- 1. The much-anticipated Santa Claus rally, a traditional year-end boost in stock market performance, failed to materialize in 2024.

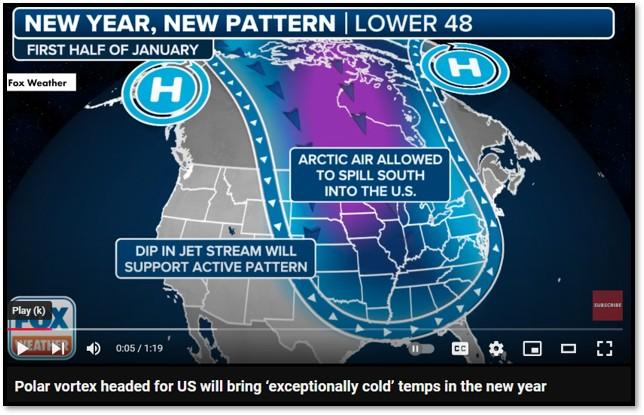

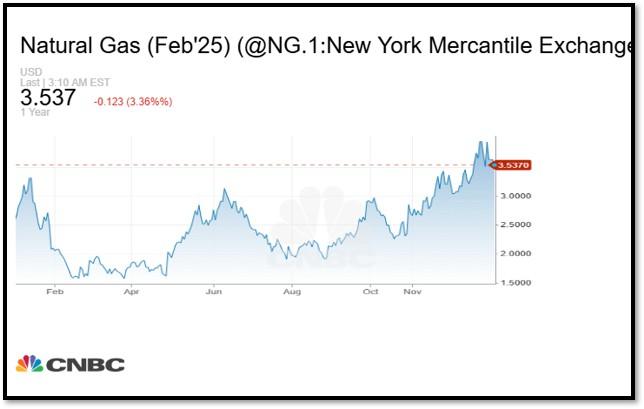

- 2. Natural gas February futures surged by approximately 15% following an updated weather forecast predicting colder-than-average temperatures across the eastern United States next month, according to CNBC.

- **With the current macro-economic backdrop, below are areas we currently favor:

- 3. The transformation of Thailand’s automotive market highlights the rapid rise of Chinese automakers in the electric vehicle (EV) space, signaling a major shift in global industry dynamics.

- 4. World Watch

- 5. Quant & Technical Corner

1. The much-anticipated Santa Claus rally, a traditional year-end boost in stock market performance, failed to materialize in 2024.

Historically, the final trading days of December and the first two of January often bring optimism to the markets, fueled by holiday sentiment and lighter trading volumes. However, this year, rising economic uncertainty and lackluster corporate earnings overshadowed seasonal patterns, leaving investors disappointed.

Adding to the lackluster finish, typical year-end profit-taking and early January selling pressures are expected to weigh on markets. Many investors lock in gains from prior rallies or rebalance portfolios, causing downward pressure on stock prices. This seasonal phenomenon is particularly pronounced following years of heightened volatility, as seen in 2024.

Looking ahead, a new administration in Washington brings a fresh set of policies and priorities that could influence market dynamics. Key areas to watch include potential changes to corporate tax policies, renewed focus on infrastructure investment, and approaches to inflation control. Investors will also be attentive to regulatory shifts affecting key sectors such as technology, healthcare, and energy. In this period of transition, the markets are likely to remain volatile. While challenges persist, opportunities may arise as new policies take shape and economic conditions adjust. Investors should stay informed and flexible, preparing for both risks and potential growth in 2025.

2. Natural gas February futures surged by approximately 15% following an updated weather forecast predicting colder-than-average temperatures across the eastern United States next month, according to CNBC.

The report from The Weather Co. and Atmospheric G2, released Sunday, highlighted the likelihood of colder conditions from Florida to Maine and parts of the Great Lakes region. The forecasted drop in temperatures is expected to drive increased demand for heating, particularly in densely populated areas along the East Coast. This anticipated demand spike has fueled the rally in natural gas prices as traders position for tighter supply and higher consumption in the coming weeks. The price increase underscores the sensitivity of energy markets to weather forecasts, especially during the winter months when natural gas is a critical resource for heating. This volatility highlights the importance of accurate forecasting and supply management to stabilize prices and meet consumer needs. The situation bodes well for utility companies as well as producers. Click onto picture below to access video from NYP. REF: CNBC, TWC, NYP

**With the current macro-economic backdrop, below are areas we currently favor:

- Fixed Income – Short-term Corporates (Low-Beta)

- Fixed Income – Corporates High Yield as Opportunistic Allocation (Low-Beta)

- Businesses that contribute to and benefit from AI & Automation (Market-Risk)

- Small Cap & Mid Cap Stocks (Market-Risk)

- Utilities (Market-Risk)

- Healthcare & Biotechnology (Market-Risk)

- Gold (Market-Risk)

- Industrials (Market-Risk)

- Asian Innovation-related Equity (Market-Risk)

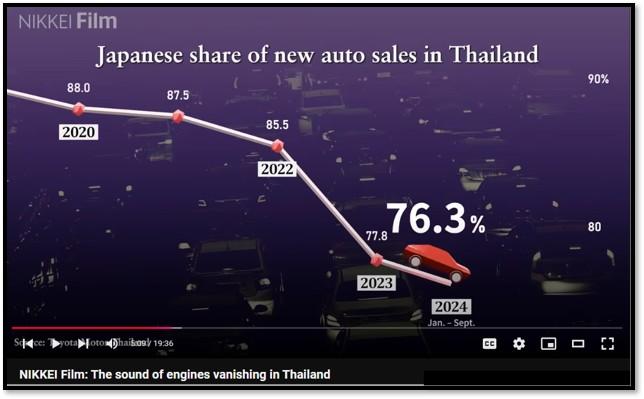

3. The transformation of Thailand’s automotive market highlights the rapid rise of Chinese automakers in the electric vehicle (EV) space, signaling a major shift in global industry dynamics.

Once dominated by Japanese automakers, Thailand is now seeing these traditional leaders lose market share as Chinese brands like BYD and Great Wall Motors capture consumer attention with affordable and technologically advanced EVs. Japanese automakers controlled nearly 90% of the Thai market for half a century, in 2023 Chinese companies like BYD began full-scale sales in the country, taking big bites out of the Japanese makers’ fat slice of the market. Supported by economies of scale and government backing, Chinese automakers have quickly outpaced competitors, offering cost-effective solutions that resonate with Thai consumers.

The appeal of EVs in Thailand is further strengthened by lower operating costs, reduced reliance on expensive fuel, and supportive government policies, such as tax incentives and subsidies. Additionally, the development of charging infrastructure has alleviated range anxiety, making EV ownership more practical and economical. In contrast, Japanese automakers, slow to pivot from internal combustion engines (ICE) and hybrids, are losing relevance in a market increasingly favoring EVs.

Thailand’s case serves as a warning for other countries. Chinese automakers’ global expansion, fueled by aggressive pricing and advanced technology, poses a significant challenge to legacy manufacturers. Traditional automakers relying on ICE risk obsolescence unless they accelerate their EV transitions. Furthermore, nations unprepared for this shift may face economic disruptions, particularly in regions reliant on ICE vehicle manufacturing. Click onto picture below to access video by NIKKEI Film. REF: TheSoundofEnginesVanishingInThailand

4. World Watch

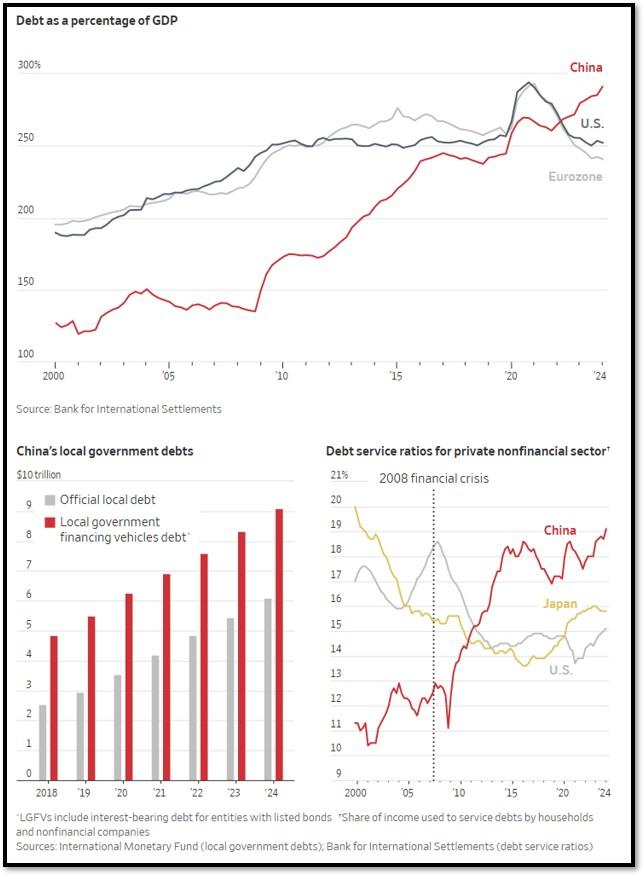

4A. What exactly is China’s current debt level (in terms of debt-to-GDP)? It depends on who you ask. As of 2024, estimates of China’s debt-to-GDP ratio vary depending on the scope of measurement.

- Fitch Ratings forecasts China’s general government debt to reach approximately 61.3% of GDP by the end of 2024, marking a significant increase from previous years but still low according to my eyes.

- The International Monetary Fund (IMF) stated 83.4% as of 2023 (as shown in item 4C below). The IMF estimates China’s public debt at about 116% of GDP as of 2024.

- Using the macro leverage ratio, which includes total outstanding non-financial debt, rose to 287.8% in 2023 and continued to increase in 2024, reaching 294.8% by the end of the first quarter according to the comprehensive economic report from embassy of Switzerland in China. Non-financial debt refers to all debt obligations within an economy that are incurred by entities other than financial institutions which include government debt, corporate debt, and household debt.

- If we include non-financial debt but exclude corporate debt of non-state-owned enterprises (SOEs) and household debt, then the combined debt-to-GDP ratio for China’s government and state-owned enterprises is approximately 151%.

China’s economy faces significant challenges from years of over-indebtedness, overbuilding, and overcapacity. Aggressive borrowing to fund infrastructure and industrial projects has left local governments and state-owned enterprises heavily burdened with debt, limiting financial stability. Meanwhile, overbuilding in real estate has resulted in surplus housing and unoccupied “ghost cities,” straining developers and destabilizing the property market. Overcapacity in industries like steel and manufacturing further undermines profitability, floods global markets, and triggers trade tensions. These issues weaken China’s domestic economy and create ripples in global trade and investment. Addressing them requires structural reforms to reduce debt dependency, curb speculative real estate practices, and shift toward a consumption-driven economy. Without decisive action, these imbalances could worsen and destabilize both China and the global economy. Click onto picture below to access video from CNA on China’s ambitious debt swap plan. (CNA is a Singaporean public broadcast station) Charts shown further below provided by WSJ. REF: WSJ, CNA

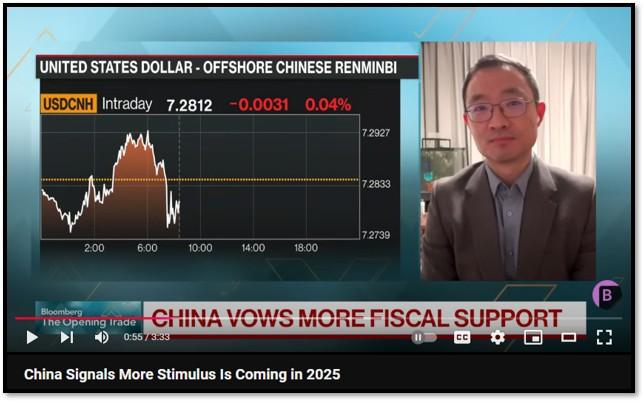

Besides more stimulus measures, China has rolled out a US$1.4 trillion debt package to ease local government financing strains with the hope of indirectly spurring economic growth. While investors have questioned its adequacy, Beijing considers the plan a critical step towards reviving the world’s second largest economy.

4B. China is expanding consumption subsidies to include smartphones and other electronics, aiming to boost domestic spending amid growing external economic pressures, according to Bloomberg. This move is part of a broader strategy to stimulate internal demand as export-driven growth faces challenges. A national trade-in program, which currently applies to home appliances and cars, will be broadened to cover personal devices such as phones, tablets, and smartwatches. Officials from China’s top economic planning agency announced the policy shift as a way to encourage consumer upgrades and drive economic activity in the technology sector. By incentivizing purchases of personal electronics, the government hopes to counter slowing exports and balance the economy toward domestic consumption. This initiative reflects China’s commitment to fostering resilience in the face of global uncertainties and sustaining growth through enhanced internal demand. Click onto picture below to access video. REF: Bloomberg

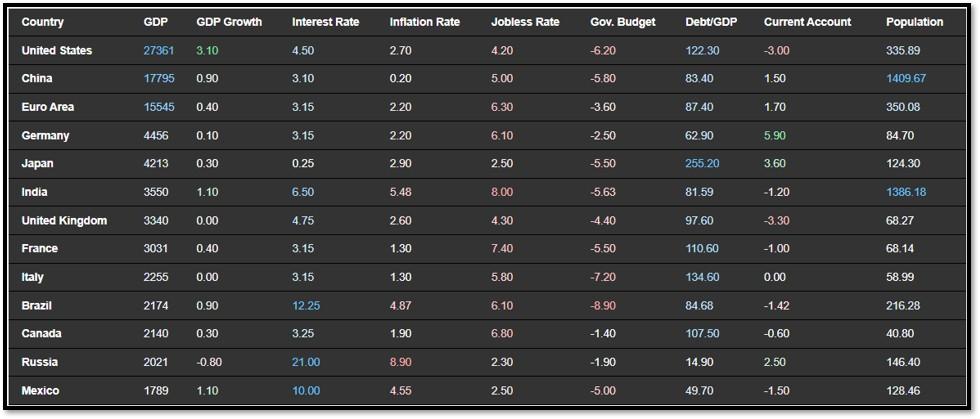

4C. Below is an updated snapshot of the current global state of economy according to TradingEconomics as of 12/30/2024. REF: TradingEconomics

- The unemployment rate in Brazil fell to 6.1% in the three months to November of 2024, the lowest on record, from 6.6% in the moving quarter ending in August, aligned with market expectations.

- China’s official NBS Manufacturing PMI unexpectedly fell to 50.1 in December 2024 from November’s seven-month high and market estimates of 50.3.

- South Korea’s annual inflation rate increased to 1.9% in December 2024, up from 1.5% in November, surpassing the market’s expectations of 1.7%.

- China’s official NBS Non-Manufacturing PMI rose to 52.2 in December 2024 from 50.0 in the previous month, pointing to the highest figure since March and exceeding market forecasts of 50.2.

5. Quant & Technical Corner

Below is a selection of quantitative & technical data we monitor on a regular basis to help gauge the overall financial market conditions and the investment environment.

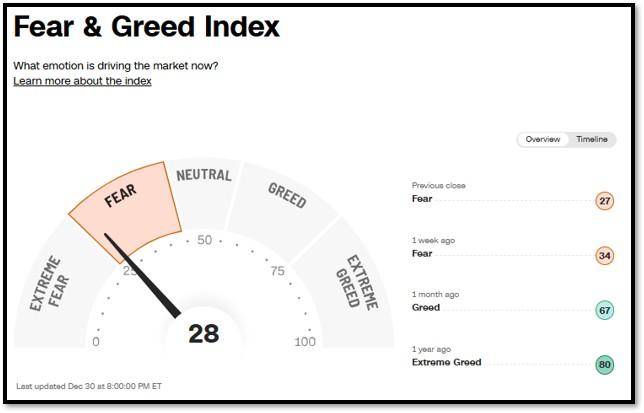

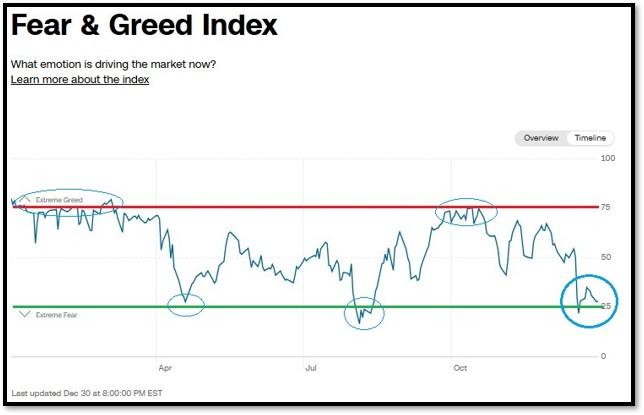

5A. Most recent read on the Fear & Greed Index with data as of 12/30/2024 – 8:00PM-ET is 28 (Fear). Last week’s data was 34 (Neutral) (1-100). CNNMoney’s Fear & Greed index looks at 7 indicators (Stock Price Momentum, Stock Price Strength, Stock Price Breadth, Put and Call Options, Junk Bond Demand, Market Volatility, and Safe Haven Demand). Keep in mind this is a contrarian indicator! REF: Fear&Greed via CNNMoney

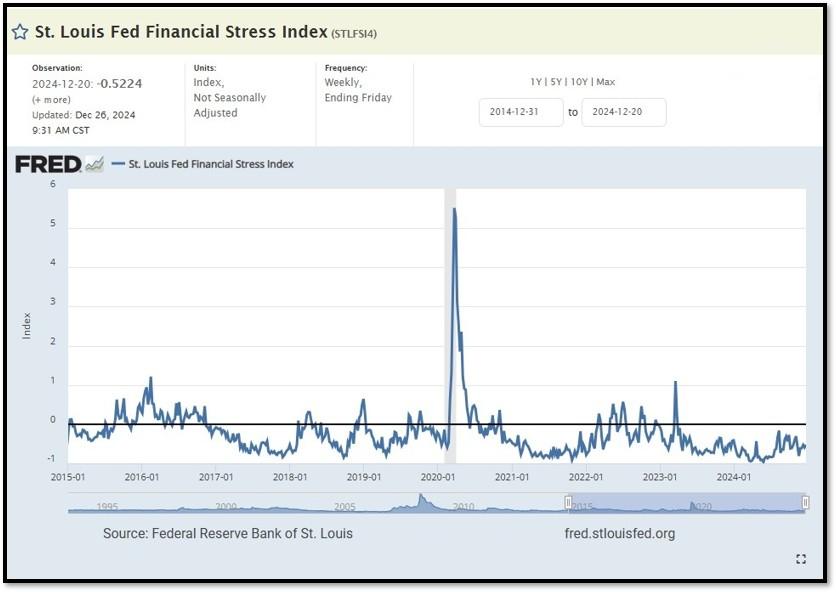

5B. St. Louis Fed Financial Stress Index’s (STLFSI4) most recent read is at –0.5224 as of December 26, 2024. A big spike up from previous readings reflecting the recent turmoil in the banking sector. Previous week’s data was -0.5906. This weekly index is not seasonally adjusted. The STLFSI4 measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. REF: St. Louis Fed

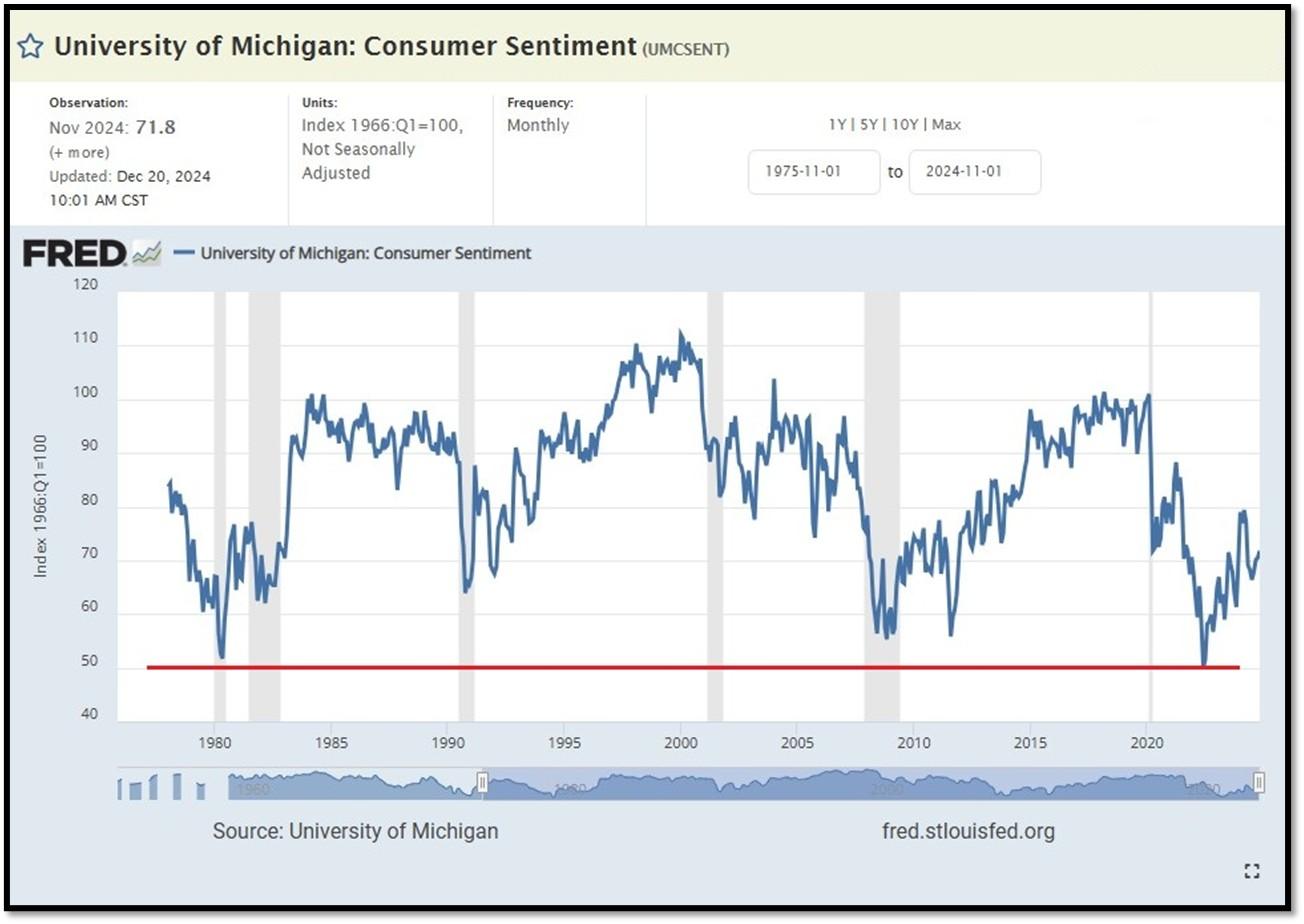

5C. University of Michigan, University of Michigan: Consumer Sentiment for September [UMCSENT] at 71.8, retrieved from FRED, Federal Reserve Bank of St. Louis, December 20, 2024. Back in June 2022, Consumer Sentiment hit a low point going back to April 1980. REF: UofM

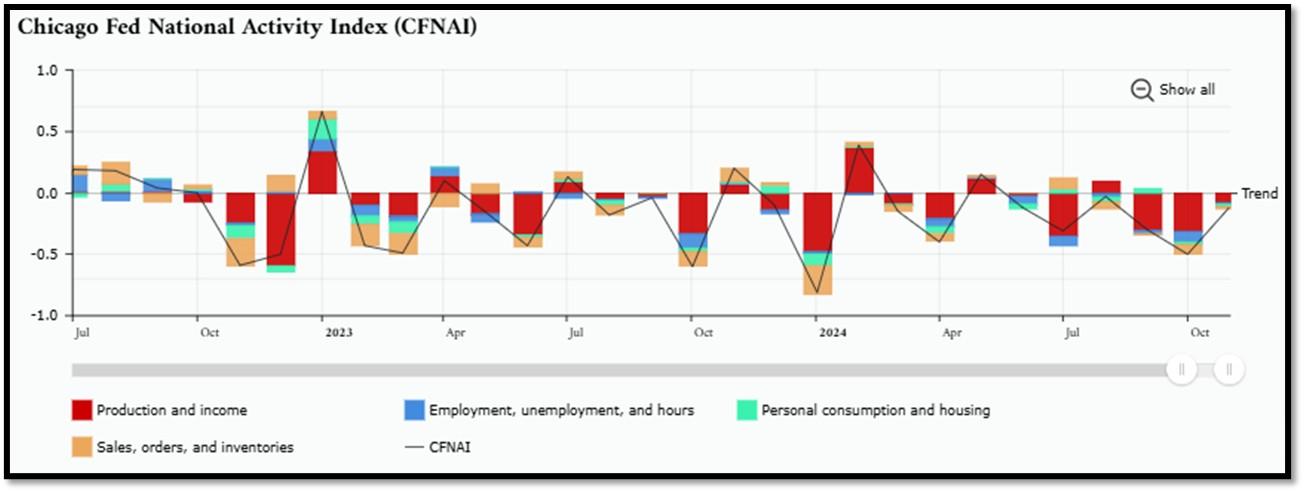

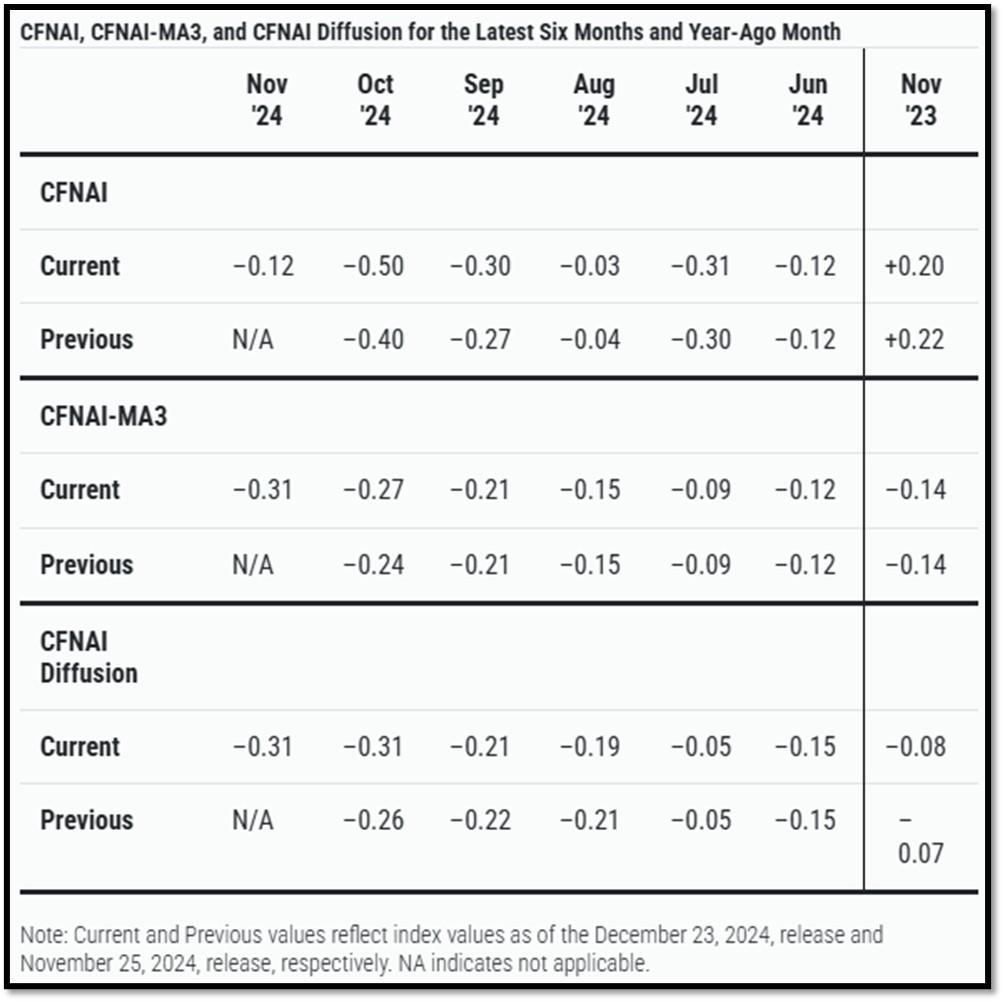

5D. The Chicago Fed National Activity Index (CFNAI) increased to –0.12 in November from –0.50 in October. Three of the four broad categories of indicators used to construct the index increased from October, but all four categories made negative contributions in November. The index’s three-month moving average, CFNAI-MA3, decreased to –0.31 in November from –0.27 in October. REF: ChicagoFed, November’s Report

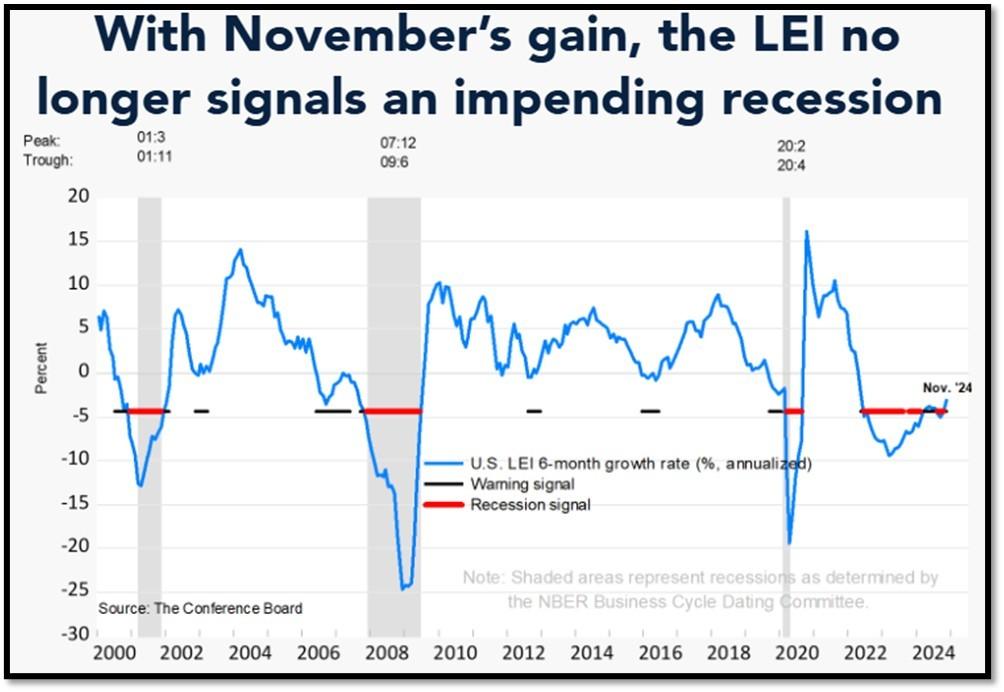

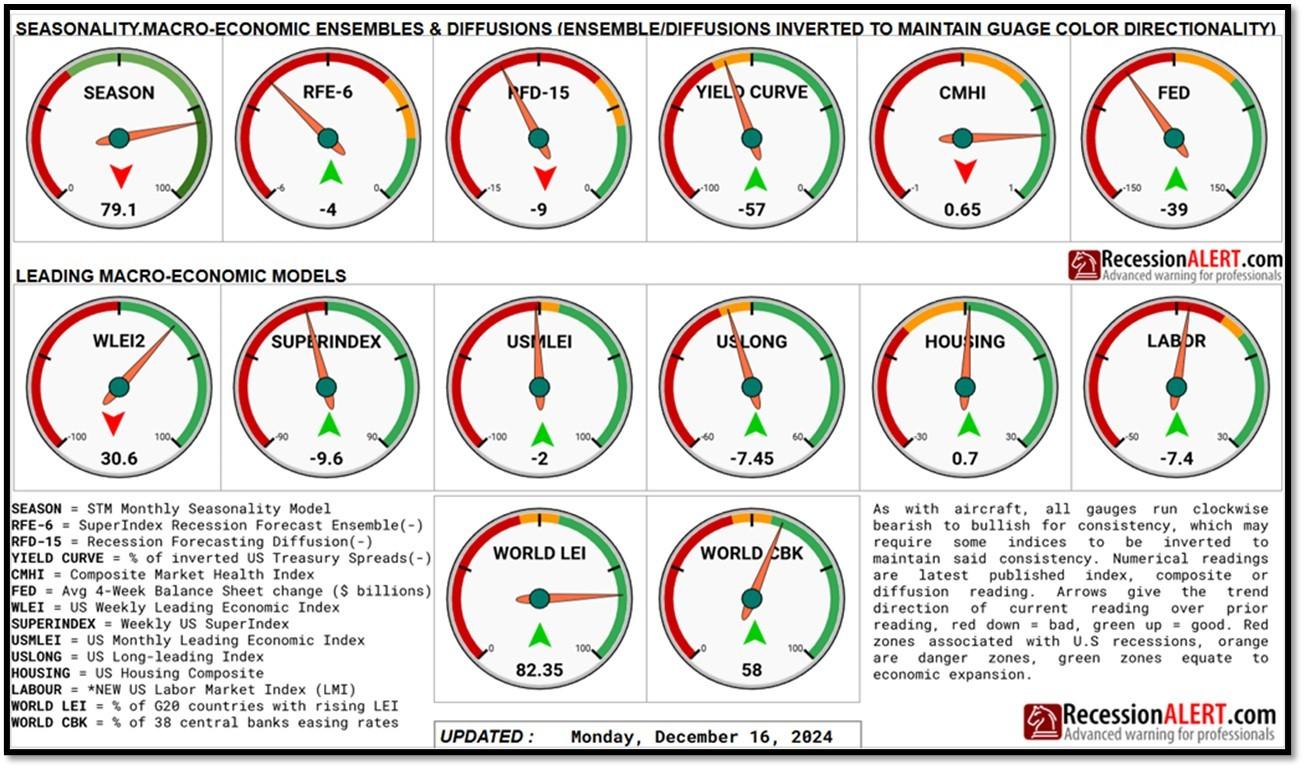

5E. (12/19/2024) The Conference Board Leading Economic Index (LEI) for the US increased by 0.3% in November 2024 to 99.7 (2016=100), nearly reversing its 0.4% decline in October. Over the six-month period between May and November 2024, the LEI declined by 1.6%, slightly less than its 1.9% decline over the previous six months (November 2023 to May 2024). The composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component. The CEI is highly correlated with real GDP. The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. Shaded areas denote recession periods or economic contractions. The dates above the shaded areas show the chronology of peaks and troughs in the business cycle. The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers’ new orders for nondefense capital goods excluding aircraft orders; Building permits for new private housing units; S&P 500® Index of Stock Prices; Leading Credit Index™; Interest rate spread (10-year Treasury bonds less federal funds rate); Average consumer expectations for business conditions. REF: ConferenceBoard, LEI Report for October (Released on 12/2/2024)

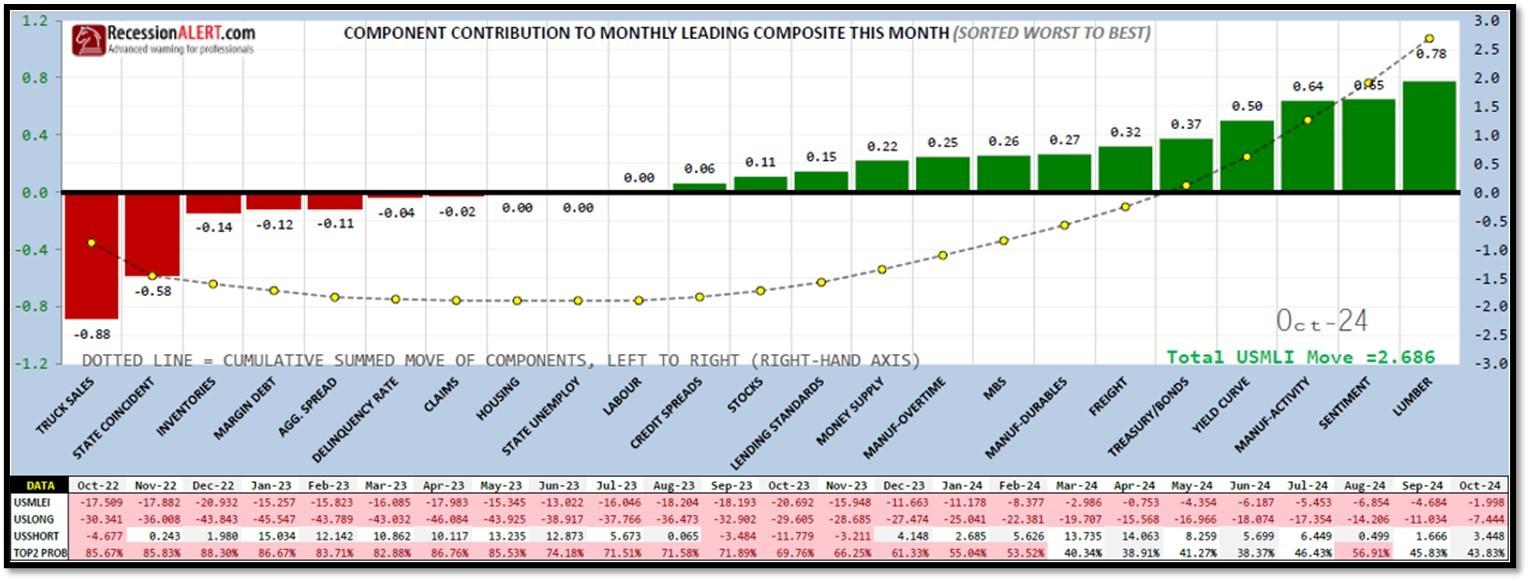

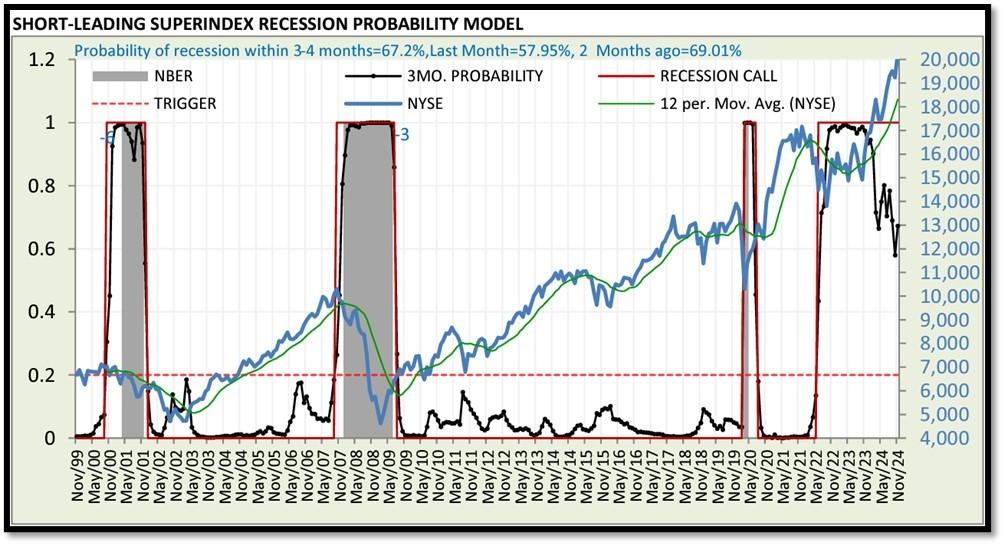

5F. Probability of U.S. falling into Recession within 3 to 4 months is currently at 67.2% (with data as of 12/16/2024 – Next Report 12/30/2024) according to RecessionAlert Research. Last release’s data was at 68.53%. This report is updated every two weeks. REF: RecessionAlertResearch

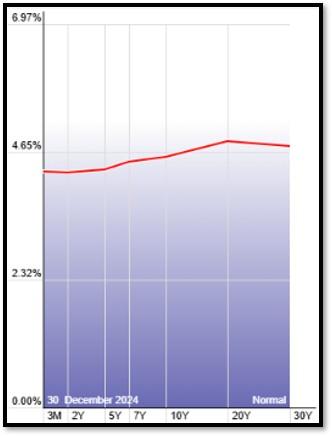

5G. Yield Curve as of 12/30/2024 is showing Normal – No Longer Inverted. Spread on the 10-yr Treasury Yield (4.53%) minus yield on the 2-yr Treasury Yield (4.24%) is currently at +29 bps. REF: Stockcharts The yield curve—specifically, the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill—is a valuable forecasting tool. It is simple to use and significantly outperforms other financial and macroeconomic indicators in predicting recessions two to six quarters ahead. REF: NYFED

5H. Recent Yields in 10-Year Government Bonds. REF: Source is from Bloomberg.com, dated 12/30/2024, rates shown below are as of 12/30/2024, subject to change.

The 10-Year US Treasury Yield… REF: StockCharts1, StockCharts2

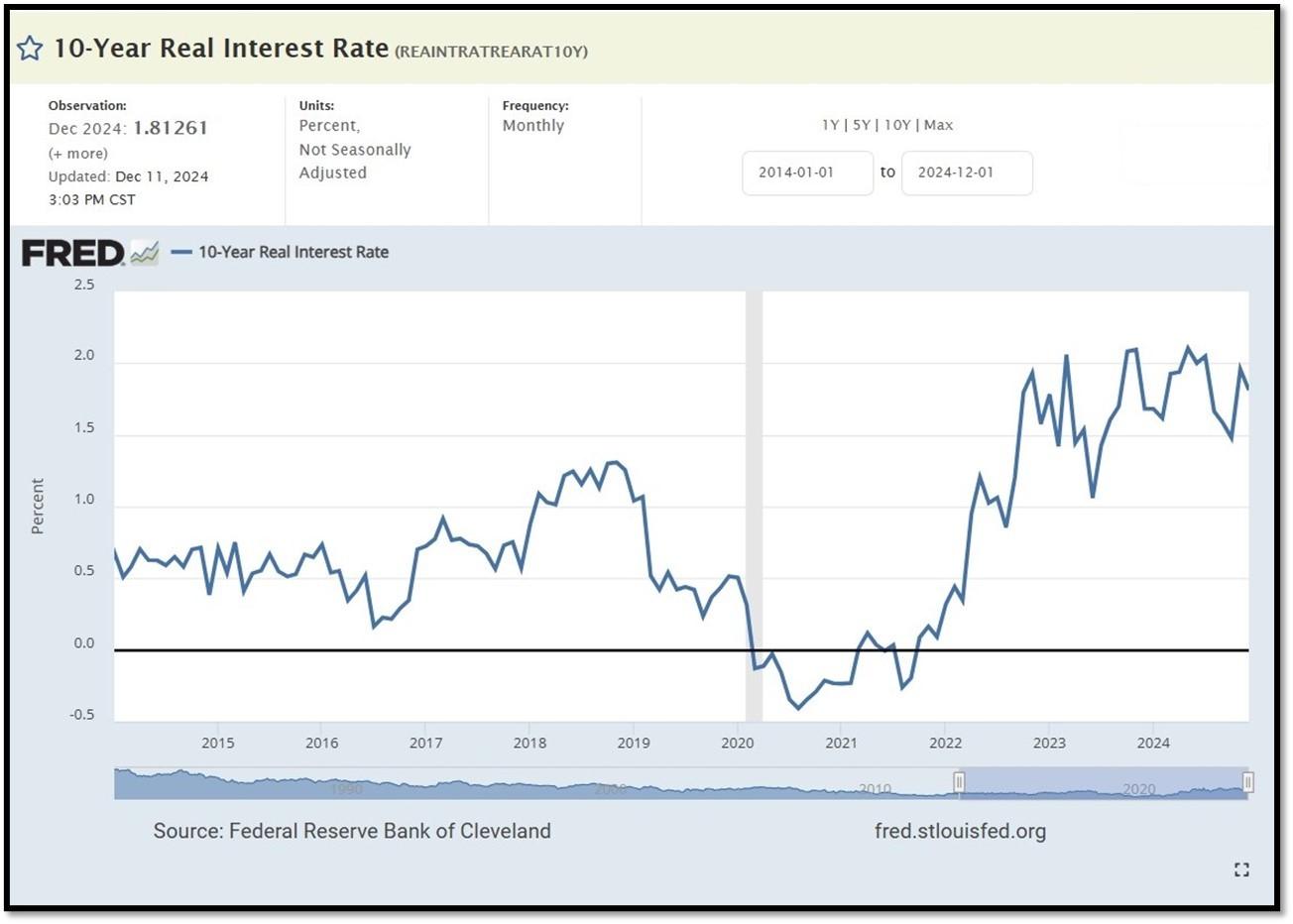

10-Year Real Interest Rate at 1.81261% as of 12/11/24. REF: REAINTRATREARAT10Y

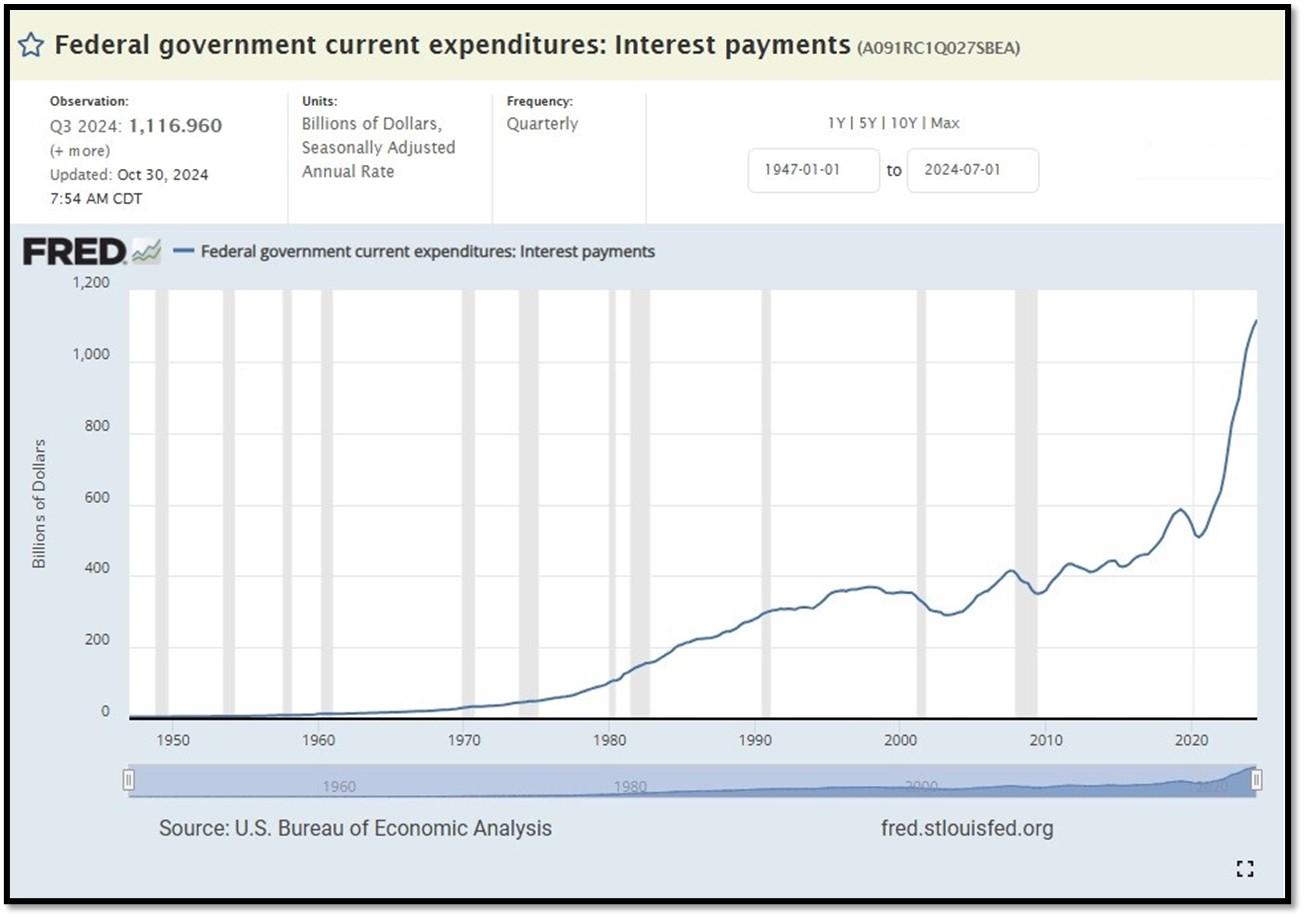

Federal government Interest Payments increased $20B+ to $1.1166 Trillion as of Q3-2024. REF: FRED-A091RC1Q027SBEA

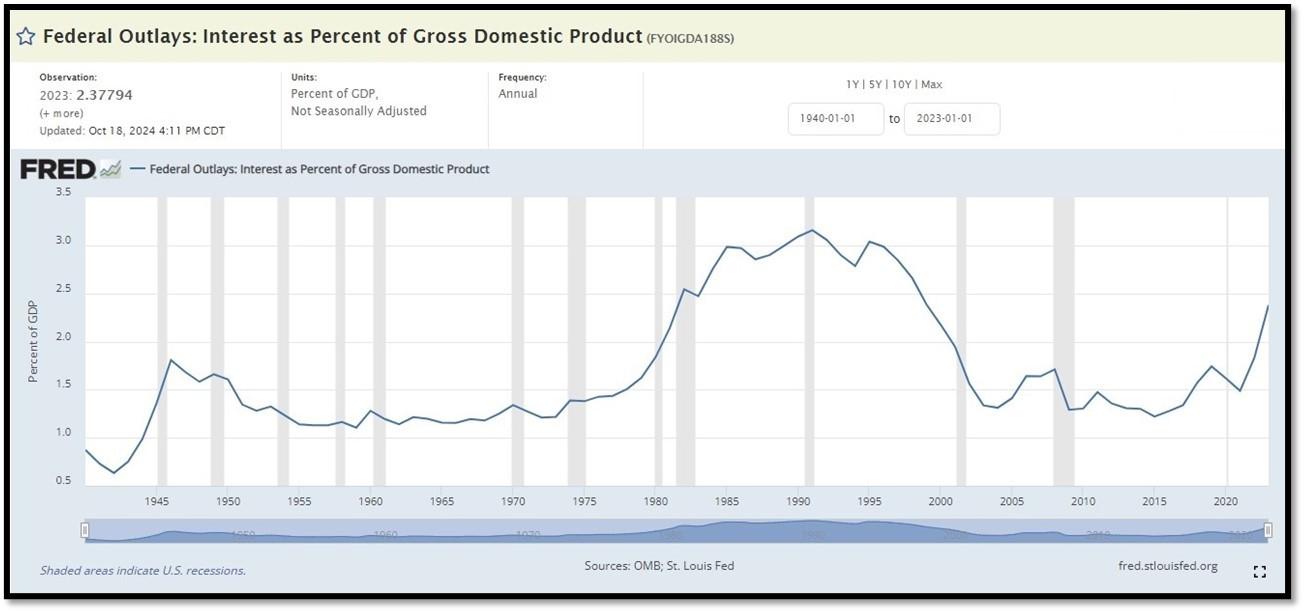

Interest payments as a percentage of GDP increased from 1.84853 in 2022 to 2.37794 as of 10/18/24. REF: FRED-FYOIGDA188S

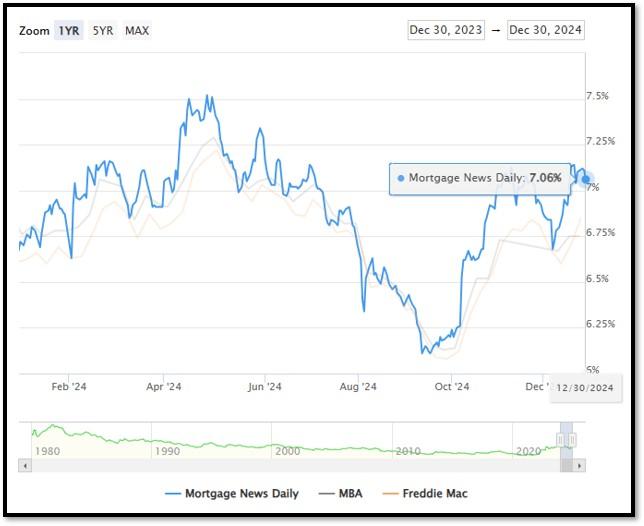

5I. (12/30/2024) Today’s National Average 30-Year Fixed Mortgage Rate is 7.06% (All Time High was 8.03% on 10/19/23). Last week’s data was 7.10%. This rate is the average 30-year fixed mortgage rates from several different surveys including Mortgage News Daily (daily index), Freddie Mac (weekly survey), Mortgage Bankers Association (weekly survey) and FHFA (monthly survey). REF: MortgageNewsDaily, Today’s Average Rate

The recent spike in the 30-year fixed-rate jumbo mortgage to 7.06%, compared to Freddie Mac’s rate at 6.85% and the Mortgage Bankers Association (MBA) rate at 6.75%, highlights key differences in the mortgage market. Jumbo mortgages, which exceed the conforming loan limits set by government agencies like Freddie Mac, typically carry higher interest rates because they are riskier for lenders. These loans are not backed by government entities, which increases the risk for lenders and, consequently, leads to higher rates. In contrast, Freddie Mac and MBA provide averages for conforming loans, which meet federal guidelines and have lower risk due to government backing, keeping their rates lower.

(12/16/24) Housing Affordability Index for Oct = 102.3 // Sep = 105.5 // Aug = 98.6 // July = 95 // June = 93.3 // May = 93.1 // April = 95.9 // March = 101.1 // February = 103.0. Data provided by Yardeni Research. REF: Yardeni

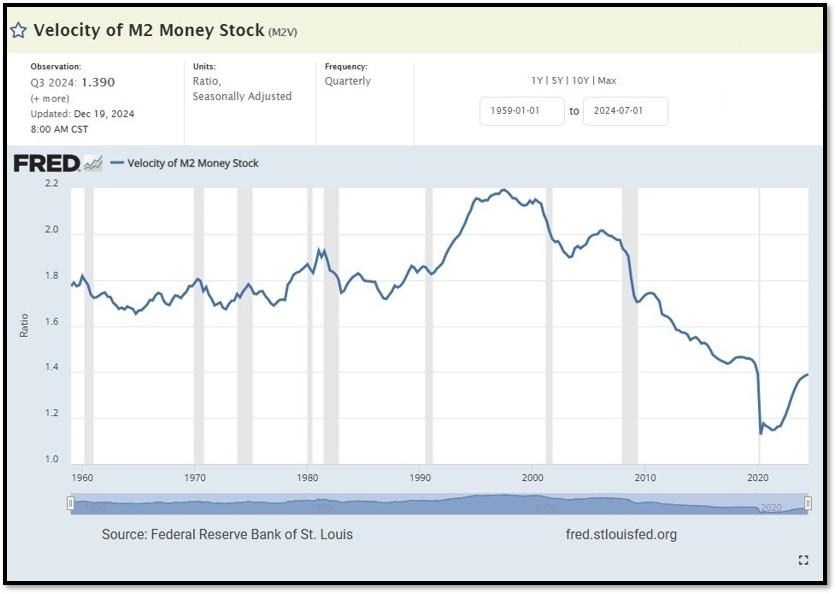

5J. Velocity of M2 Money Stock (M2V) with current read at 1.390 as of (Q3-2024 updated 12/19/2024). Previous quarter’s data was 1.389. The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. Current Money Stock (M2) report can be viewed in the reference link. REF: St.LouisFed-M2V

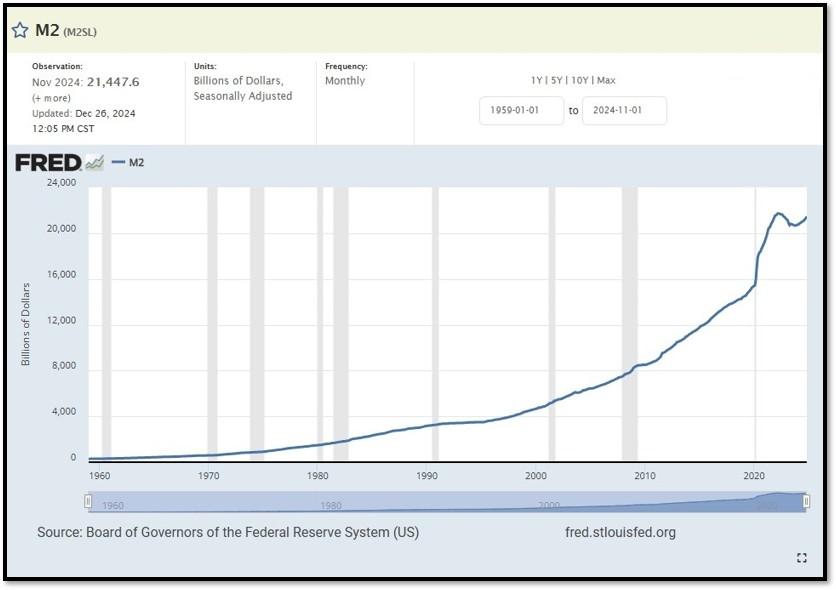

M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; Updated on November 26, 2024. REF: St.LouisFed-M2

Money Supply M0 in the United States increased to 5,616,500 USD Million in November from 5,567,200 USD Million in October of 2024. Money Supply M0 in the United States averaged 1,160,672.82 USD Million from 1959 until 2024, reaching an all-time high of 6,413,100.00 USD Million in December of 2021 and a record low of 48,400.00 USD Million in February of 1961. REF: TradingEconomics, M0

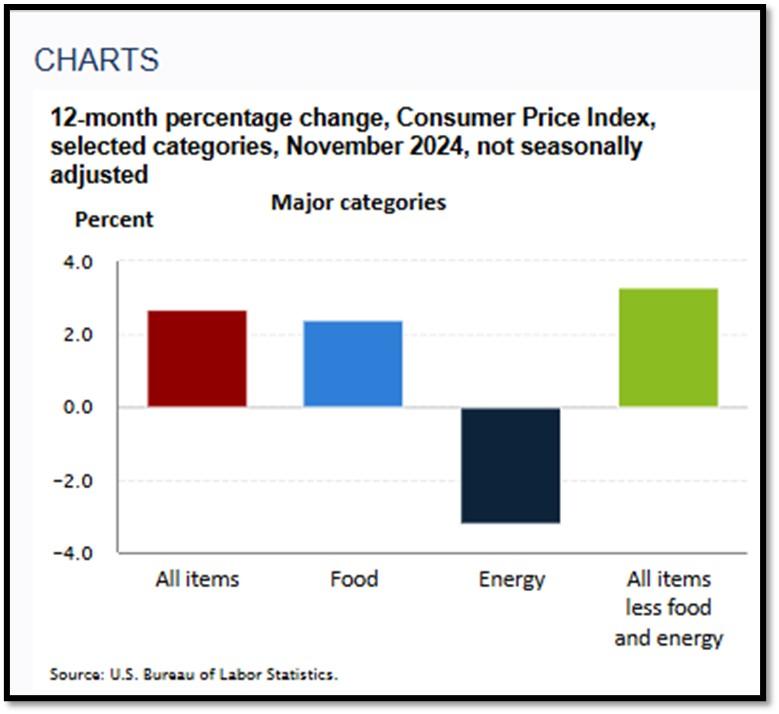

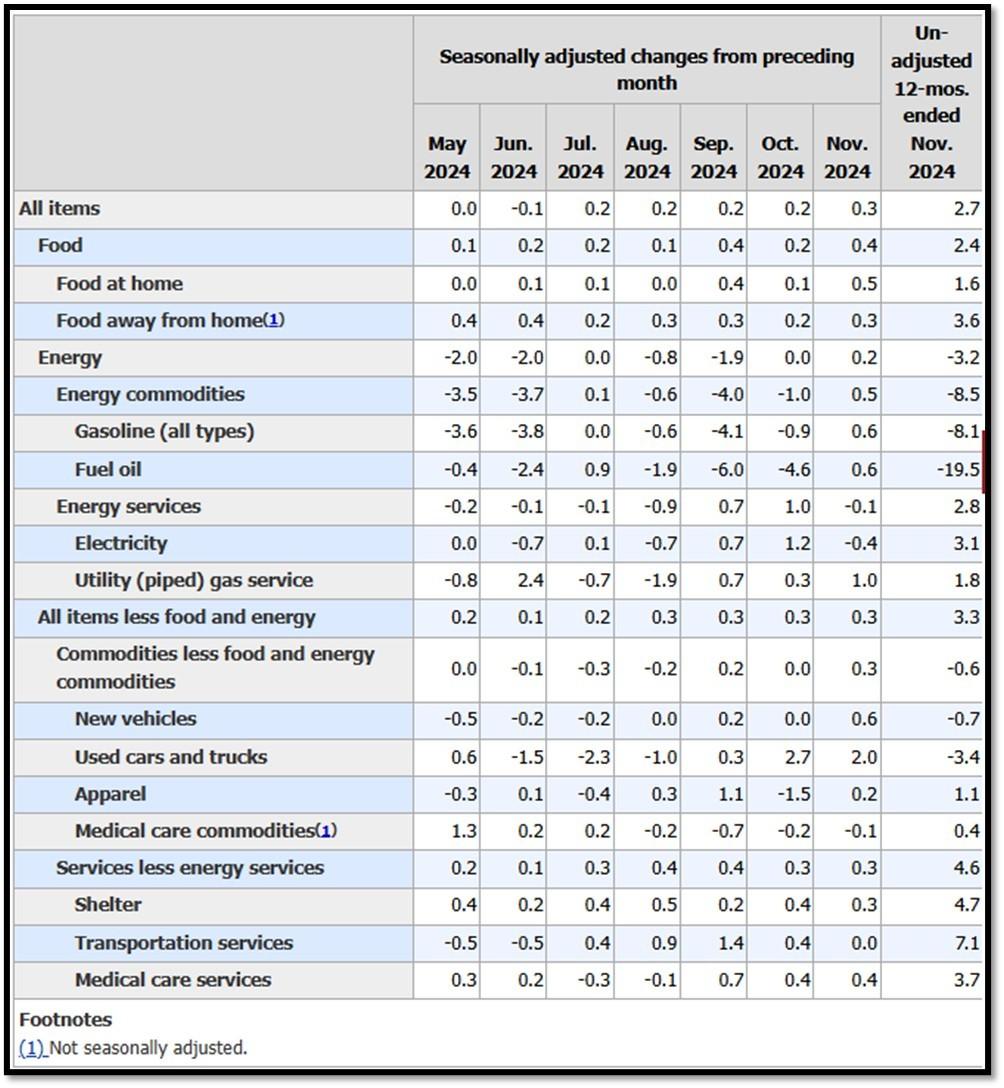

5K. In November, the Consumer Price Index for All Urban Consumers rose 0.3 percent, seasonally adjusted, and rose 2.7 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.3 percent in November (SA); up 3.3 percent over the year (NSA). December 2024 CPI data are scheduled to be released on January 15, 2024, at 8:30AM-ET. REF: BLS, BLS.GOV

5L. Technical Analysis of the S&P500 Index. Click onto reference links below for images.

- Short-term Chart: Less Bullish on 12/30/2024 – REF: Short-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Medium-term Chart: Bullish on 12/30/2024 – REF: Medium-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Market Timing Indicators – S&P500 Index as of 12/30/2024 – REF: S&P500 Charts (7 of them) by Joanne Klein’s Top 7 (Click Here to Access Updated Charts)

- A well-defined uptrend channel shown in green with S&P500 still on up trend. REF: Stockcharts

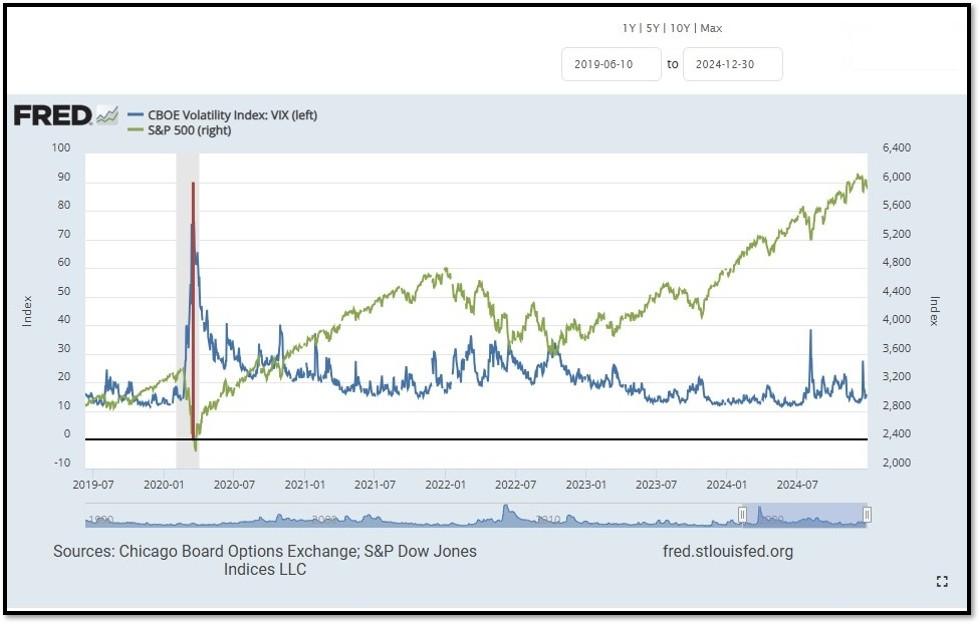

- S&P500 and CBOE Volatility Index (VIX) as of 12/30/2024. REF: FRED, Today’s Print

5M. Most recent read on the Crypto Fear & Greed Index with data as of 12/31/2024au is 64 (Greed). Last week’s data was 73 (Greed) (1-100). Fear & Greed Index – A Contrarian Data. The crypto market behavior is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction of seeing red numbers. With the Crypto Fear and Greed Index, the data try to help save investors from their own emotional overreactions. There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

Therefore, the program for this index analyzes the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means “Extreme Fear”, while 100 means “Extreme Greed”. REF: Alternative.me, Today’sReading

Bitcoin – 10-Year & 2-Year Charts. REF: Stockcharts10Y, Stockcharts2Y

Len writes much of his own content, and also shares helpful content from other trusted providers like Turner Financial Group (TFG).

The material contained herein is intended as a general market commentary, solely for informational purposes and is not intended to make an offer or solicitation for the sale or purchase of any securities. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. This information is not intended as a specific offer of investment services by Dedicated Financial and Turner Financial Group, Inc.

Dedicated Financial and Turner Financial Group, Inc., do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Any hyperlinks in this document that connect to Web Sites maintained by third parties are provided for convenience only. Turner Financial Group, Inc. has not verified the accuracy of any information contained within the links and the provision of such links does not constitute a recommendation or endorsement of the company or the content by Dedicated Financial or Turner Financial Group, Inc. The prices/quotes/statistics referenced herein have been obtained from sources verified to be reliable for their accuracy or completeness and may be subject to change.

Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. The views and strategies described herein may not be suitable for all investors. To the extent referenced herein, real estate, hedge funds, and other private investments can present significant risks, including loss of the original amount invested. All indexes are unmanaged, and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Turner Financial Group, Inc. is an Investment Adviser registered with the United States Securities and Exchange Commission however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Additional information about Turner Financial Group, Inc. is also available at www.adviserinfo.sec.gov. Advisory services are only offered to clients or prospective clients where Turner Financial Group, Inc. and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Turner Financial Group, Inc. unless a client service agreement is in place.