- 1. In Brazil, the G20 Leaders’ Summit took place on November 18 and 19, 2024, in Rio de Janeiro, with the presence of the leaders of the 19 member countries, plus the African Union and the European Union.

- 2. At the 31st Annual Baron Investment Conference in New York City, SpaceX President and COO Gwynne Shotwell provided significant updates on the company’s Starlink satellite internet service.

- *With the current macro-economic backdrop, below are areas we currently favor:

- 3. This week, you will find several notable developments emerged in artificial intelligence (AI), productivity tools, and broader technology advancements

- 4. World Watch

- 5. Quant & Technical Corner

1. In Brazil, the G20 Leaders’ Summit took place on November 18 and 19, 2024, in Rio de Janeiro, with the presence of the leaders of the 19 member countries, plus the African Union and the European Union.

The G20 Summit represents the conclusion of the work carried out by the country holding the group’s rotating presidency. It is the moment when heads of state and government approve the agreements negotiated throughout the year and point out ways of dealing with global challenges. This year, Brazil hands over G20 presidency to South Africa.

The G20 Summit 2024 focused on pressing global challenges, including conflicts, climate change, economic equity, and institutional reform. Leaders called for ceasefires in Gaza and Ukraine and emphasized increasing humanitarian aid. Brazilian President Luiz Inácio Lula da Silva urged advanced nations to accelerate emissions reduction targets, highlighting climate action as a priority. Economic equity was addressed through proposals for taxing billionaires and a global alliance against hunger and poverty endorsed by 82 nations. The summit also discussed reforming the U.N. Security Council to reflect modern realities. Click onto pictures below to access videos about how Biden, Trudeau and Meloni missed the original outdoor group photo, then later retakes another indoors. REF: 2024-G20

2. At the 31st Annual Baron Investment Conference in New York City, SpaceX President and COO Gwynne Shotwell provided significant updates on the company’s Starlink satellite internet service.

Shotwell announced that Starlink has surpassed four million subscribers and is projected to generate approximately $6.6 billion in revenue for 2024, with an estimated $600 million in free cash flow after accounting for satellite production and launch expenses. Starlink is diversifying its offerings across various markets, including residential broadband, maritime, and aviation connectivity. Shotwell highlighted plans to introduce direct-to-device services within the next month, starting with basic data and text messaging capabilities. Looking ahead, Shotwell indicated that Starlink’s continued growth could substantially increase SpaceX’s valuation. She also discussed the potential of the Starship launch system to further enhance the company’s value by revolutionizing spaceflight and expanding access to space. Although SpaceX is a private company, it remains one of the top holdings for The Baron Focused Growth Fund which we use in our investment strategies. Click onto picture below to access video. REF: BARRON’S, BaronCapital, BaronFocusedGrowthFd

*With the current macro-economic backdrop, below are areas we currently favor:

- Fixed Income – Short-term Corporates (Low-Beta)

- Fixed Income – Corporates High Yield as Opportunistic Allocation (Low-Beta)

- Businesses that contribute to and benefit from AI & Automation (Market-Risk)

- Small Cap & Mid Cap Stocks (Market-Risk)

- Utilities (Market-Risk)

- Healthcare & Biotechnology (Market-Risk)

- Gold (Market-Risk)

- Industrials (Market-Risk)

3. This week, you will find several notable developments emerged in artificial intelligence (AI), productivity tools, and broader technology advancements

Bite-sized summaries listed below.

Artificial Intelligence (AI)

- Microsoft’s AI Progress: At the recent Microsoft Ignite conference, CEO Satya Nadella acknowledged a slowdown in AI model advancements, prompting a shift towards monetizing existing technologies. Microsoft introduced new features for its enterprise AI service, Microsoft 365 Copilot, including enhanced functionalities in Office applications and autonomous AI agents.

- Nvidia’s Computing Power Forecast: Nvidia CEO Jensen Huang predicted a millionfold increase in computing power for generative AI over the next decade, driven by a current fourfold annual growth rate. This expansion is expected to significantly enhance AI capabilities.

Productivity Tools & Tech Gadgets

- Windows 11 Pro Discount: Microsoft’s Windows 11 Pro operating system is being offered at a substantial discount, now available for $17.97, down from the regular price of $199. This promotion, valid until tomorrow, aims to enhance productivity with features like snap layouts, enhanced voice typing, and robust security measures.

- A range of luxury tech gadgets has been introduced, including the Suunto Vertical Watch for fitness enthusiasts, the Mammotion Luba 2 advanced lawnmower, and the Magic Mirror for personalized exercise routines. These innovations blend technology with lifestyle enhancements.

AI Model Development Challenges: Major AI companies like OpenAI, Google, and Anthropic are experiencing slower-than-expected improvements in their large language models (LLMs). Challenges include limitations in data, technology, and hardware infrastructure, such as concerns over the overheating of Nvidia’s new Blackwell GPUs, which are critical for AI training. Click onto picture below to access video that addresses this concern. REF: Schwab

4. World Watch

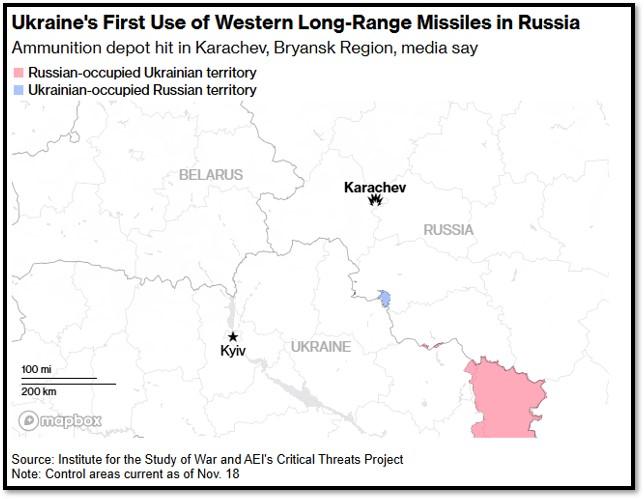

4A. Russian President Vladimir Putin signed a decree allowing nuclear weapons to be used in response to a massive conventional attack on Russian soil, as reported by Bloomberg (11/19/24). This marks a shift in Russia’s defense strategy, expanding the scenarios for nuclear use to deter potential threats to its territorial integrity. The move underscores Russia’s reliance on nuclear deterrence amidst rising tensions with NATO and other adversaries. While it aims to strengthen Russia’s security posture, the decree raises global concerns about escalation risks and undermines efforts to limit nuclear proliferation. Western nations have criticized the policy as destabilizing, further heightening geopolitical tensions. Click onto picture to access video. REF: Bloomberg, CNBC

US Stock Market Reactions: (11/19/24) S&P500 and Nasdaq eras earlier losses… “Animal Spirit” Neutralizes “Nuclear” from trading black-box-algos…

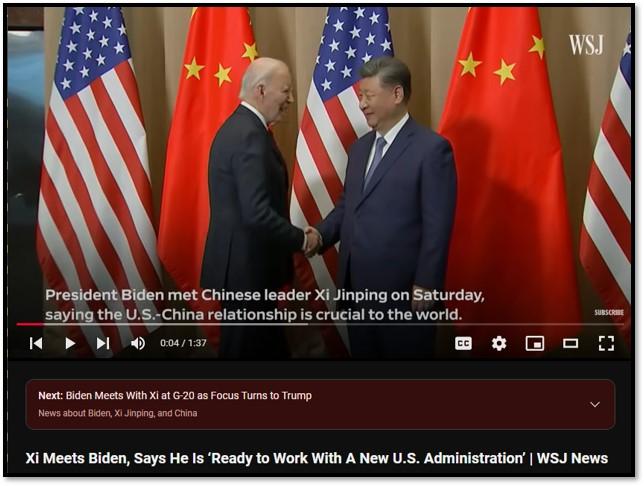

4B. During the APEC summit in Lima, Peru, Chinese President Xi Jinping expressed readiness to work with the incoming U.S. administration, emphasizing the importance of stable U.S.-China relations amid the leadership transition. Xi’s statement aimed to maintain constructive dialogue as President-elect Donald Trump signaled a more confrontational stance toward China, including potential tariffs. Discussions also covered key issues like trade, industrial policies, and global security concerns, highlighting the need for continued engagement between the two nations. Xi Jinping’s primary goal during this global summit in South America appeared to be advocating for reduced trade barriers to support the revival of China’s economy. Click onto picture below to access video. REF: WSJ

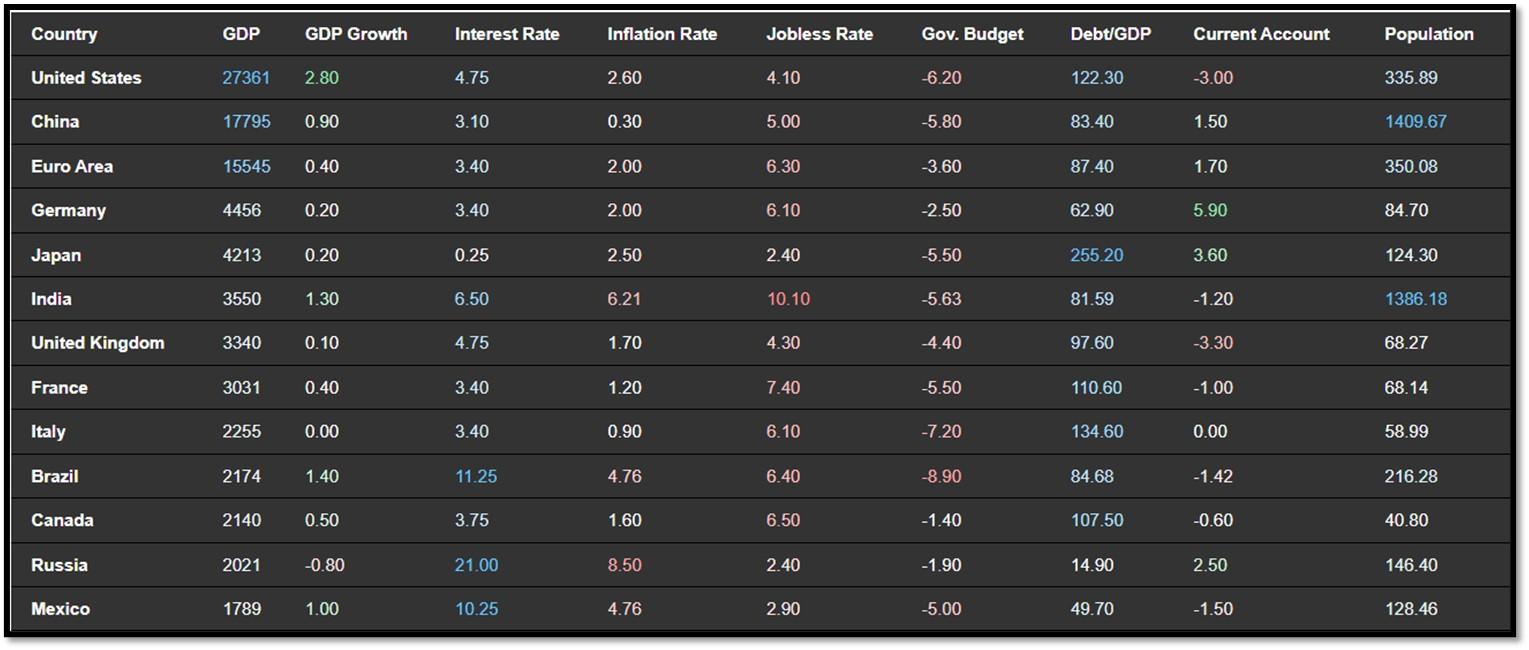

4C. Below is an updated snapshot of the current global state of economy according to TradingEconomics as of 11/18/2024. REF: TradingEconomics

- The annual inflation rate in the US accelerated to 2.6% in October 2024, up from 2.4% in September which was the lowest rate since February 2021, and in line with market expectations.

- China’s surveyed unemployment rate fell to 5% in October 2024, compared to market estimates and September’s reading of 5.1%.

- Japan’s GDP grew by 0.2% quarter-on-quarter in Q3 2024, moderating from a downwardly revised 0.5% increase in Q2 while aligning with market forecasts, preliminary data showed.

- The annual inflation rate in India soared to 6.21% in October of 2024 from 5.49% in the previous month, well above market expectations of 5.81% to mark the highest inflation rate in over one year.

5. Quant & Technical Corner

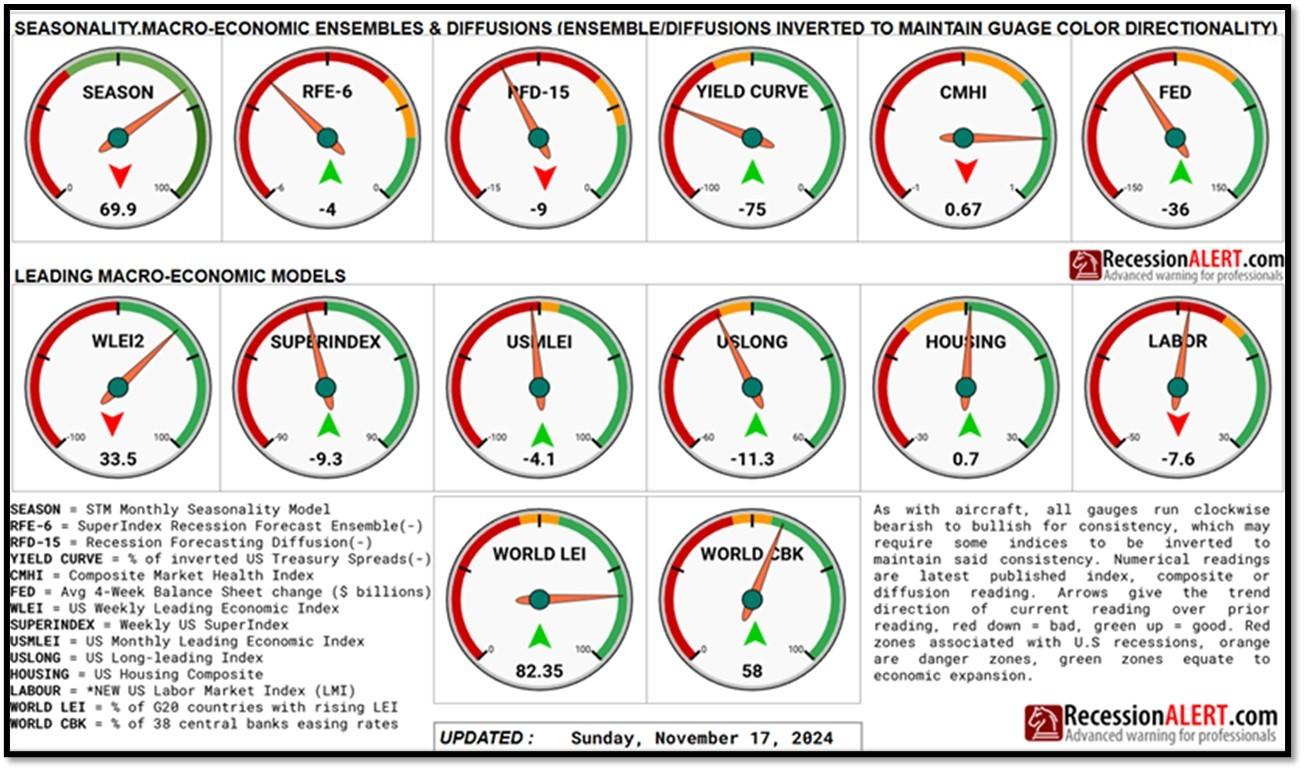

Below is a selection of quantitative & technical data we monitor on a regular basis to help gauge the overall financial market conditions and the investment environment.

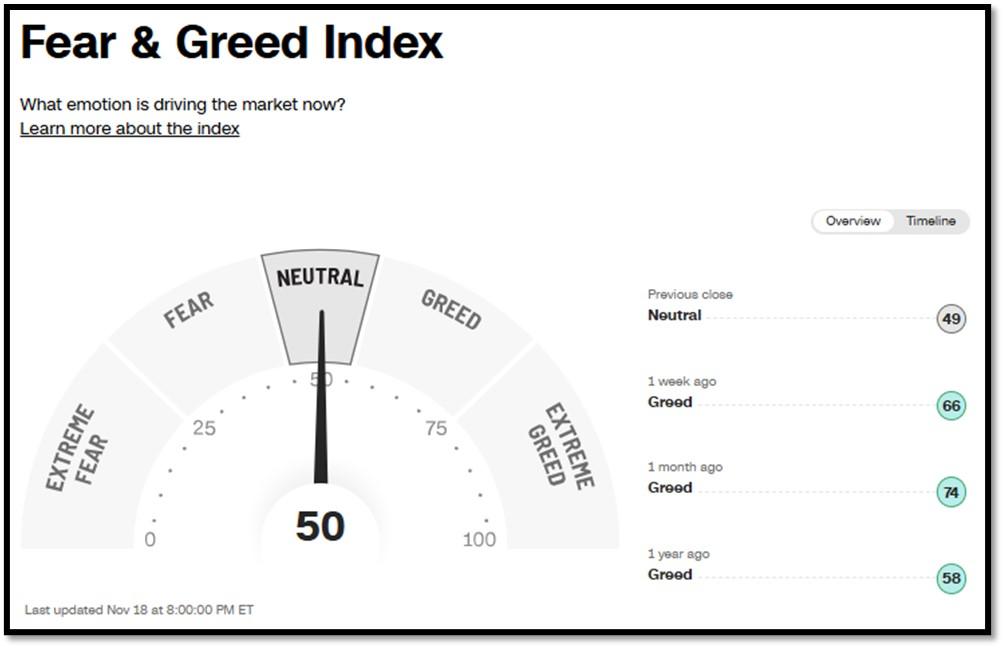

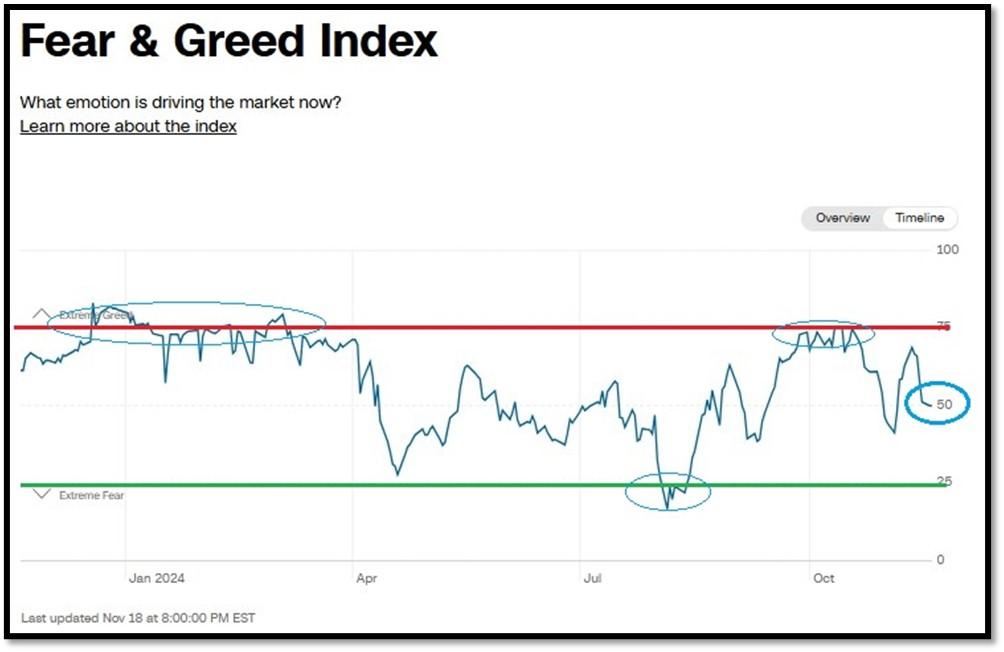

5A. Most recent read on the Fear & Greed Index with data as of 11/18/2024 – 8:00PM-ET is 50 (Neutral). Last week’s data was 66 (Greed) (1-100). CNNMoney’s Fear & Greed index looks at 7 indicators (Stock Price Momentum, Stock Price Strength, Stock Price Breadth, Put and Call Options, Junk Bond Demand, Market Volatility, and Safe Haven Demand). Keep in mind this is a contrarian indicator! REF: Fear&Greed via CNNMoney

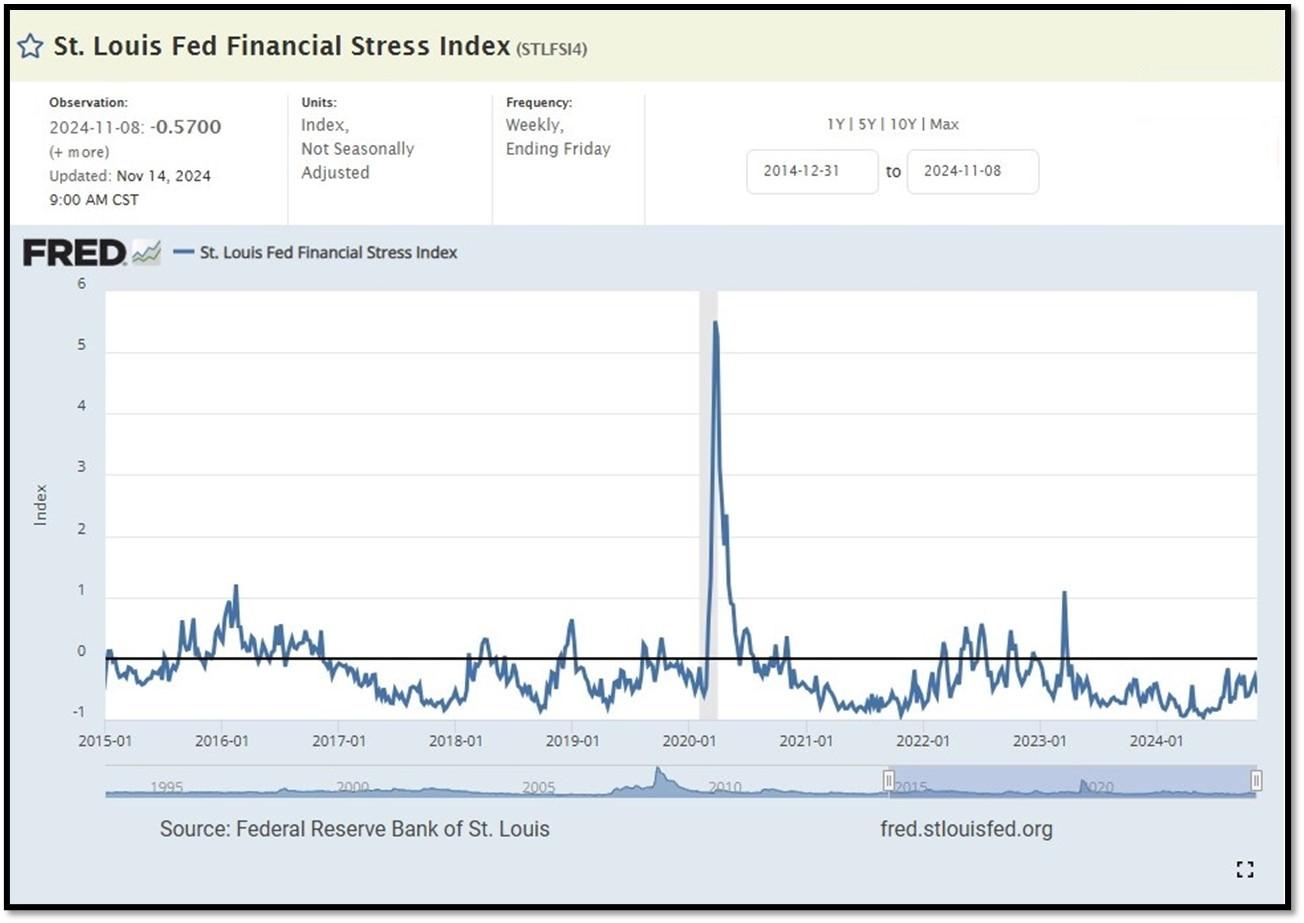

5B. St. Louis Fed Financial Stress Index’s (STLFSI4) most recent read is at –0.5700 as of November 14, 2024. A big spike up from previous readings reflecting the recent turmoil in the banking sector. Previous week’s data was -0.3062. This weekly index is not seasonally adjusted. The STLFSI4 measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. REF: St. Louis Fed

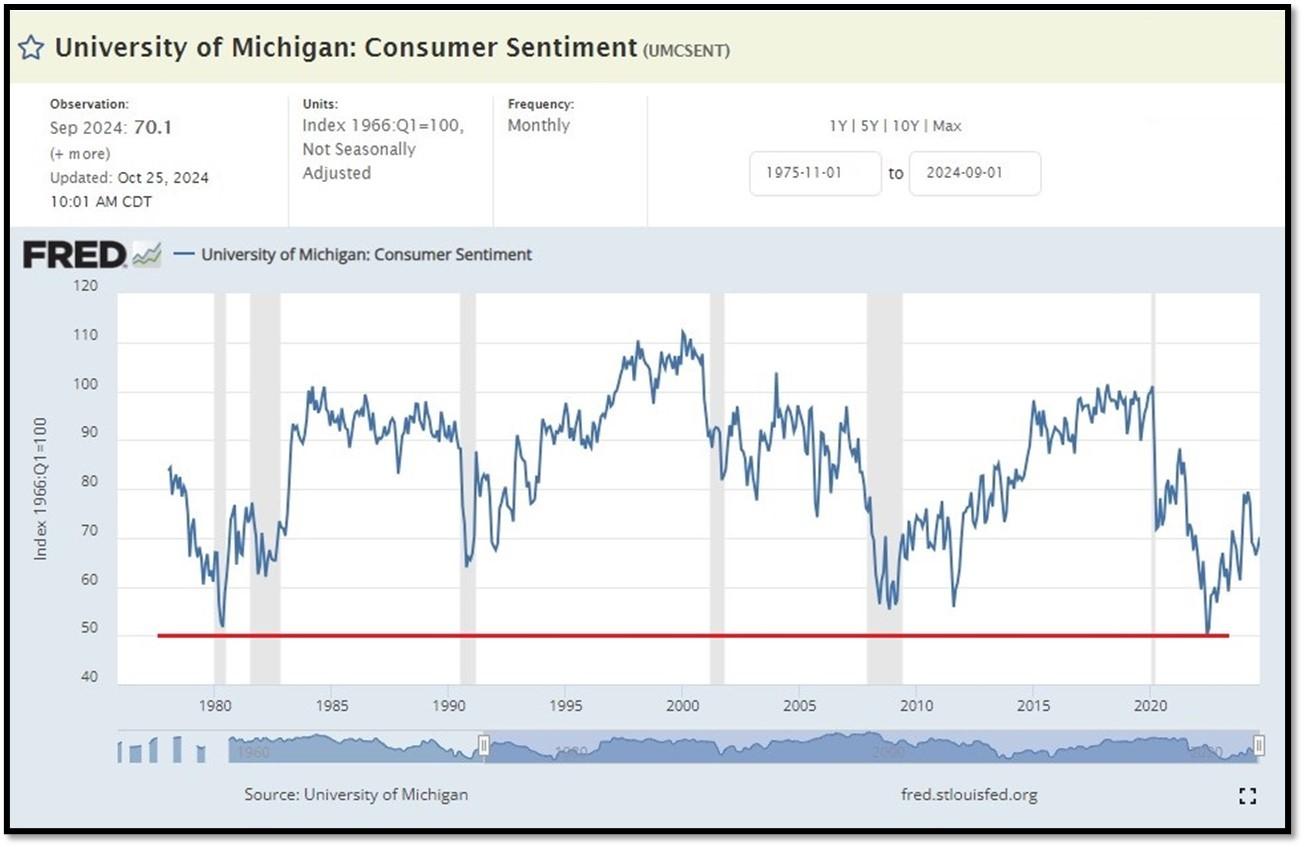

5C. University of Michigan, University of Michigan: Consumer Sentiment for September [UMCSENT] at 70.1, retrieved from FRED, Federal Reserve Bank of St. Louis, October 25, 2024. Back in June 2022, Consumer Sentiment hit a low point going back to April 1980. REF: UofM

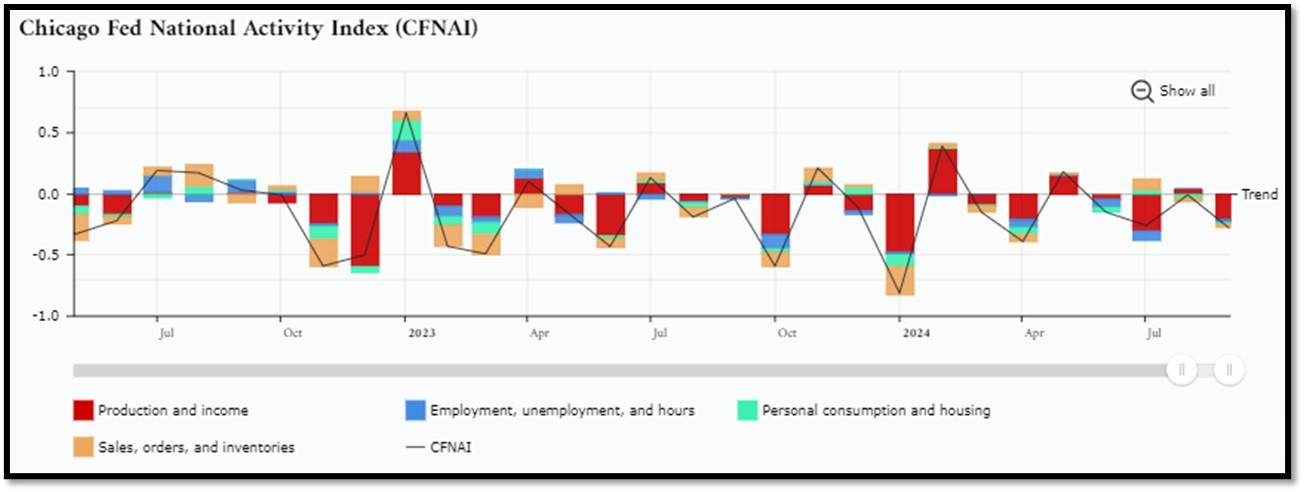

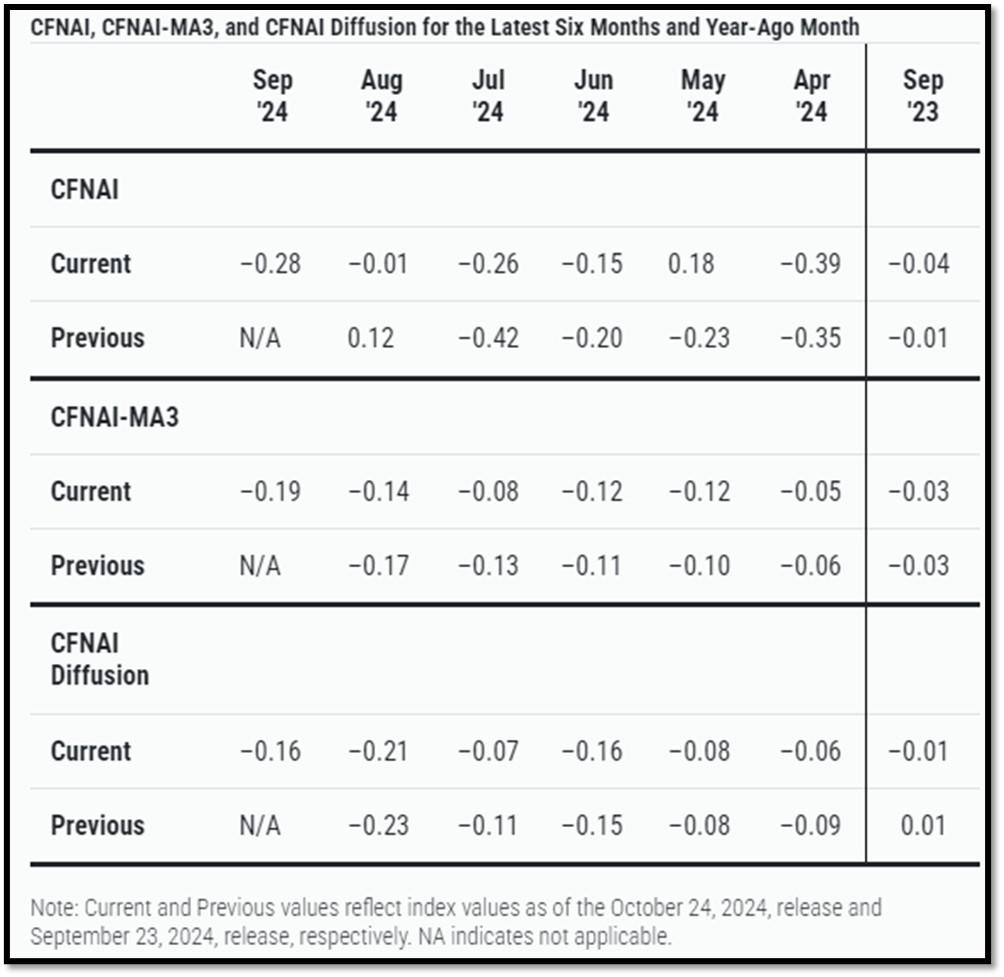

5D. The Chicago Fed National Activity Index (CFNAI) decreased to –0.28 in September from –0.01 in August. Two of the four broad categories of indicators used to construct the index decreased from August, and all four categories made negative contributions in September. The index’s three-month moving average, CFNAI-MA3, decreased to –0.19 in September from –0.14 in August. REF: ChicagoFed, September’s Report

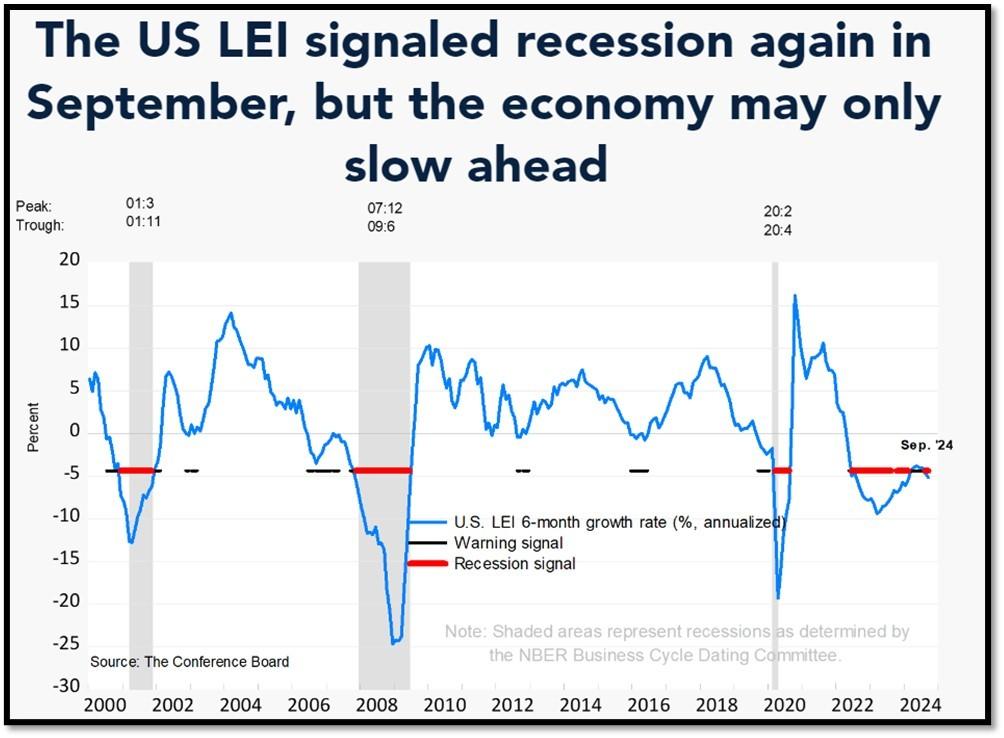

5E. (10/21/2024) The Conference Board Leading Economic Index (LEI) for the US declined by 0.5% in September 2024 to 99.7 (2016=100), following a 0.3% decline in August. Over the six-month period between March and September 2024, the LEI fell by 2.6%, more than its 2.2% decline over the previous six-month period (September 2023 to March 2024). The composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component. The CEI is highly correlated with real GDP. The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. Shaded areas denote recession periods or economic contractions. The dates above the shaded areas show the chronology of peaks and troughs in the business cycle. The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers’ new orders for nondefense capital goods excluding aircraft orders; Building permits for new private housing units; S&P 500® Index of Stock Prices; Leading Credit Index™; Interest rate spread (10-year Treasury bonds less federal funds rate); Average consumer expectations for business conditions. REF: ConferenceBoard, LEI Report for September (Released on 10/29/2024)

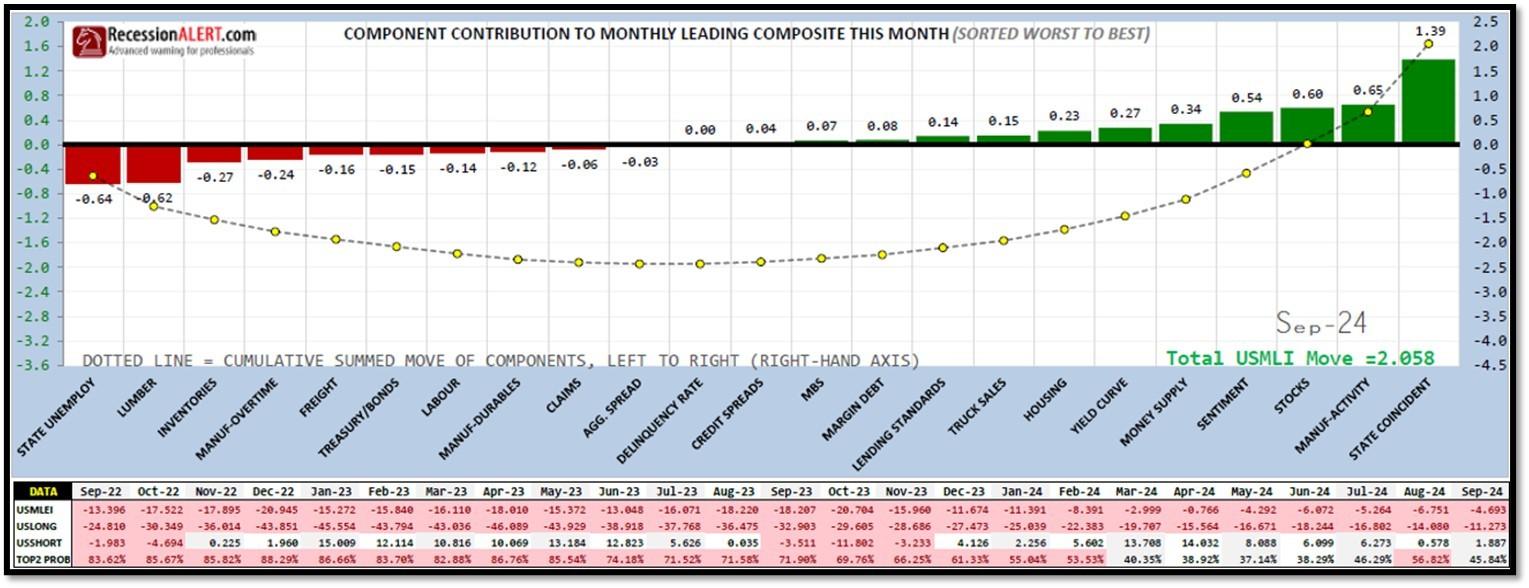

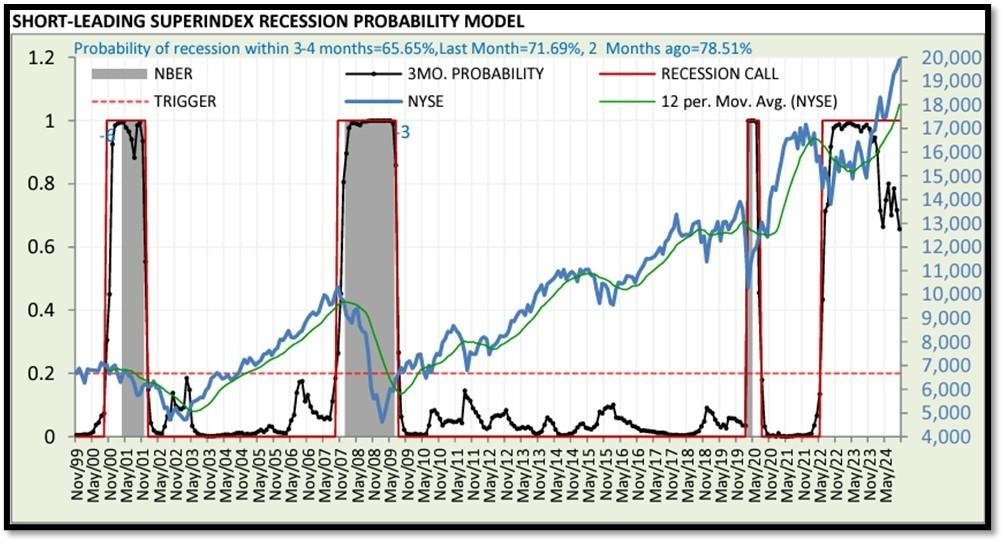

5F. Probability of U.S. falling into Recession within 3 to 4 months is currently at 65.65% (with data as of 11/18/2024 – Next Report 12/04/2024) according to RecessionAlert Research. Last release’s data was at 65.88%. This report is updated every two weeks. REF: RecessionAlertResearch

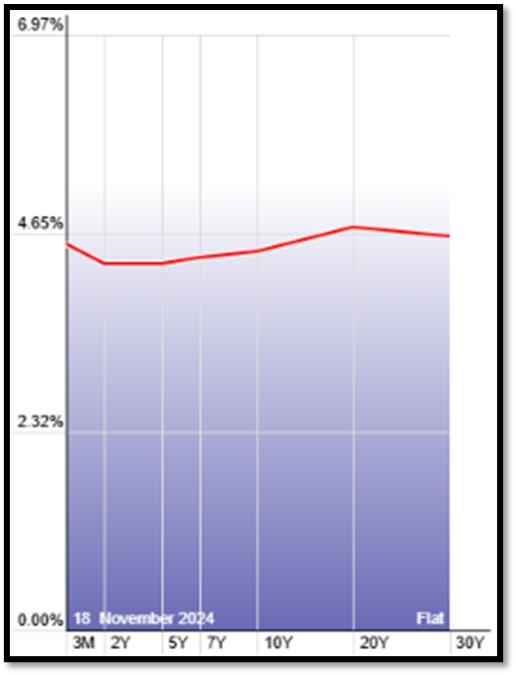

5G. Yield Curve as of 11/18/2024 is showing Flattening. Spread on the 10-yr Treasury Yield (4.41%) minus yield on the 2-yr Treasury Yield (4.28%) is currently at 13 bps. REF: Stockcharts The yield curve—specifically, the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill—is a valuable forecasting tool. It is simple to use and significantly outperforms other financial and macroeconomic indicators in predicting recessions two to six quarters ahead. REF: NYFED

5H. Recent Yields in 10-Year Government Bonds. REF: Source is from Bloomberg.com, dated 11/18/2024, rates shown below are as of 11/18/2024, subject to change.

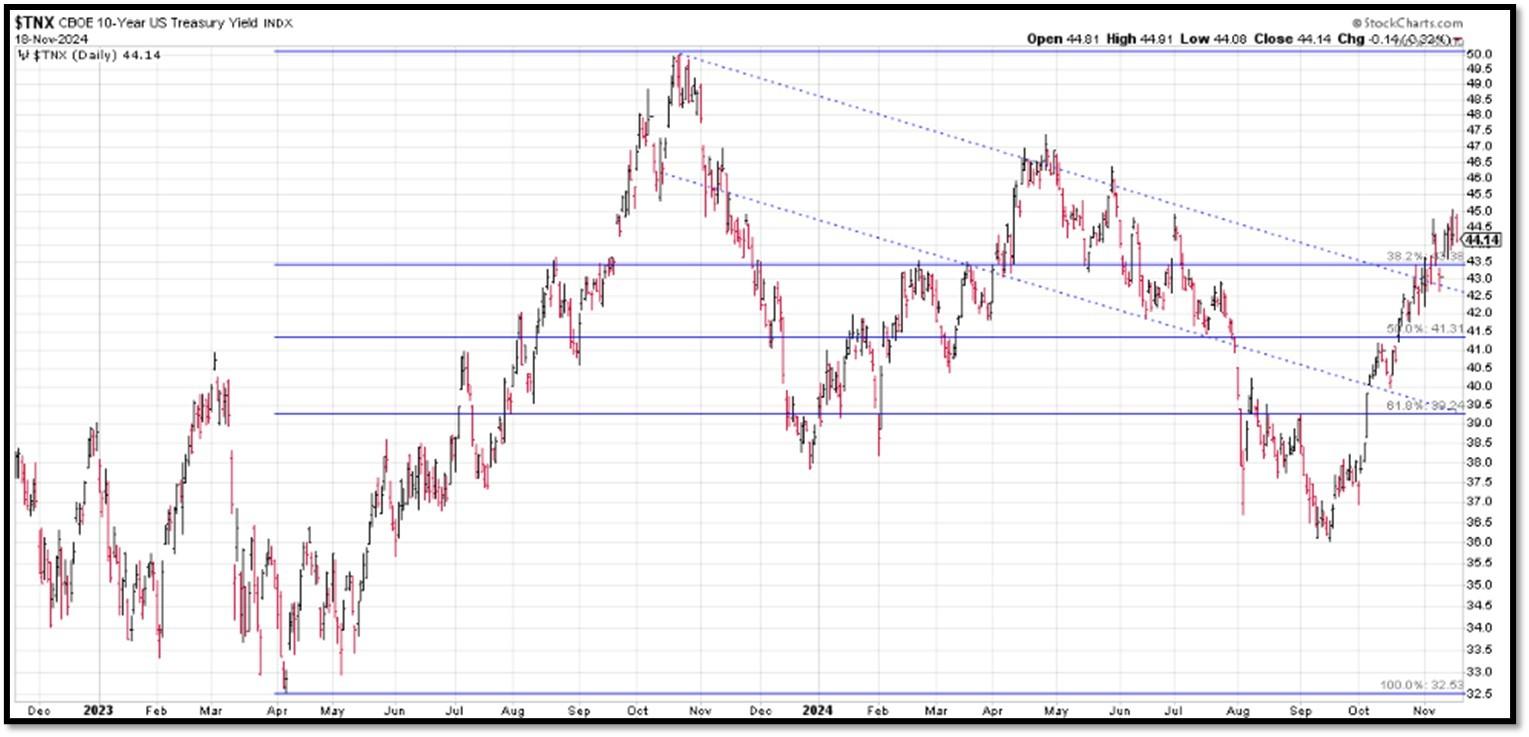

The 10-Year US Treasury Yield… REF: StockCharts1, StockCharts2

The 10-year yield – Spiked towards top of trend…

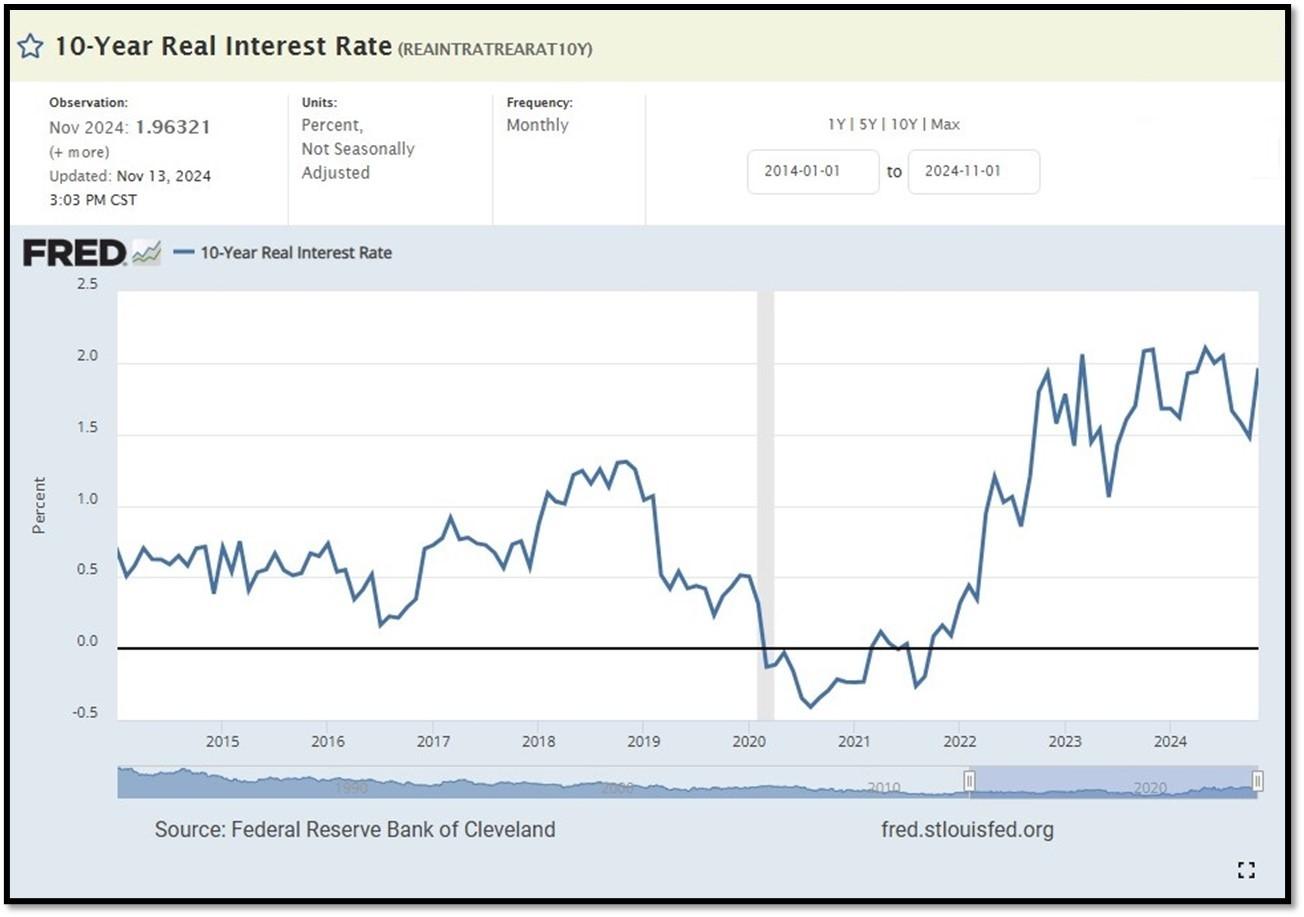

10-Year Real Interest Rate at 1.96321% as of 10/18/24. REF: REAINTRATREARAT10Y

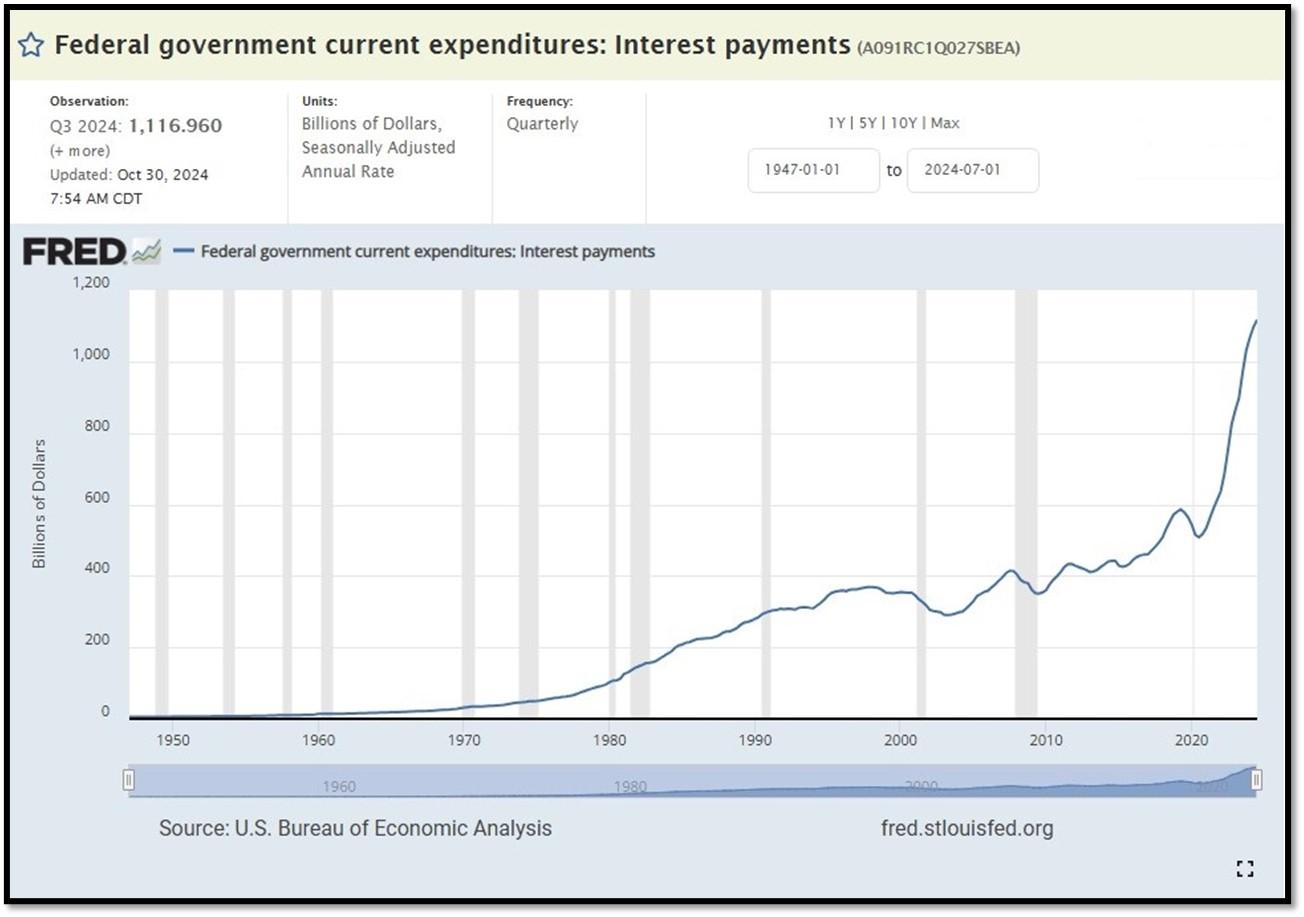

Federal government Interest Payments increased $20B+ to $1.1166 Trillion as of Q3-2024. REF: FRED-A091RC1Q027SBEA

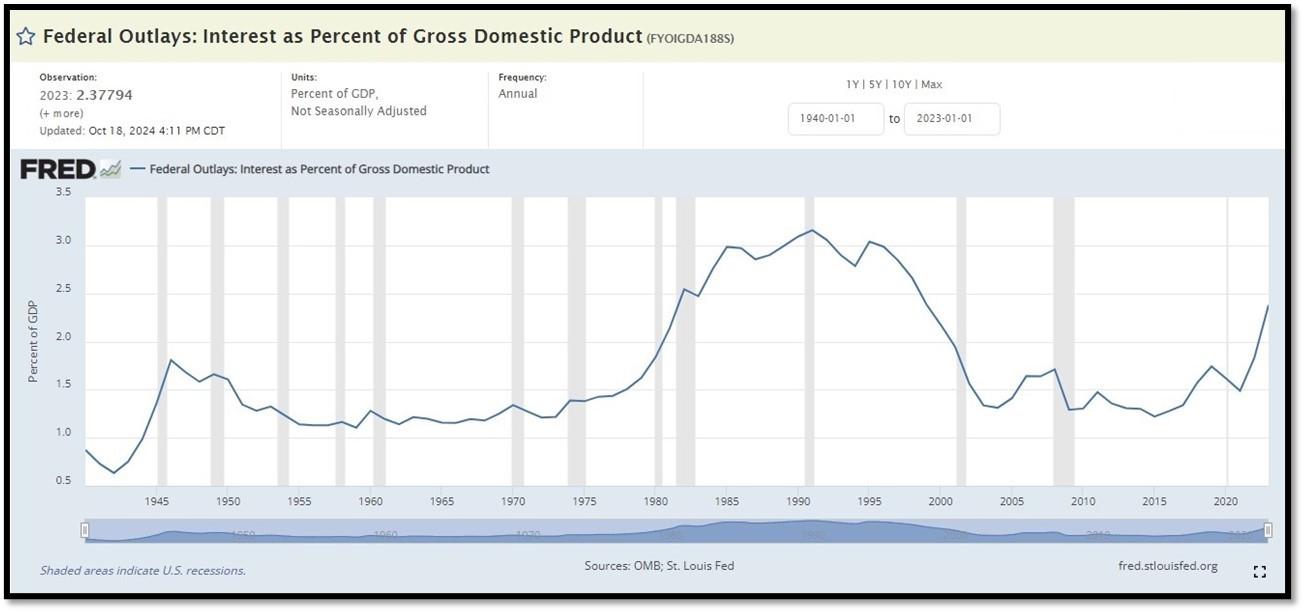

Interest payments as a percentage of GDP increased from 1.84853 in 2022 to 2.37794 as of 10/18/24. REF: FRED-FYOIGDA188S

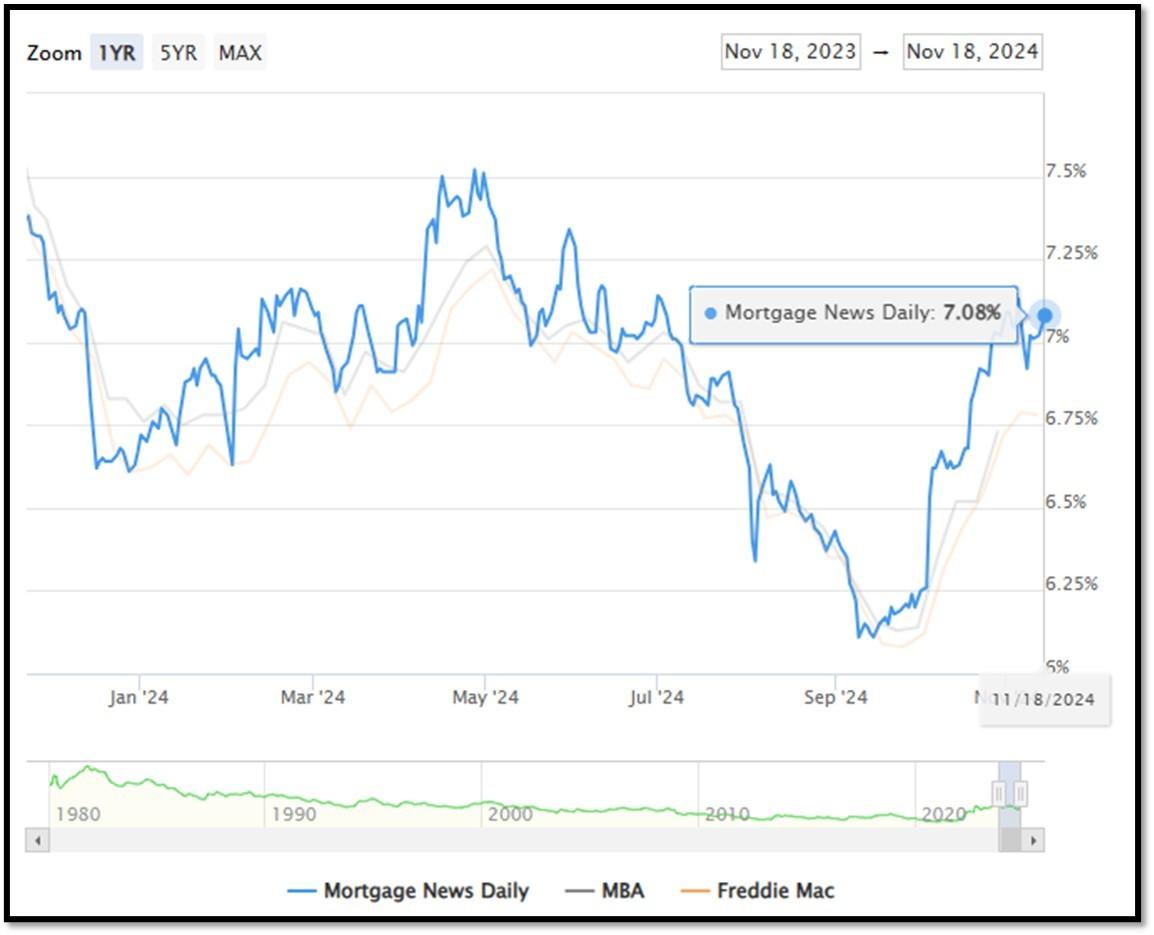

5I. (11/18/2024) Today’s National Average 30-Year Fixed Mortgage Rate is 7.08% (All Time High was 8.03% on 10/19/23). Last week’s data was 7.02%. This rate is the average 30-year fixed mortgage rates from several different surveys including Mortgage News Daily (daily index), Freddie Mac (weekly survey), Mortgage Bankers Association (weekly survey) and FHFA (monthly survey). REF: MortgageNewsDaily, Today’s Average Rate

The recent spike in the 30-year fixed-rate jumbo mortgage to 7.08%, compared to Freddie Mac’s rate at 6.78% and the Mortgage Bankers Association (MBA) rate at 6.73%, highlights key differences in the mortgage market. Jumbo mortgages, which exceed the conforming loan limits set by government agencies like Freddie Mac, typically carry higher interest rates because they are riskier for lenders. These loans are not backed by government entities, which increases the risk for lenders and, consequently, leads to higher rates. In contrast, Freddie Mac and MBA provide averages for conforming loans, which meet federal guidelines and have lower risk due to government backing, keeping their rates lower.

(11/11/24) Housing Affordability Index for Aug = 98.6 // July = 95 // June = 93.3 // May = 93.1 // April = 95.9 // March = 101.1 // February = 103.0. Data provided by Yardeni Research. REF: Yardeni

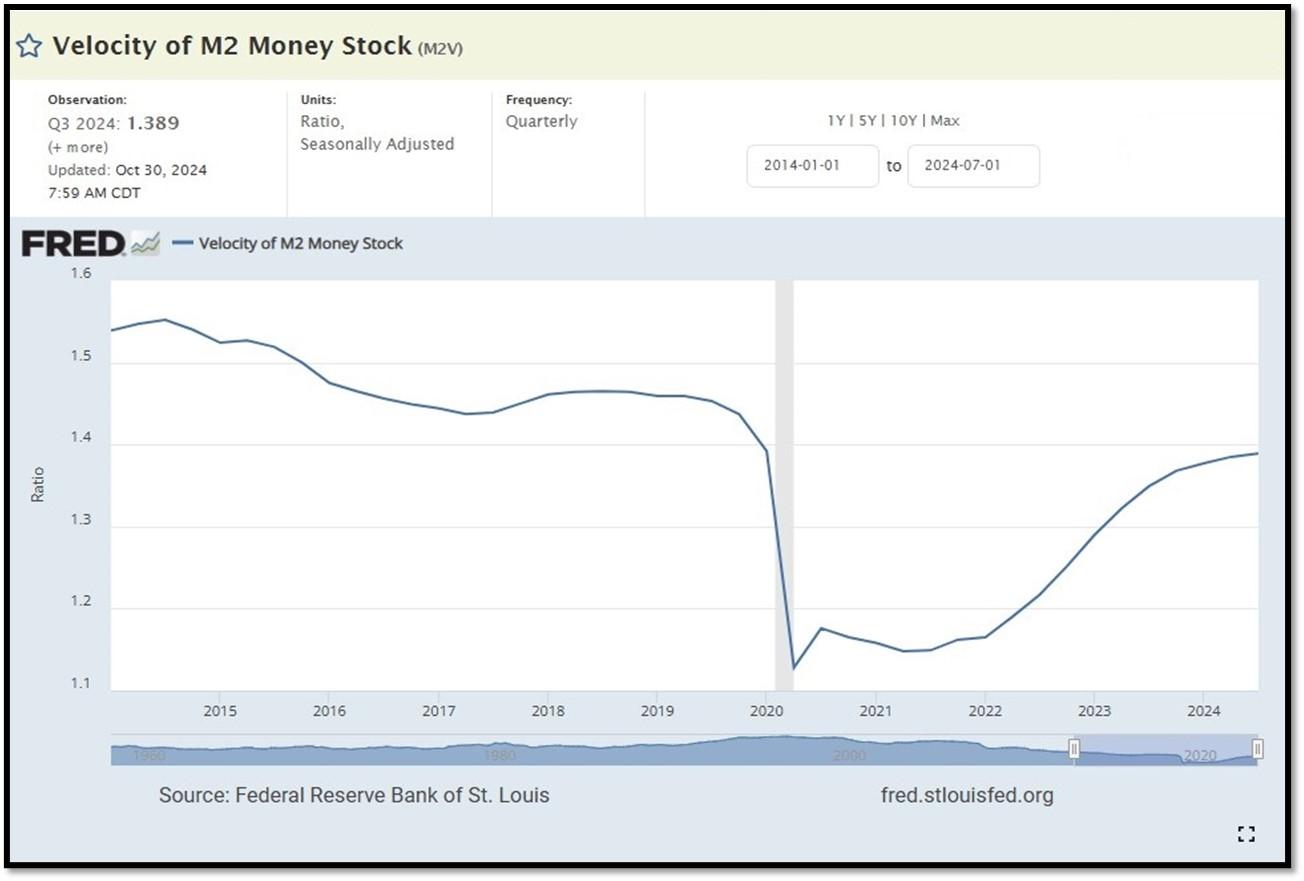

5J. Velocity of M2 Money Stock (M2V) with current read at 1.389 as of (Q2-2024 updated 10/30/2024). Previous quarter’s data was 1.385. The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. Current Money Stock (M2) report can be viewed in the reference link. REF: St.LouisFed-M2V

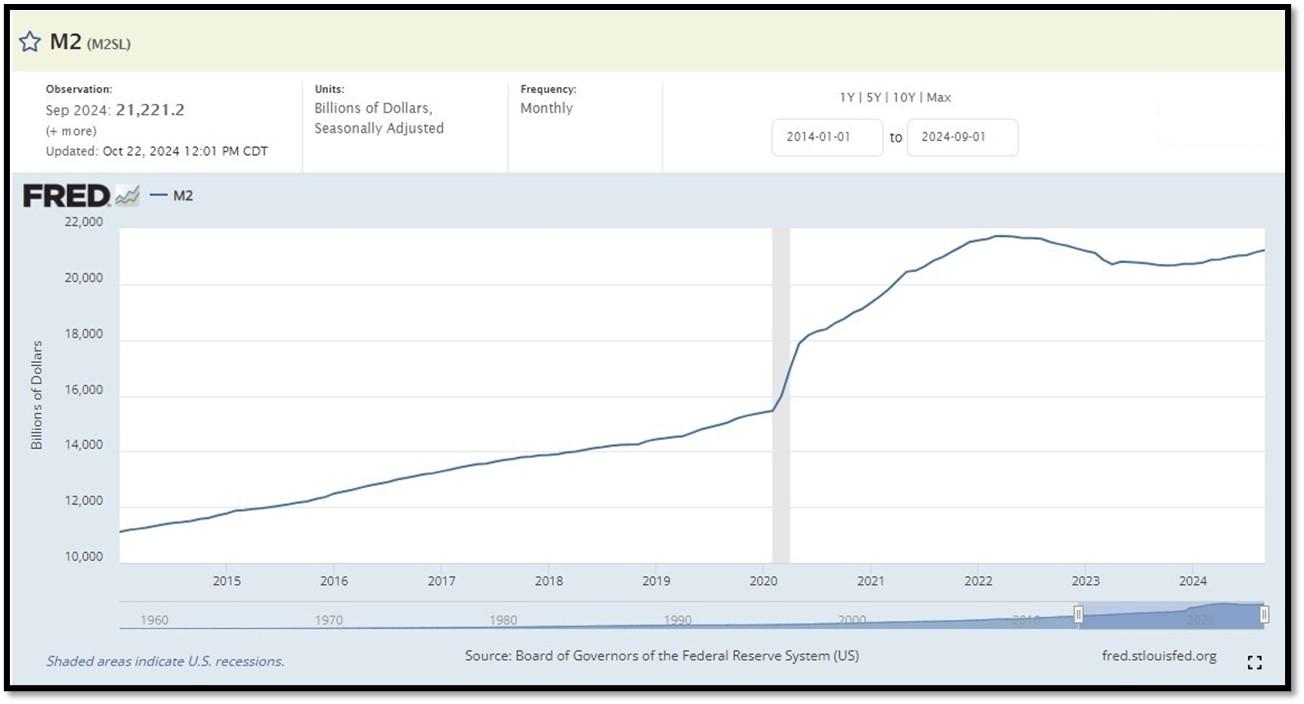

M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; Updated on October 22, 2024. REF: St.LouisFed-M2

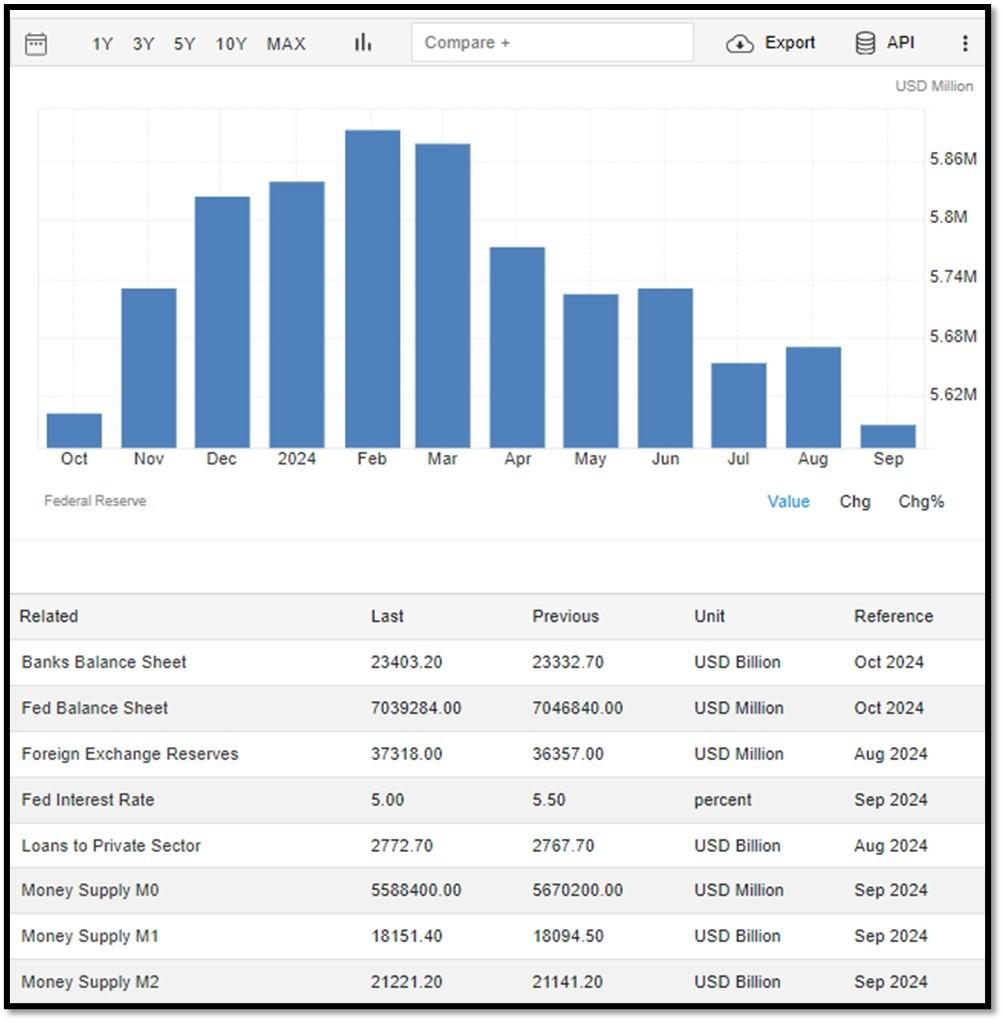

Money Supply M0 in the United States decreased to 5,588,400 USD Million in September from 5,670,200 USD Million in August of 2024. Money Supply M0 in the United States averaged 1,149,440.43 USD Million from 1959 until 2024, reaching an all-time high of 6,413,100.00 USD Million in December of 2021 and a record low of 48,400.00 USD Million in February of 1961. REF: TradingEconomics, M0

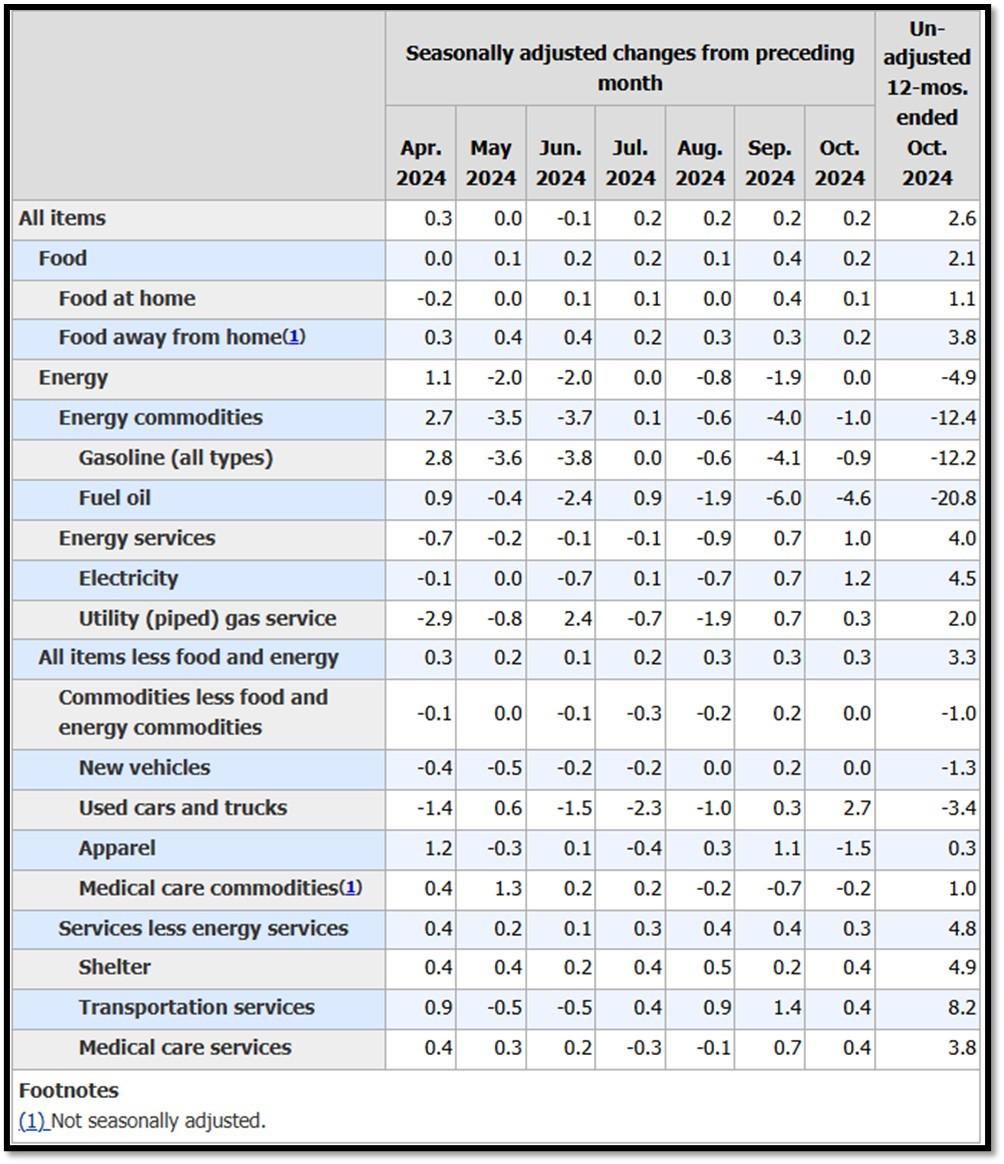

5K. In October, the Consumer Price Index for All Urban Consumers rose 0.2 percent, seasonally adjusted, and rose 2.6 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.3 percent in October (SA); up 3.3 percent over the year (NSA). November 2024 CPI data are scheduled to be released on December 11, 2024, at 8:30AM-ET. REF: BLS, BLS.GOV

5L. Technical Analysis of the S&P500 Index. Click onto reference links below for images.

- Short-term Chart: Bullish on 11/18/2024 – REF: Short-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Medium-term Chart: Bullish on 11/18/2024 – REF: Medium-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Market Timing Indicators – S&P500 Index as of 11/18/2024 – REF: S&P500 Charts (7 of them) by Joanne Klein’s Top 7 (Click Here to Access Updated Charts)

- A well-defined uptrend channel shown in green with S&P500 still on up trend. REF: Stockcharts

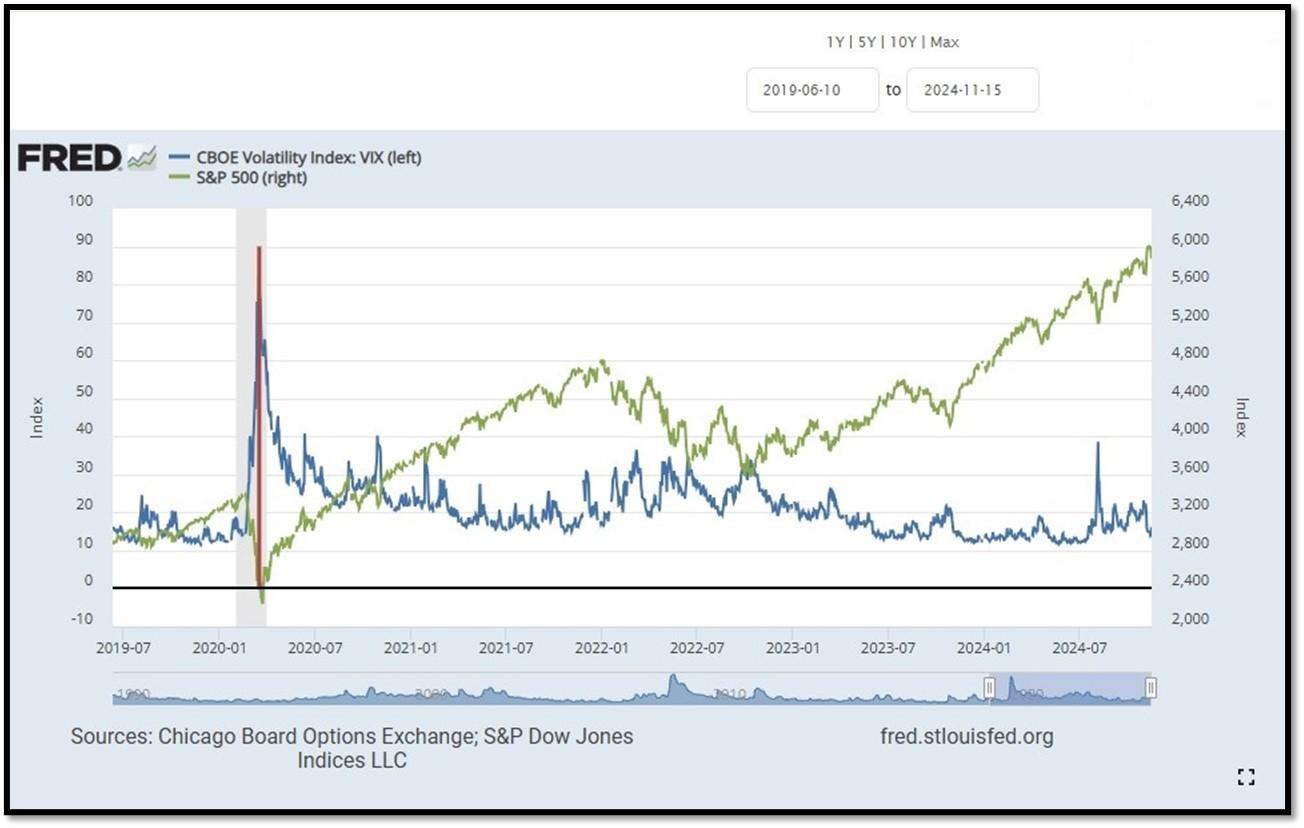

- S&P500 and CBOE Volatility Index (VIX) as of 11/15/2024. REF: FRED, Today’s Print

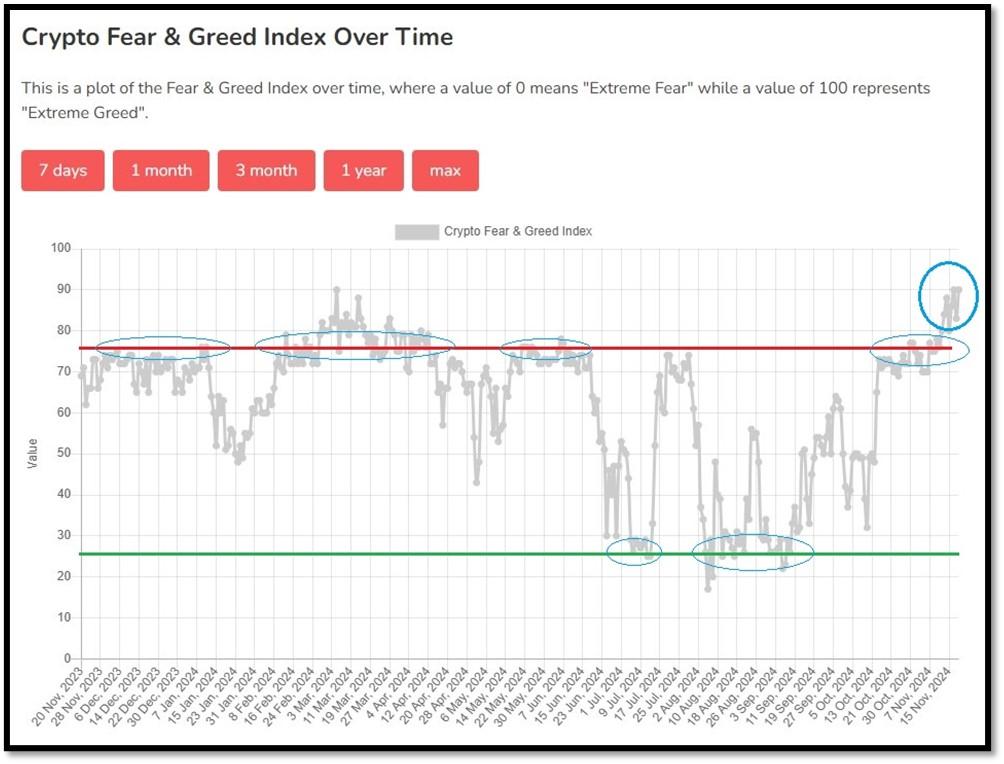

5M. Most recent read on the Crypto Fear & Greed Index with data as of 11/19/2024au is 90 (Extreme Greed). Last week’s data was 80 (Extreme Greed) (1-100). Fear & Greed Index – A Contrarian Data. The crypto market behavior is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction of seeing red numbers. With the Crypto Fear and Greed Index, the data try to help save investors from their own emotional overreactions. There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

Therefore, the program for this index analyzes the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means “Extreme Fear”, while 100 means “Extreme Greed”. REF: Alternative.me, Today’sReading

Bitcoin – 10-Year & 2-Year Charts. REF: Stockcharts10Y, Stockcharts2Y

Len writes much of his own content, and also shares helpful content from other trusted providers like Turner Financial Group (TFG).

The material contained herein is intended as a general market commentary, solely for informational purposes and is not intended to make an offer or solicitation for the sale or purchase of any securities. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. This information is not intended as a specific offer of investment services by Dedicated Financial and Turner Financial Group, Inc.

Dedicated Financial and Turner Financial Group, Inc., do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Any hyperlinks in this document that connect to Web Sites maintained by third parties are provided for convenience only. Turner Financial Group, Inc. has not verified the accuracy of any information contained within the links and the provision of such links does not constitute a recommendation or endorsement of the company or the content by Dedicated Financial or Turner Financial Group, Inc. The prices/quotes/statistics referenced herein have been obtained from sources verified to be reliable for their accuracy or completeness and may be subject to change.

Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. The views and strategies described herein may not be suitable for all investors. To the extent referenced herein, real estate, hedge funds, and other private investments can present significant risks, including loss of the original amount invested. All indexes are unmanaged, and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Turner Financial Group, Inc. is an Investment Adviser registered with the United States Securities and Exchange Commission however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Additional information about Turner Financial Group, Inc. is also available at www.adviserinfo.sec.gov. Advisory services are only offered to clients or prospective clients where Turner Financial Group, Inc. and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Turner Financial Group, Inc. unless a client service agreement is in place.