The figures can seem alarming: Twenty-two percent of Americans have less than $5,000 saved for retirement, and 15% have nothing put away at all, according to Northwestern Mutual’s 2019 Planning & Progress Study. Meanwhile, 46% of adults with jobs expect to keep working past 65.

But with proper planning and preparation, a comfortable retirement is possible, especially if you start early.

Here are some steps experts suggest you take if you want to retire at 65.

Figure out how much money you’ll need

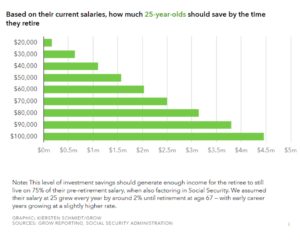

The further away you are from retiring, the more you’ll likely need. For example, a 25-year-old earning $50,000 today could very well need $1.6 million saved in order to retire comfortably, according to Grow’s calculations.

There are different factors that each individual will need to take into account, though, so your goal could differ from that of your friends, family members, and coworkers. In the end, there is no “magic number” that applies to everyone when it comes to retirement savings, says Len Hayduchok, CEO of New Jersey-based Dedicated Financial.

Still, there are a number of online tools out there that can help you get a good sense of how much you may need, including the Social Security Administration’s benefits calculator. And generally, experts at AARP say that to fund a comfortable retirement, you should save up “10 to 12 times your current income.”

Start saving and investing ASAP

There are a few popular, tax-advantaged ways to invest your money for retirement, and the sooner you begin, the more time your wealth has to grow.

If your employer offers a 401(k) retirement plan, sign up and start contributing. Many employers will match your contribution up to a certain percentage, essentially giving you free money for your retirement. Around half of working Americans are offered retirement plans by their employer, according to a 2018 report from the Stanford Center on Longevity.

You can also look at opening an IRA, or individual retirement account. As of 2019, you can contribute up to $19,000 per year to your 401(k) if you’re under 50, and up to $6,000 to your IRA.

Make sure you’re optimizing these accounts, too, so that you get the most out of them.

Keep earnings high and spending low

Trying to earn more, especially as you close in on retirement, can be a smart move, says Hayduchok: It can help you bridge the gap between what you’ve saved and what you might need. Consider taking on side hustles or generating passive income, if possible.

Meanwhile, don’t worry about keeping up with the Joneses: Instead, try to keep lifestyle creep to a minimum. The average new car in the U.S. costs more than $32,000, and the average monthly payment is $554, while for used cars, those figures are $20,137 and $391, so choosing a pre-owned car instead of a new one, for example, can save you thousands of dollars.

Originally Published: https://grow.acorns.com/steps-to-take-if-you-want-to-retire-by-65/