A STRONG START TO THE YEAR

A STRONG START TO THE YEAR

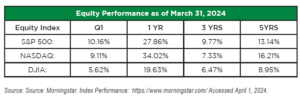

The momentum from 2023 carried over into the new year, resulting in a strong start to 2024. The upward rise could be mostly attributed to the market’s expectations that the Federal Reserve is done raising interest rates and hopes that we might see as many as six rate cuts this year.

These hopes were dashed mid-quarter, however, after Fed Chair Jerome Powell dismissed the idea that rate cuts would begin before mid-summer and indicated the Fed would only entertain three rate cuts this year. After nursing its wounds for a bit, the market decided not to dwell on this news — and continued its upward rise to finish the quarter around record levels.

CHANGING EXPECTATIONS

After raising the Fed Funds rate to 5.25-5.50% in July 2023,¹the Fed paused to assess the impact of rate hikes on the U.S. economy. At no time did they say they were stopping or signal imminent rate cuts. Despite this lack of evidence to the contrary, markets decided that a) the Fed was done raising rates and b) we would eventually see six cuts, putting the Fed Funds rate below 4% by the end of the year.

Not so fast, said the Fed. Employment — one of the Fed’s measures to determine when it’s time to raise or lower rates — was still relatively strong this quarter, with the unemployment rate ranging from 3.7-3.9%.² The Fed really wants to see unemployment increase to 4-4.5% before cutting interest rates, a number we haven’t seen since November 2021.³

Inflation has also remained an obstacle for the Fed. While inflation dropped steadily from its 40-year high of 9.1% in June 2022,⁴ it has been stuck between 3.0-3.7% for nearly a year — well above the Fed’s target of 2%.⁵ As markets skyrocketed early in the quarter, Chairman Powell doused any misconceptions about rate cuts, saying it was more likely we would see three rate cuts this year and not the anticipated six.⁶ Markets didn’t like this news. After briefly retreating, the market regrouped and refocused on stronger-than-expected earnings and the idea that rates are far more likely to go down this year than up.

Markets also have been spurred by the economy’s ongoing strength.

Gross domestic product (GDP) for the fourth quarter of 2023 came in strong at 3.2%, with GDP for the year at 3.1%.⁷ Higher interest rates haven’t resulted in a significant economic slowdown or recession as predicted. This data encouraged markets to keep moving upward; the reasoning was that if the economy keeps growing with higher interest rates, then stocks should continue to perform well no matter how many rate cuts we see this year. Equities ended the quarter in much the same way it began, with benchmark indexes breaking records nearly every week.

LOOKING AHEAD

As we enter the second quarter, some economic data has begun to weaken. The 10-year treasury yield remains above 4%, while rate curves remain inverted.⁸ Short-term rates are still higher, signaling long-term economic uncertainty. Even so, the estimate for first-quarter GDP is 3.1%, consistent with total GDP for 2023.⁹

Markets are now expecting rate cuts to begin in June, and any deviation from that expectation could spur volatility for investors. The Fed will keep a close eye on unemployment and inflation, especially energy prices. If both numbers stay steady, the Fed has a timing dilemma: if they wait until too close to the election to cut rates, it could be perceived as influencing politics. But if they cut rates too

soon or too aggressively, it could spur new challenges for investors and the economy.

Despite these uncertainties, the first quarter set us up for a strong 2024. In the last 40 years, the S&P 500 delivered 28 positive first quarter results, which are a good predictor for how the rest of the year will go.10 There likely will be bumps along the way, but the economy is still solid and we should be in good shape for at least the next few months.

No matter what direction markets go, it’s always prudent to stay diligent with your investments. If you haven’t done so lately, we recommend scheduling a time to talk with your advisor and review your financial plan to make sure your investments are aligned with your goals. Short-term events and data may increase market volatility, particularly as we head into the summer months. Your advisor can help you avoid making emotion-based decisions and work with you to stick to the plan as you work toward your long-term goals.

Len Hayduchok is the founder of The Delaware Retiree Connection, and the director and owner of Dedicated Financial. As a fiduciary and Certified Financial Planner, he offers his wealth of experience to guide others through the mire of financial and retirement planning. As a Certified Life Coach, he pairs his financial expertise with a heart to help others who want to make the most of their retirement plan. Investment Advisory services offered through SGL Financial LLC.

Want to talk to Len about your Financial Plan? SCHEDULE A CONSULT

Want to talk to Len about your Financial Plan? SCHEDULE A CONSULT

Len writes much of his own content, and also shares helpful content from other trusted providers like AE Wealth Management. This content is provided for informational purposes. It is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. None of the information contained herein shall constitute an offer to sell or solicit any offer to buy a security. Individuals are encouraged to consult with a qualified professional before making any decisions about their personal situation.

SOURCES

1. Federal Reserve Bank of New York. “Effective Federal Funds Rate.” https://www.newyorkfed.org/markets/reference-rates/effr Accessed March 19, 2024.

2, & 3. Trading Economics. “United States Employment Rate.” https://tradingeconomics.com/united-states/unemployment-rate.

Accessed March 19, 2024.

4. Politico. July 13, 2022. “U.S. inflation reached a new 40-year high in June of 9.1 percent.” https://www.politico.com/

news/2022/07/13/us-inflation-new-40-year-high-june-00045541. Accessed March 19, 2024.

5. Trading Economics. “United States Inflation Rate.” https://tradingeconomics.com/united-states/inflation-cpi. Accessed

March 19, 2024.

6. CNBC. Jan. 31, 2024. “Fed recap: Powell shoots down March rate cut.” https://www.cnbc.com/2024/01/31/fed-meeting-today-live-updates.html Accessed March 19, 2024.

7. Bureau of Economic Analysis. Feb. 28, 2024. “Gross Domestic Product, Fourth Quarter and Year 2023 (Second

Estimate).” https://www.bea.gov/news/2024/gross-domestic-product-fourth-quarter-and-year-2023-second-estimate.

Accessed March 19, 2024.

8. CNBC. “U.S. 10 Year Treasury.” https://www.cnbc.com/quotes/US10Y. Accessed March 19, 2024.

9. Federal Reserve Bank of Atlanta. “GDPNow.” https://www.atlantafed.org/cqer/research/gdpnow. Accessed March 19,

2024.

10. Keith Speights. The Motley Fool. April 3, 2023. “Will the S&P 500 Keep Rising After a Positive Q1? Here’s What

History Shows.” https://www.fool.com/investing/2023/04/03/will-the-sp-500-keep-rising-after-a-positive-q1-he/.

Accessed March 19, 2024.