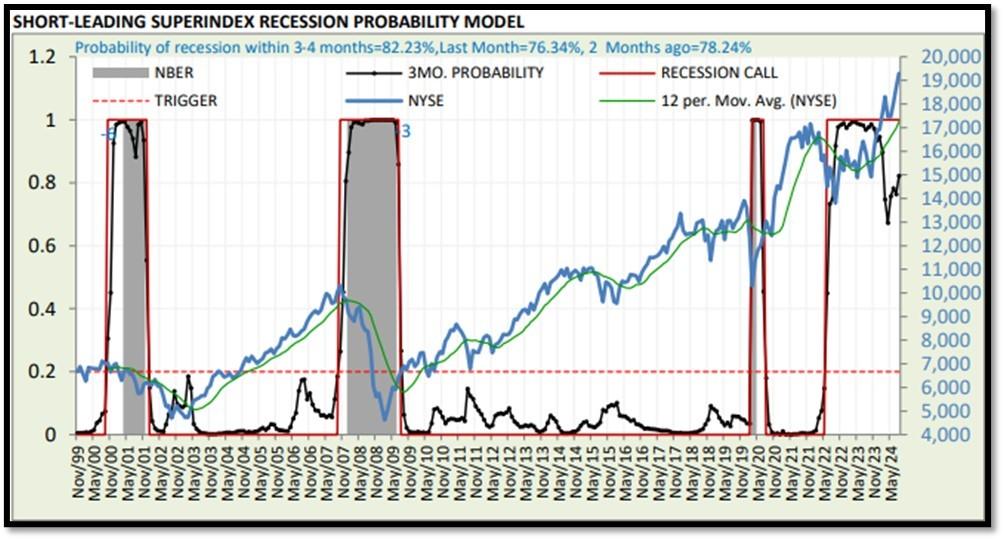

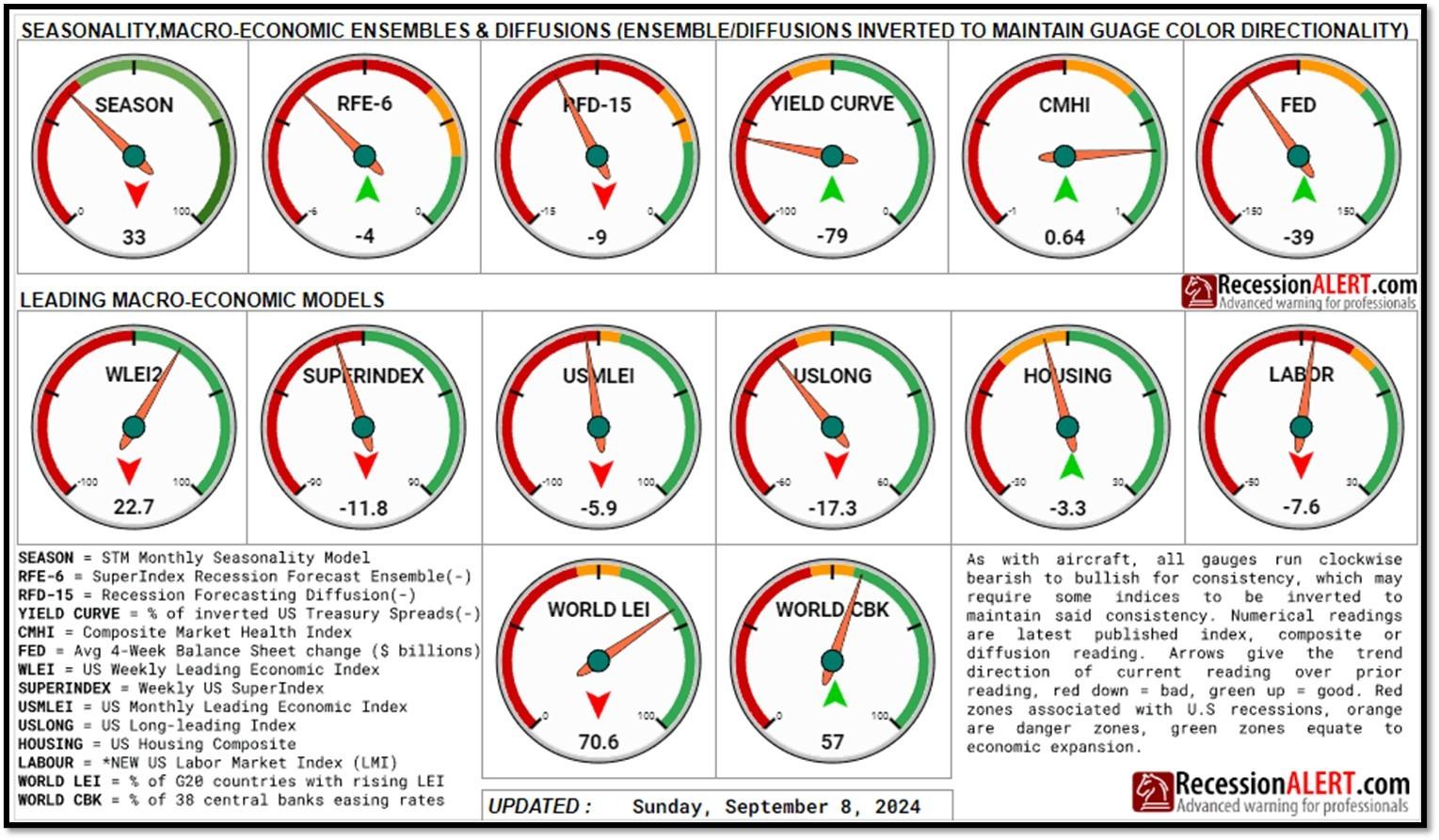

5F. Probability of U.S. falling into Recession within 3 to 4 months is currently at 82.23%

(with data as of 09/09/2024 – Next Report 09/23/2024) according to RecessionAlert Research. Last release’s data was at 81.23%. This report is updated every two weeks. REF: RecessionAlertResearch, Guages

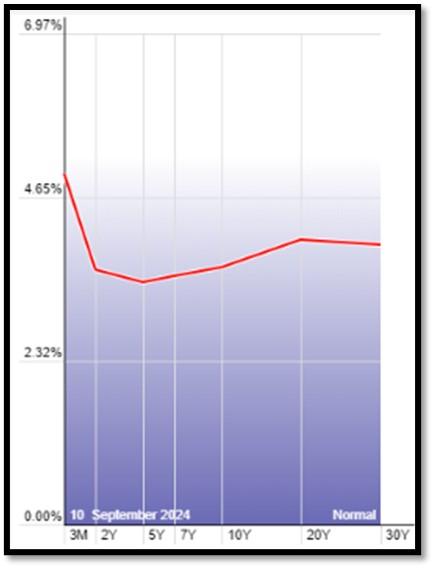

5G. Yield Curve as of 9/10/2024

is showing Inversion to Flattening. Spread on the 10-yr Treasury Yield (3.61%) minus yield on the 2-yr Treasury Yield (3.56%) is currently at 5 bps. REF: Stockcharts The yield curve—specifically, the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill—is a valuable forecasting tool. It is simple to use and significantly outperforms other financial and macroeconomic indicators in predicting recessions two to six quarters ahead. REF: NYFED

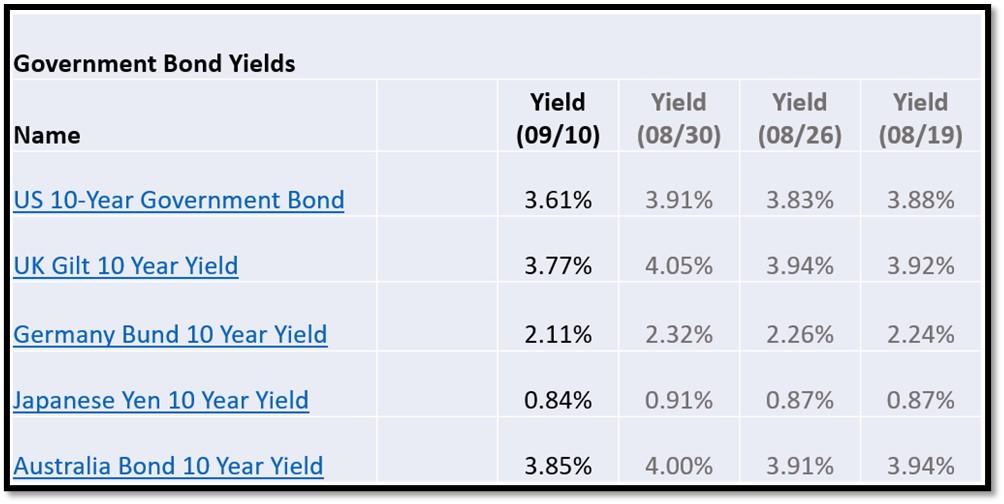

5H. Recent Yields in 10-Year Government Bonds.

The 10-Year US Treasury Yield… REF: StockCharts1, StockCharts2

The 10-year yield – Headed lower…

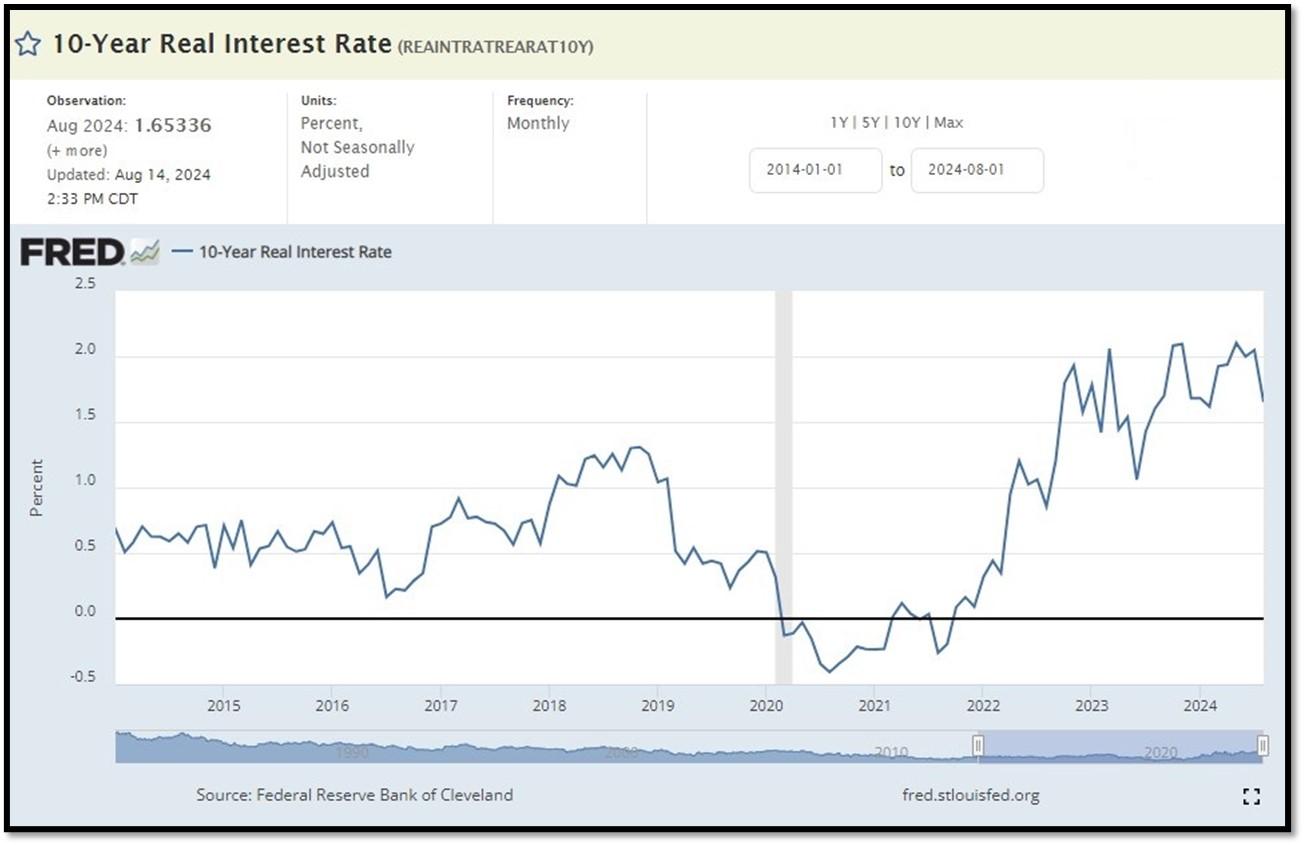

10-Year Real Interest Rate at 1.65% as of 8/14/24.

It continues to climb even when Fed stopped raising interest rates. REF: REAINTRATREARAT10Y

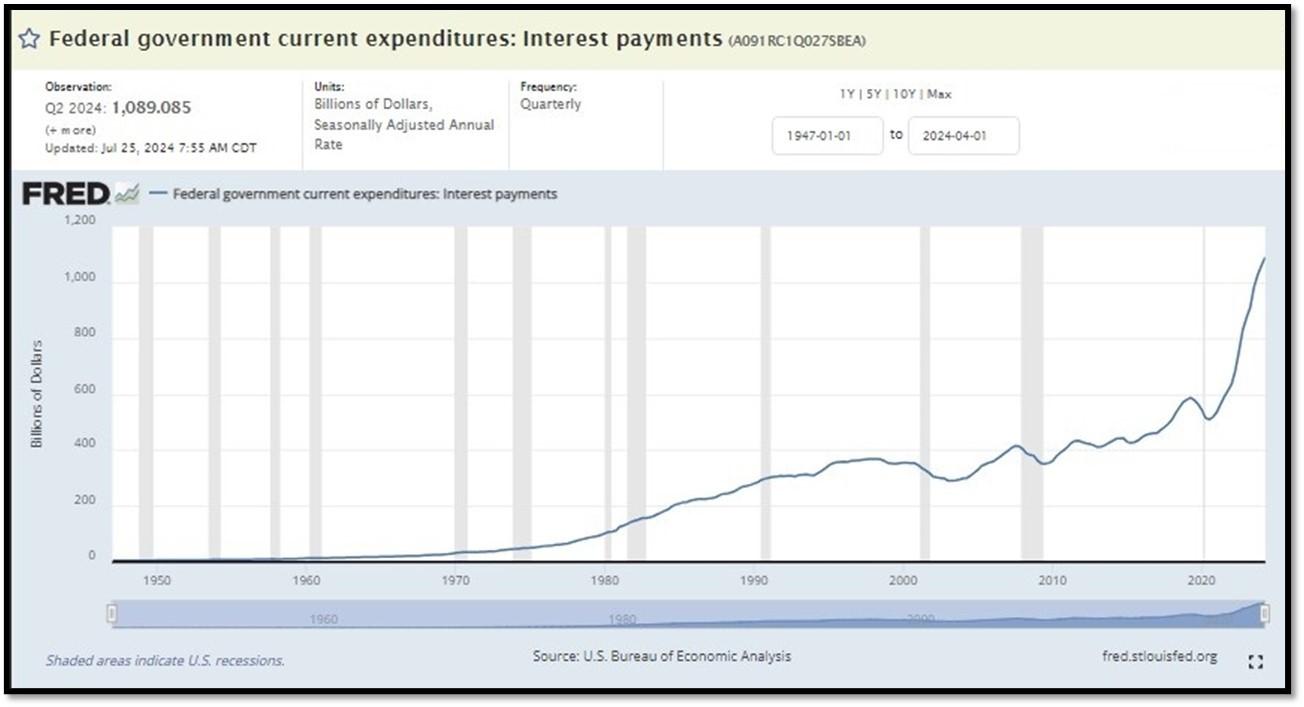

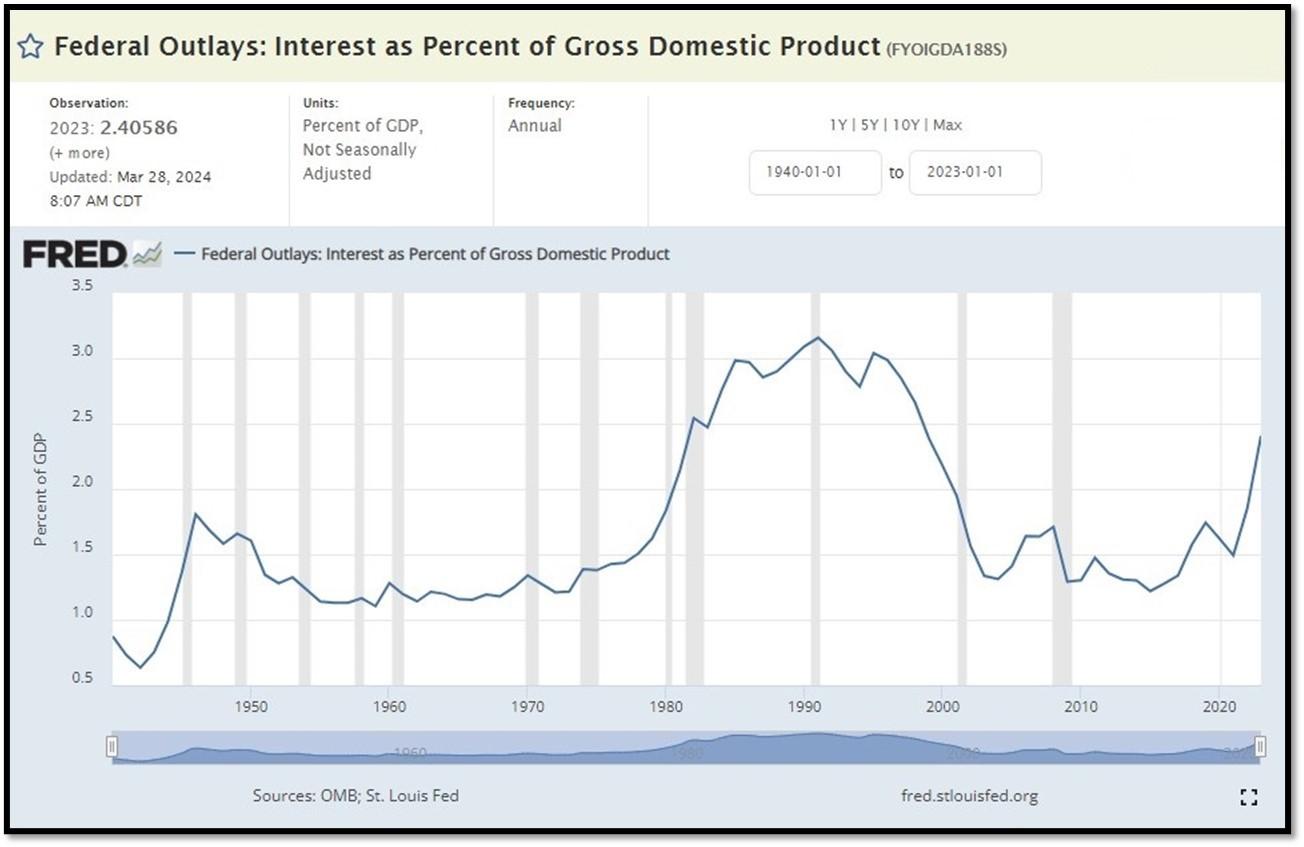

Federal government Interest Payments increased $30B to $1.089 T as of Q2-2024. REF: FRED-A091RC1Q027SBEA

Interest payments as a percentage of GDP increased from 1.84853 in 2022 to 2.40586 as of 3/28/24. REF: FRED-FYOIGDA188S

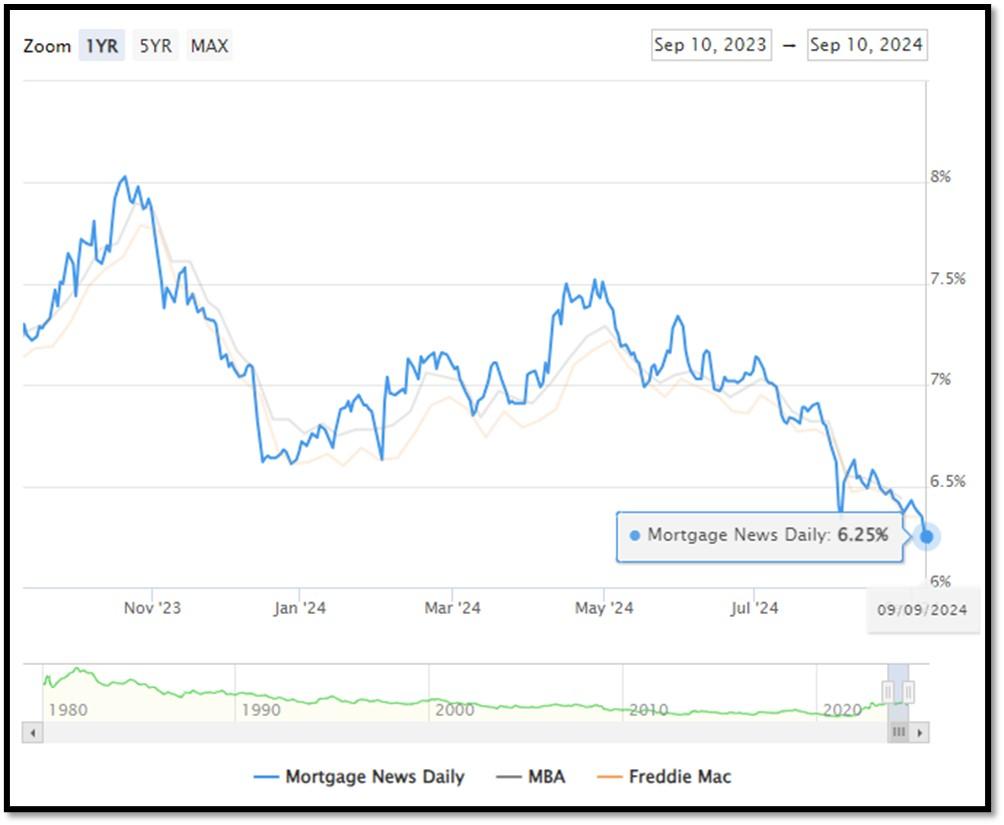

5I. (08/30/2024) Today’s National Average 30-Year Fixed Mortgage Rate is 6.43%

(All Time High was 8.03% on 10/19/23). Last week’s data was 6.43%. This rate is the average 30-year fixed mortgage rates from several different surveys including Mortgage News Daily (daily index), Freddie Mac (weekly survey), Mortgage Bankers Association (weekly survey) and FHFA (monthly survey). REF: MortgageNewsDaily, Today’s Average Rate

(08/12/24) Housing Affordability Index for June = 93.3 // May = 93.1 // April = 95.9 // March = 101.1 // February = 103.0. Data provided by Yardeni Research. REF: Yardeni

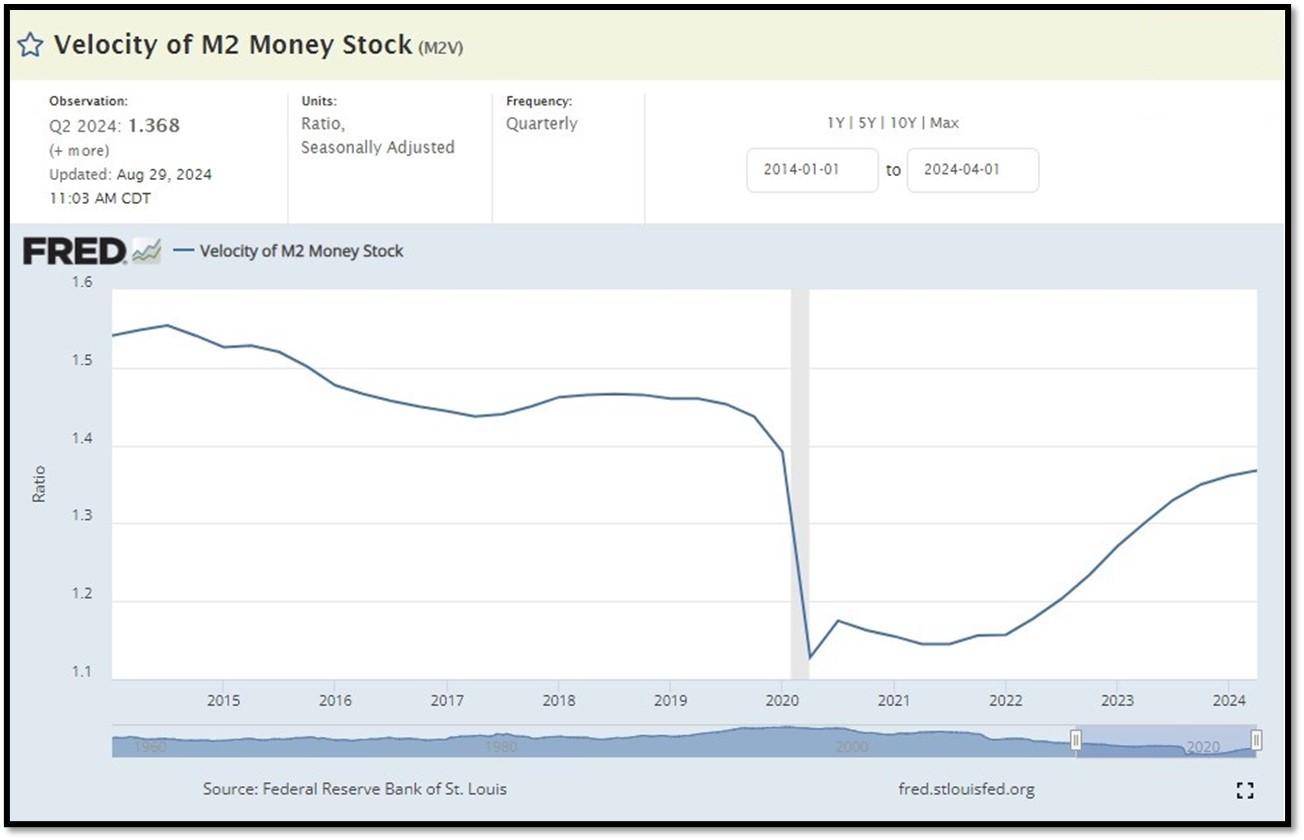

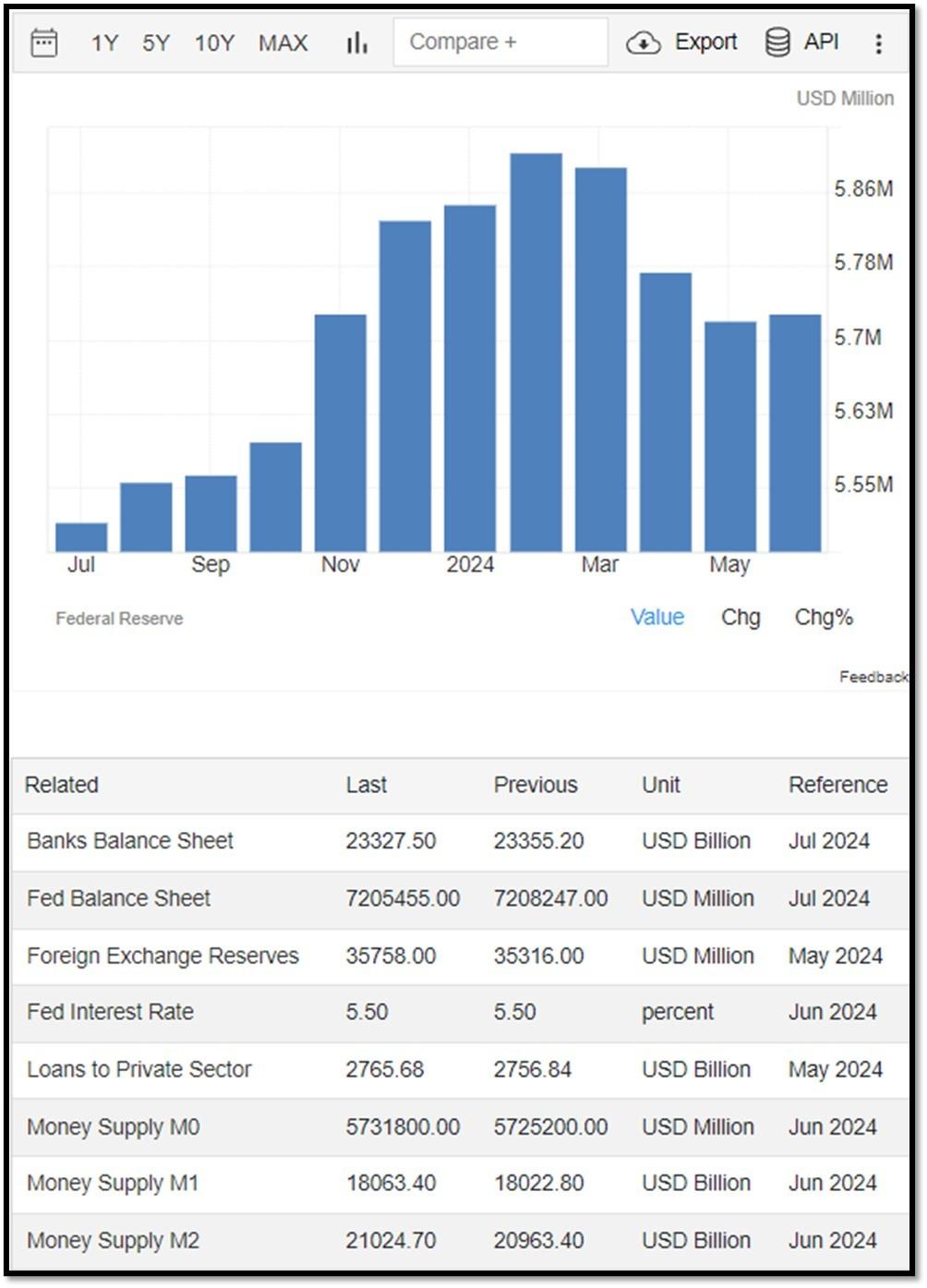

5J. Velocity of M2 Money Stock (M2V)

with current read at 1.368 as of (Q2-2024 updated 8/29/2024). Previous quarter’s data was 1.367. The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. Current Money Stock (M2) report can be viewed in the reference link. REF: St.LouisFed-M2V

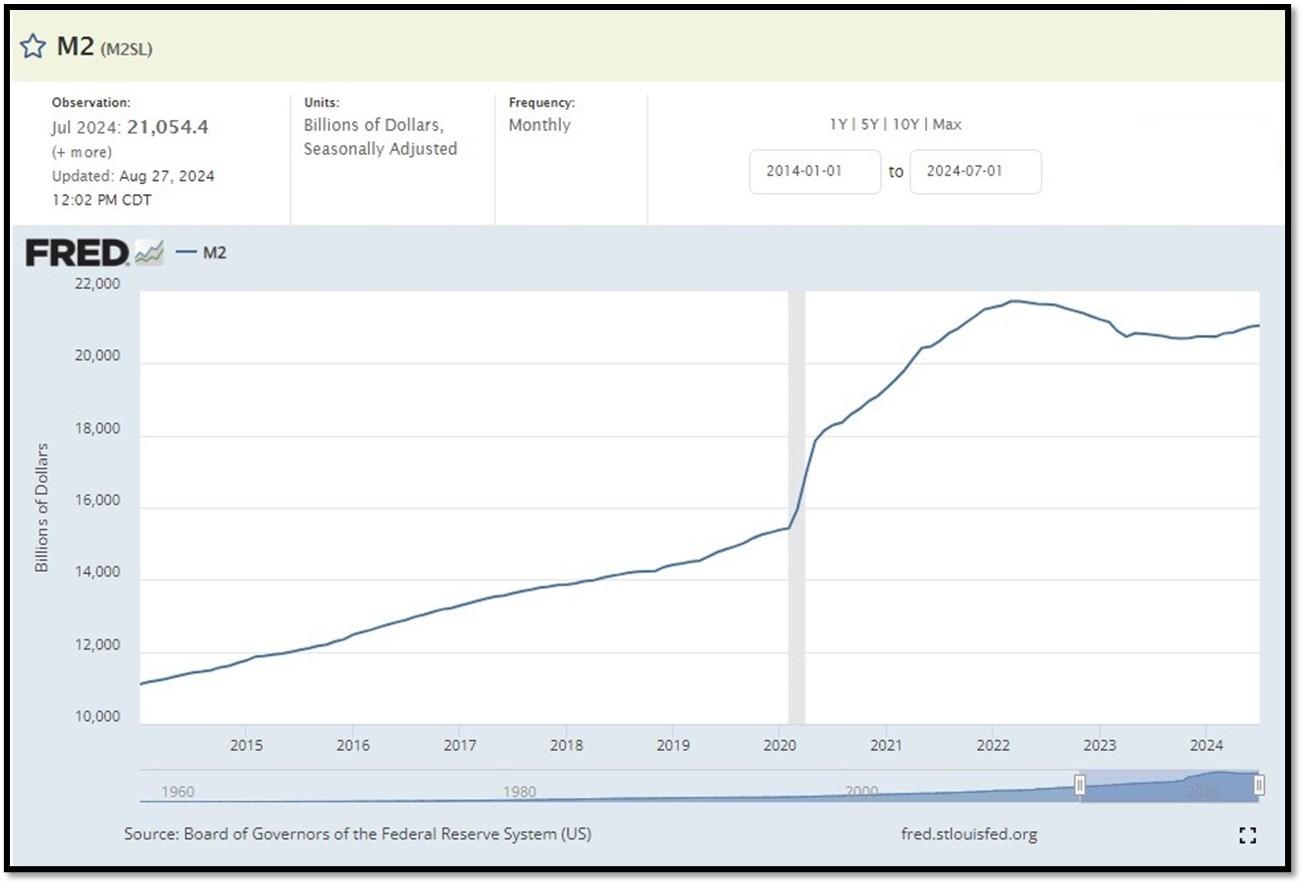

M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; Updated on August 27, 2024. REF: St.LouisFed-M2

Money Supply M0 in the United States increased to 5,731,800 USD Million in June from 5,725,200 USD Million in May of 2024. Money Supply M0 in the United States averaged 1,132,310.31 USD Million from 1959 until 2024, reaching an all time high of 6,413,100.00 USD Million in December of 2021 and a record low of 48,400.00 USD Million in February of 1961. REF: TradingEconomics, M0

5K. In August, the Consumer Price Index for All Urban Consumers rose 0.2 percent

, seasonally adjusted, and rose 2.5 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.3 percent in August (SA); up 3.2 percent over the year (NSA). September 2024 CPI data are scheduled to be released on October 10, 2024, at 8:30AM-ET. REF: BLS, BLS.GOV

5L. Technical Analysis of the S&P500 Index. Click onto reference links below for images.

- Short-term Chart: Bullish/Falling on 9/10/2024 – REF: Short-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Medium-term Chart: Bullish on 9/10/2024 – REF: Medium-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Market Timing Indicators – S&P500 Index as of 9/10/2024 – REF: S&P500 Charts (7 of them) by Joanne Klein’s Top 7 (Click Here to Access Updated Charts)

- A well-defined uptrend channel shown in green with S&P500 getting back on trend. REF: Stockcharts

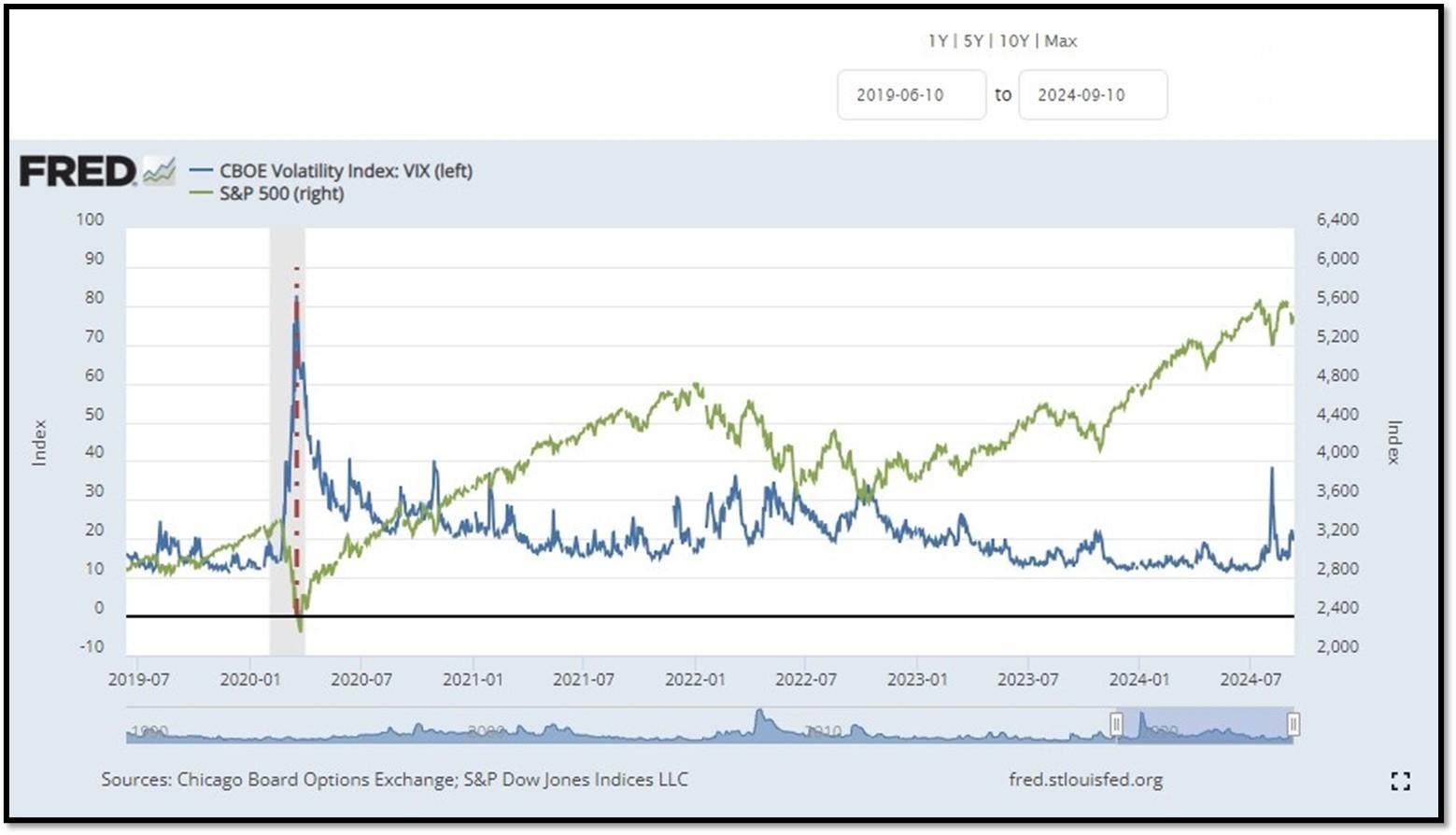

- S&P500 and CBOE Volatility Index (VIX) as of 9/10/2024. REF: FRED, Today’s Print

5M. Most recent read on the Crypto Fear & Greed Index with data as of 9/11/2024au is 37 (Fear). Last week’s data was 27 (Fear) (1-100). Fear & Greed Index – A Contrarian Data. The crypto market behavior is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction of seeing red numbers. With the Crypto Fear and Greed Index, the data try to help save investors from their own emotional overreactions. There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

Therefore, the program for this index analyzes the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means “Extreme Fear”, while 100 means “Extreme Greed”. REF: Alternative.me, Today’sReading

Bitcoin currently below the 150-day moving average. REF: Stockcharts

Len writes much of his own content, and also shares helpful content from other trusted providers like Turner Financial Group (TFG).

The material contained herein is intended as a general market commentary, solely for informational purposes and is not intended to make an offer or solicitation for the sale or purchase of any securities. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. This information is not intended as a specific offer of investment services by Dedicated Financial and Turner Financial Group, Inc.

Dedicated Financial and Turner Financial Group, Inc., do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Any hyperlinks in this document that connect to Web Sites maintained by third parties are provided for convenience only. Turner Financial Group, Inc. has not verified the accuracy of any information contained within the links and the provision of such links does not constitute a recommendation or endorsement of the company or the content by Dedicated Financial or Turner Financial Group, Inc. The prices/quotes/statistics referenced herein have been obtained from sources verified to be reliable for their accuracy or completeness and may be subject to change.

Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. The views and strategies described herein may not be suitable for all investors. To the extent referenced herein, real estate, hedge funds, and other private investments can present significant risks, including loss of the original amount invested. All indexes are unmanaged, and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Turner Financial Group, Inc. is an Investment Adviser registered with the United States Securities and Exchange Commission however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Additional information about Turner Financial Group, Inc. is also available at www.adviserinfo.sec.gov. Advisory services are only offered to clients or prospective clients where Turner Financial Group, Inc. and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Turner Financial Group, Inc. unless a client service agreement is in place.