Finding Your Balance

You’re Almost There: RETIREMENT

But as that date quickly approaches, you may begin to wonder if you’ll really have enough income in retirement. All the headlines about “record inflation” and “rising interest rates” leave you with new questions about your retirement plan, such as:

- Will I be able to live my desired lifestyle after I retire?

- Could rising interest rates alter my retirement income?

- Are there any ways to generate guaranteed income so I can have financial confidence in my later years?

In this article, we’ll explore how the current economic environment — including high inflation and rising interest rates — could impact your plan for retirement. We’ll also show you how working with an independent financial professional before your paychecks stop can further your pursuit of a financially independent retirement, no matter what tomorrow’s headlines might read.

In this article, we’ll explore how the current economic environment — including high inflation and rising interest rates — could impact your plan for retirement. We’ll also show you how working with an independent financial professional before your paychecks stop can further your pursuit of a financially independent retirement, no matter what tomorrow’s headlines might read.

BONDS: THE “SAFER” ALTERNATIVE?

One traditional strategy for many people nearing retirement has been to move from growth seeking assets (like stocks) to more conservative, fixed income products (such as bonds). They do this because bonds are generally considered a “safer” alternative, commonly considered to be less volatile than stocks.

In fact, as interest rates have generally declined since the early 1980s, many bonds have provided solid long-term returns. But while they can be an attractive addition to an overall

retirement income strategy, they are not without risk. If you’re counting on bonds to generate retirement income, you could find yourself falling short in your later years.

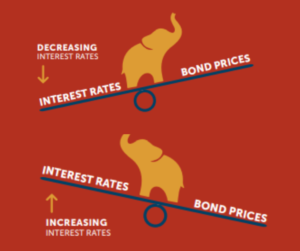

The Relationship Between Interest Rates and Bonds

What risk do bonds possess? All bonds have a predetermined term, a fixed period of time in which they generate income. Today’s bonds typically have terms from one to 30 years, although some corporations — such as Walt Disney Company and Coca-Cola — have issued 100-year bonds in the past.

What risk do bonds possess? All bonds have a predetermined term, a fixed period of time in which they generate income. Today’s bonds typically have terms from one to 30 years, although some corporations — such as Walt Disney Company and Coca-Cola — have issued 100-year bonds in the past.

1Albert Phung. Investopedia. May 25, 2022. “Why Do Companies Issue 100-Year Bonds?” https://www.investopedia.com/ask/answers/06/100yearbond.asp. Accessed Feb. 27, 2023.

Bond values fluctuate over time, moved up and down by changing interest rates.  Bonds and interest rates have an inverse relationship: When interest rates go up, a bond’s value goes down and vice versa. The trouble lies at the end of your bond’s term, particularly for intermediate- and long-term bonds. If interest rates have risen since you bought your bond, you may find that the value of your bond has decreased when it’s time to cash in. You could also have difficulty finding another bond to generate the same amount of income you need in retirement.

Bonds and interest rates have an inverse relationship: When interest rates go up, a bond’s value goes down and vice versa. The trouble lies at the end of your bond’s term, particularly for intermediate- and long-term bonds. If interest rates have risen since you bought your bond, you may find that the value of your bond has decreased when it’s time to cash in. You could also have difficulty finding another bond to generate the same amount of income you need in retirement.

BOND RISK AND YOUR RETIREMENT

How can this play out in your retirement income plan? Let’s take a look at a hypothetical example.

How can this play out in your retirement income plan? Let’s take a look at a hypothetical example.

Meet Bob. Bob retired in early 2010 with $500,000 in retirement savings. After determining the amount of Social Security he and his wife would receive, Bob concluded that he would need to generate an additional $17,000 a year in income to live the comfortable lifestyle he and his wife desired.

Seeking that additional retirement income, Bob used his $500,000 to purchase a 10-year bond. At the time, the interest rate was 3.5%. This meant that Bob could generate $17,500 in annual income from the interest he earned, keeping his principal intact. This was a great solution for Bob, at least until the bond matured.

When the 10 years were up, Bob had to reinvest his $500,000. The problem? Interest rates had dropped to 1%. That meant that if he reinvested in the same 10-year bond, he’d only be able to generate $5,000 in income each year — less than a third of what he was earning before. Coupled with the impact of inflation over a 10-year period, which is reflected in increasing costs of goods and services, this loss in income could result in a significant change in lifestyle for Bob and his wife.

But what happens if the reverse is true, and interest rates are on the rise? If Bob purchases a 10-year bond with his $500,000 when the interest rate is 1%, he’ll generate $5,000 in income each year. But if interest rates then rise — say to 2% — Bob may want to consider selling his bond and buying a new one to take advantage of the higher interest rate. However, because Bob’s original bond is less attractive at the lower interest rate, Bob would have to sell the bond at a lower price than he paid. Because of that, Bob would likely have to supplement his principal to reinvest $500,000 in a new bond at the higher rate.

The examples contained herein are for illustrative purposes only; they should not be viewed as a representation of either past or future results.

Answering the Call

What if interest rates had dropped to 1% five years into Bob’s 10-year bond term? Bonds generally have a call period, time during which the issuer of the bond can “call,” or buy back, the bond for the purchase price plus any accrued interest. In Bob’s case, when the interest rate dropped from 3.5% to 1%, the issuer may have had the ability to call the bond in order to reissue the debt at a lower interest rate.

In that case, Bob would have been in the same position of having to purchase a new 10-year bond, knowing it would generate less than a third of the income provided by the previous 10-year bond. The only difference is that now he would face this predicament much earlier than in the scenario where the bond reached full maturity. Most bonds offer call protection for the first two to three years of the bond period, but far fewer offer call protection for the life of the bond.

A DIFFERENT APPROACH TO FIXED INCOME

As you prepare for and approach retirement, your financial professional will likely look for

As you prepare for and approach retirement, your financial professional will likely look for

strategies and products to diversify and protect your assets. They will also seek out methods

for generating guaranteed income that lasts as long as you need it.

While bonds are often a good source of fixed income, they don’t come with any guarantees. You may want to consider adding fixed annuities to your overall retirement income strategy to help protect and grow your retirement assets while providing a steady, reliable source of guaranteed income throughout retirement.

Retirement Income for Life —Guaranteed

Like bonds, a fixed annuity offers a safer alternative to investing in the stock market, where volatility can put assets at risk. However, annuities offer one feature bonds do not: a guaranteed income stream for life. You’ll continue to receive the same, steady income each year for as long as you live, regardless of what interest rates do.

With a fixed annuity, you purchase a contract from an insurance company. You pay a premium, either in one lump sum or in set intervals over time. In exchange, the insurance company provides you with a guaranteed stream of income payouts, either starting immediately or at some point in the future.

Fixed annuities offer tax-deferred accumulation potential and a death benefit during the accumulation phase. They’re also backed by the financial strength and claims paying ability of the issuing insurance carrier.

A Fixed Annuity in Action

Let’s look back at our previous example with Bob and his wife. Investing his $500,000 in bonds, Bob experienced the downside to interest rate risk. What if he had instead used that $500,000 to purchase a fixed index annuity with an optional “income” rider?

Let’s look back at our previous example with Bob and his wife. Investing his $500,000 in bonds, Bob experienced the downside to interest rate risk. What if he had instead used that $500,000 to purchase a fixed index annuity with an optional “income” rider?

Income riders are known by a variety of names and are designed to provide alternative income options above and beyond the standard annuitization options or free withdrawal features in the fixed index annuity contract itself. Many “income” riders available today offer a 4% to 5% lifetime withdrawal rate, depending on the owner’s age. If Bob purchased his annuity with $500,000, he could generate $20,000 to $25,000 in annual income guaranteed for his lifetime. Optional income riders are subject to availability and may require an additional fee but can provide an attractive income solution during retirement.

One trade-off: Unlike bonds, with an annuity your principal is reduced by any income payments. However, the income payments are guaranteed. In Bob’s situation, he could have generated the additional income he needed, regardless of interest rates or stock market volatility. While his principal would be reduced, his income stream would have remained intact for the remainder of his life (and possibly the life of his spouse as well, depending on how he chooses to take payments).

Before beginning lifetime income payments, most annuities contain provisions that allow you to withdraw a percentage of the value of the base annuity contract each year, up to a certain limit, without a penalty. However, these withdrawals will also reduce the contract value and the value of any protection benefits. Excess withdrawals above the contract’s limit typically incur surrender charges (early withdrawal penalties) within the first five to 10 years of the contract. Because annuities are designed as long-term retirement vehicles, withdrawals are also subject to ordinary income taxes. If withdrawals are taken before age 59½, they are also subject to an additional 10% federal tax.

RETIREMENT INCOME YOU CAN COUNT ON

As interest rates rise, the return on your fixed income investments may not be what you had hoped — possibly impacting your retirement income plan and future lifestyle. And with retirement approaching quickly, you may not have time to make up any losses to the income you were counting on to do all that you had planned.

Now may be a good time to consider adding a fixed annuity to your overall retirement strategy. Reviewing all of the components of your retirement strategy before the paychecks stop can help you feel more confident as you look forward to retirement.

Now may be a good time to consider adding a fixed annuity to your overall retirement strategy. Reviewing all of the components of your retirement strategy before the paychecks stop can help you feel more confident as you look forward to retirement.

Len Hayduchok is the founder of The Delaware Retiree Connection, and the director and owner of Dedicated Financial. As a fiduciary and Certified Financial Planner, he offers his wealth of experience to guide others through the mire of financial and retirement planning. As a Certified Life Coach, he pairs his financial expertise with a heart to help others who want to make the most of their retirement plan. Investment Advisory services offered through SGL Financial LLC.

Want to talk to Len about your Retirement / Financial Plan? SCHEDULE A CONSULT

Len writes much of his own content, and also shares helpful content from other trusted providers like SGL Financial. This content is provided for informational purposes only and is not intended to serve as

the basis for financial decisions. Investing involves risk, including the potential loss of principal. Any references to protection benefits or lifetime income generally refer to fixed insurance products, never securities or investment products. Annuities are not a deposit, nor are they insured by any bank, the FDIC, NCUA or by any federal government agency. Insurance and annuity product guarantees are backed by the financial strength and claims-paying ability of the issuing insurance company. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Content prepared by Advisors Excel. © 2023 Advisors Excel, LLC