As the U.S. presidential election approaches, the uncertainty surrounding the potential outcome and the policies of the next administration intensifies, creating anxiety among businesses and investors. This cycle of anticipation has always played a significant role in shaping economic sentiment every four years, but the stakes are especially high in the current climate. Several extraordinary events both within the United States and globally have amplified this uncertainty, making the 2024 election particularly consequential.

Domestic Economic and Political Climate

Domestically, the United States was wrestling with a variety of economic and political challenges. High inflation, increasing interest rates, and concerns over a possible recession have already created a fragile economic environment. Things are improving with inflation data showing signs of deceleration and interest rates are finally heading down1. Businesses are closely watching the election because different candidates propose contrasting approaches to handling these economic pressures. For instance, a candidate focused on reducing inflation through austerity measures might deter government spending on infrastructure or social programs, affecting sectors like construction, healthcare, and education. Conversely, a candidate prioritizing government stimulus could encourage investments in green energy or technology sectors but might also contribute to a rising federal deficit.

The U.S. political landscape is also more polarized than ever2. Issues such as immigration, tax policy, healthcare, and climate change policy are contentious. The election of a candidate with a more protectionist, inward-looking agenda could lead to a shift in trade policies, affecting industries reliant on global supply chains. On the other hand, a president advocating for more global engagement and free trade could have the opposite effect, opening new markets for U.S. companies but also increasing competition.

International Events and Global Markets

Globally, events such as the ongoing war in Ukraine, escalating tensions with China, and geopolitical instability in the Middle East add another layer of uncertainty for businesses and investors. These factors contribute to volatility in global supply chains and energy markets. The next U.S. president will have a critical role in shaping the country’s foreign policy, which will inevitably influence global markets. Investors and multinational corporations, in particular, are concerned about potential trade wars, new sanctions, or shifts in foreign alliances.

Additionally, the global economy is facing its own set of challenges, such as climate change and technological disruption, both of which require decisive leadership. How the U.S. responds to these global issues—whether through regulations, incentives, or innovation—will have long-term consequences on industries ranging from energy to technology3.

Hypothetical Investment-Related Implications

Weighing the focus both candidates have shared on various policies, what is the potential impact on the investment landscape and our economy? We will review how the policies of the Presidential candidates could shape the following topics.

Energy & Infrastructure – Support for fossil fuels would benefit oil, gas, and coal companies through deregulation and will likely lower the price of fuel, while renewable energy might struggle due to reduced government backing. Increased spending on traditional infrastructure (roads, bridges) could boost construction and industrial sectors. Expanding investments in renewable energy, electric vehicles, and green infrastructure, could boost sectors like clean technology and construction, while imposing stricter regulations on fossil fuels4. Implications: Green Energy sector should do well.

Healthcare – Private healthcare providers might benefit from deregulation, but pharmaceutical companies could face mixed results with potential drug pricing reforms. Support of public healthcare expansion and drug price regulation would likely benefit healthcare tech and telemedicine but pressuring traditional healthcare and pharmaceuticals5. Implications: The life-science / healthcare sector will benefit.

Tax Policy – Raising taxes on corporations and the wealthy may impact profits in large businesses, though sectors like clean energy and R&D could gain from tax incentives6. Implications: Possibly the technology and healthcare sectors will benefit.

Corporate tax cuts and reduced regulations, particularly in energy, finance, and healthcare, would boost corporate profits, making these sectors attractive. However, it could increase deficits and long-term inflation risks.

International Trade – A more diplomatic approach to trade could stabilize global markets, benefiting industries with complex supply chains. A protectionist trade stance would favor U.S. manufacturing, but sectors reliant on global supply chains, like tech and consumer goods, could face higher costs7.

Financial Regulation – Tighter regulations on Wall Street may lead to more scrutiny of banks but offer opportunities for fintech and compliance companies. Implications: Possibly negative for big banks and positive for fintech.

Low Interest Rates – Low interest rates will likely benefit benefits sectors like real estate and construction, but possibly add to inflation risks.

Defense – Higher military spending would benefit defense contractors, military technology, and cyber-security companies.

Immigration – Strict immigration policies could lead to labor shortages, potentially impacting sectors like agriculture and hospitality.

Technology & Data – Tougher regulations on big tech, particularly around antitrust and data privacy, could hinder growth for giants like Amazon or Meta, while boosting sectors like cybersecurity8. Implications: The technology and cyber-security sectors will benefit. While regulation would likely remain moderate, antitrust actions could create risks for large tech firms.

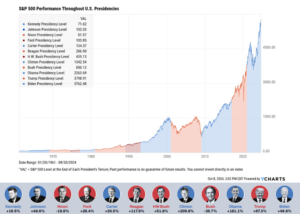

Reviewing Previous Elections for Past 20 Years:

2020 Election: Biden vs. Trump (Joe Biden wins)

Stock Market Reaction: In the weeks following Biden’s victory, the market rallied, fueled by optimism around the recovery from the COVID-19 pandemic, vaccine rollouts, and the potential for economic stimulus. The S&P 500 rose nearly 7% in November 2020, marking its best post-election performance in decades. Markets also liked the idea of divided government (gridlock).

2016 Election: Trump vs. Clinton (Donald Trump wins)

Stock Market Reaction: After Trump’s victory, the stock market surged, driven by expectations of corporate tax cuts, deregulation, and increased infrastructure spending. The S&P 500 rose approximately 5% by the end of November 2016, and the rally continued into 2017.

2012 Election: Obama vs. Romney (Barack Obama wins re-election)

Stock Market Reaction: Following Obama’s re-election, the market initially dipped due to concerns about the “fiscal cliff” (a combination of expiring tax cuts and across-the-board government spending cuts). From November 7, 2012, the S&P500 returned upwards of 2.27% to finish the year.

2008 Election: Obama vs. McCain (Barack Obama wins)

Stock Market Reaction: The 2008 election occurred during the height of the global financial crisis (GFC). Following Obama’s victory, the market continued to decline sharply due to the broader economic turmoil. The S&P 500 fell around 5% in the two days following the election, but this was part of a broader downturn in global markets.

2004 Election: Bush vs. Kerry (George W. Bush wins re-election)

Stock Market Reaction: After Bush’s victory, the stock market rallied with the S&P 500 rising over 4.3% to finish the year. The market was largely driven by relief over the continuation of Bush’s tax policies and national security strategy.

Over the past 20 years, both the stock and bond markets have generally performed well in the period following presidential elections, with one major exception: 2008, during the Great Financial Crisis. In most election years, market participants have responded positively to the resolution of uncertainty, as investors and businesses are able to better assess future policies and economic conditions10.

REFERENCES:

- Standford Law School – The Big Tech Antitrust Paradox – February, 2024.