- 1. Federal Reserve Governor Adriana Kugler credited the economy’s resilience to increased worker productivity and a growing labor force, driven partly by immigration.

- 2. China’s government is preparing to continue to stimulate its economy, with key actions expected around the Central Economic Working Conference (CEWC) in December.

- **With the current macro-economic backdrop, below are areas we currently favor:

- 3. This week, I want to highlight the revolution happening in the global auto manufacturing sector.

- 4. World Watch

- .

1. Federal Reserve Governor Adriana Kugler credited the economy’s resilience to increased worker productivity and a growing labor force, driven partly by immigration.

While the Federal Reserve is considering future interest rate cuts, concerns about persistent inflation remain. Recent data showing a rise in inflation for October has led to cautious deliberations among officials regarding the timing of these cuts. Despite inflationary pressures, consumer spending and overall economic activity continue to show robust growth. REF: Kugler

Preliminary data reveals that Black Friday and Cyber Monday in 2024 achieved record-breaking sales, signaling robust consumer spending and a strong holiday shopping season. On Black Friday, U.S. online sales reached between $10.7 billion and $11 billion, a 10.2% increase from the previous year. Globally, sales climbed to $74.4 billion, reflecting a 5% year-over-year growth. Cyber Monday followed suit, with U.S. spending projected at $13.2 billion, marking a 6.1% increase and making it the largest online shopping day of the year. Electronics, clothing, and toys topped the list of popular items, while mobile shopping accounted for 57.6% of online sales. “Buy now, pay later” services also saw a notable 12.8% increase, contributing $711.3 million in Black Friday sales (Not a good sign). Retailers performed exceptionally well, with Amazon reporting its best Black Friday week ever, driven by high sales of Echo and Fire TV devices. Shopify merchants also saw a 22% increase in sales, peaking at $4.2 million per minute. REF: BFS

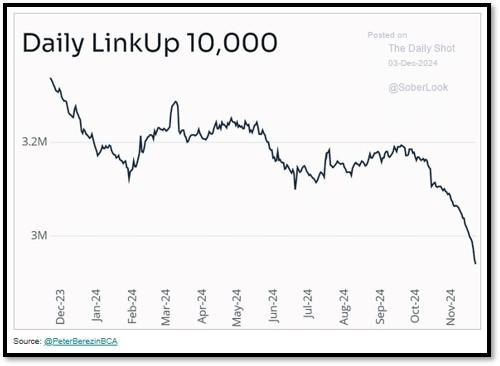

Meanwhile, another statistic paints a different picture. According to LinkUp, the decline in job openings has accelerated. REF: DailyShot

2. China’s government is preparing to continue to stimulate its economy, with key actions expected around the Central Economic Working Conference (CEWC) in December.

The People’s Bank of China (PBOC) has initiated liquidity injections, including 900 billion yuan through policy loans, and is considering issuing 2 trillion yuan in special sovereign bonds to boost consumption and manage local debt. Interest rate adjustments, such as lowering the reserve requirement ratio (RRR) and cutting rates on reverse repurchases, are designed to reduce financing costs, encouraging spending. The property market is also under focus, with reduced mortgage rates and expanded project financing to stabilize this sector. REF: CNWire, PIIE, REUTERS

Sounds familiar, doesn’t it? However, what’s different this time is that the technical signals are coming in. Recent technical analyses indicate that Chinese and broader Asian equities are exhibiting buy signals, suggesting potential investment opportunities. Click onto picture below to access video. REF: CNBC

**With the current macro-economic backdrop, below are areas we currently favor:

- Fixed Income – Short-term Corporates (Low-Beta)

- Fixed Income – Corporates High Yield as Opportunistic Allocation (Low-Beta)

- Businesses that contribute to and benefit from AI & Automation (Market-Risk)

- Small Cap & Mid Cap Stocks (Market-Risk)

- Utilities (Market-Risk)

- Healthcare & Biotechnology (Market-Risk)

- Gold (Market-Risk)

- Industrials (Market-Risk)

- Asian Equity (Market-Risk) *NEW*

3. This week, I want to highlight the revolution happening in the global auto manufacturing sector.

Traditional automakers are facing significant challenges, and I believe consolidations are inevitable. Global EV adoption, coupled with the growing prominence of Chinese automakers, has put many car brands in jeopardy. According to the Financial Times, insiders suggest that Nissan has only 12 to 14 months to survive. The company has already sold a third of its stake in Mitsubishi to raise cash. Nissan has cut thousands of jobs and announced plans last month to lay off approximately 9,000 employees as production fell by 20%, driven by declining sales in the U.S. and China. Renault or Honda might ultimately acquire Nissan. There’s more…

Carlos Tavares, the CEO of Stellantis—a global automotive group encompassing brands like Jeep, Peugeot, and Fiat—resigned on December 1, 2024, amid declining sales and strategic disagreements with the board. Under Tavares’s leadership since the 2021 merger of PSA Group and Fiat Chrysler Automobiles, Stellantis initially achieved profitability. However, recent challenges, including a 20% drop in sales volumes and a €12 billion revenue loss, led to mounting pressures. Tavares’s aggressive cost-cutting measures and management style strained relations with dealers, suppliers, and unions. His decision to close the Vauxhall Vivaro van plant in Luton, risking 1,000 jobs, faced significant backlash.

General Motors (GM) plans to sell its stake in a $2.6 billion electric vehicle (EV) battery plant in Lansing, Michigan, to its partner LG Energy Solution. This decision reflects a strategic shift due to slower-than-expected demand for EVs, prompting GM to reassess its production capacities. Proposed U.S. policies, such as ending consumer EV subsidies and imposing tariffs on imports from Canada and Mexico, could adversely affect GM.

Ford is grappling with declining consumer demand for EVs, leading to job cuts and calls for government incentives to boost sales. The company recently announced the elimination of 800 positions and is urging the UK government to implement consumer incentives of up to £5,000 for EV purchases to remain competitive against affordable Chinese models. Ford reported a significant drop in second-quarter earnings, attributed to an $800 million increase in warranty repair costs for vehicles built in 2021 and earlier.

Volkswagen is considering closing at least three factories in Germany due to declining sales and profitability. The company reported a 64% drop in profits for the three months ending September 2024, primarily due to a sales slump in China. The company faces substantial debt, estimated at €155.6 billion, raising concerns about its financial health and long-term viability.

Rivian Automotive Inc., an electric vehicle (EV) manufacturer, is navigating significant financial challenges and has yet to achieve profitability. In the third quarter of 2024, Rivian reported a net loss of $1.1 billion, or $1.08 per share, on revenue of $874 million. Rivian has secured a conditional $6.6 billion loan from the U.S. Department of Energy to construct a new manufacturing plant in Georgia.

Fisker, the EV startup, filed for Chapter 11 bankruptcy in June 2024 after unsuccessful attempts to secure additional funding and partnerships. Production delays and financial mismanagement contributed to its downfall. Click onto pictures below to access videos. REF: CNBC, MotorTrend

4. World Watch

4A. Huawei’s Recruitment of Zeiss SMT Talent: A Strategic Move in the Tech Race. Huawei Technologies has reportedly been recruiting employees from Zeiss SMT, a German leader in optics and semiconductor technology, offering salaries as much as triple their current pay. This aggressive talent acquisition underscores Huawei’s strategy to enhance its semiconductor and optical technology capabilities, especially as it faces global restrictions on accessing advanced chips.

Zeiss SMT specializes in photolithography systems critical for semiconductor manufacturing. By targeting its workforce, Huawei aims to acquire not only skilled personnel but also valuable expertise and insights. This tactic is especially significant for Huawei, which has been seeking to reduce dependence on foreign technology amidst U.S.-led sanctions. The poaching of talent poses challenges for Zeiss SMT. The loss of key employees could disrupt innovation and give Huawei a competitive edge, even indirectly, through the transfer of knowledge and expertise. For Germany, this highlights a vulnerability in retaining top-tier talent in strategic industries, especially when competing with the financial clout of global tech giants.

Huawei’s actions also raise ethical and regulatory questions. While offering competitive pay is standard practice, concerns linger about potential misuse of proprietary knowledge. This trend reflects a broader dynamic in the tech world, where companies increasingly compete for talent to maintain technological leadership. Ultimately, Huawei’s recruitment strategy underscores the intensifying global tech race, forcing companies and governments to adapt to protect intellectual property and retain critical talent. Click onto picture below to access video. REF: WSJ, Firstpost

4B. On December 3, 2024, South Korean President Yoon Suk Yeol declared martial law, citing the need to combat “anti-state forces” among domestic political opponents. This unprecedented move in the nation’s recent democratic history led to immediate and widespread protests, with citizens and lawmakers expressing strong opposition. The National Assembly convened an emergency session, where all 190 members present voted unanimously to rescind the martial law decree. Facing overwhelming dissent, President Yoon lifted the martial law order just hours after its imposition. The incident has raised significant concerns about South Korea’s political stability.

South Korean stocks, as reflected by the iShares MSCI South Korea ETF (EWY), have declined over 20% from its recent high due to a combination of global, regional, and domestic challenges. Rising US interest rates strengthened the US dollar, making it more attractive to investors. This shift has led to capital outflows from emerging markets, including South Korea. South Korea’s economy is heavily reliant on exports. Global trade tensions and potential tariffs, particularly from the U.S., have raised concerns about South Korea’s export competitiveness. The Korean won plunged to its lowest value in 25 months, reaching 1,444 per U.S. dollar, before recovering slightly to around 1,420. Click onto picture below to access video. REF: Bloomberg, Stockcharts

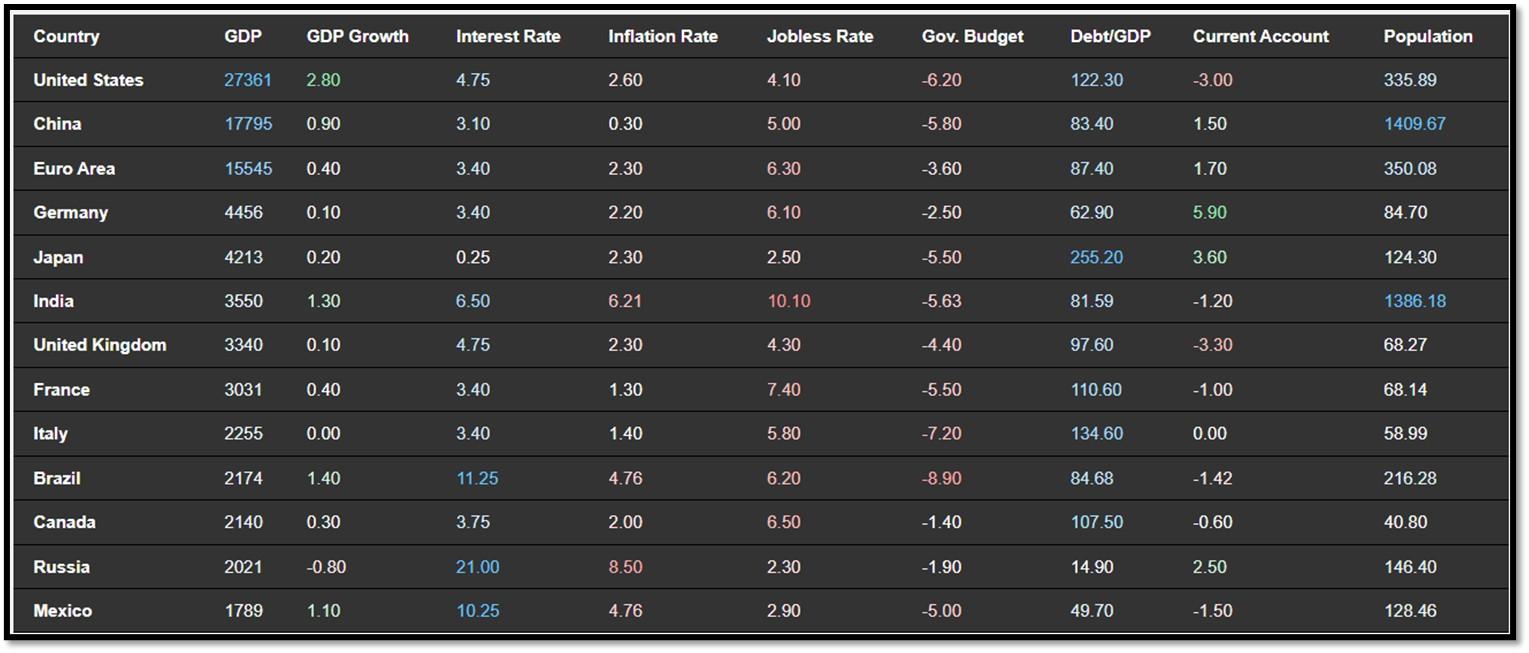

4C. Below is an updated snapshot of the current global state of economy according to TradingEconomics as of 12/2/2024. REF: TradingEconomics

- Germany’s annual inflation rate rose to 2.2% in November 2024, up from 2% in October but slightly below market expectations of 2.3%, marking the highest level in four months, according to preliminary estimates.

- Japan’s unemployment rate ticked up to 2.5% in October 2024 from September’s eight-month low of 2.4%, aligning with market estimates.

- Annual inflation rate in France edged up to 1.3% in November 2024, the highest in three months, compared to 1.2% in October, but below forecasts of 1.5%, preliminary estimates showed.

- The annual inflation rate in Italy rose to 1.4% in November of 2024 from 0.9% in the previous month, the highest in one year, and matching market expectations according to a flash estimate.

.

Below is a selection of quantitative & technical data we monitor on a regular basis to help gauge the overall financial market conditions and the investment environment.

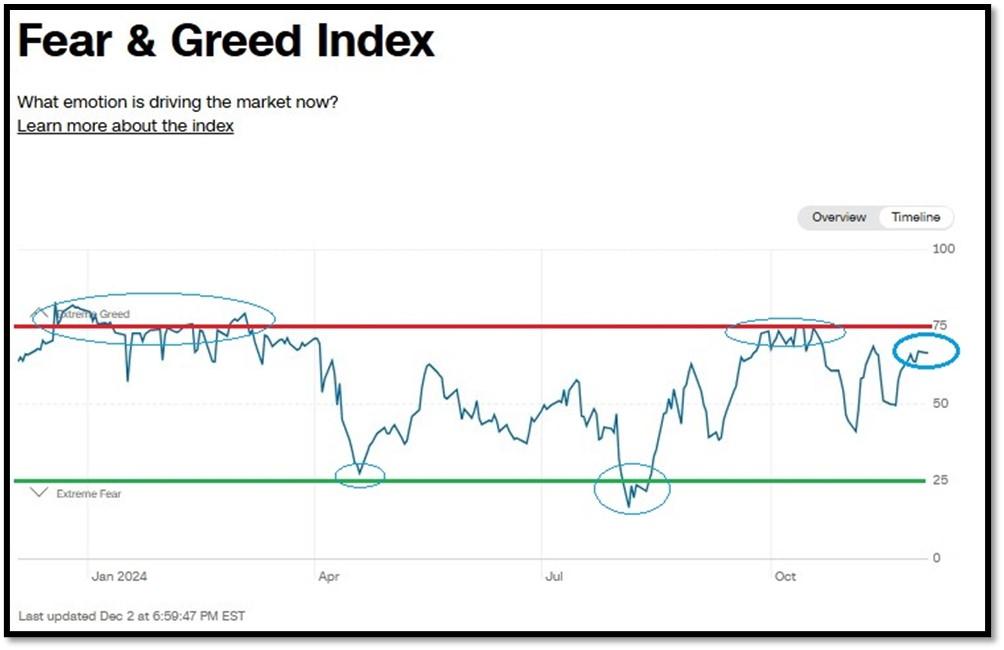

5A. Most recent read on the Fear & Greed Index with data as of 12/2/2024 – 8:00PM-ET is 67 (Greed). Last week’s data was 64 (Greed) (1-100). CNNMoney’s Fear & Greed index looks at 7 indicators (Stock Price Momentum, Stock Price Strength, Stock Price Breadth, Put and Call Options, Junk Bond Demand, Market Volatility, and Safe Haven Demand). Keep in mind this is a contrarian indicator! REF: Fear&Greed via CNNMoney

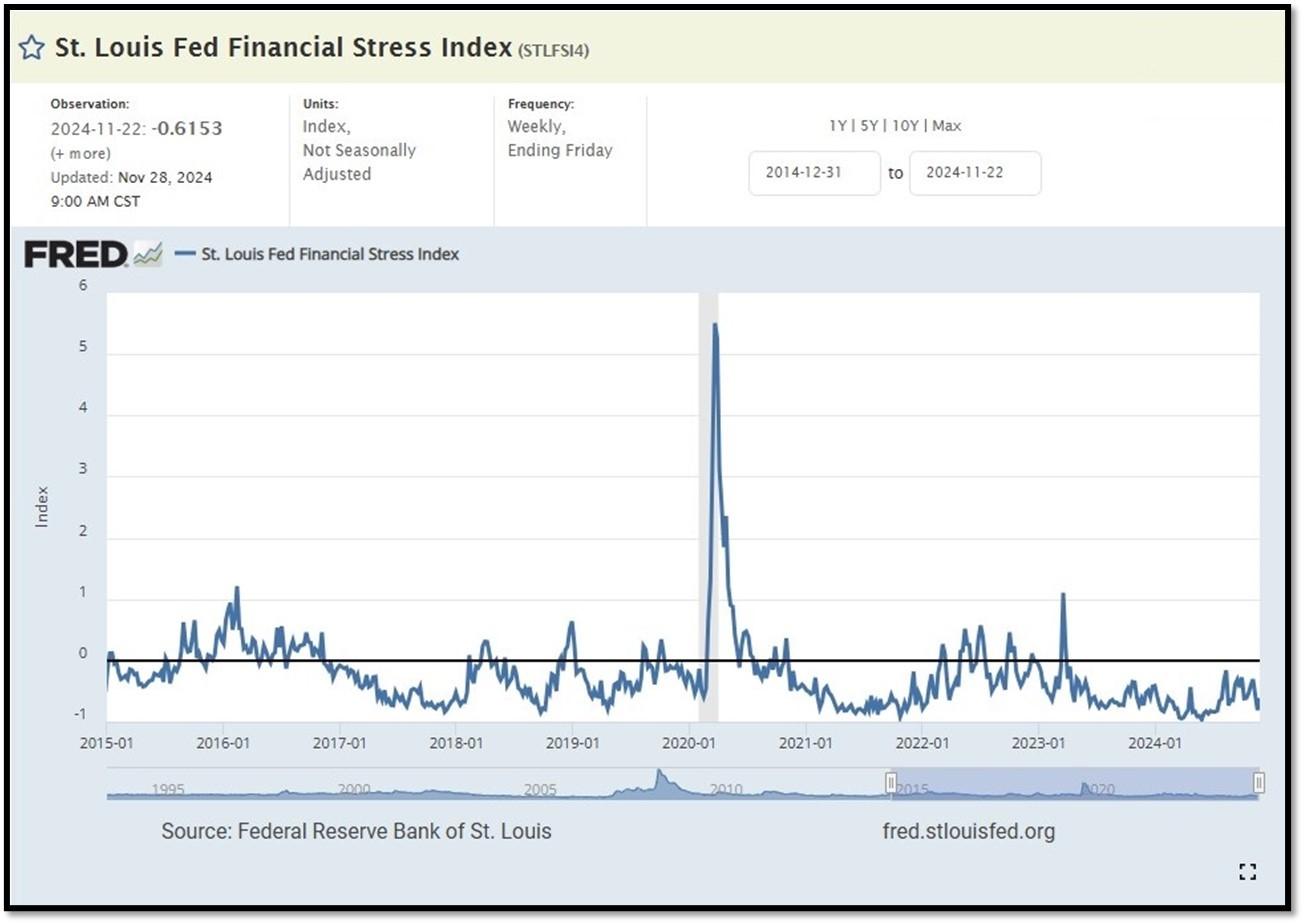

5B. St. Louis Fed Financial Stress Index’s (STLFSI4) most recent read is at –0.6153 as of November 28, 2024. A big spike up from previous readings reflecting the recent turmoil in the banking sector. Previous week’s data was -0.8092. This weekly index is not seasonally adjusted. The STLFSI4 measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. REF: St. Louis Fed

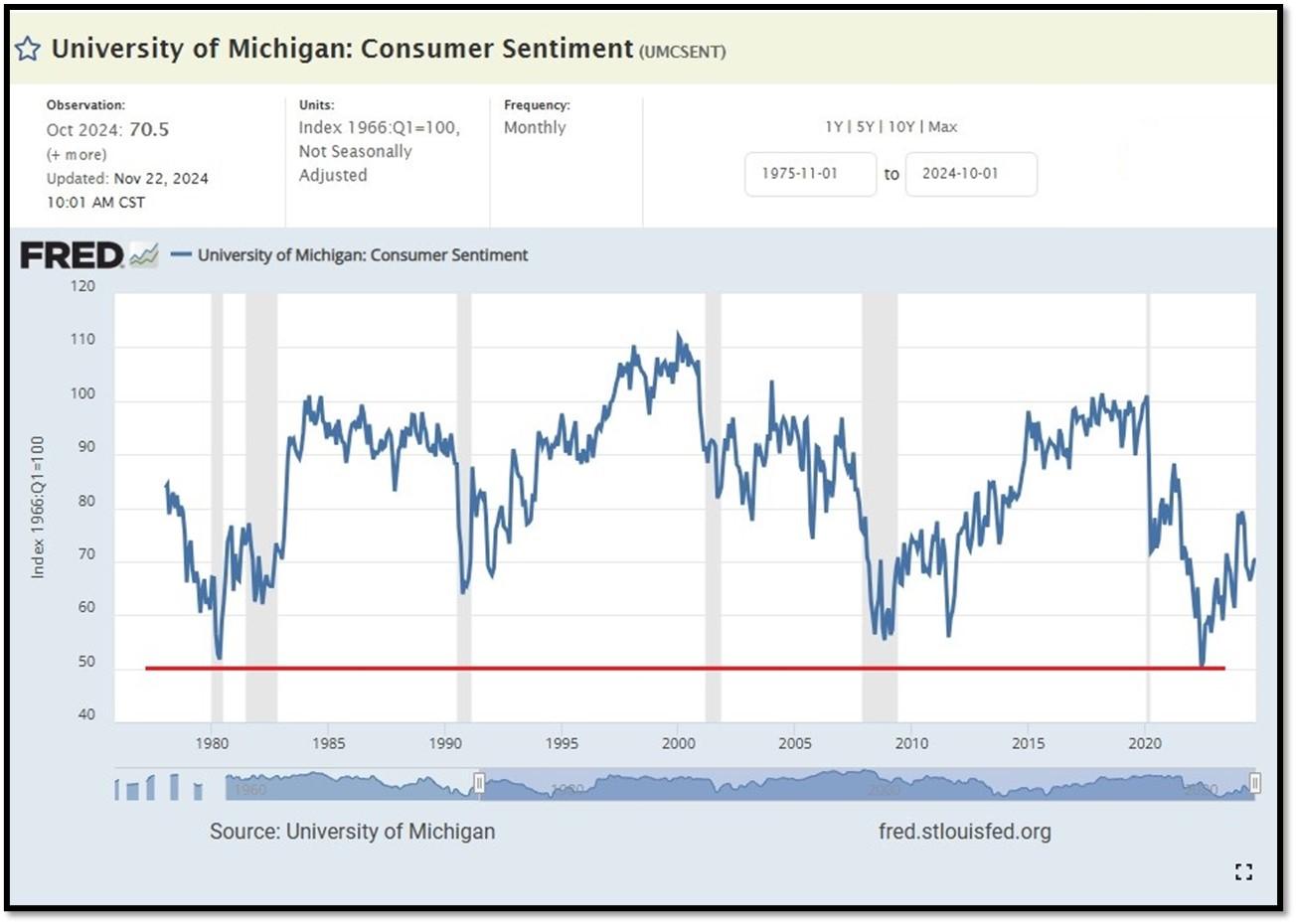

5C. University of Michigan, University of Michigan: Consumer Sentiment for September [UMCSENT] at 70.5, retrieved from FRED, Federal Reserve Bank of St. Louis, October 25, 2024. Back in June 2022, Consumer Sentiment hit a low point going back to April 1980. REF: UofM

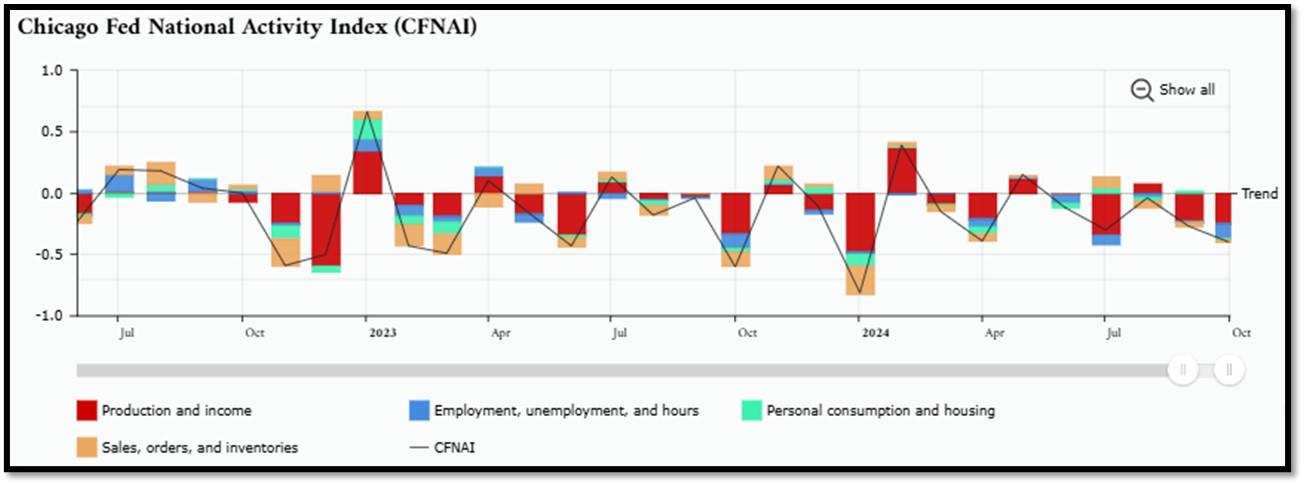

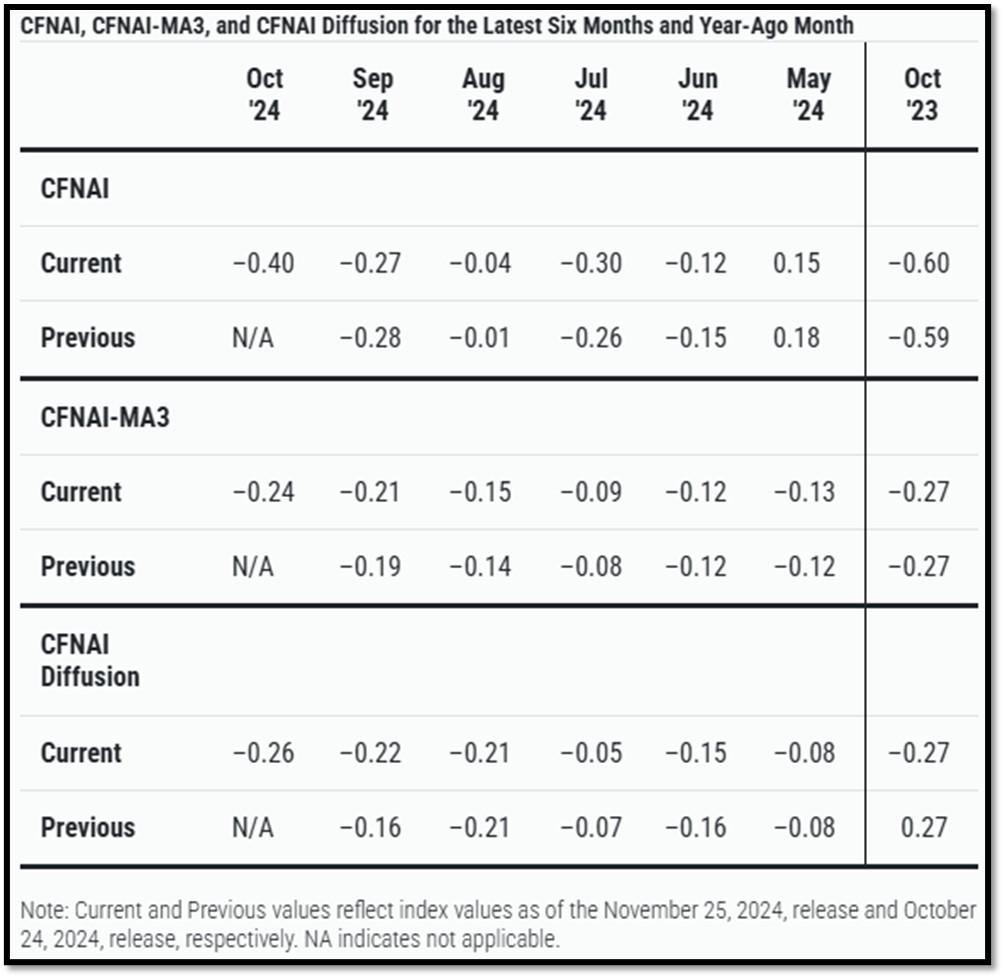

5D. The Chicago Fed National Activity Index (CFNAI) decreased to –0.40 in October from –0.27 in September. Three of the four broad categories of indicators used to construct the index decreased from September, and all four categories made negative contributions in October. The index’s three-month moving average, CFNAI-MA3, decreased to –0.24 in October from –0.21 in September. REF: ChicagoFed, October’s Report

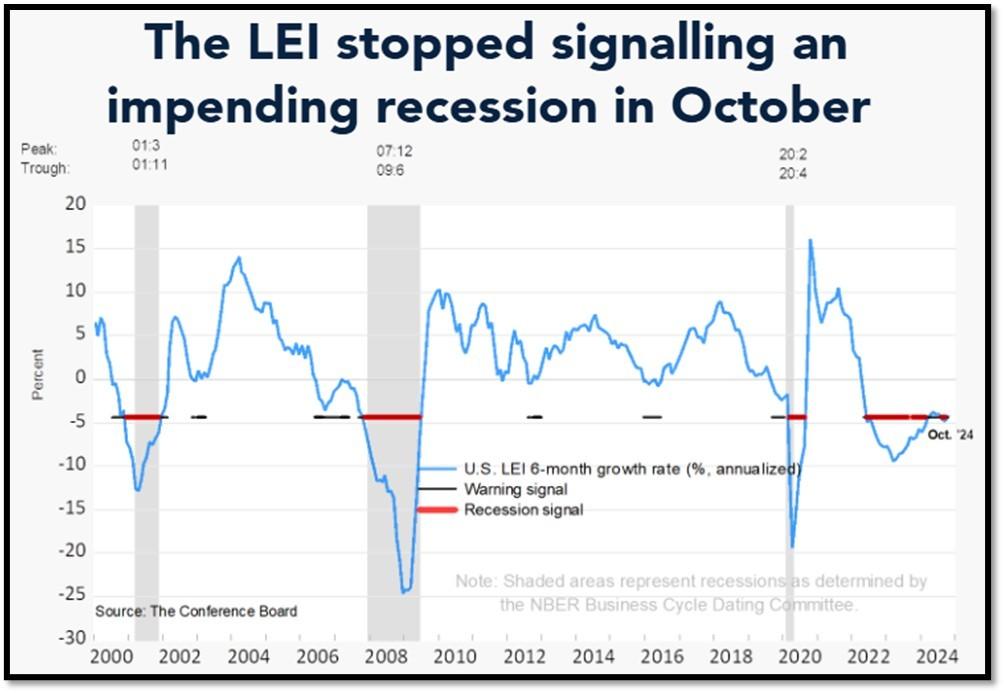

5E. (11/21/2024) The Conference Board Leading Economic Index (LEI) for the US declined by 0.4% in October 2024 to 99.5 (2016=100), following a 0.3% decline in September (revised up from a 0.5% decline). Over the six-month period between April and October 2024, the LEI fell by 2.2%, slightly more than its 2.0% decline over the previous six-month period (October 2023 to April 2024). The composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component. The CEI is highly correlated with real GDP. The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. Shaded areas denote recession periods or economic contractions. The dates above the shaded areas show the chronology of peaks and troughs in the business cycle. The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers’ new orders for nondefense capital goods excluding aircraft orders; Building permits for new private housing units; S&P 500® Index of Stock Prices; Leading Credit Index™; Interest rate spread (10-year Treasury bonds less federal funds rate); Average consumer expectations for business conditions. REF: ConferenceBoard, LEI Report for October (Released on 12/2/2024)

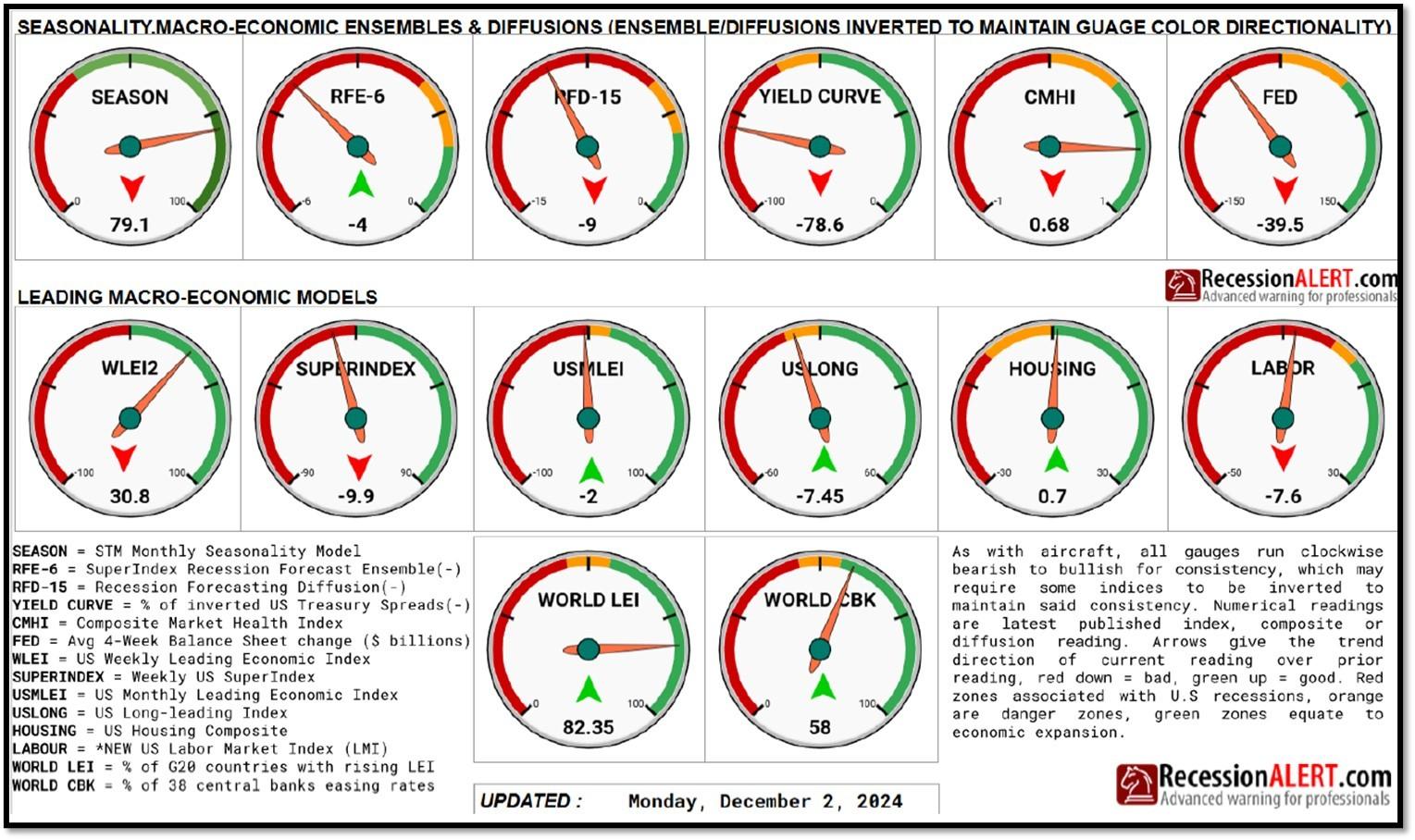

5F. Probability of U.S. falling into Recession within 3 to 4 months is currently at 68.53% (with data as of 12/2/2024 – Next Report 12/16/2024) according to RecessionAlert Research. Last release’s data was at 65.65%. This report is updated every two weeks. REF: RecessionAlertResearch

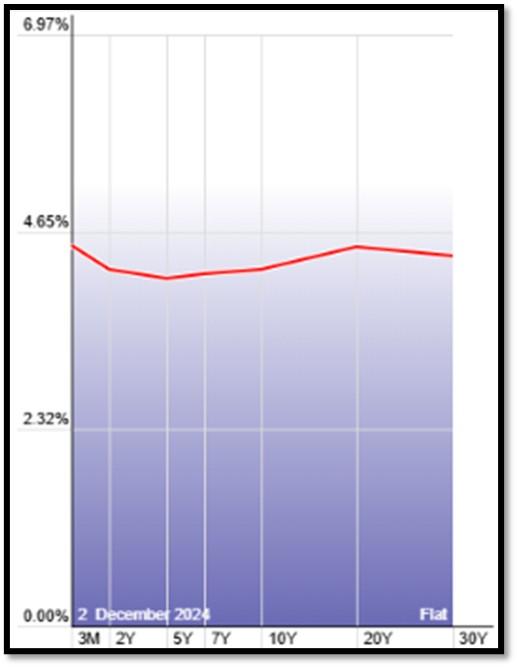

5G. Yield Curve as of 12/2/2024 is showing Flattening. Spread on the 10-yr Treasury Yield (4.21%) minus yield on the 2-yr Treasury Yield (4.18%) is currently at 3 bps. REF: Stockcharts The yield curve—specifically, the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill—is a valuable forecasting tool. It is simple to use and significantly outperforms other financial and macroeconomic indicators in predicting recessions two to six quarters ahead. REF: NYFED

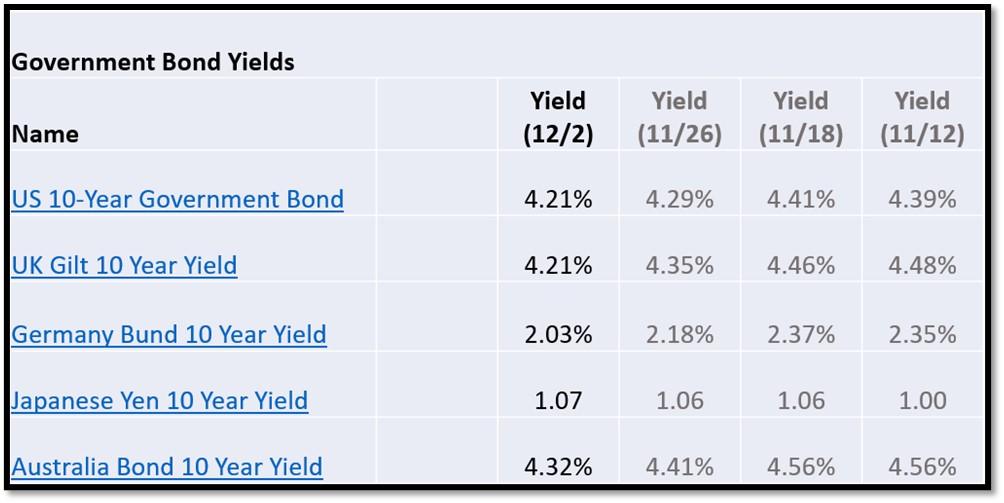

5H. Recent Yields in 10-Year Government Bonds. REF: Source is from Bloomberg.com, dated 12/2/2024, rates shown below are as of 12/2/2024, subject to change.

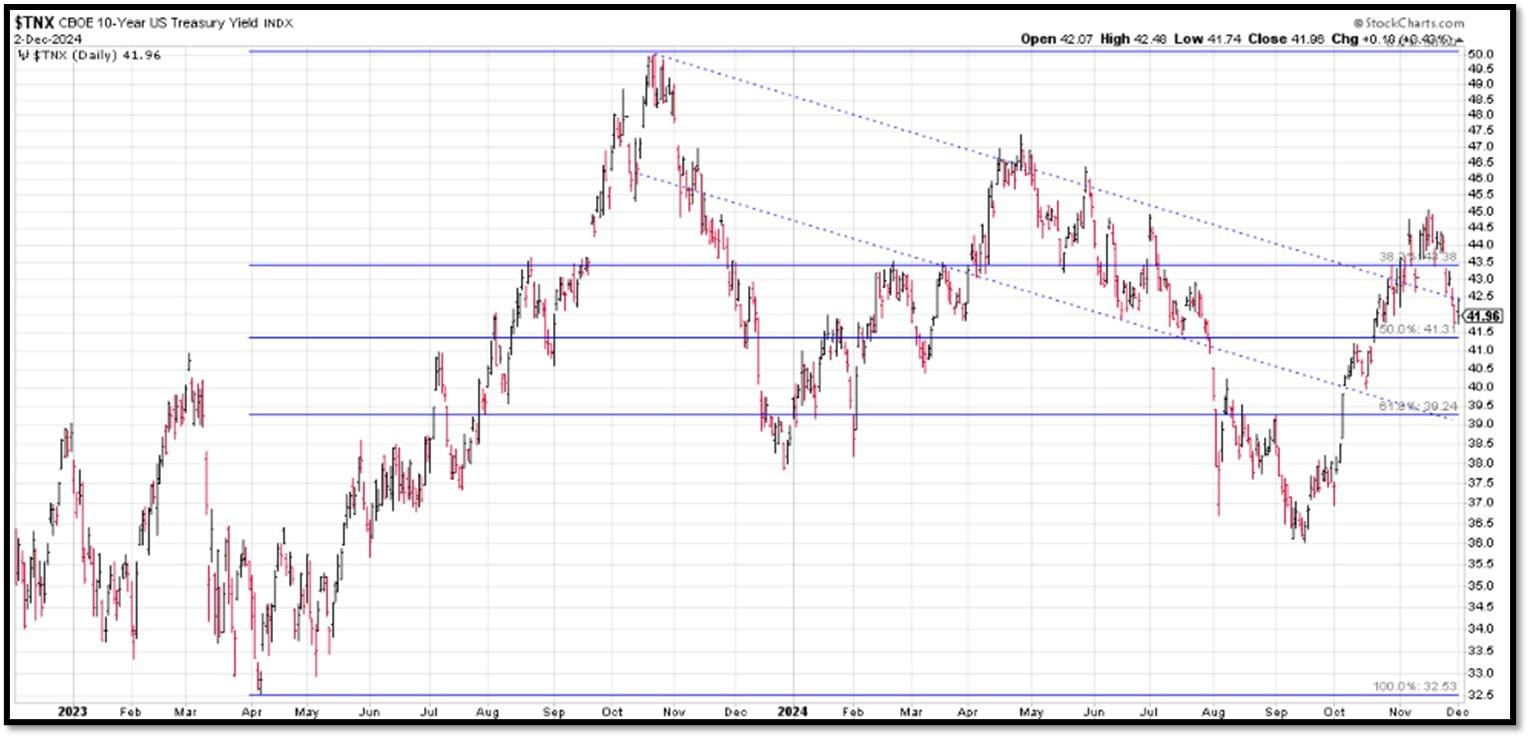

The 10-Year US Treasury Yield… REF: StockCharts1, StockCharts2

The 10-year yield – Spiked towards top of trend…

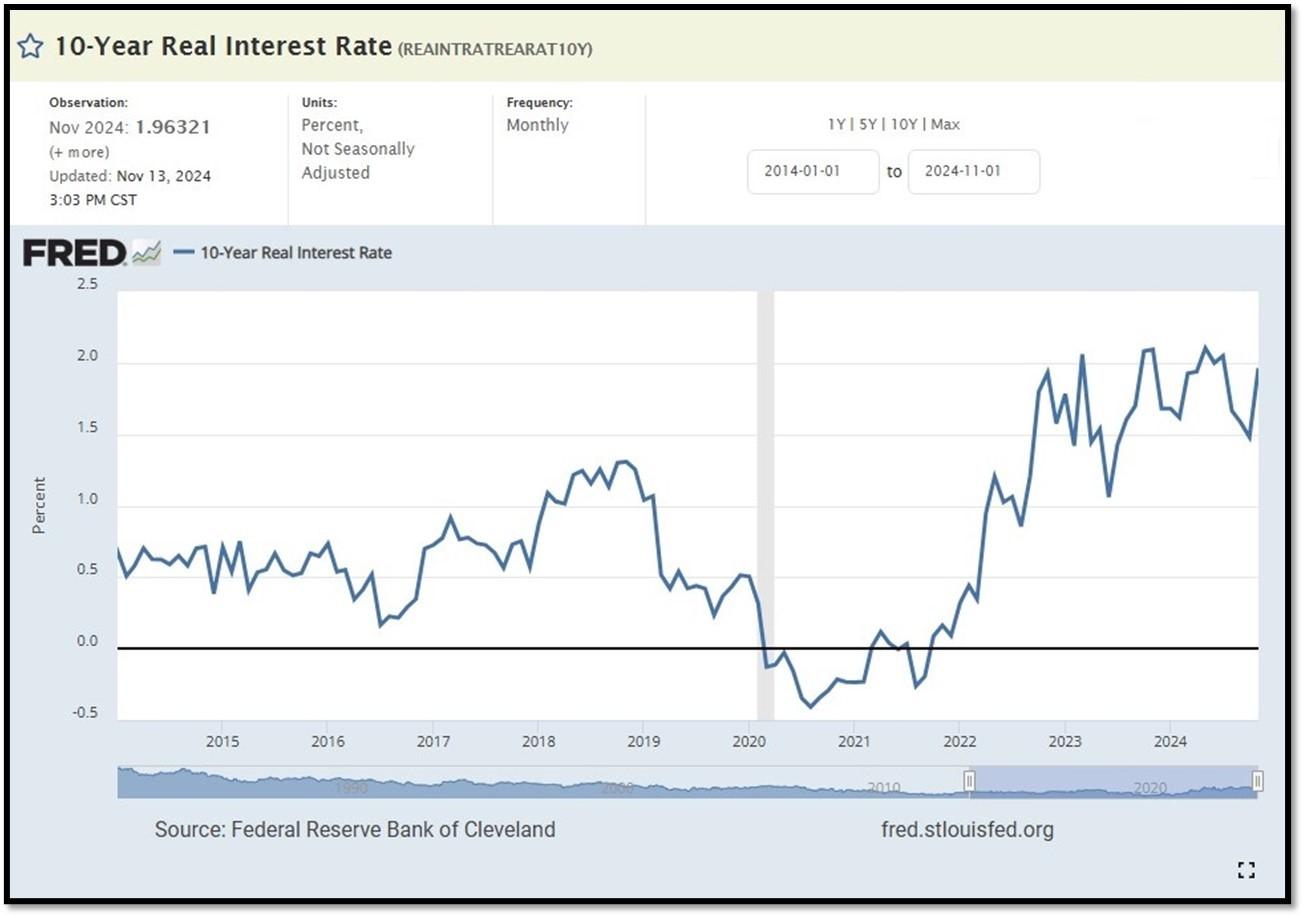

10-Year Real Interest Rate at 1.96321% as of 11/13/24. REF: REAINTRATREARAT10Y

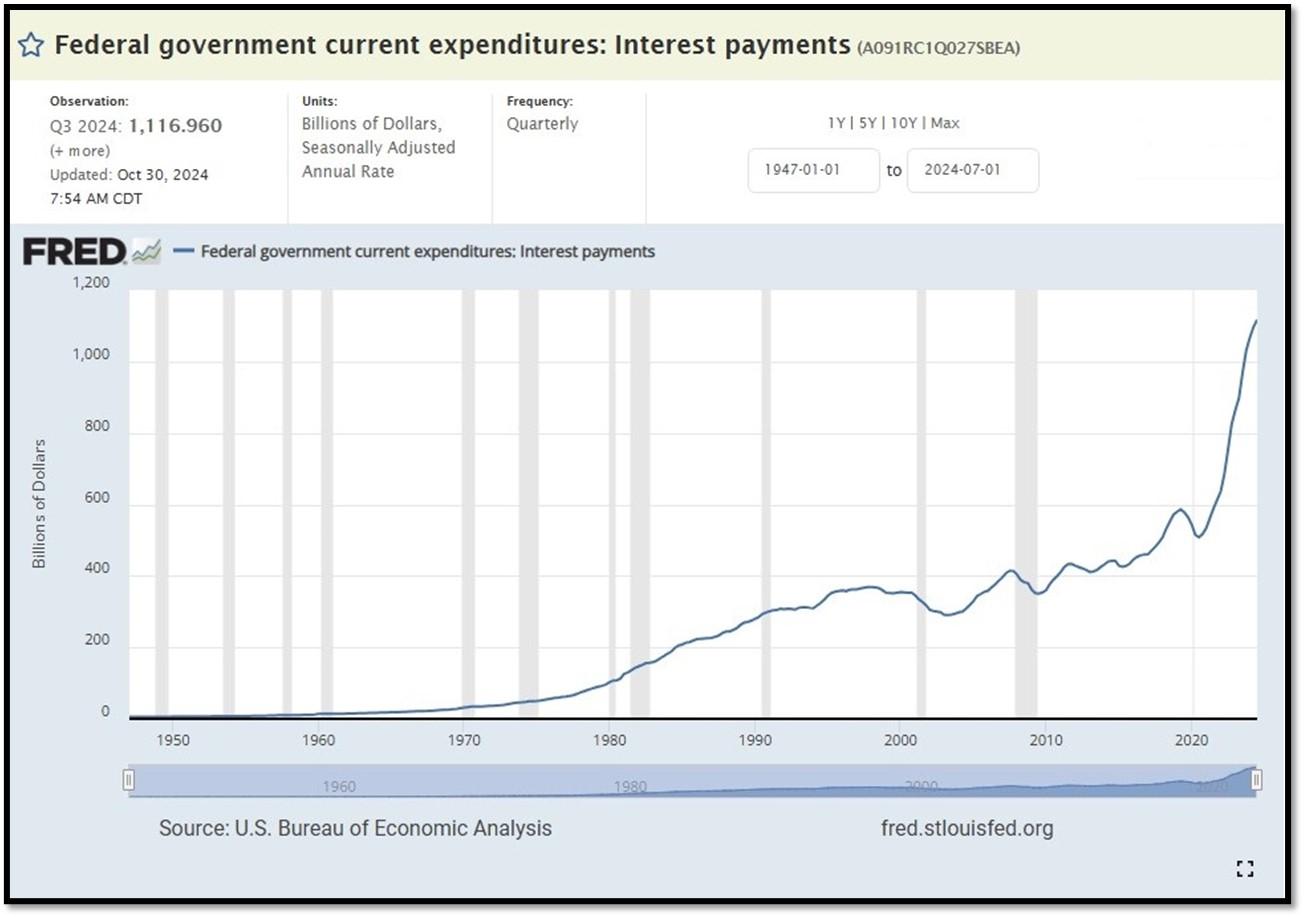

Federal government Interest Payments increased $20B+ to $1.1166 Trillion as of Q3-2024. REF: FRED-A091RC1Q027SBEA

Interest payments as a percentage of GDP increased from 1.84853 in 2022 to 2.37794 as of 10/18/24. REF: FRED-FYOIGDA188S

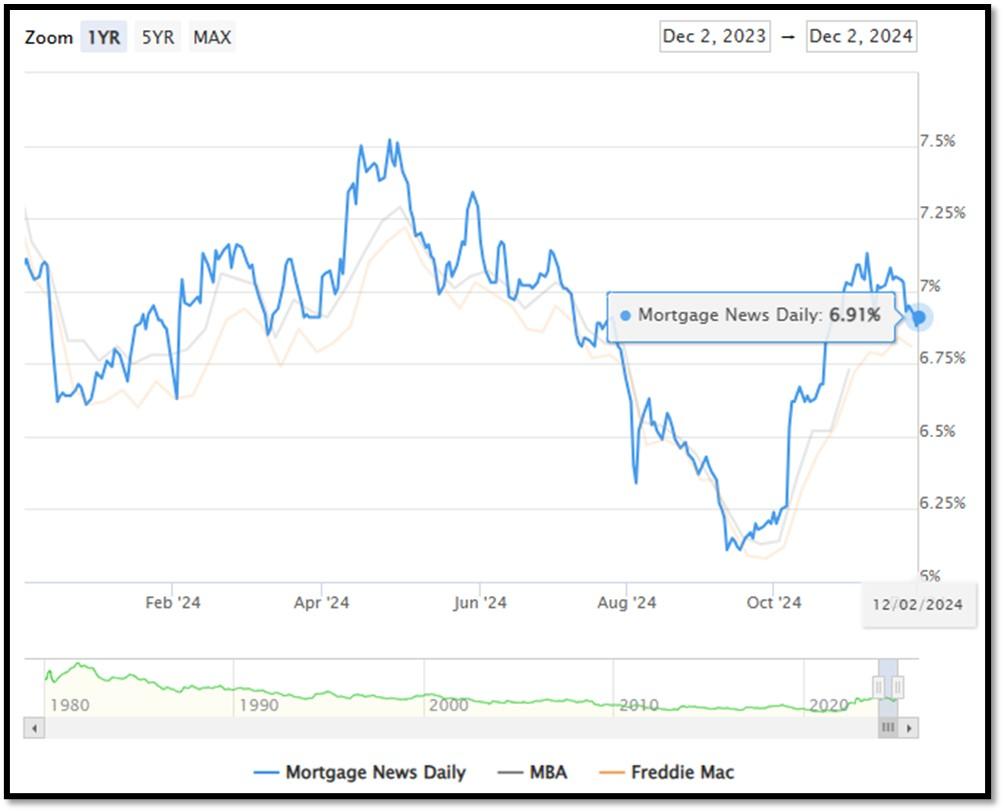

5I. (12/2/2024) Today’s National Average 30-Year Fixed Mortgage Rate is 6.91% (All Time High was 8.03% on 10/19/23). Last week’s data was 6.93%. This rate is the average 30-year fixed mortgage rates from several different surveys including Mortgage News Daily (daily index), Freddie Mac (weekly survey), Mortgage Bankers Association (weekly survey) and FHFA (monthly survey). REF: MortgageNewsDaily, Today’s Average Rate

The recent spike in the 30-year fixed-rate jumbo mortgage to 6.91%, compared to Freddie Mac’s rate at 6.81% and the Mortgage Bankers Association (MBA) rate at 6.73%, highlights key differences in the mortgage market. Jumbo mortgages, which exceed the conforming loan limits set by government agencies like Freddie Mac, typically carry higher interest rates because they are riskier for lenders. These loans are not backed by government entities, which increases the risk for lenders and, consequently, leads to higher rates. In contrast, Freddie Mac and MBA provide averages for conforming loans, which meet federal guidelines and have lower risk due to government backing, keeping their rates lower.

(11/11/24) Housing Affordability Index for Aug = 98.6 // July = 95 // June = 93.3 // May = 93.1 // April = 95.9 // March = 101.1 // February = 103.0. Data provided by Yardeni Research. REF: Yardeni

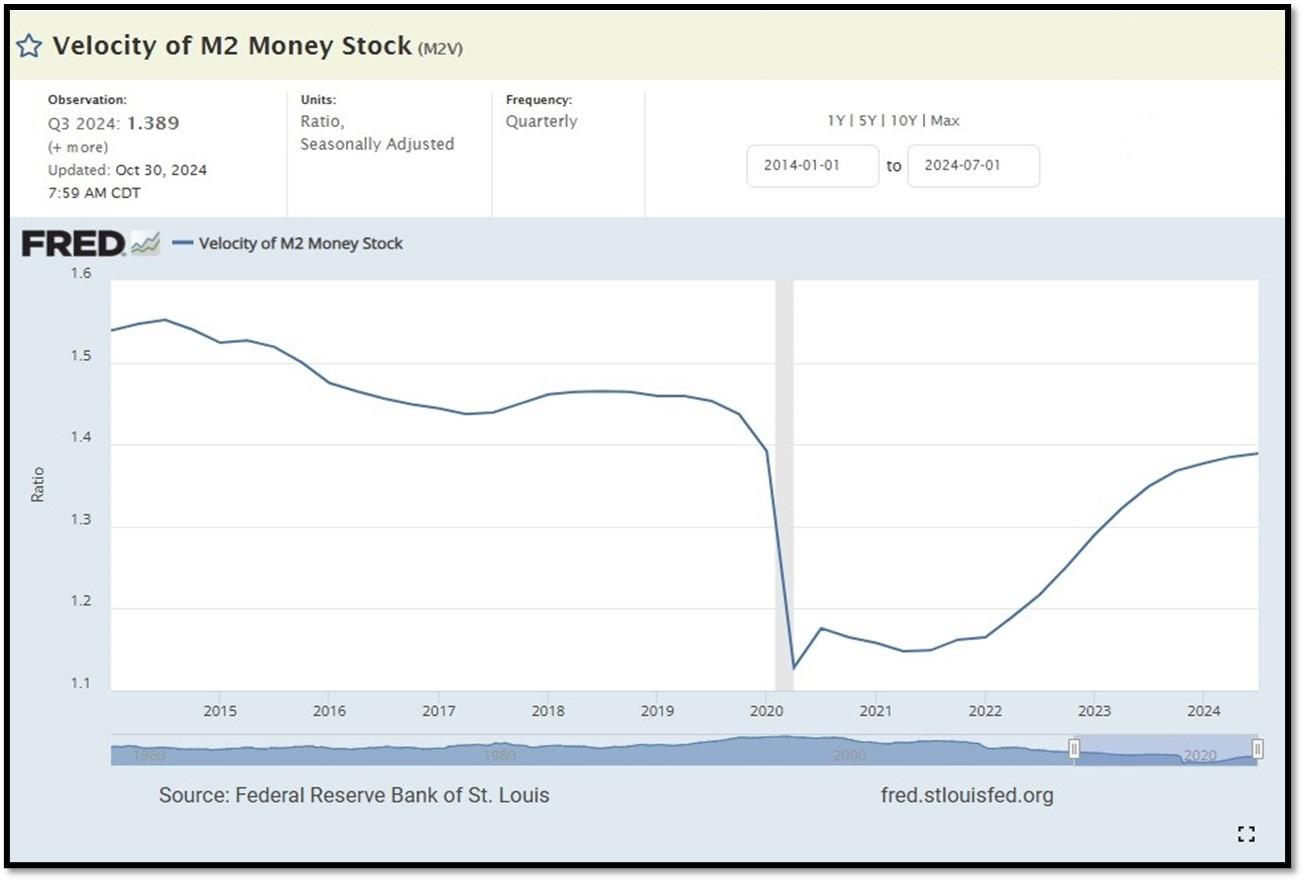

5J. Velocity of M2 Money Stock (M2V) with current read at 1.389 as of (Q2-2024 updated 10/30/2024). Previous quarter’s data was 1.385. The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. Current Money Stock (M2) report can be viewed in the reference link. REF: St.LouisFed-M2V

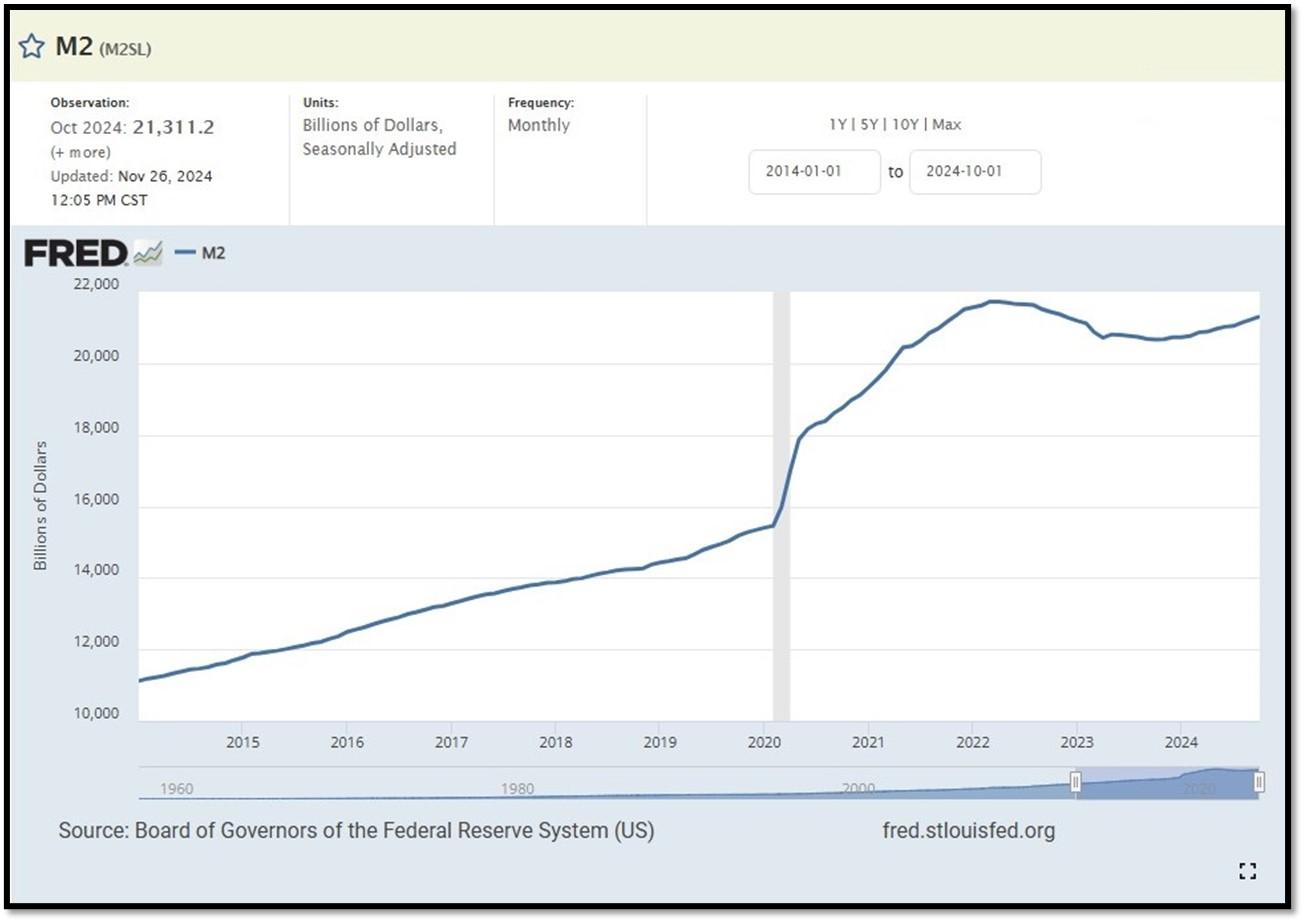

M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; Updated on November 26, 2024. REF: St.LouisFed-M2

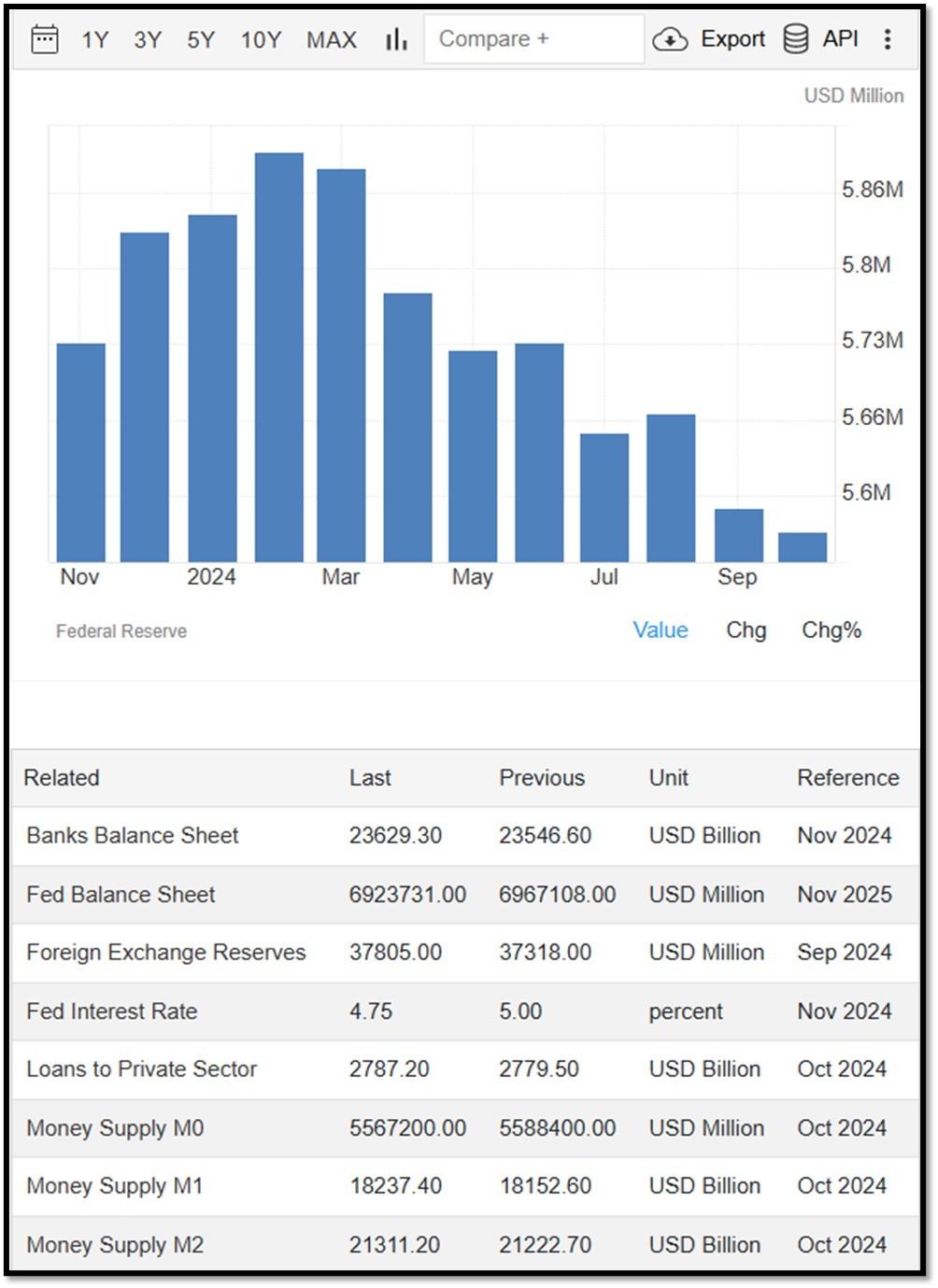

Money Supply M0 in the United States decreased to 5,567,200 USD Million in October from 5,588,400 USD Million in September of 2024. Money Supply M0 in the United States averaged 1,155,032.53 USD Million from 1959 until 2024, reaching an all-time high of 6,413,100 USD Million in December of 2021 and a record low of 48,400 USD Million in February of 1961. REF: TradingEconomics, M0

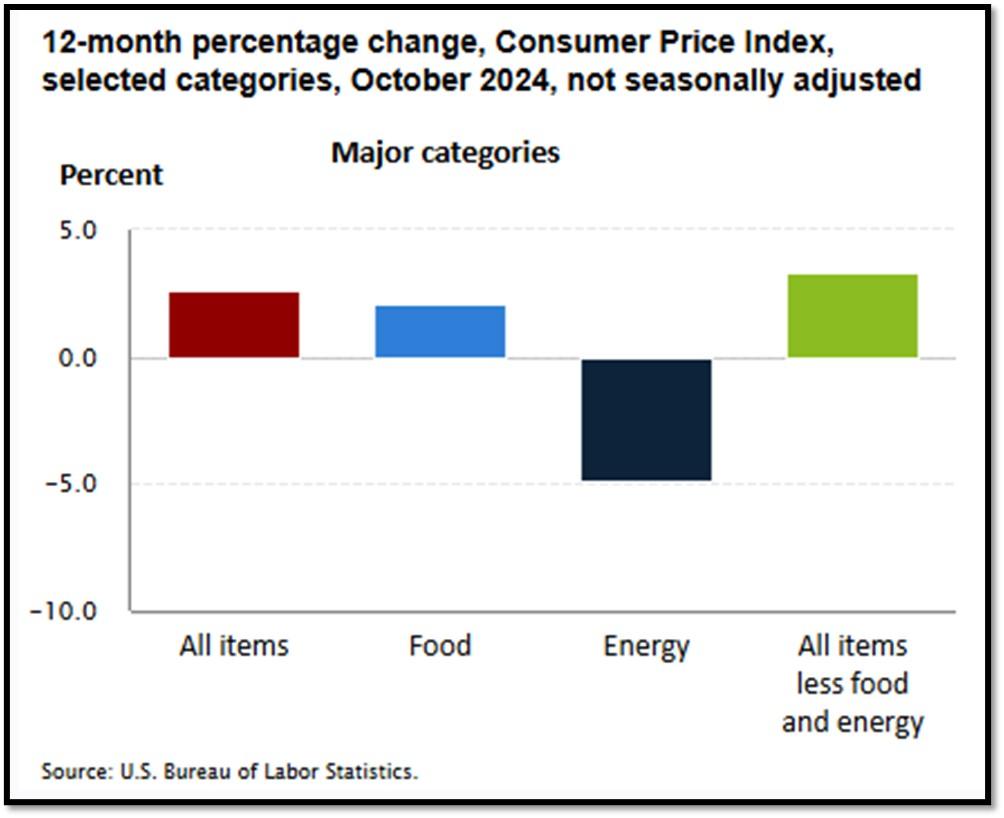

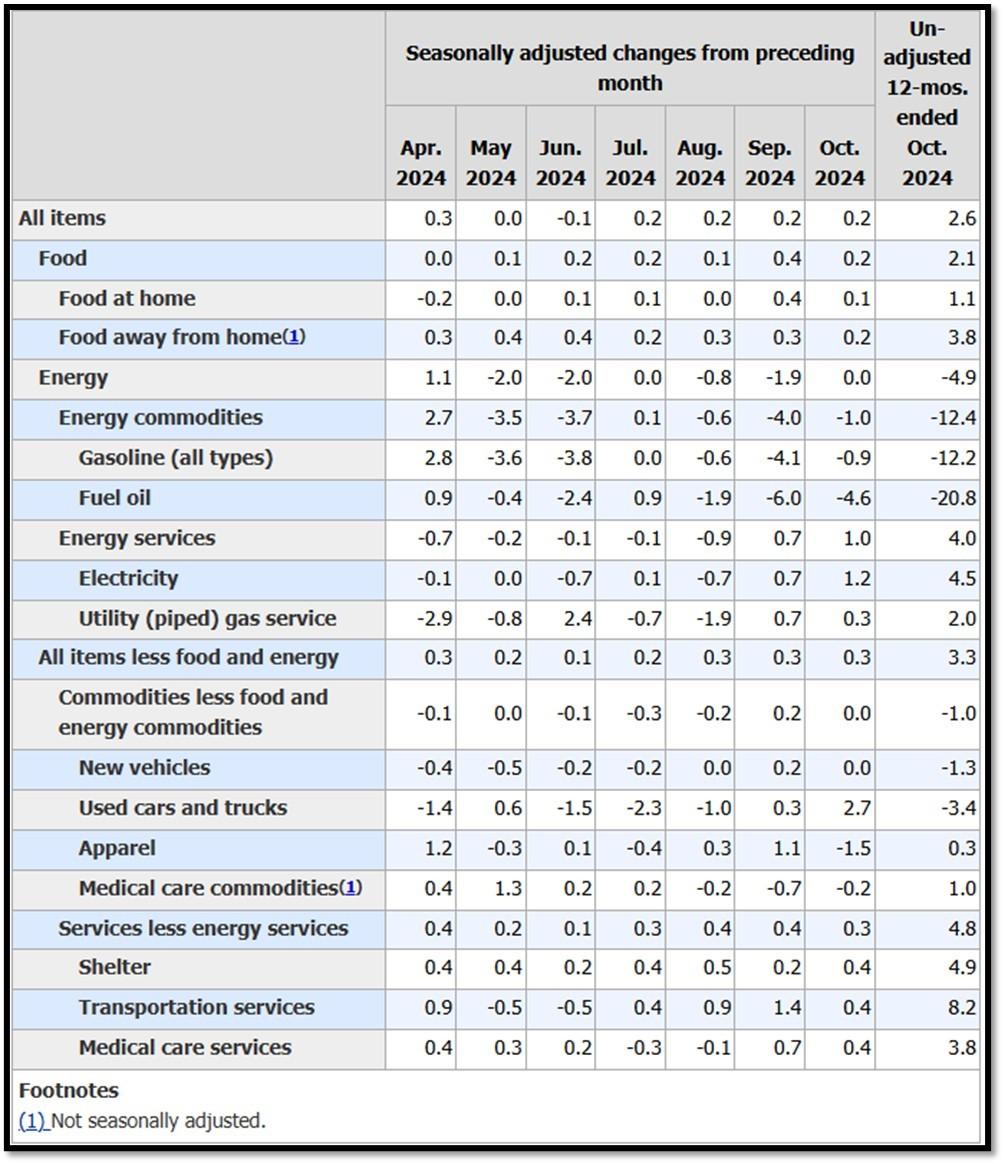

5K. In October, the Consumer Price Index for All Urban Consumers rose 0.2 percent, seasonally adjusted, and rose 2.6 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.3 percent in October (SA); up 3.3 percent over the year (NSA). November 2024 CPI data are scheduled to be released on December 11, 2024, at 8:30AM-ET. REF: BLS, BLS.GOV

5L. Technical Analysis of the S&P500 Index. Click onto reference links below for images.

- Short-term Chart: Bullish on 12/2/2024 – REF: Short-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Medium-term Chart: Bullish on 12/2/2024 – REF: Medium-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Market Timing Indicators – S&P500 Index as of 12/2/2024 – REF: S&P500 Charts (7 of them) by Joanne Klein’s Top 7 (Click Here to Access Updated Charts)

- A well-defined uptrend channel shown in green with S&P500 still on up trend. REF: Stockcharts

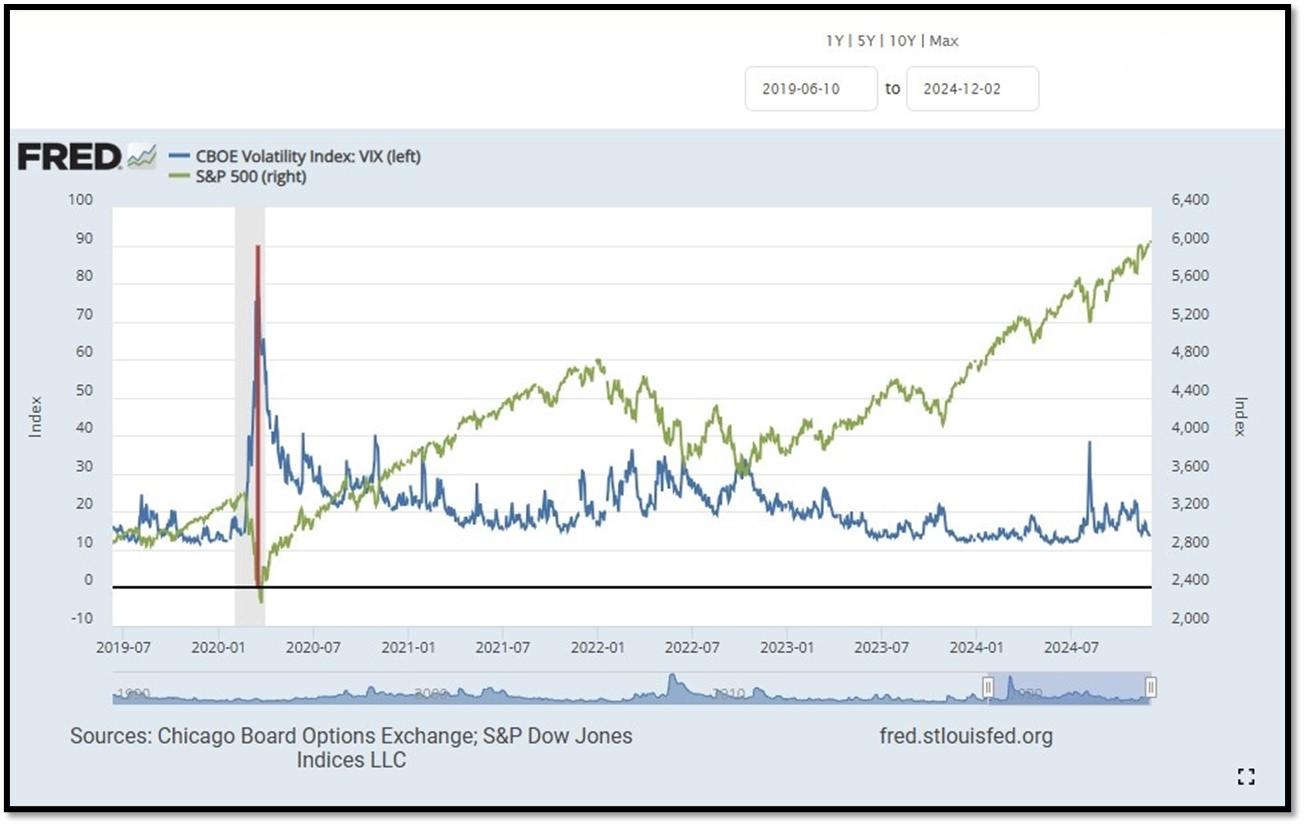

- S&P500 and CBOE Volatility Index (VIX) as of 12/2/2024. REF: FRED, Today’s Print

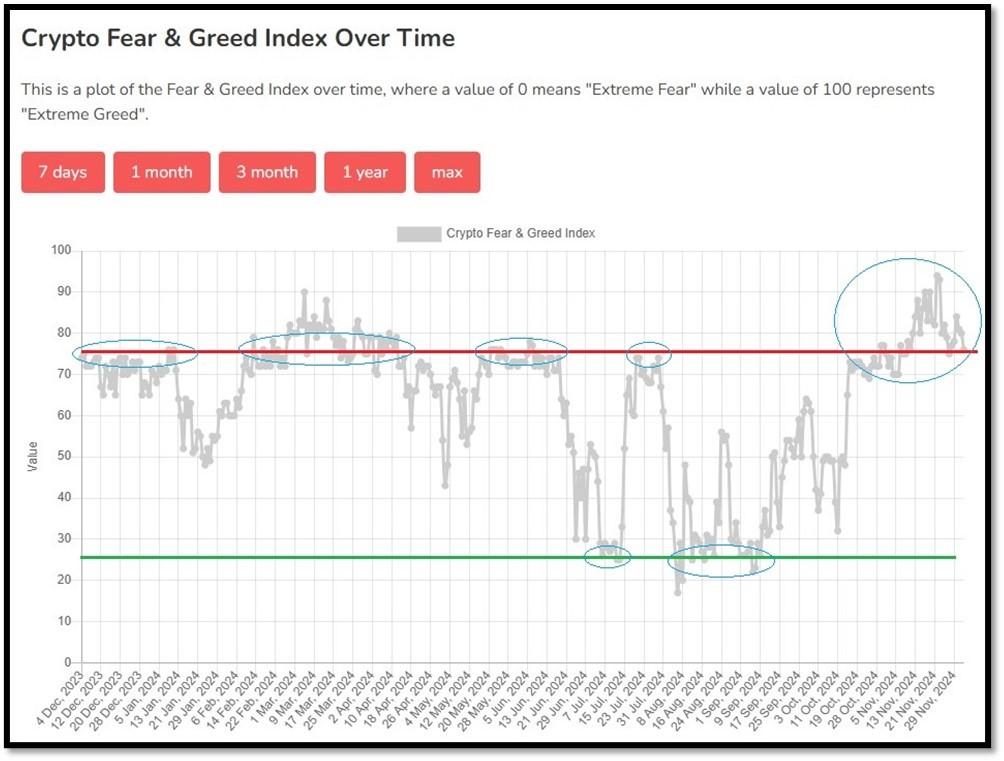

5M. Most recent read on the Crypto Fear & Greed Index with data as of 12/3/2024au is 76 (Extreme Greed). Last week’s data was 79 (Extreme Greed) (1-100). Fear & Greed Index – A Contrarian Data. The crypto market behavior is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction of seeing red numbers. With the Crypto Fear and Greed Index, the data try to help save investors from their own emotional overreactions. There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

Therefore, the program for this index analyzes the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means “Extreme Fear”, while 100 means “Extreme Greed”. REF: Alternative.me, Today’sReading

Bitcoin – 10-Year & 2-Year Charts. REF: Stockcharts10Y, Stockcharts2Y

Len writes much of his own content, and also shares helpful content from other trusted providers like Turner Financial Group (TFG).

The material contained herein is intended as a general market commentary, solely for informational purposes and is not intended to make an offer or solicitation for the sale or purchase of any securities. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. This information is not intended as a specific offer of investment services by Dedicated Financial and Turner Financial Group, Inc.

Dedicated Financial and Turner Financial Group, Inc., do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Any hyperlinks in this document that connect to Web Sites maintained by third parties are provided for convenience only. Turner Financial Group, Inc. has not verified the accuracy of any information contained within the links and the provision of such links does not constitute a recommendation or endorsement of the company or the content by Dedicated Financial or Turner Financial Group, Inc. The prices/quotes/statistics referenced herein have been obtained from sources verified to be reliable for their accuracy or completeness and may be subject to change.

Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. The views and strategies described herein may not be suitable for all investors. To the extent referenced herein, real estate, hedge funds, and other private investments can present significant risks, including loss of the original amount invested. All indexes are unmanaged, and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Turner Financial Group, Inc. is an Investment Adviser registered with the United States Securities and Exchange Commission however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Additional information about Turner Financial Group, Inc. is also available at www.adviserinfo.sec.gov. Advisory services are only offered to clients or prospective clients where Turner Financial Group, Inc. and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Turner Financial Group, Inc. unless a client service agreement is in place.