- 1. The stock and bond markets reacted positively to the latest inflation (CPI) report for September.

- 2. Are we entering The New Nuclear Age?

- With the current macro-economic backdrop, below are areas we currently favor:

- 3. Welcome To The Autonomous Future… The “We, Robot” event on October 10, 2024, was a thrilling showcase of Tesla’s technological innovations, pushing the future of mobility and robotics to new heights.

- 4. World Watch

- 5. Quant & Technical Corner

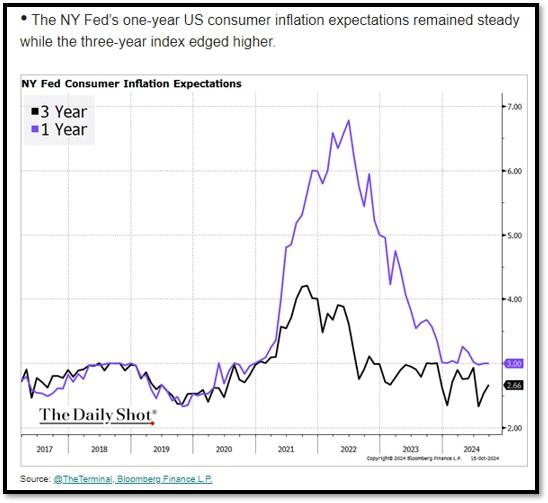

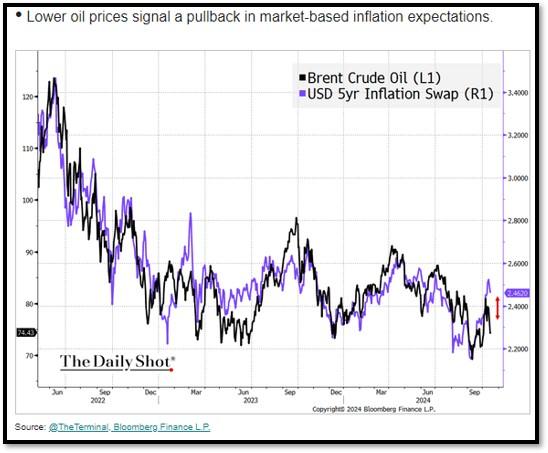

1. The stock and bond markets reacted positively to the latest inflation (CPI) report for September.

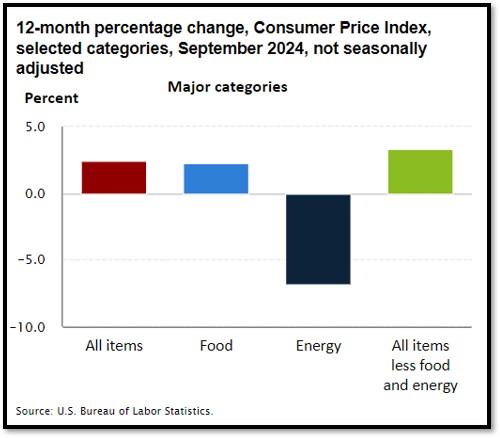

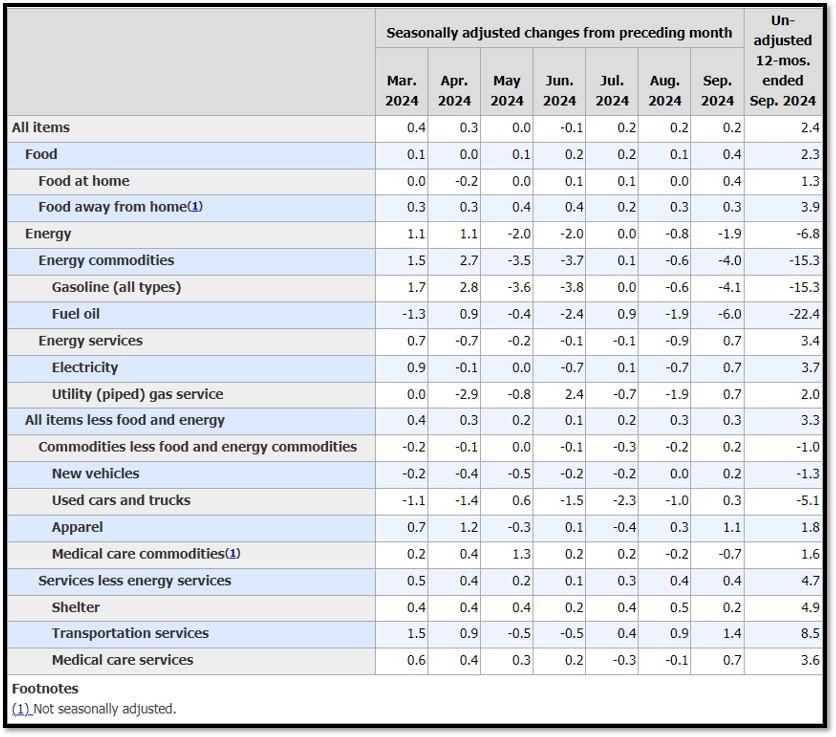

Released on October 10, the latest CPI report showed that inflation continues to moderate, but certain areas remain persistent. Headline inflation dropped to 2.3% year-over-year, down from 2.5% in the previous month, reflecting easing energy prices. However, core inflation, which excludes volatile food and energy prices, remained higher at 3.2%, driven by rising costs in shelter and services. Keep in mind that shelter is a lagging indicator. This mixed picture of inflation is critical for the Federal Reserve as it determines its next steps on interest rate cuts. With job growth strong and unemployment falling, the Fed is carefully monitoring inflation trends before deciding whether to continue cutting rates. A lower-than-expected CPI could provide more room for rate cuts, but persistent inflation in core areas could delay further easing. See item 5K further below for additional information. REF: BLS, Dailyshot

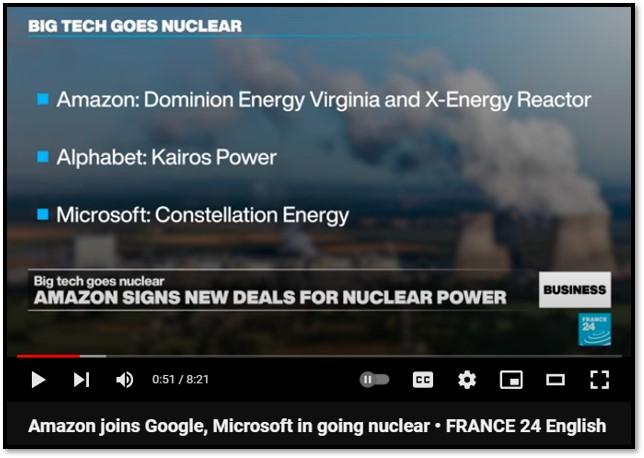

2. Are we entering The New Nuclear Age?

Amazon, Google, and Microsoft have recently committed to using nuclear power, particularly small modular reactors (SMRs), to meet the rising energy demands of their AI-driven data centers. Amazon has invested $650 million in a data center powered by the Susquehanna nuclear plant, while Google is exploring nuclear as part of its push for net-zero emissions by 2030. Microsoft is also planning to restart the Three Mile Island nuclear plant by 2028, supporting its cloud services. These moves reflect the tech industry’s turn to nuclear power for reliable, carbon-free energy.

Recent advancements in Small Modular Reactors (SMRs) reflect growing global interest in this technology for cleaner, scalable energy solutions. NuScale Power leads the way, being the first SMR design certified by U.S. regulators, with Romania set to deploy its VOYGR unit at the Doicești site. In Canada, Ontario Power Generation is building four SMRs at its Darlington facility, expected to go online by 2029. TerraPower, backed by Bill Gates, is developing an advanced sodium-cooled reactor with molten salt storage, a key innovation in improving nuclear efficiency. Meanwhile, X-energy is focusing on advanced microreactors, winning a contract from the U.S. Department of Defense for its transportable reactor technology. Click onto picture below to access video. REF: BARRON’S, France24

With the current macro-economic backdrop, below are areas we currently favor:

- Fixed Income – Short-term (Low-Beta)

- Fixed Income – Adding Duration, preferred stocks & High Yield as Opportunistic Allocation (Low-Beta)

- Businesses that contribute to and benefit from AI & Automation (Market-Risk)

- Mid Cap Stocks & Small Cap Stocks

- Clean Energy / Solar / Utilities (Market-Risk)

- Healthcare & Biotechnology (Market-Risk)

- Gold (Market-Risk)

- Industrials (Market-Risk)

3. Welcome To The Autonomous Future… The “We, Robot” event on October 10, 2024, was a thrilling showcase of Tesla’s technological innovations, pushing the future of mobility and robotics to new heights.

Among the highlights was the reveal of Tesla’s fully autonomous Robotaxi, promising a revolution in urban transportation featuring butterfly doors. Tesla also wowed the audience with the introduction of the Robovan (that seats up to 20) and the humanoid robot, Optimus, whose capabilities have advanced remarkably. A jaw-dropping drone light show added to the spectacle, reinforcing Tesla’s commitment to merging cutting-edge AI with everyday life. The event left attendees excited for Tesla’s bold vision of the future.

While some critics were underwhelmed by the event, citing unanswered questions about Tesla’s self-driving technology, production timelines, and realistic launch dates, I believe we should give the public time to digest all that just happened. There’s a lot to unpack, and the full impact of these innovations may become clearer with time. Click onto pictures below to access videos including the latest episode of ARK Invest’s Brainstorm EP65. REF: CNET, TeslaMasterPlan3, ARK Invest’s Brainstorm65

4. World Watch

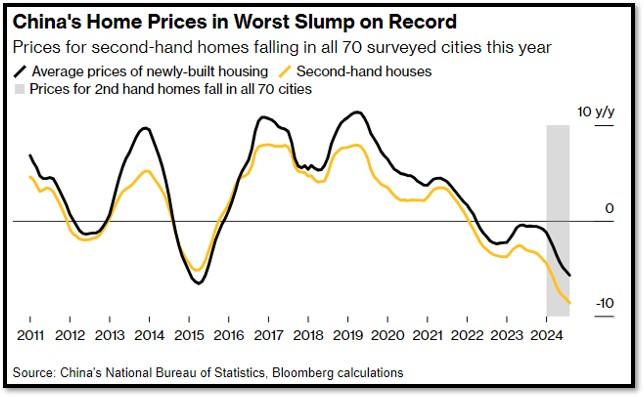

4A. China to Boost Support for Unfinished Properties to $562 Billion according to Bloomberg. China has announced a $562 billion plan to support unfinished real estate projects, a response to its ongoing property crisis. The collapse of major developers like Evergrande has left many construction projects incomplete, resulting in significant financial losses for homebuyers and destabilizing the broader economy. The funds will be directed towards local governments, developers, and financial institutions to ensure stalled housing projects are completed.

This bailout is crucial for restoring consumer confidence, stabilizing property prices, and supporting local government revenues, which rely heavily on land sales. The real estate sector plays a key role in China’s GDP, and its failure would have wider economic implications. The government’s intervention aims to prevent further economic fallout and mitigate the damage to financial institutions burdened with bad loans from the crisis. However, the long-term challenge remains in avoiding over-leveraging and ensuring sustainable practices in the future. Click onto picture below to access video. REF: Bloomberg

4B. SpaceX’s recent return of its Starship rocket marks a significant milestone in the company’s mission to revolutionize space travel. Starship, designed as a fully reusable spacecraft, is central to SpaceX’s long-term goals of reducing space exploration costs and enabling missions to the moon, Mars, and beyond. This successful return is a major step forward for the spacecraft, which has undergone numerous tests and adjustments to improve its performance and durability. Starship’s reusability is key to making space travel more sustainable. Unlike traditional rockets, which are discarded after launch, Starship is designed to be refueled and relaunched, dramatically lowering the cost of space missions. SpaceX’s ambition for Starship extends beyond Earth’s orbit, with plans for the spacecraft to support NASA’s Artemis missions to the moon and eventually play a role in establishing a human presence on Mars. “A day for the history books,” engineers at SpaceX declared as the booster landed safely. Elon Musk refers to the “chopsticks” as part of a giant mechanism he calls “Mechazilla.” This massive structure, including the launch tower and its robotic arms, is designed to catch and secure the Starship rocket after launch, eliminating the need for landing legs. Mechazilla plays a crucial role in SpaceX’s goal of making Starship fully reusable and enabling rapid turnaround for multiple launches.

While the road to success has included challenges—earlier tests saw several failed landings—each test has provided valuable data, leading to design improvements in its engines and heat-shielding systems. This progress is critical not only for SpaceX’s goals but for the broader space industry, as Starship’s capabilities open new opportunities for both government and commercial missions. Click onto picture below to access video from Bloomberg. REF: Bloomberg, BBC

4C. A Chinese security group has called for a review of Intel’s chips, escalating tech tensions between China and the U.S. This follows U.S. restrictions on semiconductor exports to China, aimed at limiting access to advanced technologies that could enhance China’s military. The move is part of China’s broader strategy to reduce reliance on U.S. tech and boost its own semiconductor industry. This “tech cold war” between the two nations continues to disrupt global supply chains and could impact companies operating in both markets. There’s a chip war happening, in case you didn’t know. Click the picture below to watch the full documentary on this topic. REF: WSJ

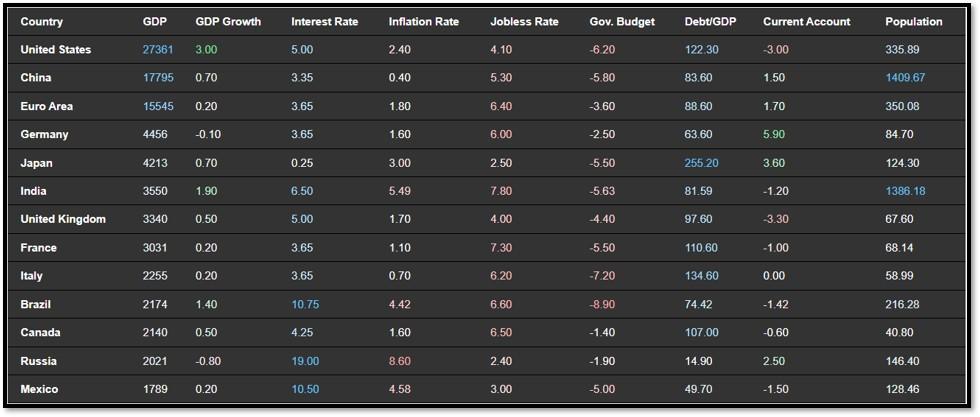

4D. Below is an updated snapshot of the current global state of economy according to TradingEconomics as of 10/16/2024. REF: TradingEconomics

- The annual inflation rate in the US slowed for a sixth consecutive month to 2.4% in September 2024, the lowest since February 2021, from 2.5% in August.

- China’s annual inflation rate stood at 0.4% in September 2024, below market forecasts and August’s figure of 0.6%. This was the 8th month of consumer inflation but was the lowest print since June, highlighting the need for more policy support from Beijing to address growing deflation risks.

- The annual inflation rate in India rose to 5.49% in September of 2024 from 3.65% in the previous month, well above market estimates of 5%.

- Unemployment Rate in India decreased to 7.80 percent in September from 8.50 percent in August of 2024.

5. Quant & Technical Corner

Below is a selection of quantitative & technical data we monitor on a regular basis to help gauge the overall financial market conditions and the investment environment.

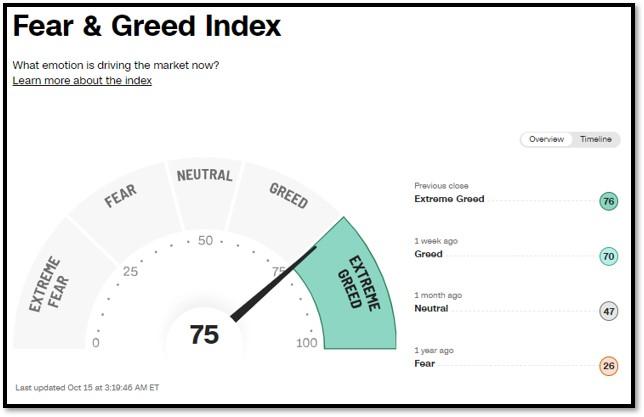

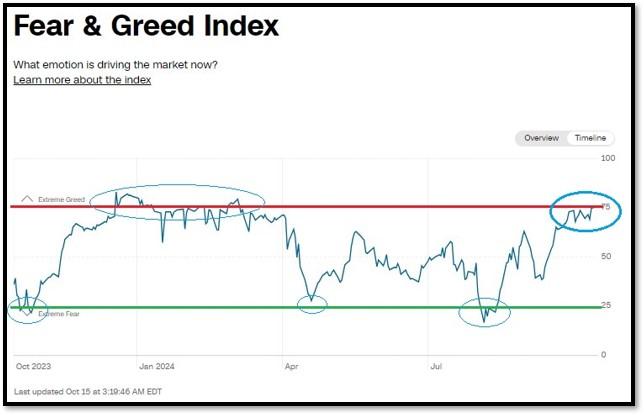

5A. Most recent read on the Fear & Greed Index with data as of 10/15/2024 – 3:19AM-ET is 75 (Greed). Last week’s data was 70 (Greed) (1-100). CNNMoney’s Fear & Greed index looks at 7 indicators (Stock Price Momentum, Stock Price Strength, Stock Price Breadth, Put and Call Options, Junk Bond Demand, Market Volatility, and Safe Haven Demand). Keep in mind this is a contrarian indicator! REF: Fear&Greed via CNNMoney

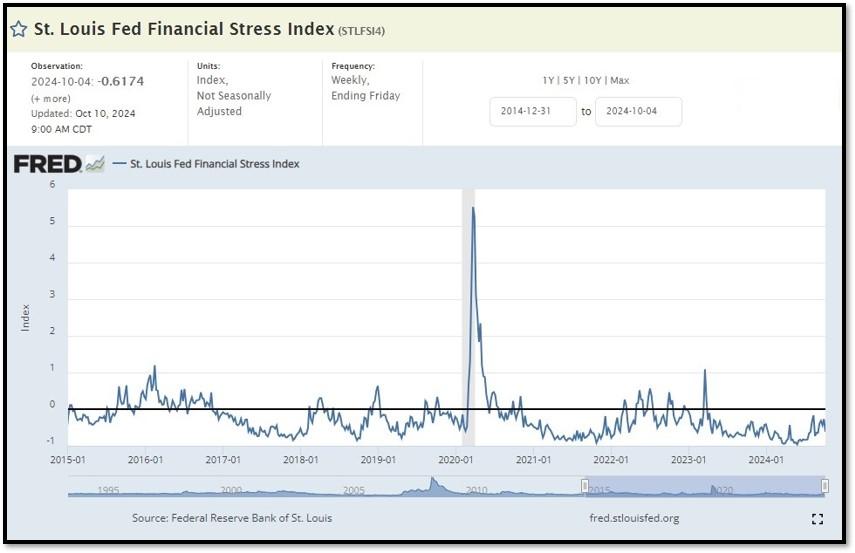

5B. St. Louis Fed Financial Stress Index’s (STLFSI4) most recent read is at –0.6174 as of October 10, 2024. A big spike up from previous readings reflecting the recent turmoil in the banking sector. Previous week’s data was -0.3947. This weekly index is not seasonally adjusted. The STLFSI4 measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. REF: St. Louis Fed

5C. University of Michigan, University of Michigan: Consumer Sentiment for June [UMCSENT] at 67.9 (last month’s data at 66.4), retrieved from FRED, Federal Reserve Bank of St. Louis, September 27, 2024. Back in June 2022, Consumer Sentiment hit a low point going back to April 1980. REF: UofM

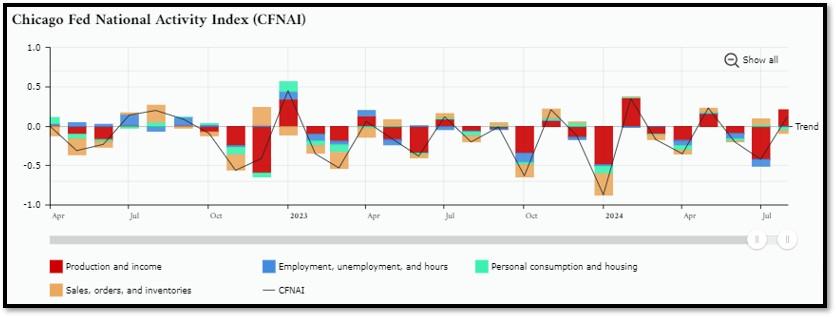

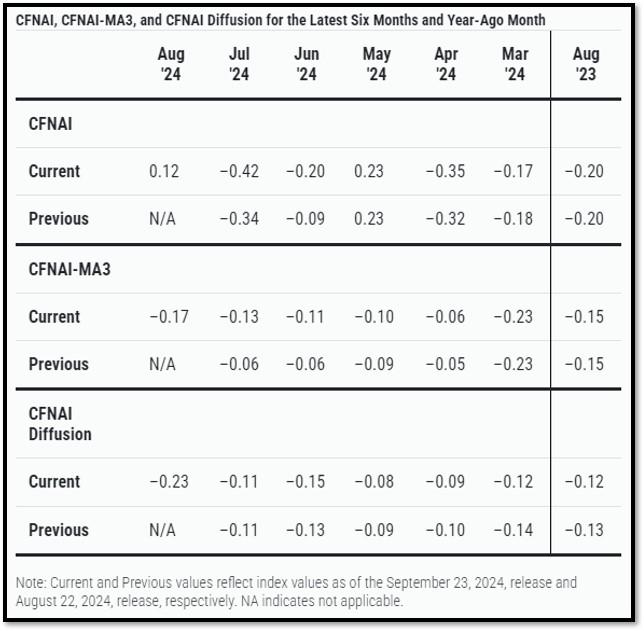

5D. The Chicago Fed National Activity Index (CFNAI) increased to +0.12 in August from –0.42 in July. Two of the four broad categories of indicators used to construct the index increased from July, and one category made a positive contribution in August. The index’s three-month moving average, CFNAI-MA3, decreased to –0.17 in August from –0.13 in July. REF: ChicagoFed, August’s Report

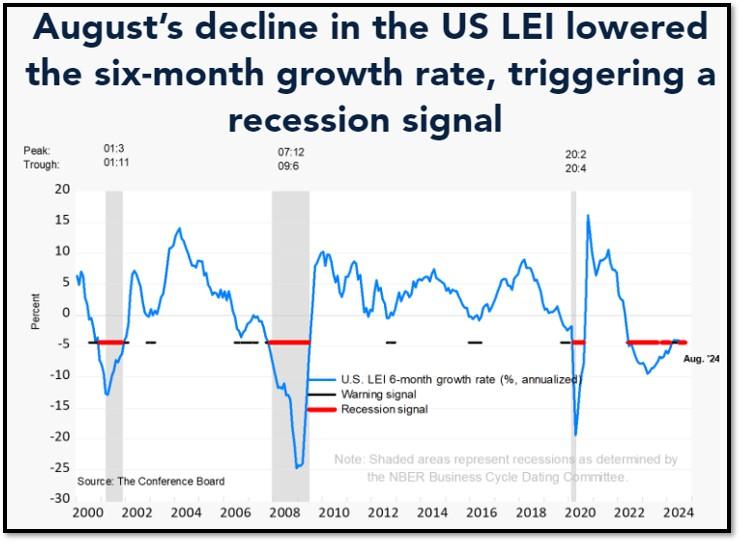

5E. (09/19/2024) The Conference Board Leading Economic Index (LEI) for the U.S. declined by 0.2% in August 2024 to 100.2 (2016=100), following an unrevised 0.6% decline in July. Over the six-month period between February and August 2024, the LEI fell by 2.3%, a smaller rate of decline than the 2.7% drop over the six-month period between August 2023 and February 2024. The composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component. The CEI is highly correlated with real GDP. The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. Shaded areas denote recession periods or economic contractions. The dates above the shaded areas show the chronology of peaks and troughs in the business cycle. The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers’ new orders for nondefense capital goods excluding aircraft orders; Building permits for new private housing units; S&P 500® Index of Stock Prices; Leading Credit Index™; Interest rate spread (10-year Treasury bonds less federal funds rate); Average consumer expectations for business conditions. REF: ConferenceBoard, LEI Report for August (Released on 9/27/2024)

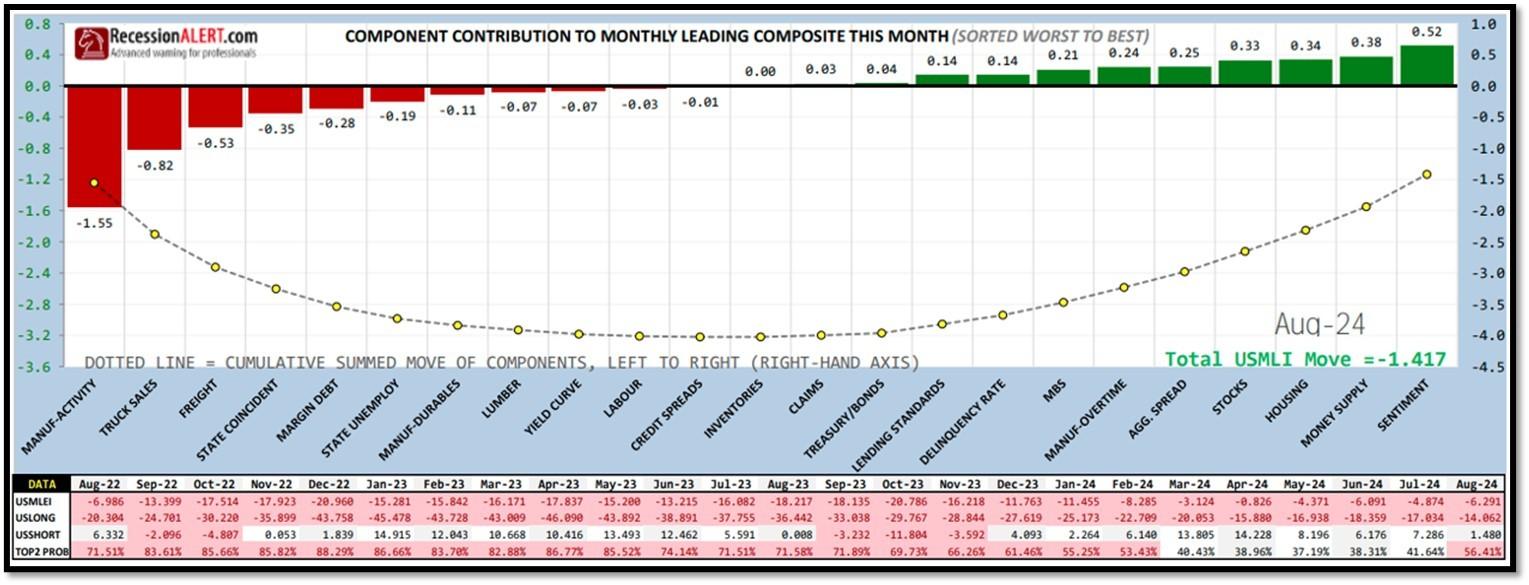

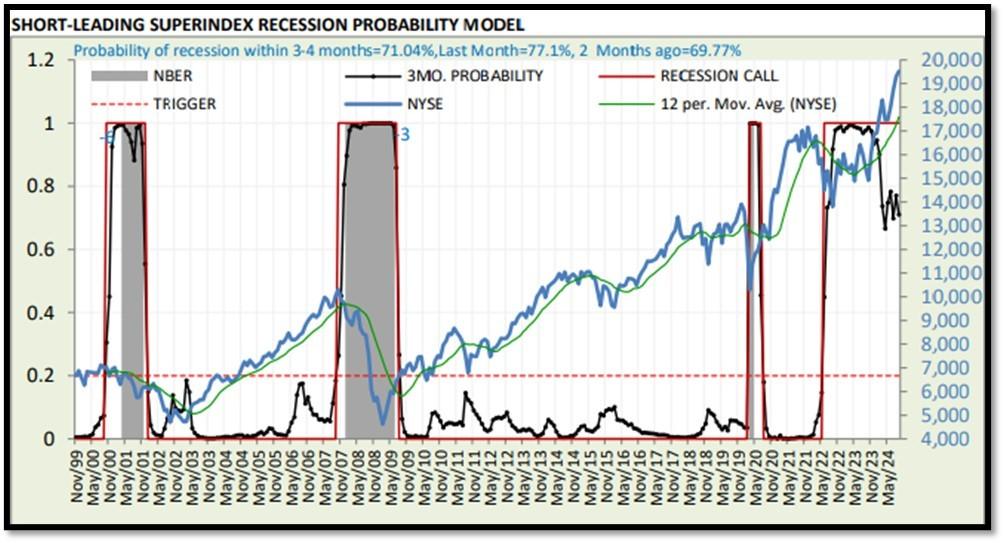

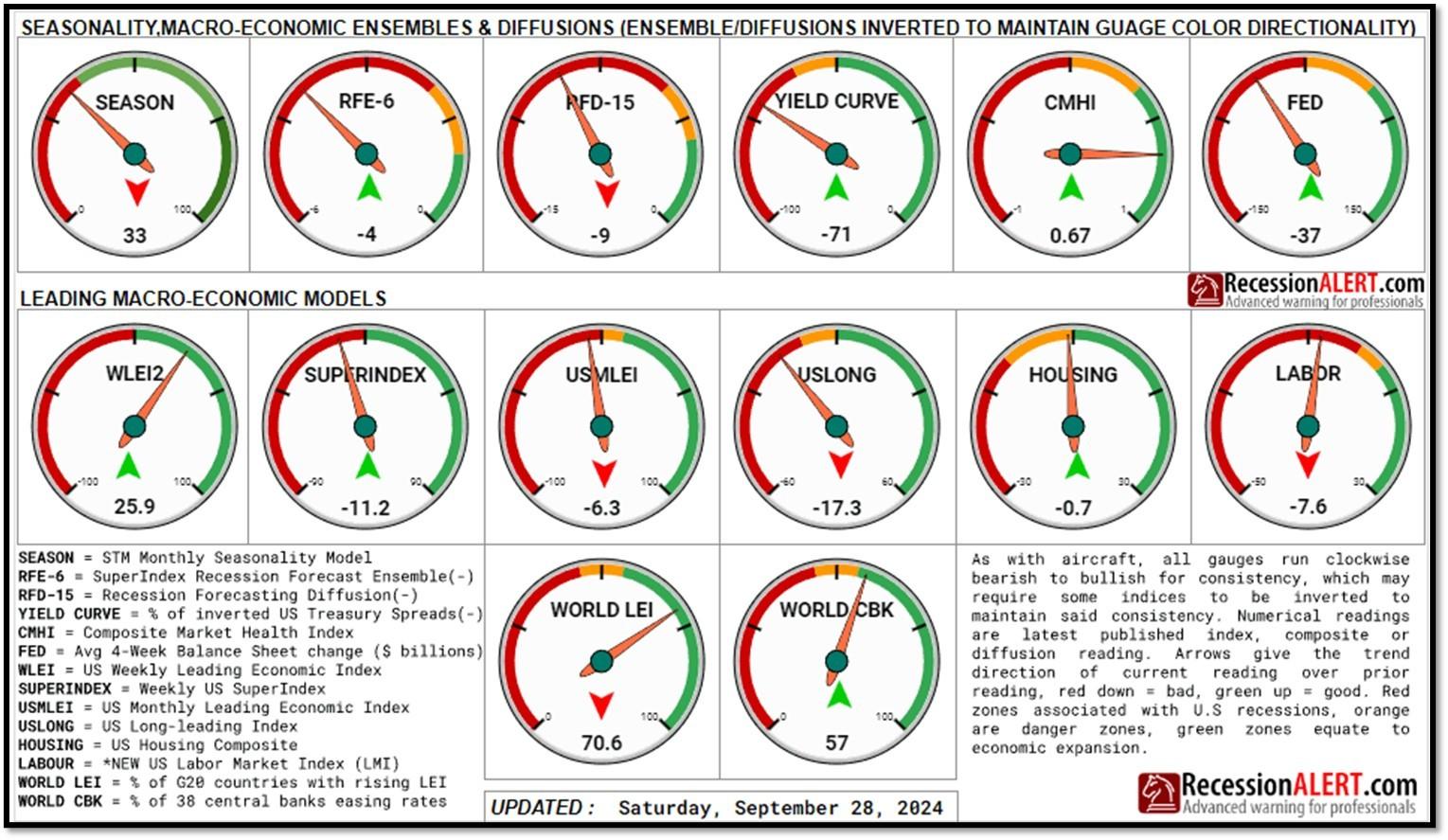

5F. Probability of U.S. falling into Recession within 3 to 4 months is currently at 71.04% (with data as of 10/6/2024 – Next Report 10/20/2024) according to RecessionAlert Research. Last release’s data was at 70.3%. This report is updated every two weeks. REF: RecessionAlertResearch, Gauges

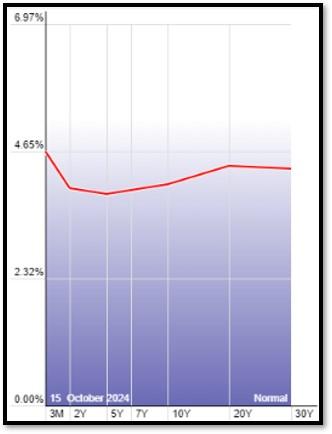

5G. Yield Curve as of 10/15/2024 is showing Inversion to Flattening. Spread on the 10-yr Treasury Yield (4.01%) minus yield on the 2-yr Treasury Yield (3.94%) is currently at 7 bps. REF: Stockcharts The yield curve—specifically, the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill—is a valuable forecasting tool. It is simple to use and significantly outperforms other financial and macroeconomic indicators in predicting recessions two to six quarters ahead. REF: NYFED

5H. Recent Yields in 10-Year Government Bonds. REF: Source is from Bloomberg.com, dated 10/15/2024, rates shown below are as of 10/15/2024, subject to change.

The 10-Year US Treasury Yield… REF: StockCharts1, StockCharts2

The 10-year yield – Spiked back to trend…

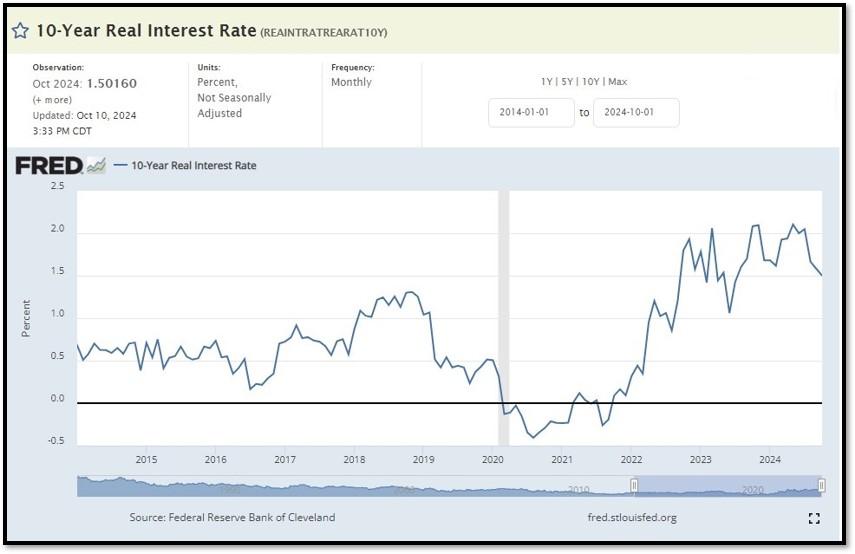

10-Year Real Interest Rate at 1.5016% as of 10/10/24. REF: REAINTRATREARAT10Y

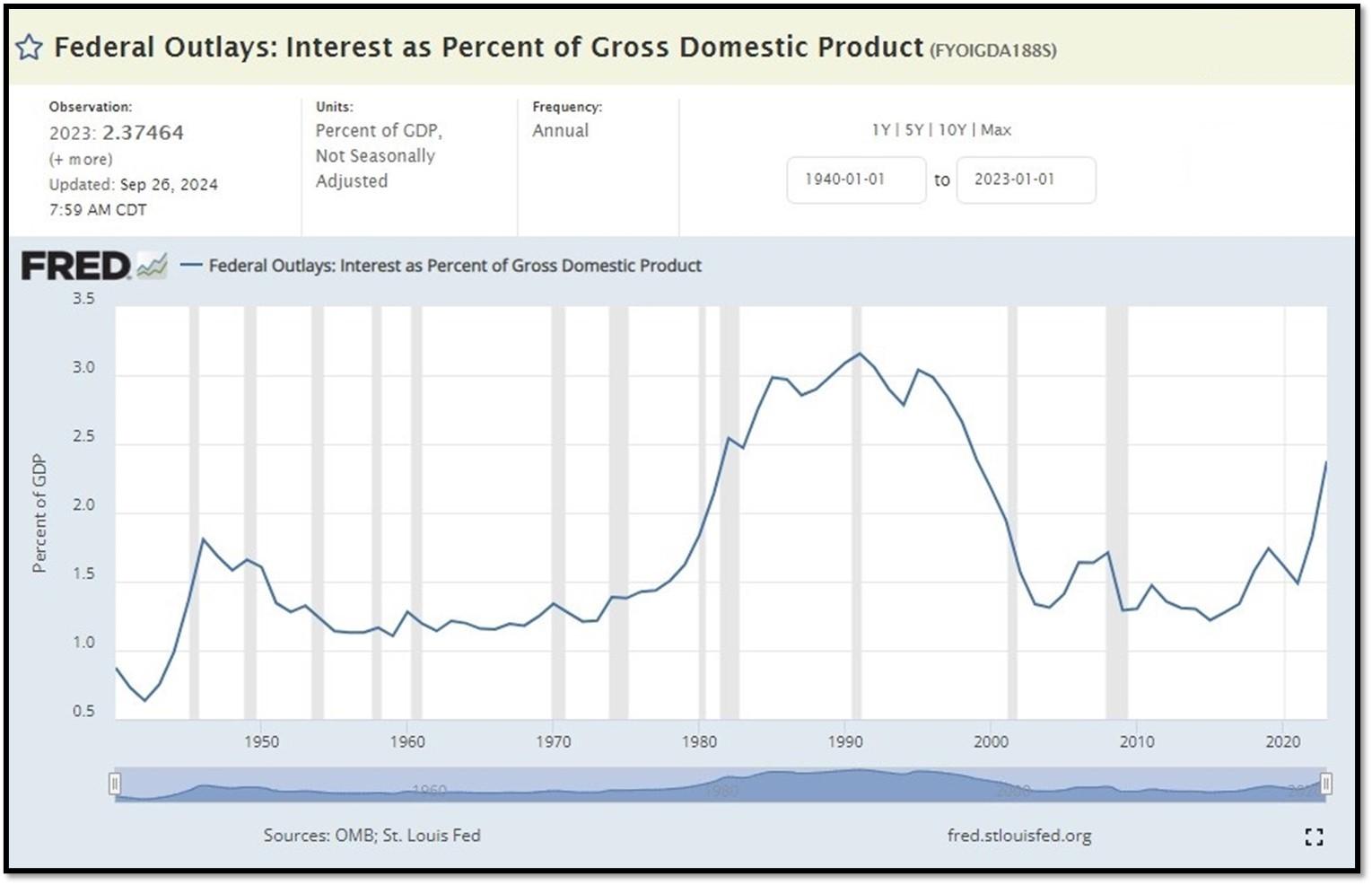

Federal government Interest Payments increased $22B to $1.096 T as of Q2-2024. REF: FRED-A091RC1Q027SBEA

Interest payments as a percentage of GDP increased from 1.84853 in 2022 to 2.37464 as of 9/26/24. REF: FRED-FYOIGDA188S

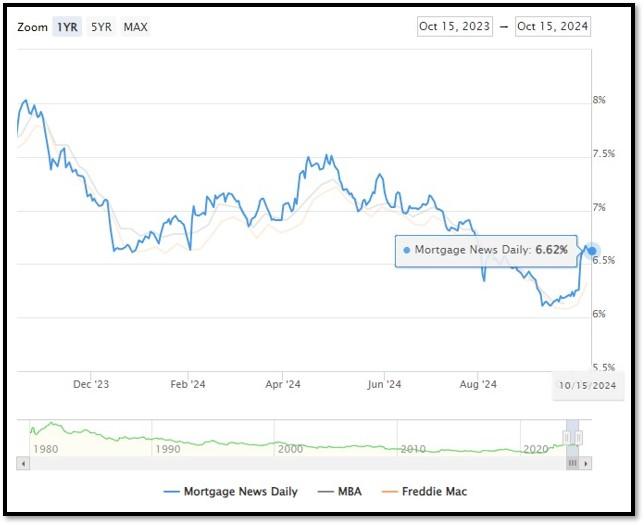

5I. (10/15/2024) Today’s National Average 30-Year Fixed Mortgage Rate is 6.62% (All Time High was 8.03% on 10/19/23). Last week’s data was 6.62%. This rate is the average 30-year fixed mortgage rates from several different surveys including Mortgage News Daily (daily index), Freddie Mac (weekly survey), Mortgage Bankers Association (weekly survey) and FHFA (monthly survey). REF: MortgageNewsDaily, Today’s Average Rate

(10/15/24) Housing Affordability Index for Aug = 98.6 // July = 95 // June = 93.3 // May = 93.1 // April = 95.9 // March = 101.1 // February = 103.0. Data provided by Yardeni Research. REF: Yardeni

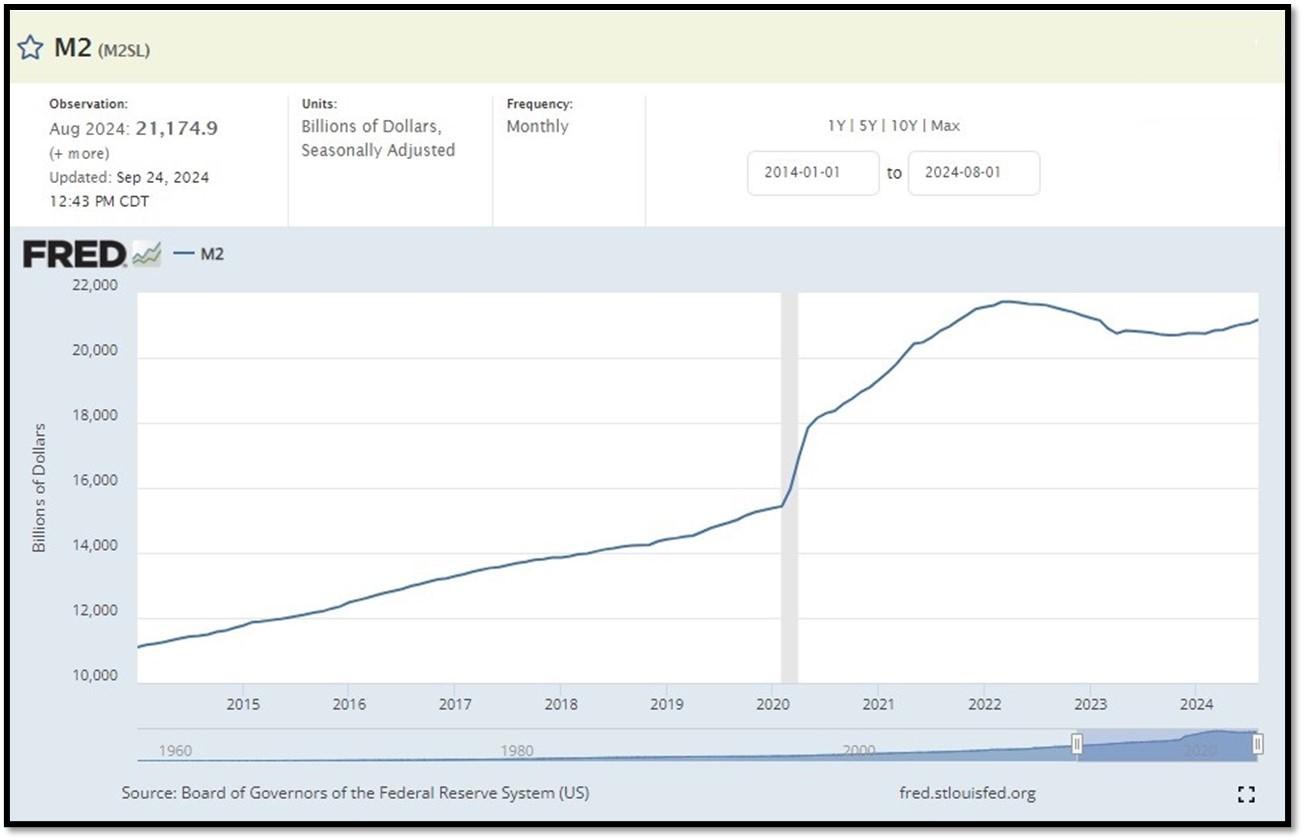

5J. Velocity of M2 Money Stock (M2V) with current read at 1.385 as of (Q2-2024 updated 9/26/2024). Previous quarter’s data was 1.368. The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. Current Money Stock (M2) report can be viewed in the reference link. REF: St.LouisFed-M2V

M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; Updated on August 27, 2024. REF: St.LouisFed-M2

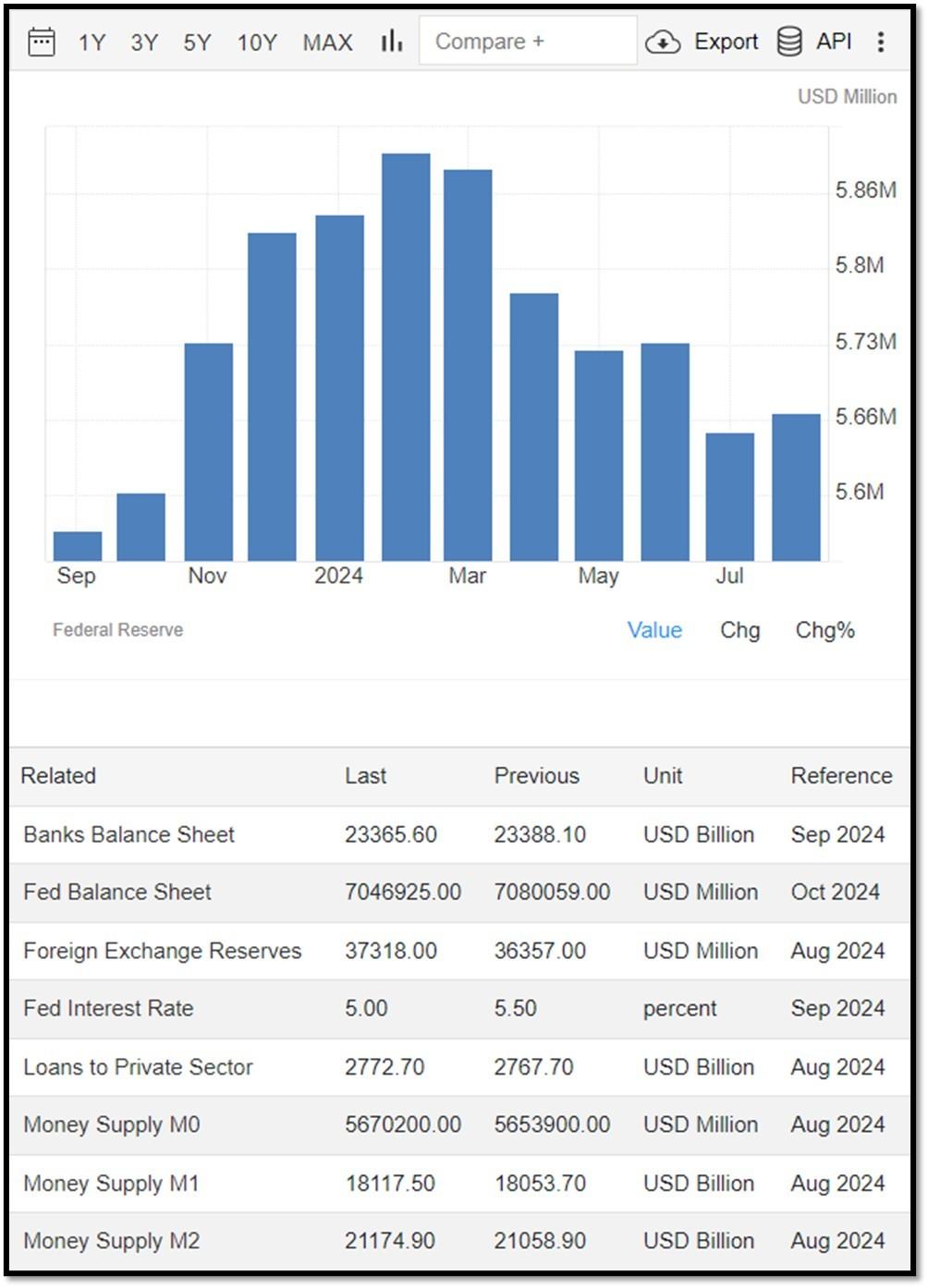

Money Supply M0 in the United States increased to 5,670,200 USD Million in August from 5,653,900 USD Million in July of 2024. Money Supply M0 in the United States averaged 1,143,807.23 USD Million from 1959 until 2024, reaching an all-time high of 6,413,100.00 USD Million in December of 2021 and a record low of 48,400.00 USD Million in February of 1961. REF: TradingEconomics, M0

5K. In September, the Consumer Price Index for All Urban Consumers rose 0.2 percent, seasonally adjusted, and rose 2.4 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.3 percent in September (SA); up 3.3 percent over the year (NSA). October 2024 CPI data are scheduled to be released on November 13, 2024, at 8:30AM-ET. REF: BLS, BLS.GOV

5L. Technical Analysis of the S&P500 Index. Click onto reference links below for images.

- Short-term Chart: Bullish on 10/16/2024 – REF: Short-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Medium-term Chart: Bullish on 10/16/2024 – REF: Medium-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Market Timing Indicators – S&P500 Index as of 10/16/2024 – REF: S&P500 Charts (7 of them) by Joanne Klein’s Top 7 (Click Here to Access Updated Charts)

- A well-defined uptrend channel shown in green with S&P500 getting back on trend. REF: Stockcharts

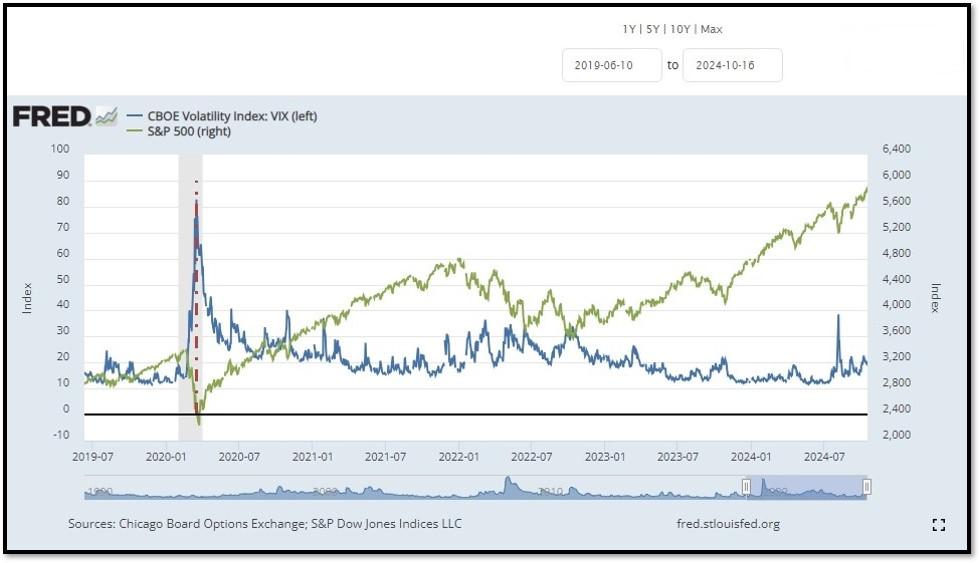

- S&P500 and CBOE Volatility Index (VIX) as of 10/16/2024. REF: FRED, Today’s Print

5M. Most recent read on the Crypto Fear & Greed Index with data as of 10/17/2024au is 71 (Neutral). Last week’s data was 39 (Fear) (1-100). Fear & Greed Index – A Contrarian Data. The crypto market behavior is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction of seeing red numbers. With the Crypto Fear and Greed Index, the data try to help save investors from their own emotional overreactions. There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

Therefore, the program for this index analyzes the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means “Extreme Fear”, while 100 means “Extreme Greed”. REF: Alternative.me, Today’sReading

Bitcoin – Could it break out to the upside? REF: Stockcharts

Len writes much of his own content, and also shares helpful content from other trusted providers like Turner Financial Group (TFG).

The material contained herein is intended as a general market commentary, solely for informational purposes and is not intended to make an offer or solicitation for the sale or purchase of any securities. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. This information is not intended as a specific offer of investment services by Dedicated Financial and Turner Financial Group, Inc.

Dedicated Financial and Turner Financial Group, Inc., do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Any hyperlinks in this document that connect to Web Sites maintained by third parties are provided for convenience only. Turner Financial Group, Inc. has not verified the accuracy of any information contained within the links and the provision of such links does not constitute a recommendation or endorsement of the company or the content by Dedicated Financial or Turner Financial Group, Inc. The prices/quotes/statistics referenced herein have been obtained from sources verified to be reliable for their accuracy or completeness and may be subject to change.

Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. The views and strategies described herein may not be suitable for all investors. To the extent referenced herein, real estate, hedge funds, and other private investments can present significant risks, including loss of the original amount invested. All indexes are unmanaged, and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Turner Financial Group, Inc. is an Investment Adviser registered with the United States Securities and Exchange Commission however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Additional information about Turner Financial Group, Inc. is also available at www.adviserinfo.sec.gov. Advisory services are only offered to clients or prospective clients where Turner Financial Group, Inc. and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Turner Financial Group, Inc. unless a client service agreement is in place.