- 1. The recent U.S. election has spurred a resurgence of “animal spirits” among investors in the stock and bond markets.

- 2. Gold prices are consolidating in the early Asian session (of November 13, 2024), but inflationary concerns are putting downward pressure on its near-term outlook.

- *With the current macro-economic backdrop, below are areas we currently favor:

- 3. CNBC and ARK Invest reported the main driving force behind Bitcoin’s resurgence is Donald Trump’s electoral win for the presidential seat.

- 4. World Watch

- 5. Quant & Technical Corner

1. The recent U.S. election has spurred a resurgence of “animal spirits” among investors in the stock and bond markets.

This concept, introduced by economist John Maynard Keynes, describes the boost in investor confidence and optimism that encourages more aggressive risk-taking and investment. Following the election of pro-business leaders, including Donald Trump, markets have responded positively, with both stock and bond sectors experiencing increased activity and rising prices. Investors appear to anticipate policies favorable to corporate growth and economic expansion, such as tax cuts, deregulation, and potential infrastructure spending, which have fueled a wave of enthusiasm for U.S. equities.

In parallel, the Federal Reserve’s recent interest rate cut has also contributed to this renewed optimism. The Fed reduced interest rates as a preemptive move to support economic growth amid global uncertainties and inflation concerns, making borrowing more affordable. Lower interest rates typically encourage spending and investment as yields on fixed-income assets like bonds decrease, driving investors to seek higher returns in the stock market. This rate cut, combined with the optimism following the election, has set the stage for a bullish outlook in U.S. markets as investors flock to riskier assets with the expectation of strong economic growth in the coming months. REF: Dailyshot, AnimalSpirit

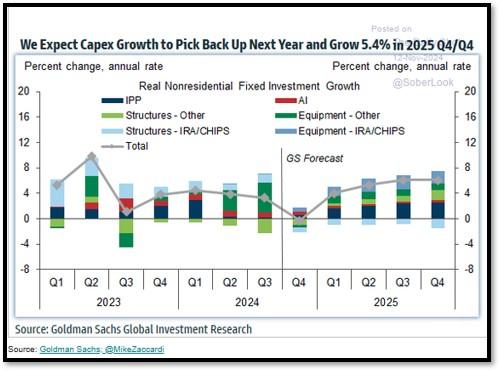

Goldman expects robust CapEx (Capital Expenditure) growth next year… (Chart provided by Dailyshot)

2. Gold prices are consolidating in the early Asian session (of November 13, 2024), but inflationary concerns are putting downward pressure on its near-term outlook.

The possibility of new tariffs under the Trump administration is sparking inflation worries. This is leading markets to expect that the Federal Reserve may delay any easing of interest rates, as higher inflation generally requires tighter monetary policy. This expectation of delayed Fed action has strengthened the U.S. dollar, as investors anticipate higher returns from dollar-denominated assets. A stronger dollar typically makes gold less attractive for non-U.S. buyers, as it raises the relative cost of gold. Consequently, this combination of inflation concerns, a robust dollar, and a likely pause in Fed rate cuts is adding bearish momentum to gold prices, suggesting a negative short-term outlook for the precious metal. REF: Investing.com, WSJ

*With the current macro-economic backdrop, below are areas we currently favor:

- Fixed Income – Short-term Corporates (Low-Beta)

- Fixed Income – Corporates High Yield as Opportunistic Allocation, Non-US (Low-Beta)

- Businesses that contribute to and benefit from AI & Automation (Market-Risk)

- Small Cap & Mid Cap Stocks (Market-Risk)

- Utilities (Market-Risk)

- Healthcare & Biotechnology (Market-Risk)

- Gold (Market-Risk)

- Industrials (Market-Risk)

3. CNBC and ARK Invest reported the main driving force behind Bitcoin’s resurgence is Donald Trump’s electoral win for the presidential seat.

Bitcoin broke its previous high ($73,794) on November 6, the day Trump won the election. Since then, Bitcoin has been on a nonstop bull run, charging to its all-time high of nearly $85,000 on (11/11/24). See item# 5M further below for additional information on Bitcoin. Trump’s election aligns with a growing movement in Congress, where 266 pro-crypto candidates were elected to the House of Representatives and 18 to the Senate. This shift indicates a significant increase in political support for digital currencies, blockchain technology, and crypto regulation reform at the federal level.

When the new Congress convenes in January, pro-crypto voices are expected to hold a majority across both chambers, surpassing anti-crypto representatives. This development signals a potential shift in the legislative approach to digital assets. Previously, regulatory uncertainties and a lack of consensus had stifled the growth and integration of crypto assets in the U.S. financial system. However, with a growing base of pro-crypto lawmakers, the government may now be positioned to advance legislation that supports the development and integration of blockchain technology while establishing clear, balanced regulations to protect investors. Experts in this space believe Bitcoin can hit $100K+ by year end. Click onto picture below to access video from ARK Invest’s CIO/CEO Cathie Wood on post-election insights. Lots of nuggets here. REF: ARK-INVEST, Whitepaper

4. World Watch

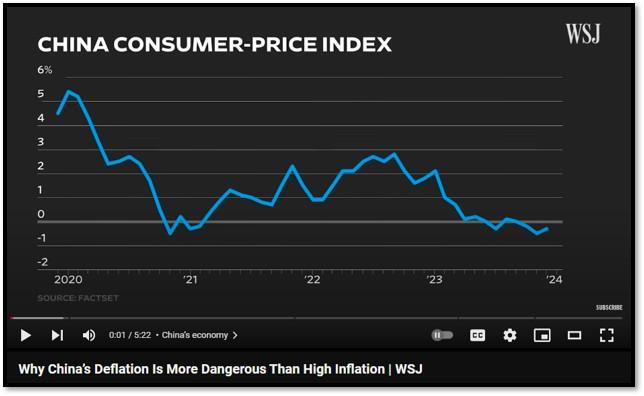

4A. While Americans are grappling with inflation, the Chinese are facing concerns about deflation. As mentioned in item 4C below, China’s inflation rate stood at 0.3% in October 2024, compared with market estimates and September’s figure of 0.4%. This marks the ninth consecutive month of consumer inflation, but it is the lowest reading since June, underscoring rising deflation risks despite Beijing’s stimulus measures introduced in late September to support the slowing economy.

Deflation, or a sustained drop in general prices, poses significant risks to China’s economy, particularly due to the country’s unique economic structure and current challenges. Falling prices can lead consumers to delay purchases, hoping for even lower prices. In China, where consumer spending is already subdued, deflation exacerbates weak demand, creating a cycle where lower spending reduces corporate revenues and investment. This reduced investment, in turn, further weakens economic growth, which is especially problematic for an economy driven largely by infrastructure and manufacturing. Click onto picture below to access video. REF: WSJ, WSJvideo

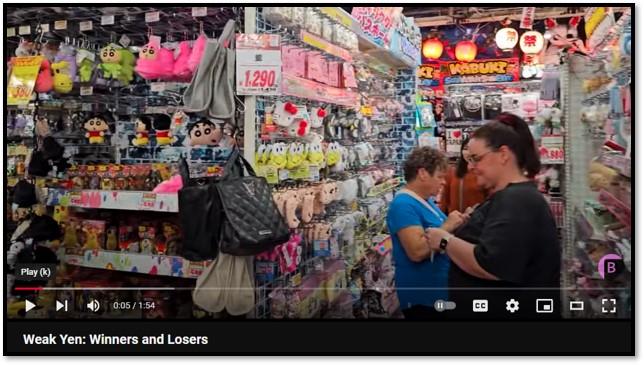

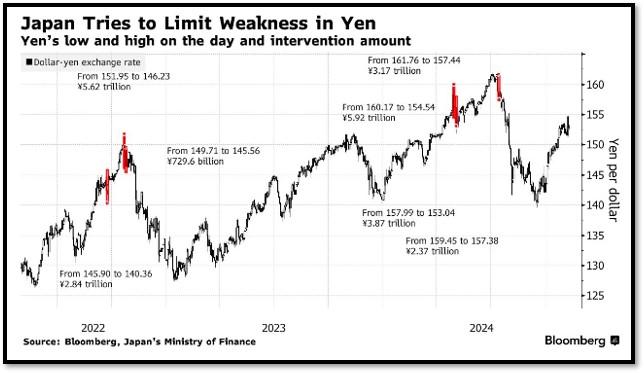

4B. Japanese Yen weakens to 155 against the US dollar. The yen’s drop to 155 per U.S. dollar is mainly due to divergent monetary policies between Japan and the U.S. While the Bank of Japan keeps interest rates near zero to support growth, the U.S. Federal Reserve has raised rates to tackle inflation in 2022. This rate gap drives investors toward U.S. assets, strengthening the dollar and weakening the yen. The drop has taken the yen near levels when Japanese authorities last intervened to prop up its currency, with the nation’s top foreign exchange official warning about the one-sided, sudden moves.

Japan’s trade deficit and high reliance on imported energy also increase dollar demand, further pressuring the yen. Speculation of further yen declines intensifies selling, while limited intervention from the BOJ has left room for continued depreciation. This weak yen benefits Japanese exporters by making goods cheaper abroad but raises import costs, affecting domestic consumers and businesses. Click onto picture below to access video. REF: Bloomberg, BloombergVideo

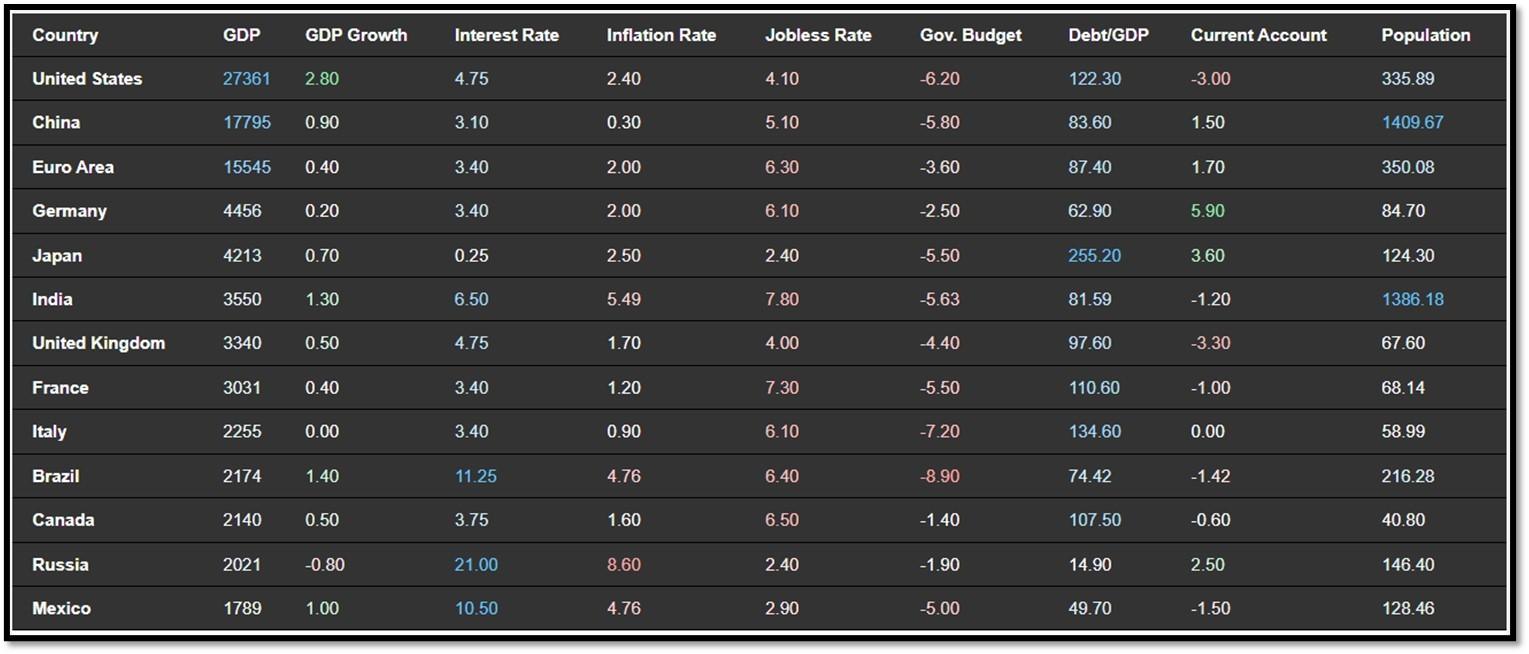

4C. Below is an updated snapshot of the current global state of economy according to TradingEconomics as of 11/11/2024. REF: TradingEconomics

- The Fed lowered the federal funds target range by 25 basis points to 4.5%-4.75% at its November 2024 meeting, following a jumbo 50 basis point cut in September, in line with expectations.

- China’s annual inflation rate stood at 0.3% in October 2024, compared with market estimates and September’s figure of 0.4%.

- The Bank of England lowered its Bank Rate by 25bps to 4.75% in its November 2024 decision, as expected, marking the second rate cut in four years following the start of its cutting cycle in August.

- The Central Bank of Brazil hiked its Selic rate by 50 bps to 11.25% in its November 2024 meeting, aiming to bring inflation back to target and support economic stability.

5. Quant & Technical Corner

Below is a selection of quantitative & technical data we monitor on a regular basis to help gauge the overall financial market conditions and the investment environment.

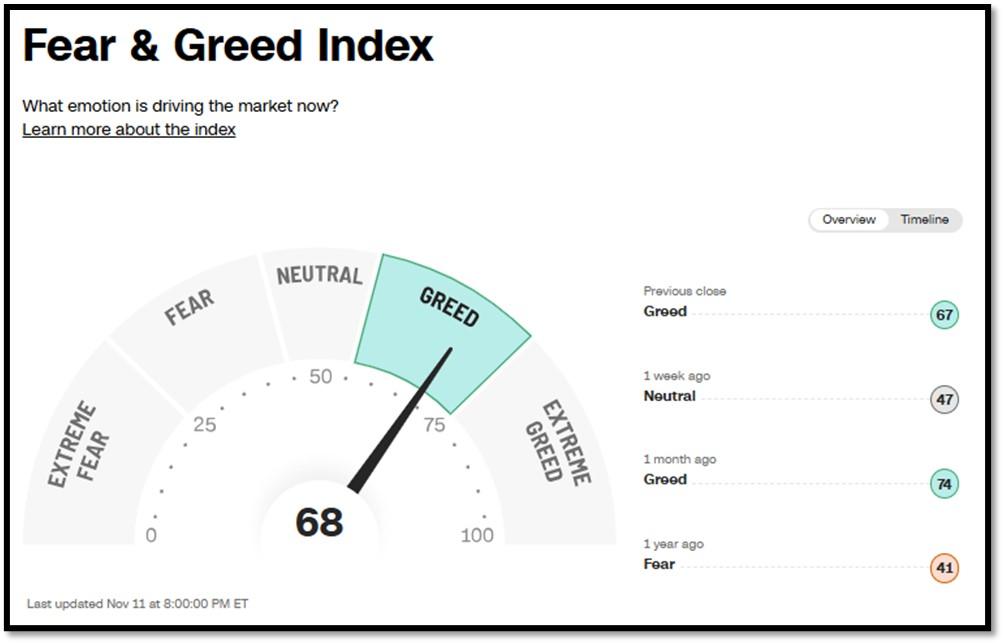

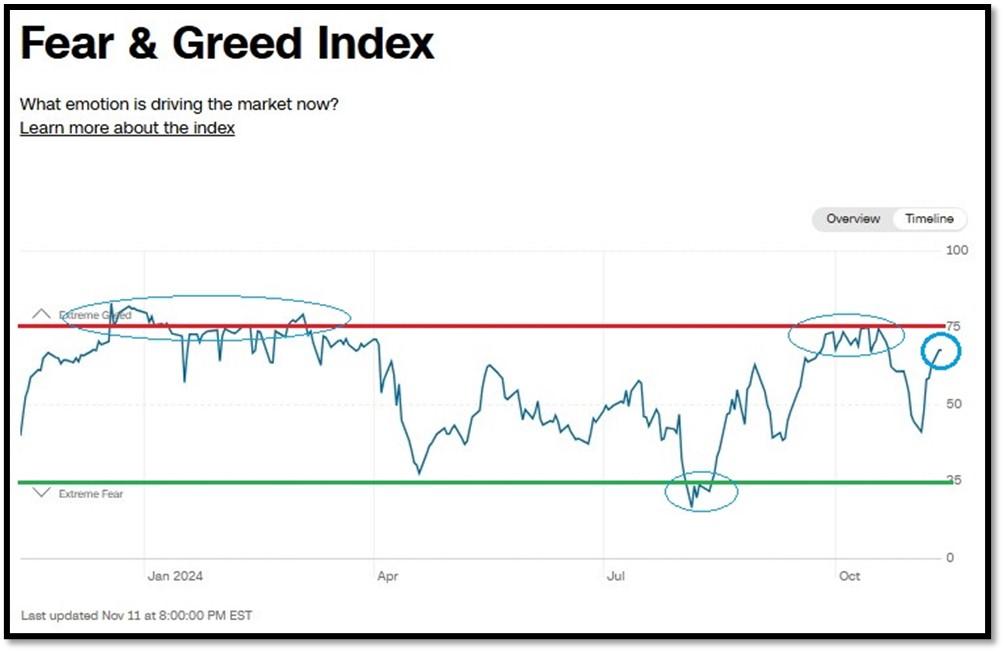

5A. Most recent read on the Fear & Greed Index with data as of 11/11/2024 – 8:00PM-ET is 68 (Greed). Last week’s data was 47 (Neutral) (1-100). CNNMoney’s Fear & Greed index looks at 7 indicators (Stock Price Momentum, Stock Price Strength, Stock Price Breadth, Put and Call Options, Junk Bond Demand, Market Volatility, and Safe Haven Demand). Keep in mind this is a contrarian indicator! REF: Fear&Greed via CNNMoney

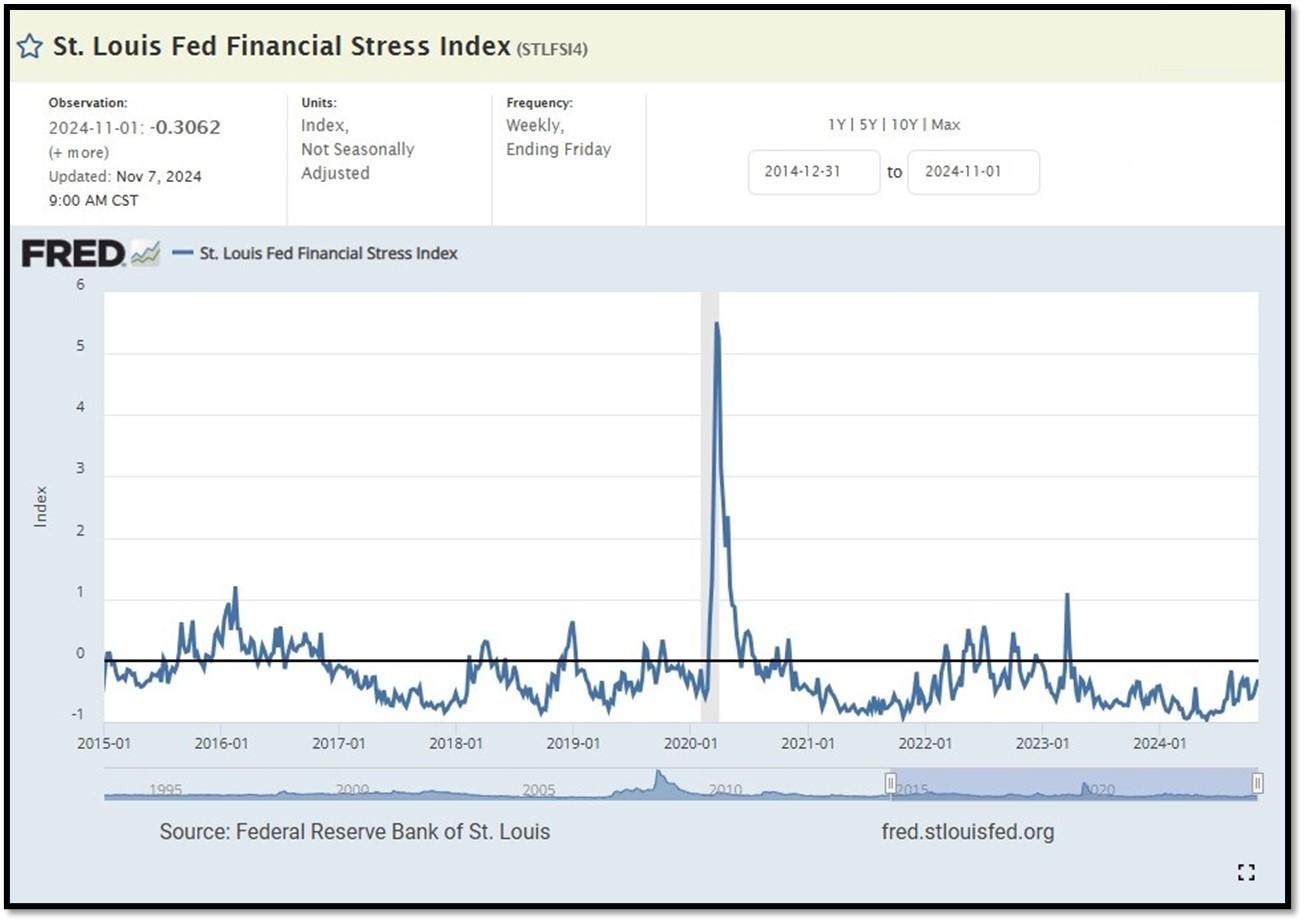

5B. St. Louis Fed Financial Stress Index’s (STLFSI4) most recent read is at –0.3062 as of November 7, 2024. A big spike up from previous readings reflecting the recent turmoil in the banking sector. Previous week’s data was -0.4004. This weekly index is not seasonally adjusted. The STLFSI4 measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. REF: St. Louis Fed

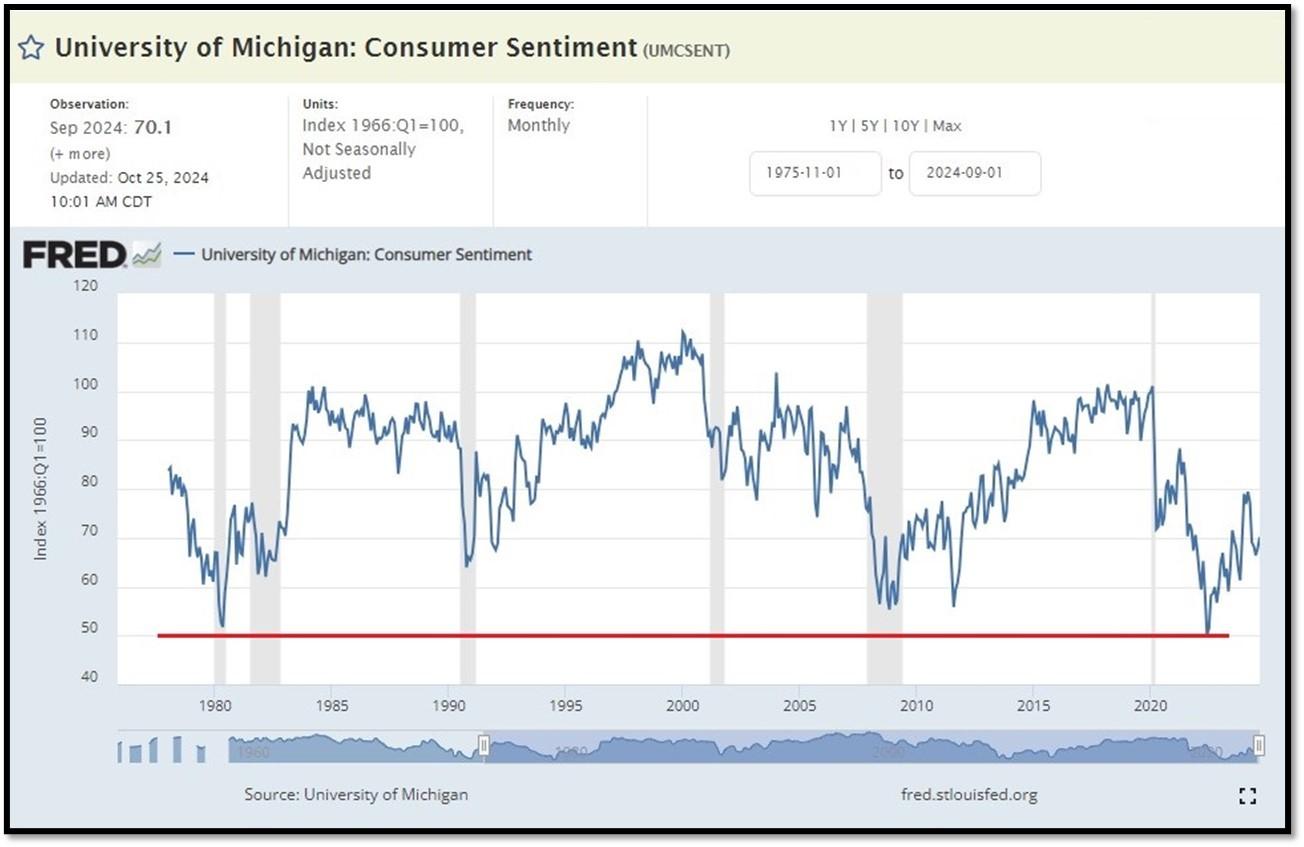

5C. University of Michigan, University of Michigan: Consumer Sentiment for September [UMCSENT] at 70.1, retrieved from FRED, Federal Reserve Bank of St. Louis, October 25, 2024. Back in June 2022, Consumer Sentiment hit a low point going back to April 1980. REF: UofM

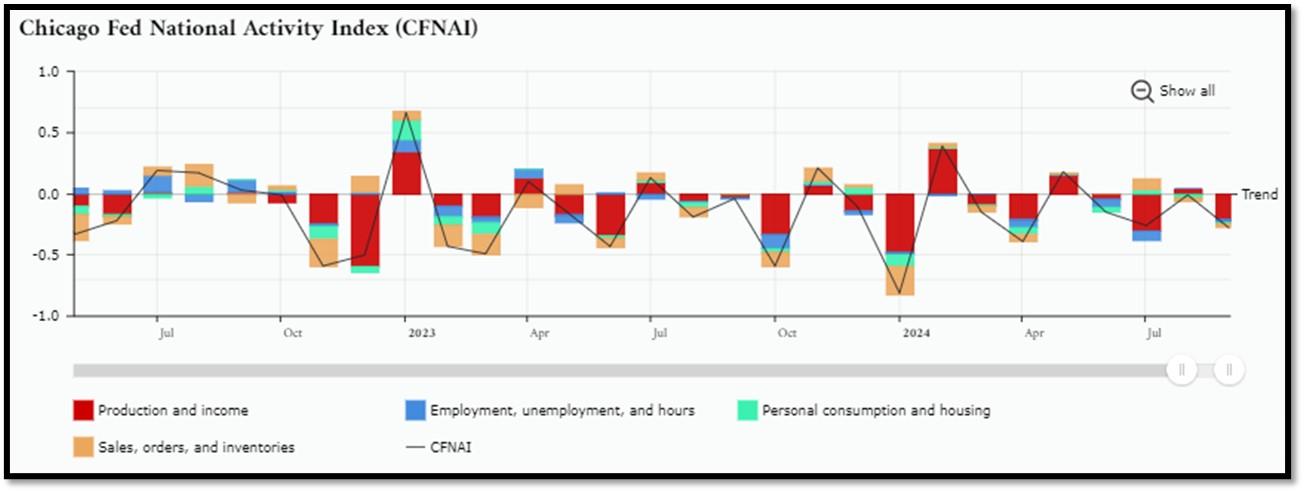

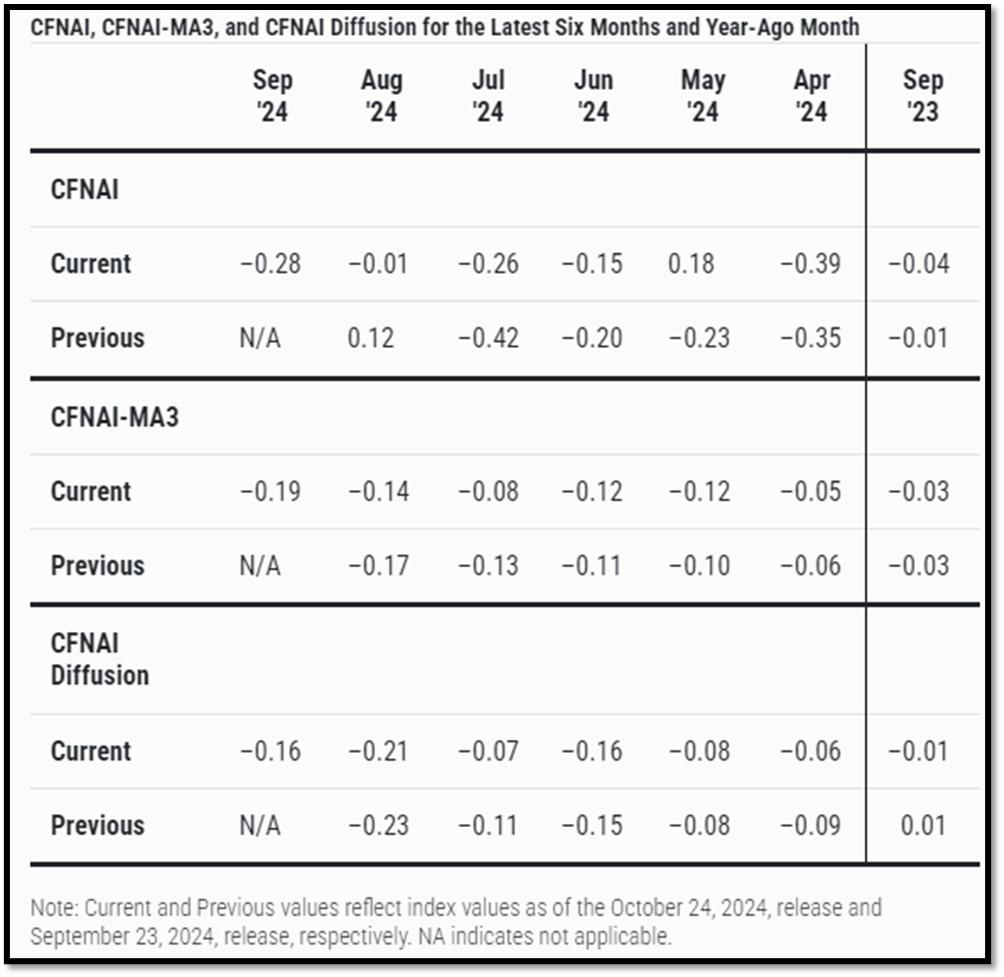

5D. The Chicago Fed National Activity Index (CFNAI) decreased to –0.28 in September from –0.01 in August. Two of the four broad categories of indicators used to construct the index decreased from August, and all four categories made negative contributions in September. The index’s three-month moving average, CFNAI-MA3, decreased to –0.19 in September from –0.14 in August. REF: ChicagoFed, September’s Report

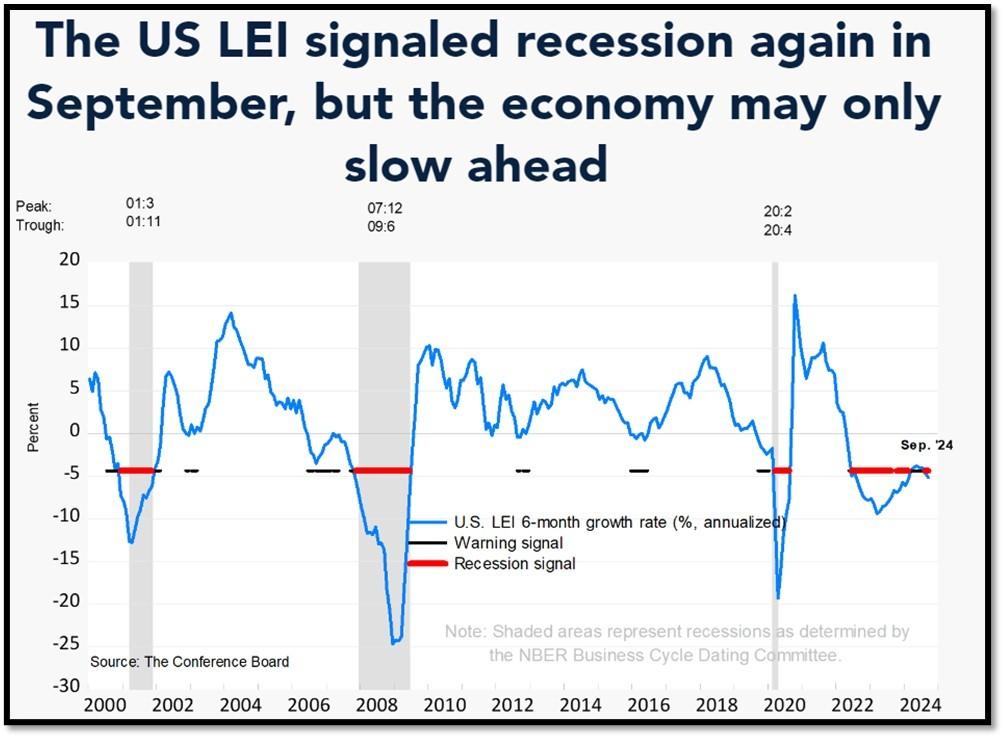

5E. (10/21/2024) The Conference Board Leading Economic Index (LEI) for the US declined by 0.5% in September 2024 to 99.7 (2016=100), following a 0.3% decline in August. Over the six-month period between March and September 2024, the LEI fell by 2.6%, more than its 2.2% decline over the previous six-month period (September 2023 to March 2024). The composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component. The CEI is highly correlated with real GDP. The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. Shaded areas denote recession periods or economic contractions. The dates above the shaded areas show the chronology of peaks and troughs in the business cycle. The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers’ new orders for nondefense capital goods excluding aircraft orders; Building permits for new private housing units; S&P 500® Index of Stock Prices; Leading Credit Index™; Interest rate spread (10-year Treasury bonds less federal funds rate); Average consumer expectations for business conditions. REF: ConferenceBoard, LEI Report for September (Released on 10/29/2024)

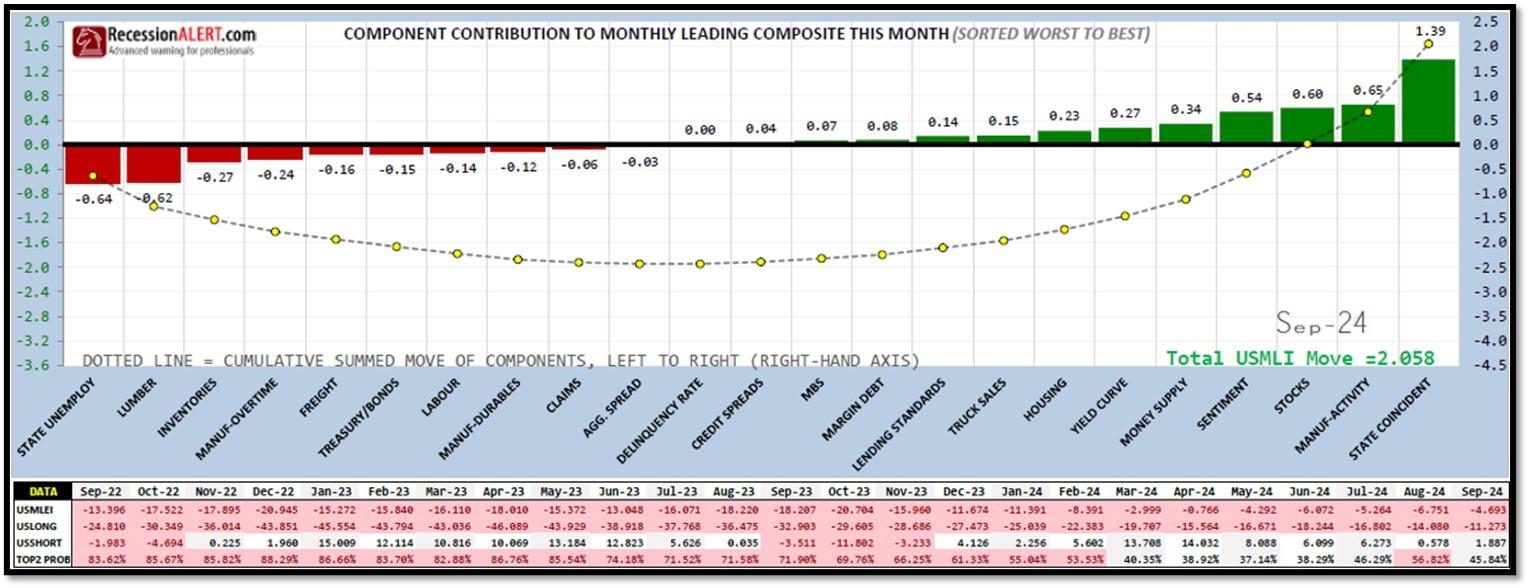

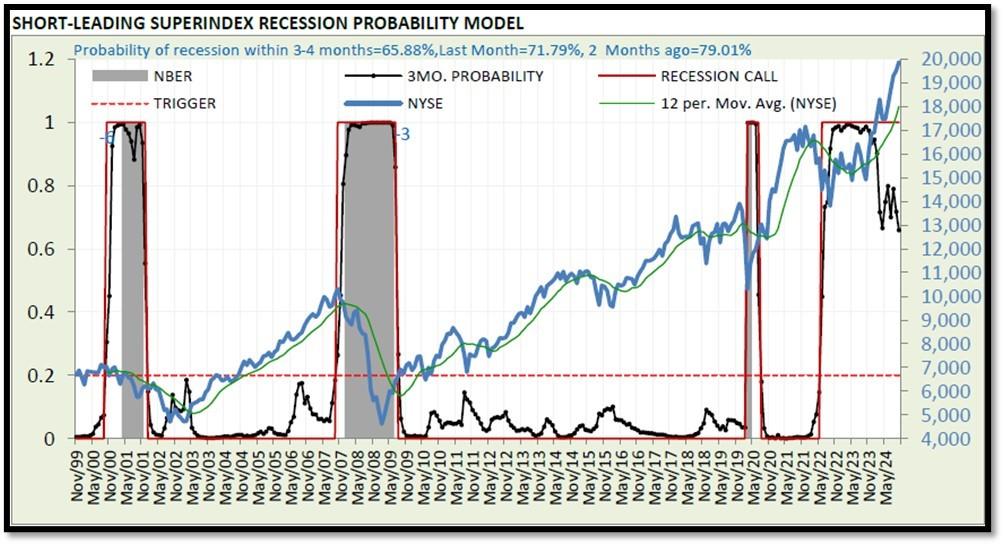

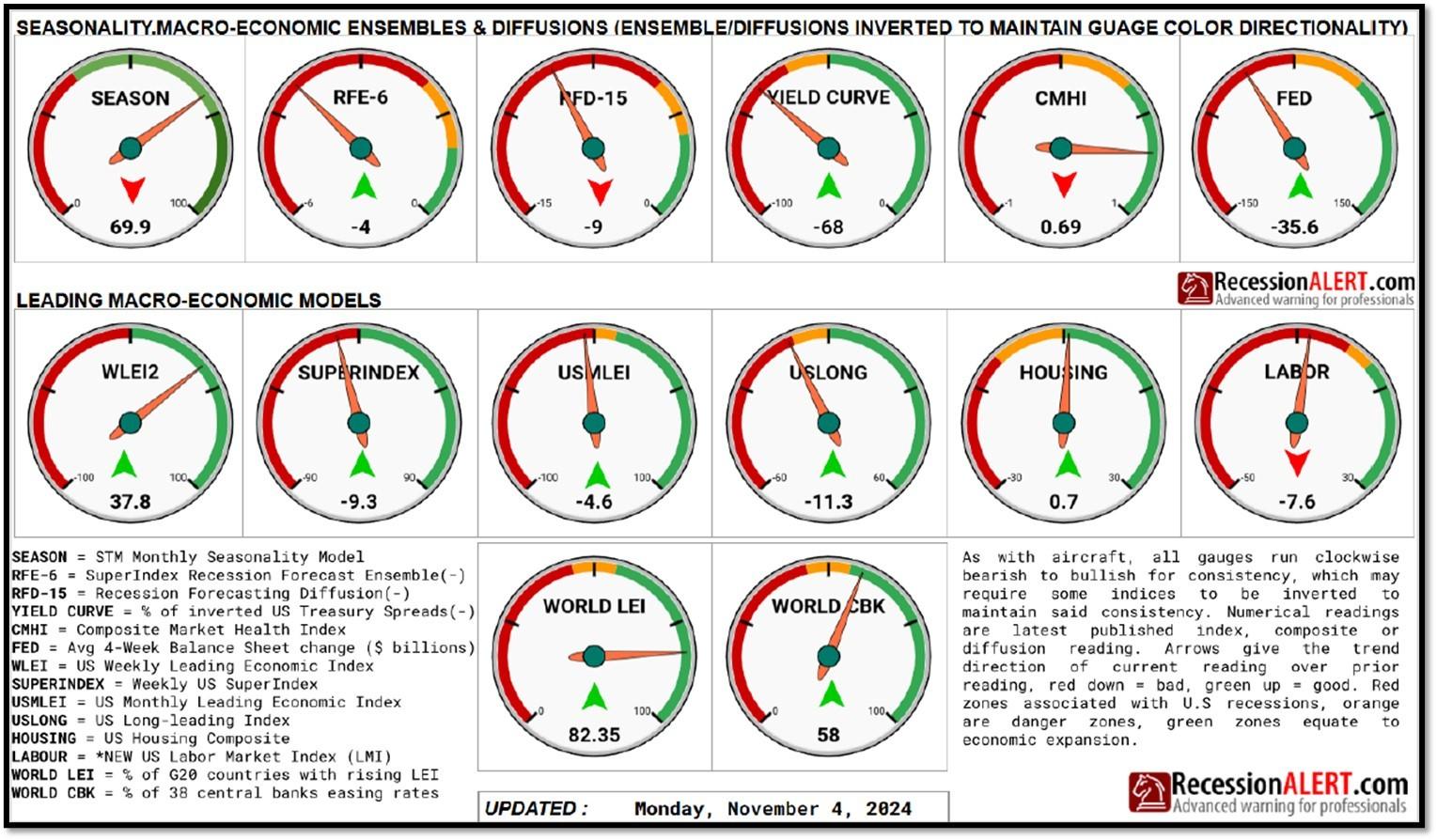

5F. Probability of U.S. falling into Recession within 3 to 4 months is currently at 65.88% (with data as of 11/4/2024 – Next Report 11/18/2024) according to RecessionAlert Research. Last release’s data was at 66.48%. This report is updated every two weeks. REF: RecessionAlertResearch

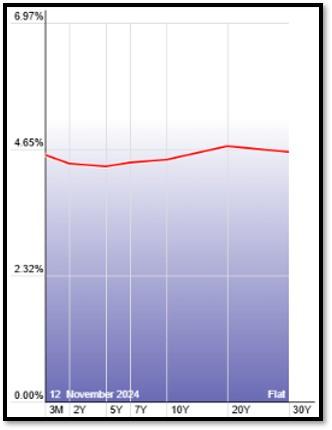

5G. Yield Curve as of 11/12/2024 is showing Flattening. Spread on the 10-yr Treasury Yield (4.33%) minus yield on the 2-yr Treasury Yield (4.30%) is currently at 8 bps. REF: Stockcharts The yield curve—specifically, the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill—is a valuable forecasting tool. It is simple to use and significantly outperforms other financial and macroeconomic indicators in predicting recessions two to six quarters ahead. REF: NYFED

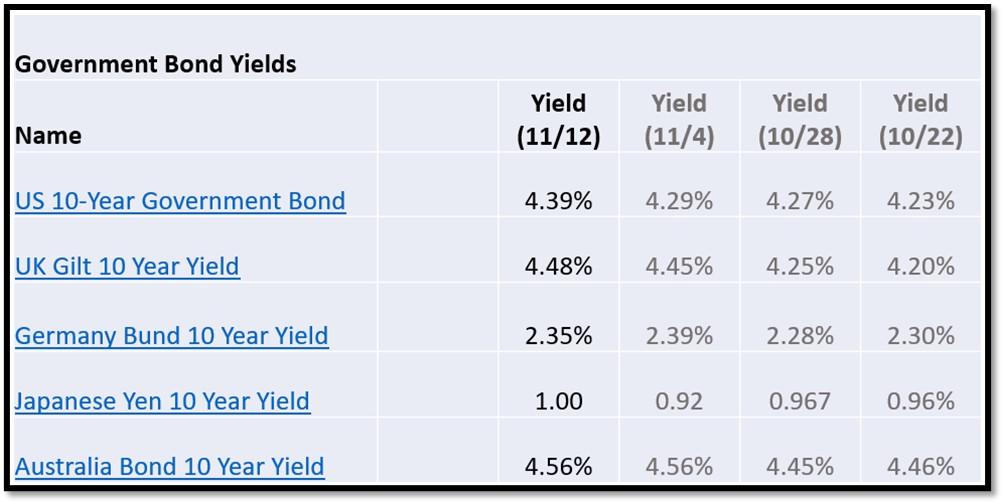

5H. Recent Yields in 10-Year Government Bonds. REF: Source is from Bloomberg.com, dated 11/12/2024, rates shown below are as of 11/12/2024, subject to change.

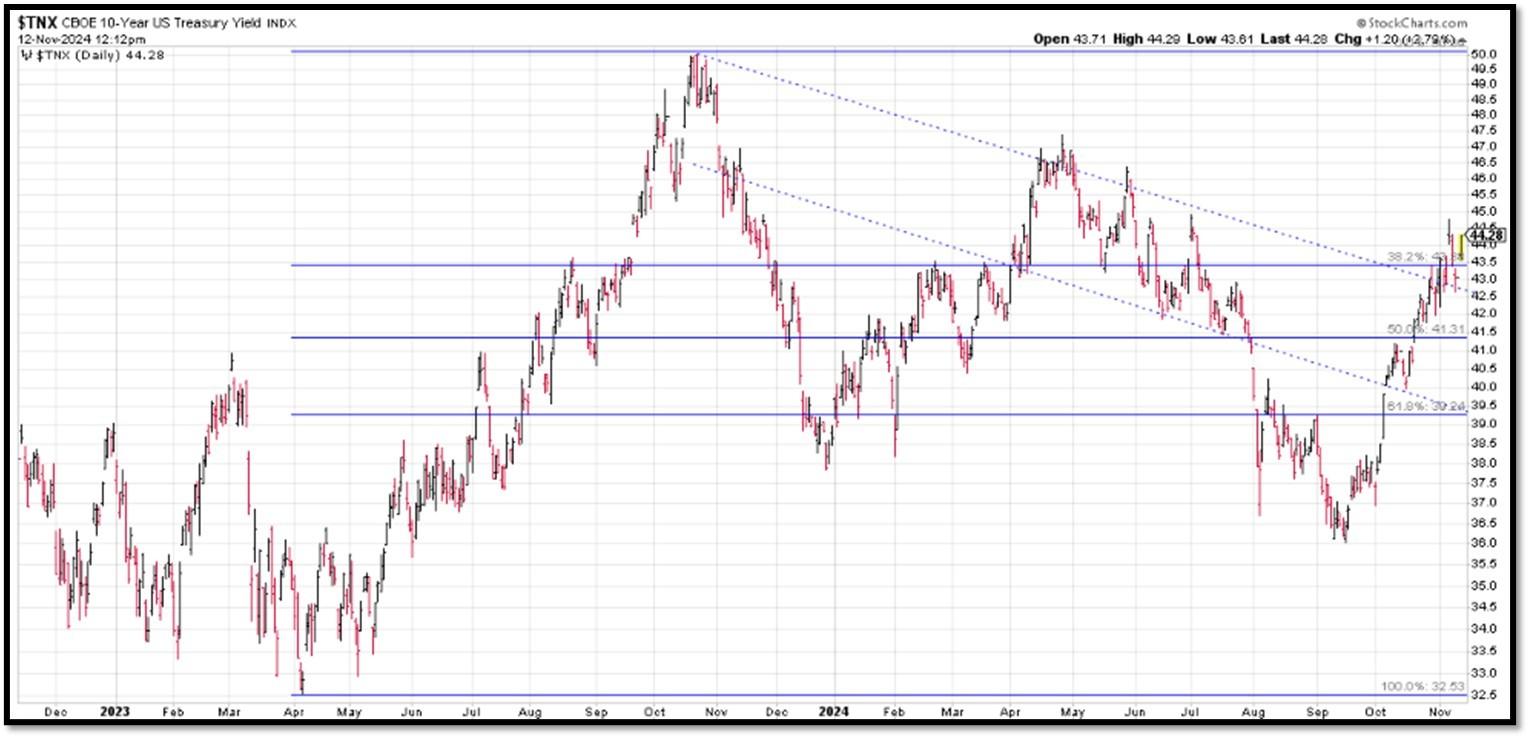

The 10-Year US Treasury Yield… REF: StockCharts1, StockCharts2

The 10-year yield – Spiked towards top of trend…

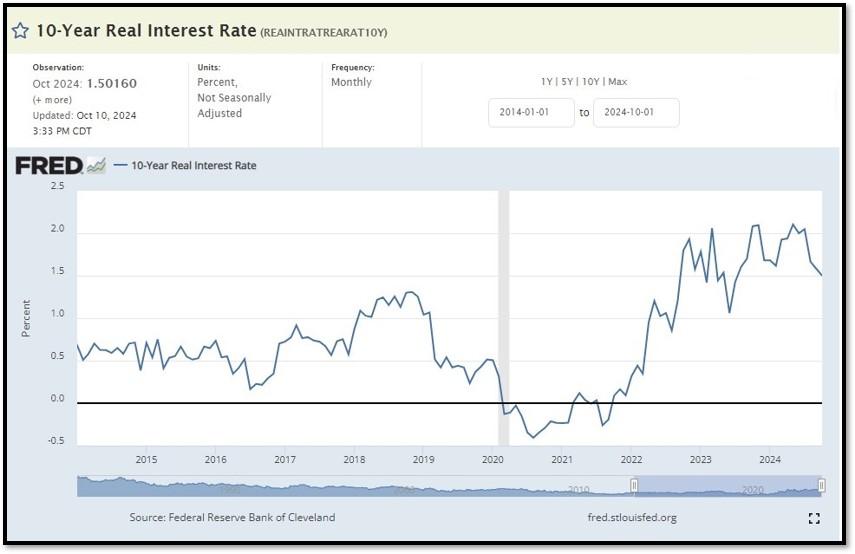

10-Year Real Interest Rate at 1.5016% as of 10/10/24. REF: REAINTRATREARAT10Y

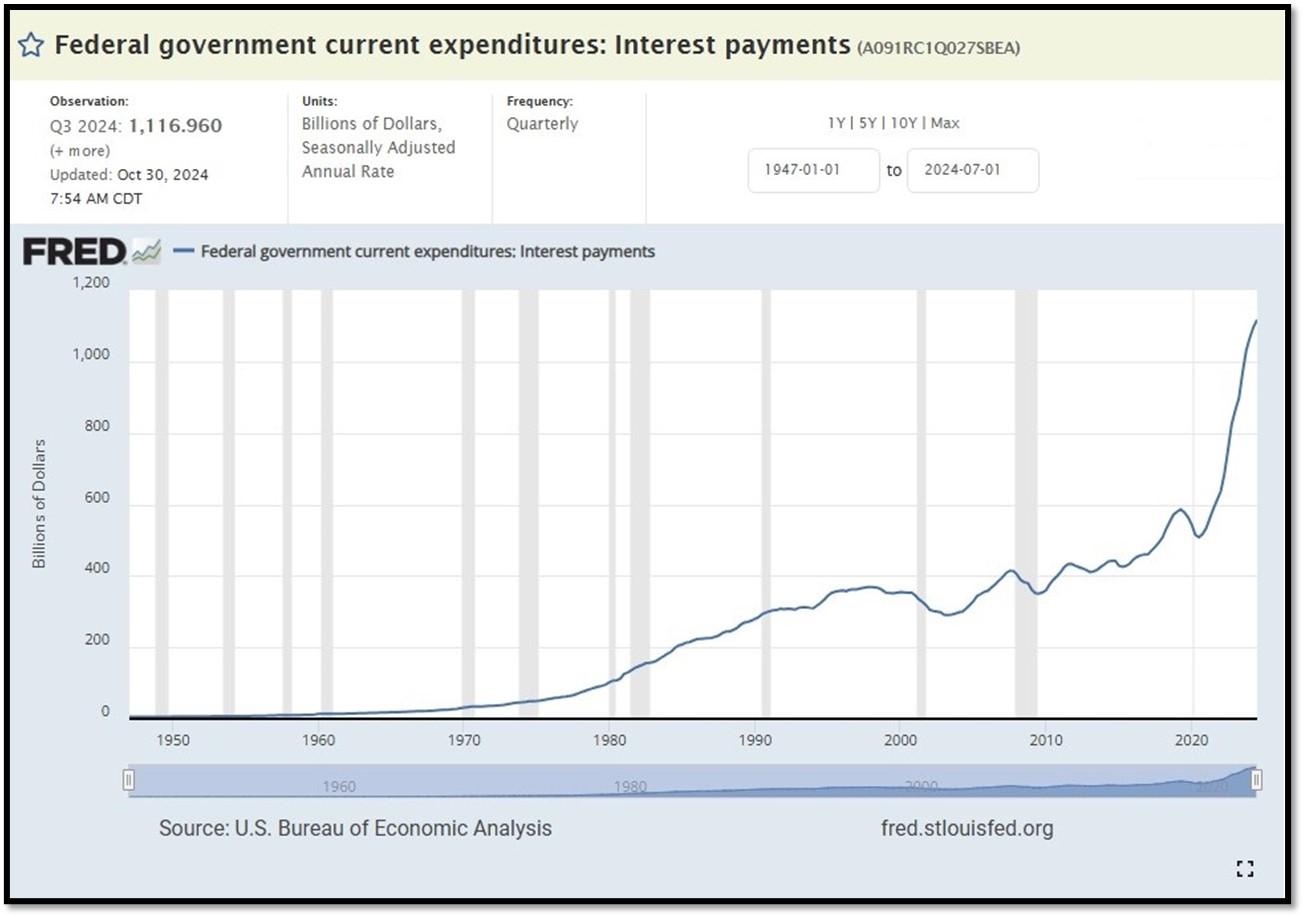

Federal government Interest Payments increased $20B+ to $1.1166 Trillion as of Q3-2024. REF: FRED-A091RC1Q027SBEA

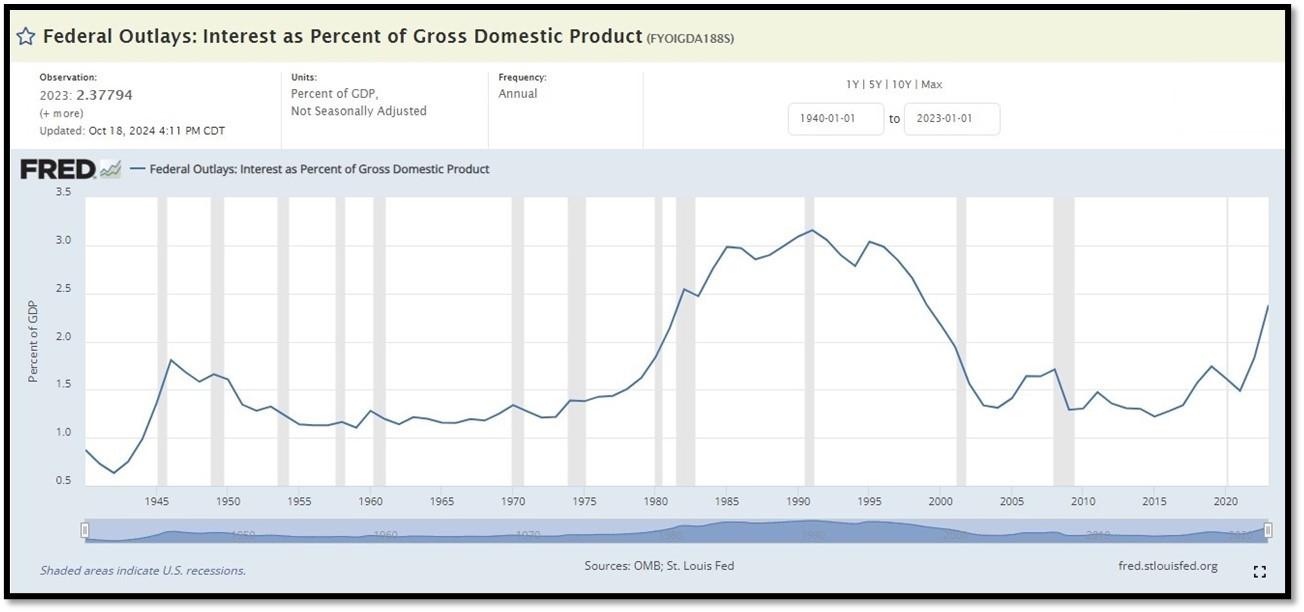

Interest payments as a percentage of GDP increased from 1.84853 in 2022 to 2.37794 as of 10/18/24. REF: FRED-FYOIGDA188S

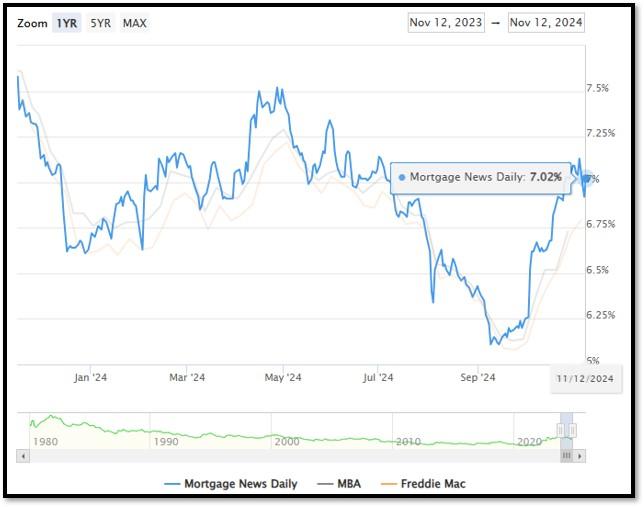

5I. (11/12/2024) Today’s National Average 30-Year Fixed Mortgage Rate is 7.02% (All Time High was 8.03% on 10/19/23). Last week’s data was 7.05%. This rate is the average 30-year fixed mortgage rates from several different surveys including Mortgage News Daily (daily index), Freddie Mac (weekly survey), Mortgage Bankers Association (weekly survey) and FHFA (monthly survey). REF: MortgageNewsDaily, Today’s Average Rate

The recent spike in the 30-year fixed-rate jumbo mortgage to 7.02%, compared to Freddie Mac’s rate at 6.79% and the Mortgage Bankers Association (MBA) rate at 6.73%, highlights key differences in the mortgage market. Jumbo mortgages, which exceed the conforming loan limits set by government agencies like Freddie Mac, typically carry higher interest rates because they are riskier for lenders. These loans are not backed by government entities, which increases the risk for lenders and, consequently, leads to higher rates. In contrast, Freddie Mac and MBA provide averages for conforming loans, which meet federal guidelines and have lower risk due to government backing, keeping their rates lower.

(11/11/24) Housing Affordability Index for Aug = 98.6 // July = 95 // June = 93.3 // May = 93.1 // April = 95.9 // March = 101.1 // February = 103.0. Data provided by Yardeni Research. REF: Yardeni

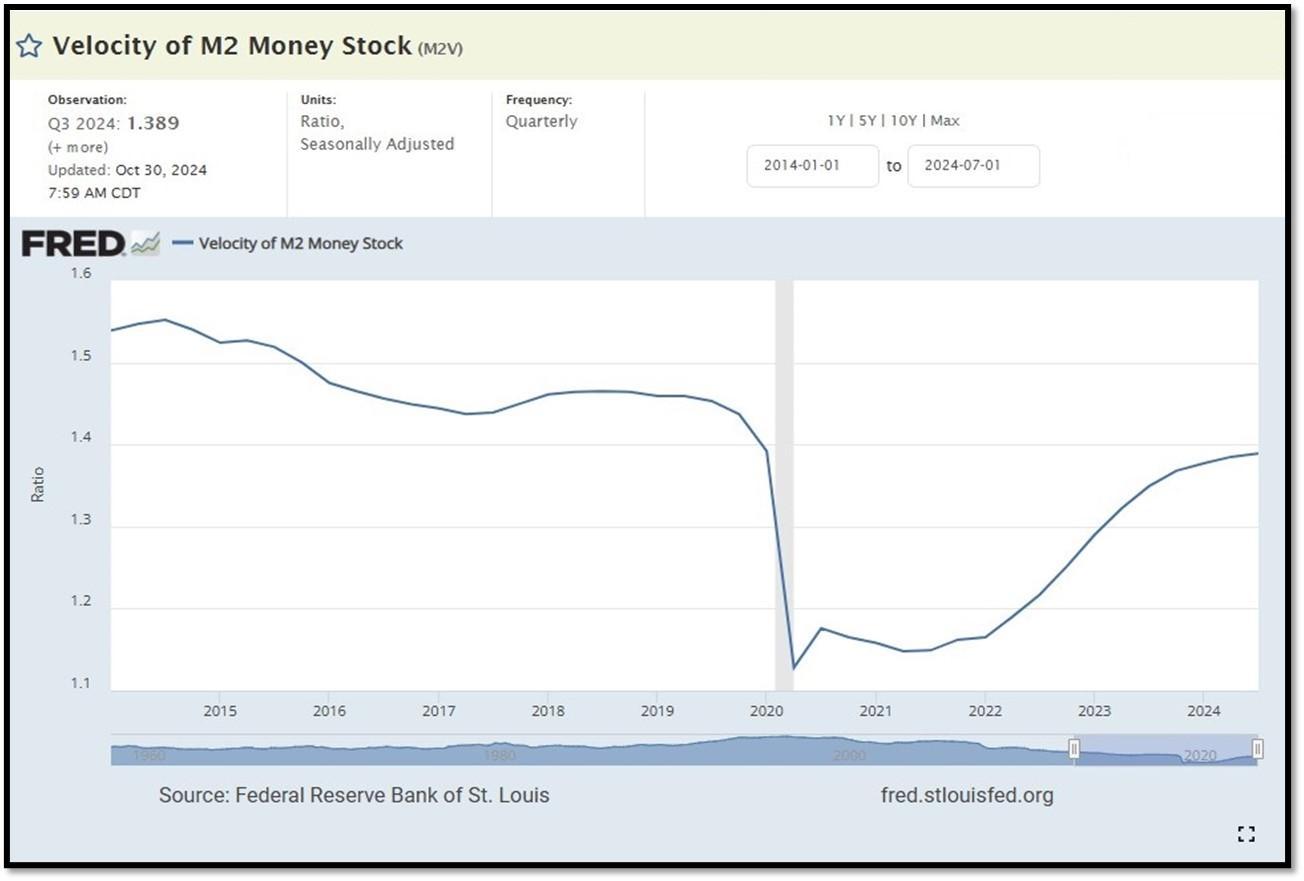

5J. Velocity of M2 Money Stock (M2V) with current read at 1.389 as of (Q2-2024 updated 10/30/2024). Previous quarter’s data was 1.385. The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. Current Money Stock (M2) report can be viewed in the reference link. REF: St.LouisFed-M2V

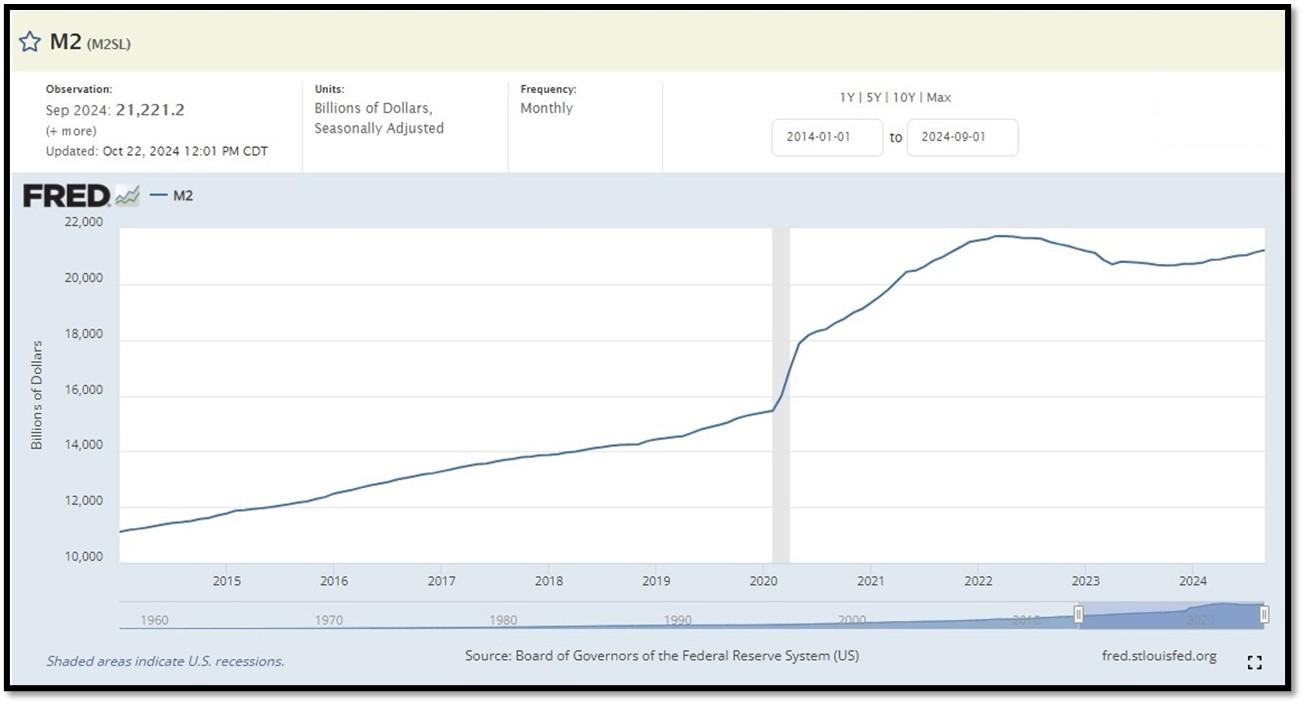

M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; Updated on October 22, 2024. REF: St.LouisFed-M2

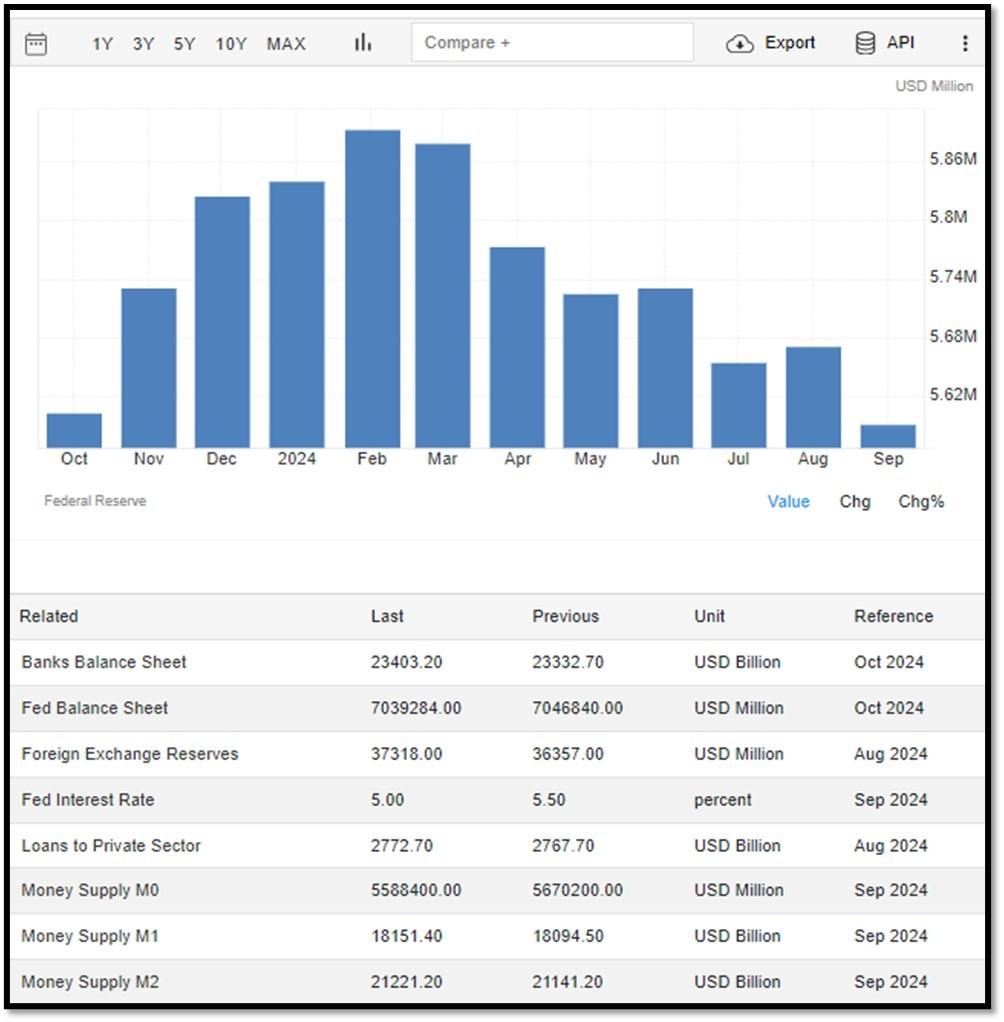

Money Supply M0 in the United States decreased to 5,588,400 USD Million in September from 5,670,200 USD Million in August of 2024. Money Supply M0 in the United States averaged 1,149,440.43 USD Million from 1959 until 2024, reaching an all-time high of 6,413,100.00 USD Million in December of 2021 and a record low of 48,400.00 USD Million in February of 1961. REF: TradingEconomics, M0

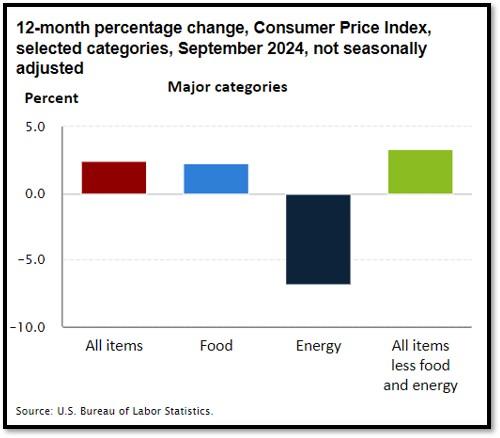

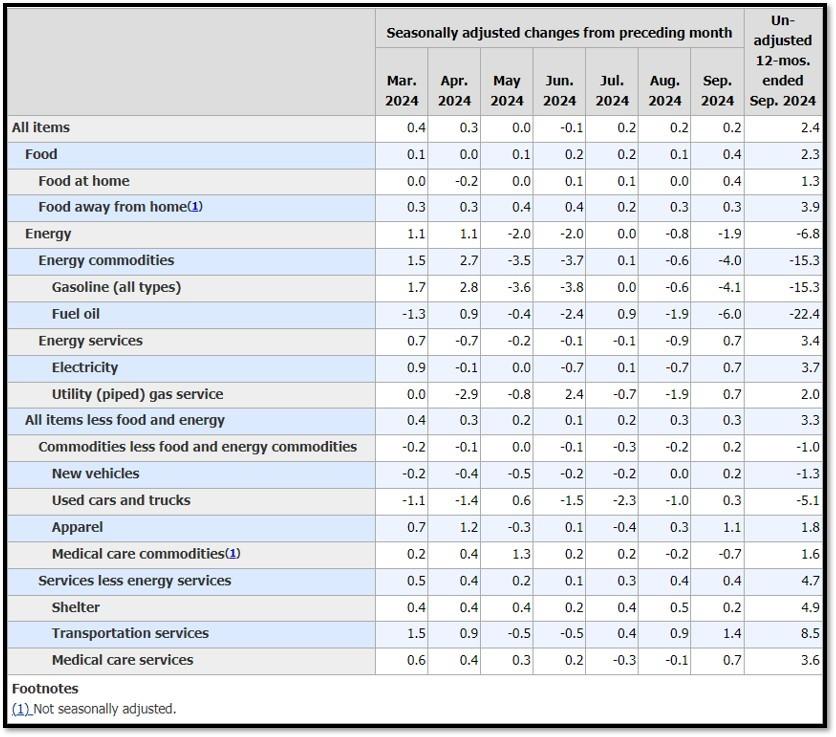

5K. In September, the Consumer Price Index for All Urban Consumers rose 0.2 percent, seasonally adjusted, and rose 2.4 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.3 percent in September (SA); up 3.3 percent over the year (NSA). October 2024 CPI data are scheduled to be released on November 13, 2024, at 8:30AM-ET. REF: BLS, BLS.GOV

5L. Technical Analysis of the S&P500 Index. Click onto reference links below for images.

- Short-term Chart: Bullish on 11/11/2024 – REF: Short-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Medium-term Chart: Bullish on 11/11/2024 – REF: Medium-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Market Timing Indicators – S&P500 Index as of 11/11/2024 – REF: S&P500 Charts (7 of them) by Joanne Klein’s Top 7 (Click Here to Access Updated Charts)

- A well-defined uptrend channel shown in green with S&P500 still on up trend. REF: Stockcharts

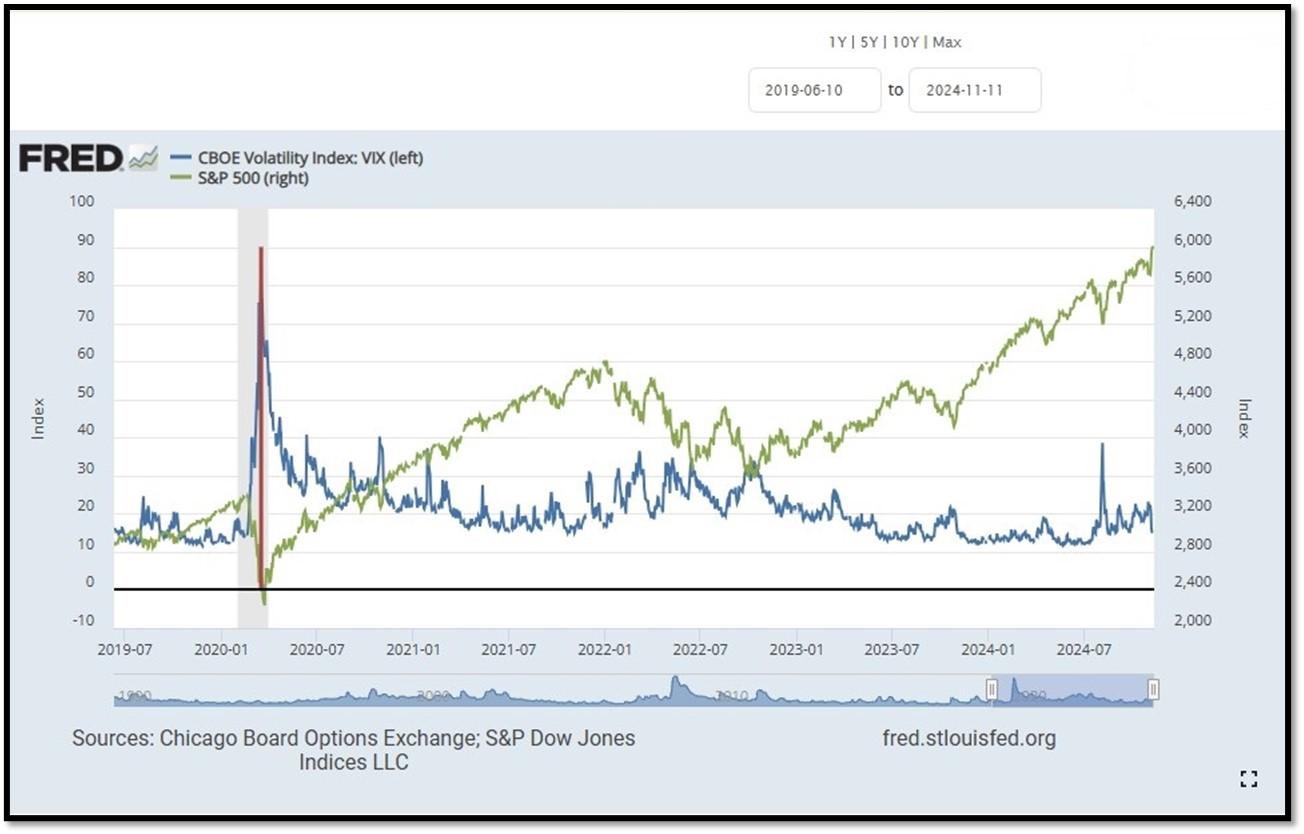

- S&P500 and CBOE Volatility Index (VIX) as of 11/11/2024. REF: FRED, Today’s Print

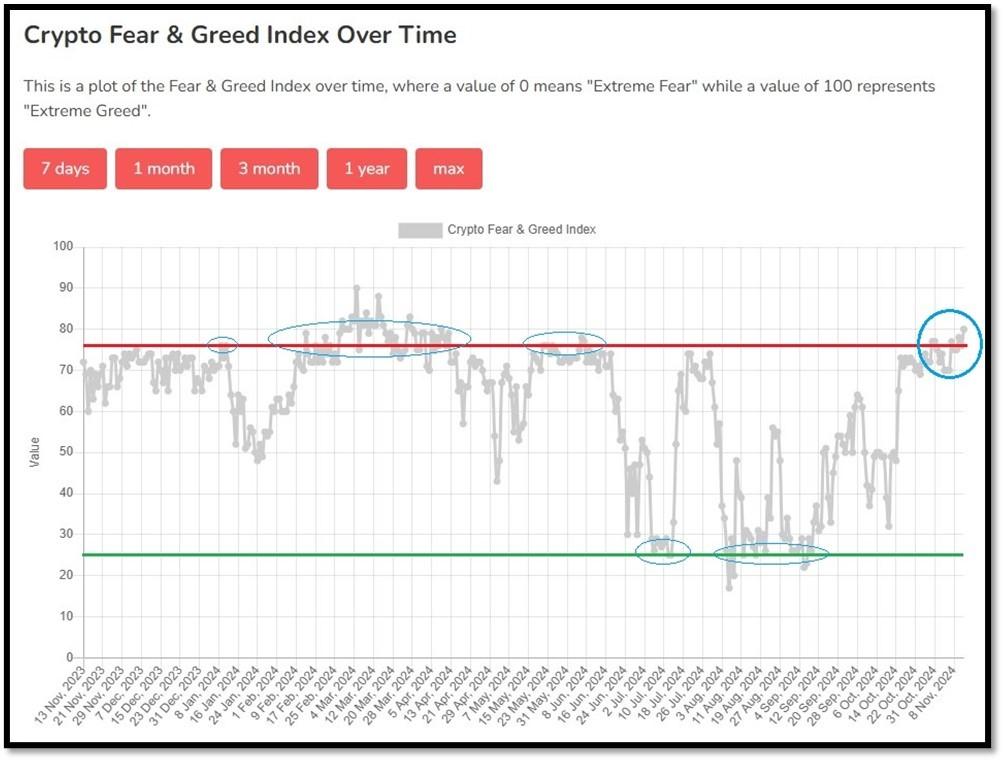

5M. Most recent read on the Crypto Fear & Greed Index with data as of 11/12/2024au is 80 (Extreme Greed). Last week’s data was 70 (Greed) (1-100). Fear & Greed Index – A Contrarian Data. The crypto market behavior is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction of seeing red numbers. With the Crypto Fear and Greed Index, the data try to help save investors from their own emotional overreactions. There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

Therefore, the program for this index analyzes the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means “Extreme Fear”, while 100 means “Extreme Greed”. REF: Alternative.me, Today’sReading

Bitcoin – 10-Year & 2-Year Charts. REF: Stockcharts10Y, Stockcharts2Y

Len writes much of his own content, and also shares helpful content from other trusted providers like Turner Financial Group (TFG).

The material contained herein is intended as a general market commentary, solely for informational purposes and is not intended to make an offer or solicitation for the sale or purchase of any securities. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. This information is not intended as a specific offer of investment services by Dedicated Financial and Turner Financial Group, Inc.

Dedicated Financial and Turner Financial Group, Inc., do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Any hyperlinks in this document that connect to Web Sites maintained by third parties are provided for convenience only. Turner Financial Group, Inc. has not verified the accuracy of any information contained within the links and the provision of such links does not constitute a recommendation or endorsement of the company or the content by Dedicated Financial or Turner Financial Group, Inc. The prices/quotes/statistics referenced herein have been obtained from sources verified to be reliable for their accuracy or completeness and may be subject to change.

Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. The views and strategies described herein may not be suitable for all investors. To the extent referenced herein, real estate, hedge funds, and other private investments can present significant risks, including loss of the original amount invested. All indexes are unmanaged, and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Turner Financial Group, Inc. is an Investment Adviser registered with the United States Securities and Exchange Commission however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Additional information about Turner Financial Group, Inc. is also available at www.adviserinfo.sec.gov. Advisory services are only offered to clients or prospective clients where Turner Financial Group, Inc. and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Turner Financial Group, Inc. unless a client service agreement is in place.