Make Sure You Don’t Pay More Than Is Needed

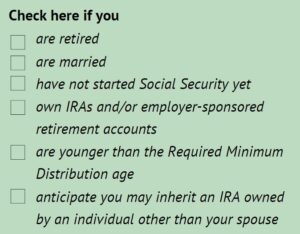

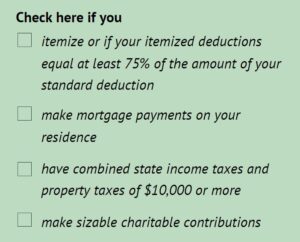

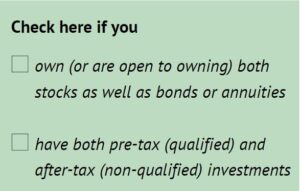

It is always advisable to reduce your tax obligation using all the tax strategies available to you. Below are the most common strategies available to individuals who are retired or are soon to be retired. After each section you will see boxes to check to help you assess if the strategy that was described may apply to you. The more boxes you check related to the strategy the greater the indication is that you may be able to benefit from it.

Roth Conversions of Tax Qualified Accounts

(IRAs, 401ks and other employer-sponsored plans)

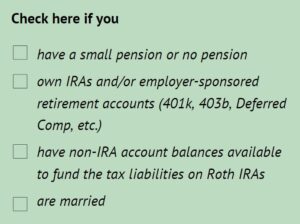

The potential tax benefit of tax-qualified accounts is to pay taxes on income at a later date, when you take distributions and may be in a lower tax bracket. However, with the prospect of tax rates being increased in the future, it is possible you may be deferring taxes on your tax-deferred account to a higher tax bracket. If you are no longer receiving employment income, it is highly unlikely you will have less taxable income in the future. In fact, your income will be higher if you have not yet begun your Social Security Benefits and your Required Minimum Distributions from your tax-qualified accounts. If this describes you, you might have higher income and be in a higher bracket in the future.

To see if you may be able to benefit from a Roth Conversion strategy, first determine what tax bracket you will be in when you receive your full “Retirement Base Income” (pensions, Social Security and Required Minimum Distributions from your Tax-Qualified accounts), then compare this to your current tax bracket. If you expect to be in a higher tax bracket in the

future, convert your IRAs to Roth IRAs to the point that your taxable income is at the top of the highest current tax bracket that is less than what you expect your future tax bracket will be, for your full “Retirement Base Income.” Just be careful your income does not exceed the Medicare Income-Related Monthly Adjustment Amount (IRMAA) limit or you will be subject to higher premiums for your Medicare coverages.

Income Tax Deductions

The Tax Cuts and Job Act of 2017 increased the standard deduction and made it more difficult for taxpayers to itemize, which you must do for your charitable contribution to have a tax benefit. Although your primary reason for making a donation might not be to qualify for a tax deduction, it is fiscally wise to structure donations to take advantage of deductions to reduce your tax liability. There are two strategies you may be able to take advantage of:

Consolidate the charitable contributions you ordinarily make over a two-year period into a single calendar year if that would increase your deductions enough to allow you to itemize.

Satisfy your Required Minimum Distributions (RMDs) by making Charitable Qualified Distributions payable directly from your IRA to charity. Because the distribution is not taxable you will not be able to claim it as a deduction. Eliminating reportable income from an IRA distribution has the same tax benefit as claiming a deduction.

Tax Types–Ordinary Income and Capital Gain

The type of investments you have will determine if they will be taxed at the higher ordinary income or lower long-term capital gains tax rates. Interest earned by banking instruments, bonds and annuities are taxed as ordinary income while stocks held for more than 1 year are taxed as long-term capital gains. Stocks have a preferred tax treatment, but tax considerations should not be the determining factor in an investment decision, and you should not over-allocate to stocks above your appropriate risk level.

Most investors have a diversified portfolio with some investments taxed at ordinary income and others at capital gain tax rates. Most investors also have investments in tax-qualified IRA or 401k accounts and non-qualified after-tax accounts. All tax-qualified investments are taxed at ordinary income rates and all banking instruments, bonds and annuities are taxed at ordinary tax rates. In order for an investment to receive the more favorable capital gains treatment an equity holding (typically a stock) must be held in an after-tax account. Any other combination of tax qualified accounts and non-equity investments will be taxed as ordinary income. When consistent with your overall investment objectives (that account for risk tolerance, as well as growth and liquidity needs) allocate annuities and bond holdings in qualified IRA accounts and stocks in non-IRA accounts.

Taxes on Social Security

The type of investments you have will determine if they will be taxed at the higher ordinary income or lower capital gains tax rates. Interest earned by banking instruments, bonds and annuities are taxed as ordinary income while stocks held for more than 1 year are taxed as long-term capital gains. Stocks have a preferred tax treatment, but tax considerations should not be the determining factor in an investment decision, and you should not over-allocate to stocks above your appropriate risk level.

The amount of your Social Security benefit that is taxed is determined by your total income, including the Social Security payments themselves, employment and investment income, and distributions from IRAs and employer-sponsored retirement accounts. Depending on the amount of total income, taxable income may trigger additional taxes on Social Security payments. For example, a Required Minimum Distribution will be taxed and could also result in Social Security income to be taxed – in effect creating a double tax. As you are able, avoid your distributions from your tax-qualified accounts from creating taxes on your Social Security benefits. If you have IRAs and tax-qualified accounts through current or previous employment (such as 401k’s) you might benefit from converting these accounts to a Roth IRA (regardless of your age and whether you have earned income) and eliminating Required Minimum Distributions which could cause your Social Security benefits to be taxed.

The amount of your Social Security benefit that is taxed is determined by your total income, including the Social Security payments themselves, employment and investment income, and distributions from IRAs and employer-sponsored retirement accounts. Depending on the amount of total income, taxable income may trigger additional taxes on Social Security payments. For example, a Required Minimum Distribution will be taxed and could also result in Social Security income to be taxed – in effect creating a double tax. As you are able, avoid your distributions from your tax-qualified accounts from creating taxes on your Social Security benefits. If you have IRAs and tax-qualified accounts through current or previous employment (such as 401k’s) you might benefit from converting these accounts to a Roth IRA (regardless of your age and whether you have earned income) and eliminating Required Minimum Distributions which could cause your Social Security benefits to be taxed.

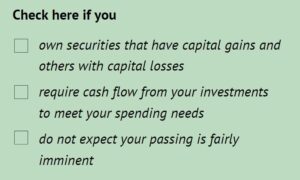

Investment Tax Harvesting

Selling securities that have lost money to offset taxes on appreciated assets is a wise strategy for investors to structure more productive and tax-efficient portfolios regardless of their age. However, the stage of life retirees are in may create a reason to sell or not sell a security that has increased in value.

Investors may have a greater need to sell their investments to generate cash flow to supplement their income and cover their expenses after they retired than when they were employed. It may not be possible to avoid capital gains to meet their spending needs. Conversely, the current tax law allows for a “step up in cost basis” of assets upon the passing of the owner, meaning those who inherit the asset do not have to pay capital gains on the appreciation of the asset from the time it was purchased to the time of the death of the owner, but only from the time of the passing of the owner to the time they sell it. This provision in the tax law would be a reason perhaps not to sell appreciated securities.

Investors may have a greater need to sell their investments to generate cash flow to supplement their income and cover their expenses after they retired than when they were employed. It may not be possible to avoid capital gains to meet their spending needs. Conversely, the current tax law allows for a “step up in cost basis” of assets upon the passing of the owner, meaning those who inherit the asset do not have to pay capital gains on the appreciation of the asset from the time it was purchased to the time of the death of the owner, but only from the time of the passing of the owner to the time they sell it. This provision in the tax law would be a reason perhaps not to sell appreciated securities.