- 1. The CPI data due March 13, 2025, is a key gauge of U.S. inflation, with February’s expected 0.3% rise—down from January’s 0.5%—hinting at cooling pressures.

- 2. The Atlanta Federal Reserve’s GDPNow estimate for the first quarter of 2025 has plummeted to a striking -2.8% as of March 3, 2025, a sharp departure from its earlier projections hovering around +4% just a month prior.

- 3. Tesla’s stock has plummeted over 50% from its peak, raising eyebrows among investors, yet this dip seems more like a hiccup than a collapse.

- 4. World Watch

- 5. Quant & Technical Corner

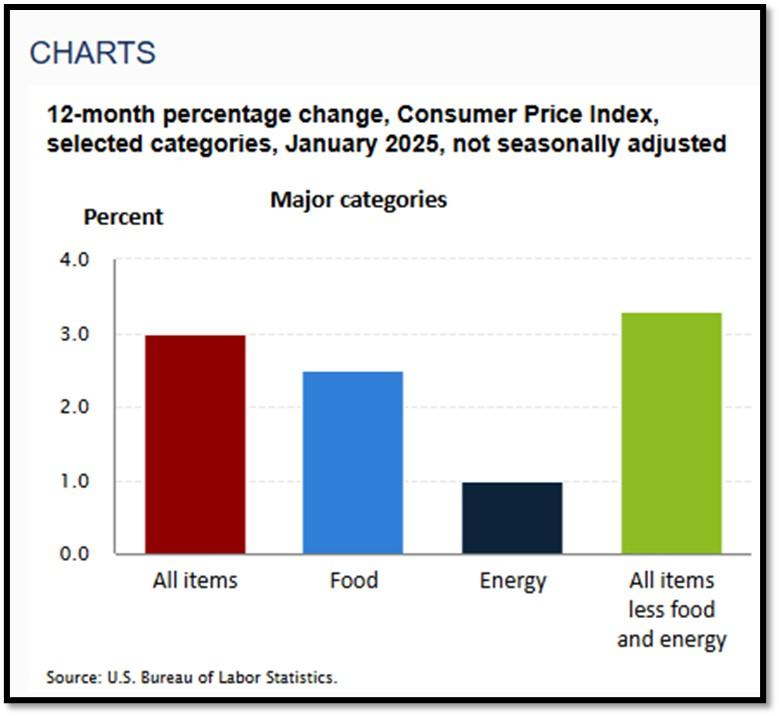

1. The CPI data due March 13, 2025, is a key gauge of U.S. inflation, with February’s expected 0.3% rise—down from January’s 0.5%—hinting at cooling pressures.

This drop could ease fears after January’s 3% annual spike, potentially nudging the Fed toward rate cuts by mid-2025 if it nears their 2% goal, while a higher-than-expected figure might stoke worries about persistent inflation and delay relief. Core CPI and shelter costs will offer deeper insight, shaping views on a soft landing or recession risks in a shaky 2025 economy.

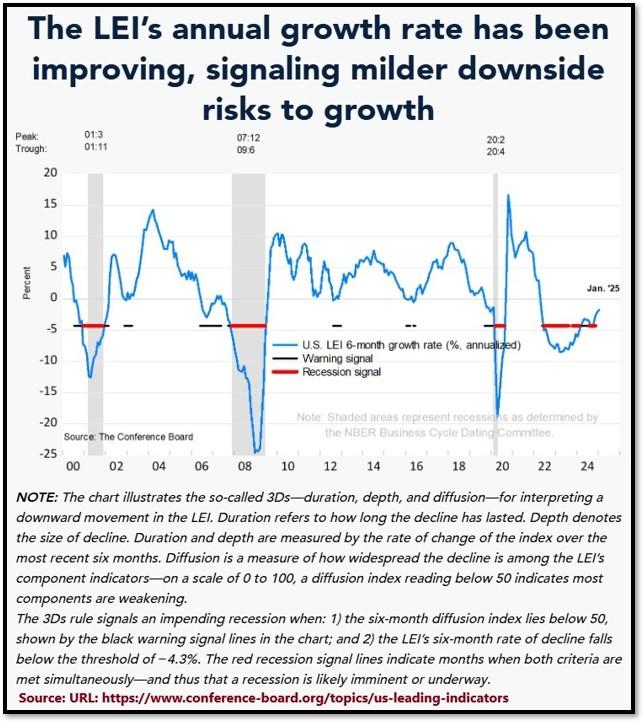

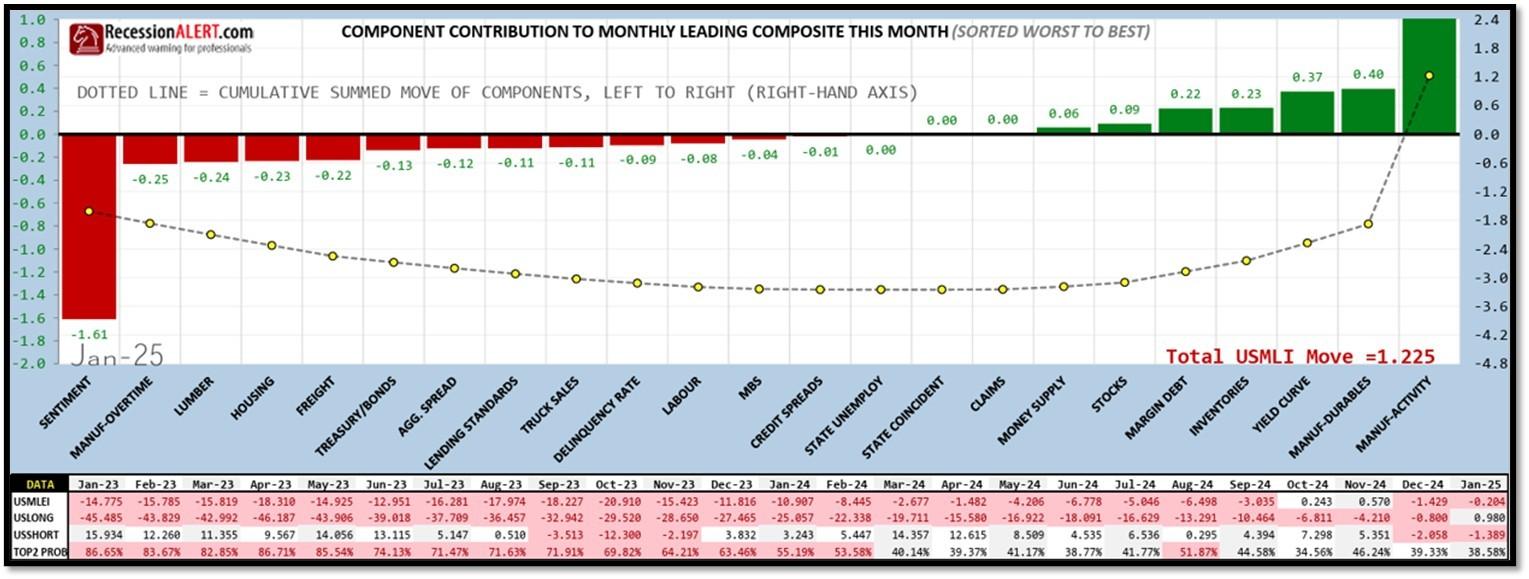

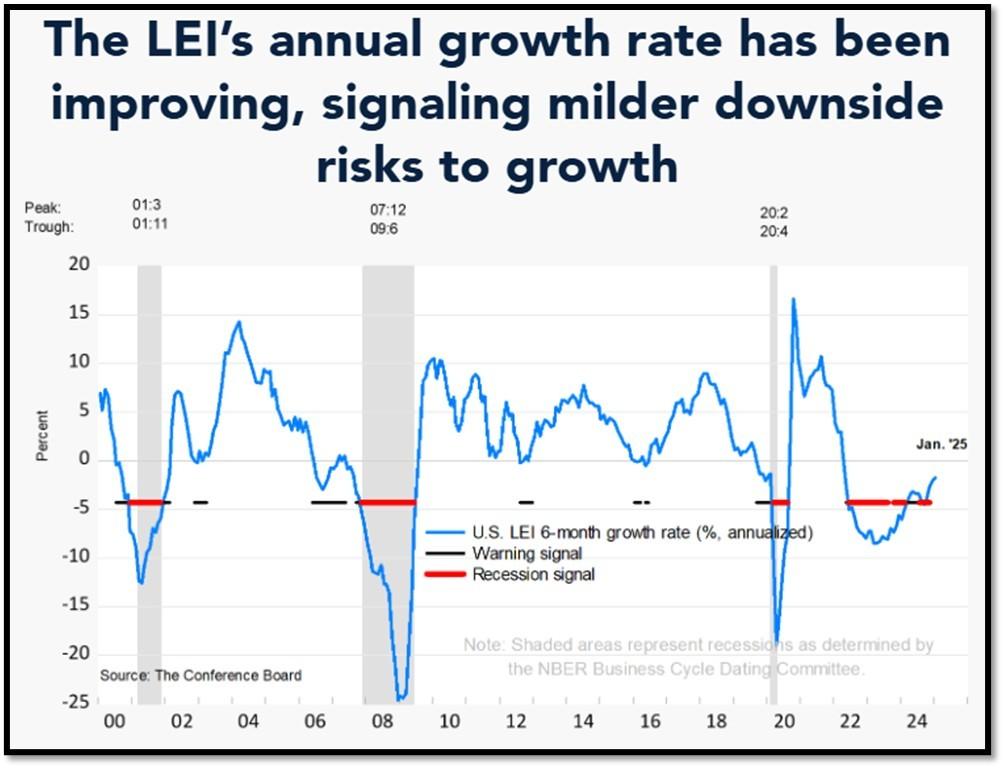

The recent risk of a recession is overstated, as economic indicators suggest we are in the early stages of recovery rather than heading toward a downturn. The Conference Board’s Leading Economic Index (LEI), which tracks economic activity on a month-to-month basis, had been signaling negative growth since June 2022. However, we are now emerging from this phase, indicating that the economy was in a rolling recession and is transitioning into a recovery mode. While some continue to voice recession concerns, the data does not support such fears. Additionally, we must recognize that we are in a period of economic expansion driven by innovation and technology, which is inherently deflationary and supports long-term growth.

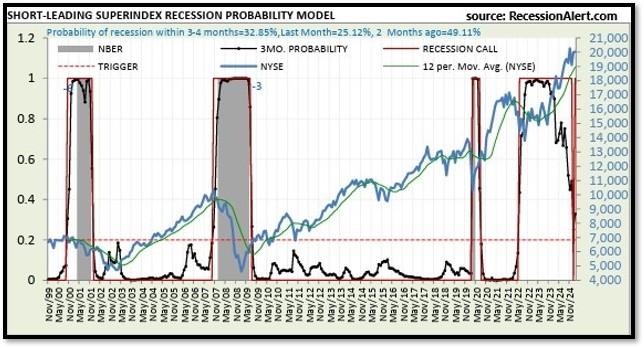

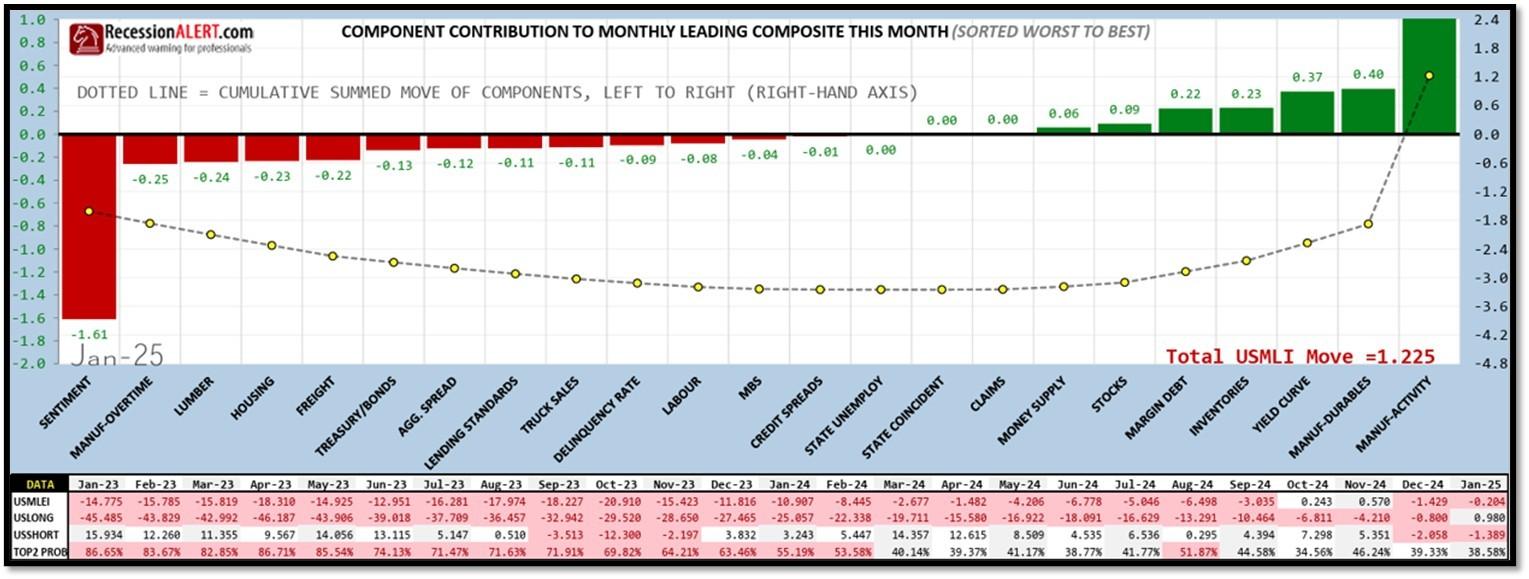

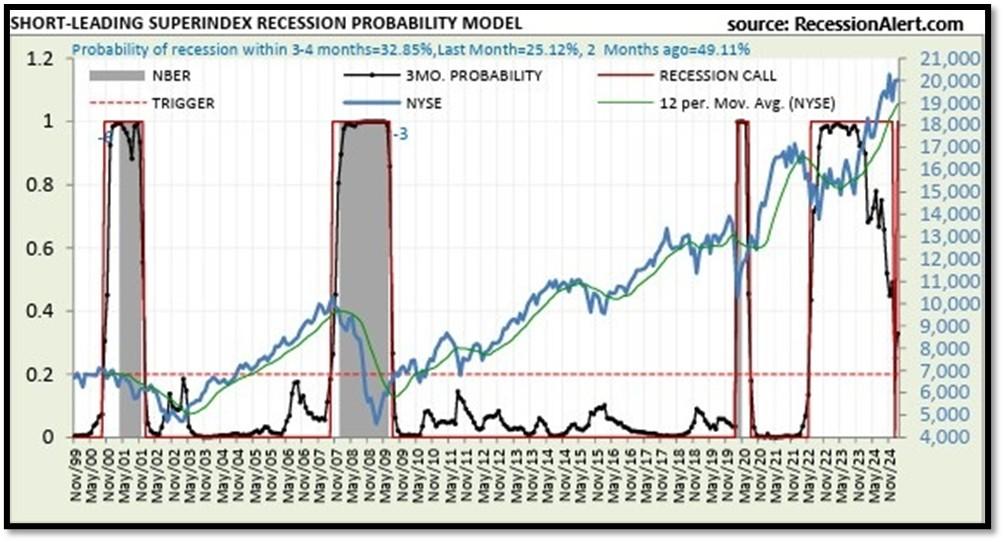

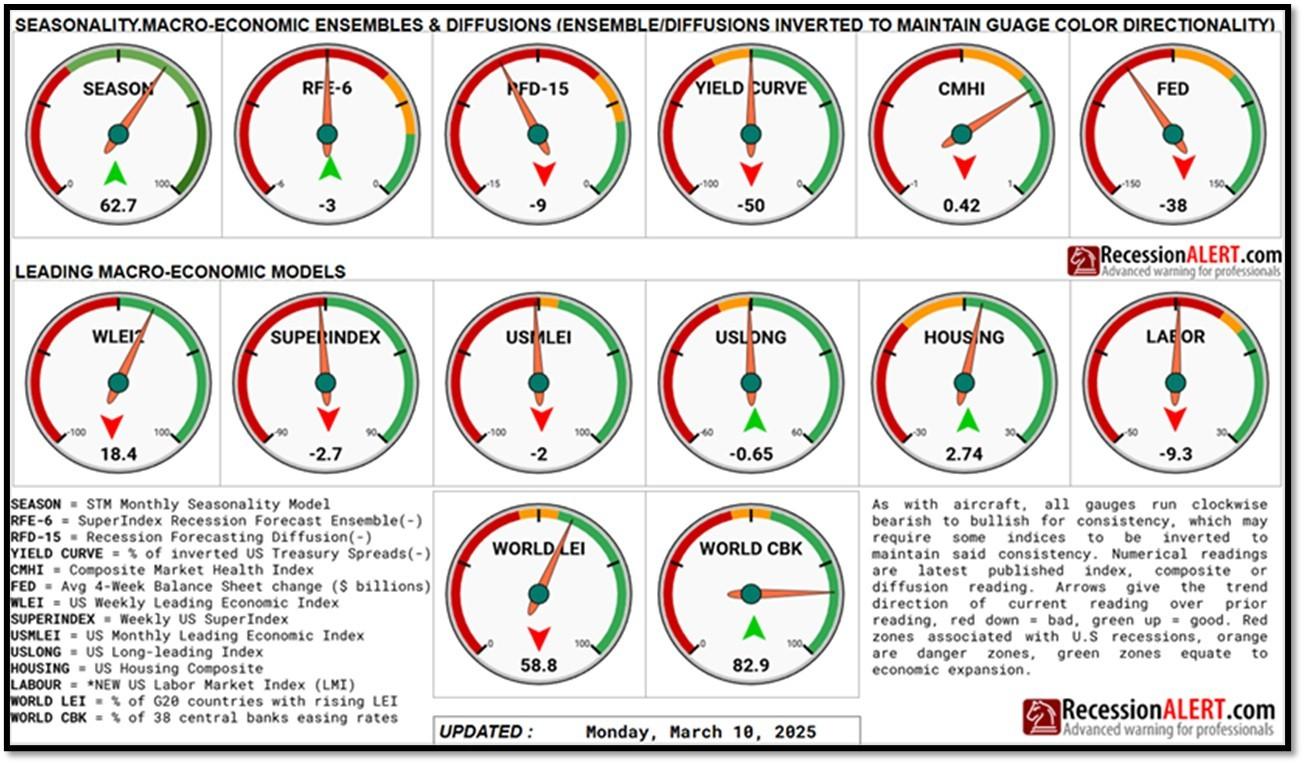

Furthermore, the impact of recent tariff policies on GDP is minimal, as historical data from 2016 suggests. Inflation concerns are also exaggerated, given that oil supply remains ample. OPEC has announced an increase in production, and U.S. drillers are ramping up operations. A potential peace deal could further boost supply, helping to keep energy costs in check. At the same time, the tech-driven boom is accelerating productivity and efficiency across industries, further reducing inflationary pressures. With economic fundamentals improving, inflationary risks easing, and technology fueling expansion, the prevailing narrative of an imminent recession appears overblown. Current probability of US recession in 3-4 months stand at 32.85% according to RecessionAlert. In addition, DOGE-related laid off and federal employees accepted buyout offers total approximately 5% of the total federal civilian workforce. Total federal civilian workforce is approximately 1.87% of the entire US civilian workforce. Lastly, the stock and bond markets now fully pricing in 3 Fed Rate Cuts this year, and that bodes well for risk assets in general. REF: TheConferenceBoard, RessionAlert, OPEC

We have experienced a “rolling recession” since June 2022 and are only now emerging from it. However, authorities are not labeling it a recession due to high employment data.

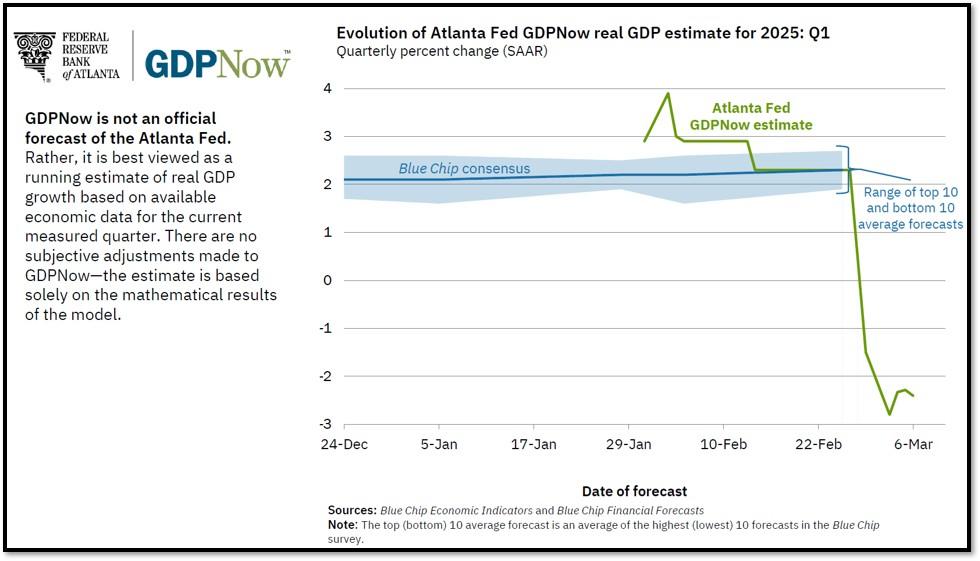

2. The Atlanta Federal Reserve’s GDPNow estimate for the first quarter of 2025 has plummeted to a striking -2.8% as of March 3, 2025, a sharp departure from its earlier projections hovering around +4% just a month prior.

This dramatic revision has sparked questions about what’s driving such a bleak outlook for U.S. economic growth. At first glance, the record-breaking $153 billion trade deficit in January—a figure that dwarfs previous highs—stands out as a potential culprit. This surge in imports, possibly fueled by businesses stockpiling goods ahead of anticipated tariffs under President Trump’s administration, has slashed the net exports contribution to GDP from -0.41 to -3.7 percentage points in the model. However, while this import spike plays a significant role, it’s not the sole factor skewing the forecast; a deeper look reveals a confluence of economic weaknesses amplifying the decline.

Beyond the trade deficit, the GDPNow model’s downturn reflects disappointing data across multiple sectors. Personal consumption, which drives roughly two-thirds of U.S. GDP, took a hit with January’s real spending dropping 0.5%—the steepest decline since early 2021—reducing its GDP contribution by a full percentage point. This aligns with slumping consumer confidence, a 1.8% plunge in retail sales (the worst in nearly two years), and warnings from retail giants like Walmart about a tough 2025. Meanwhile, manufacturing and construction sectors have faltered, with February’s ISM manufacturing PMI signaling contraction and January’s construction spending falling short of expectations. These updates, incorporated into the GDPNow model by early March, further dragged down estimates for private fixed investment, compounding the negative outlook. The model’s data-driven nature means it reacts swiftly to such inputs, even if they represent only a partial picture of the quarter.

The question remains: did January and February’s import data disproportionately skew the forecast, or is this a broader signal of distress? While the trade deficit’s impact is undeniable—potentially inflated by anomalies like gold imports, which may not fully affect GDP as calculated by the Bureau of Economic Analysis—it’s not an isolated distortion. The GDPNow model, designed to mirror official GDP methodology without subjective tweaks, is highly sensitive to early data releases, and with only January’s full figures and one February report available, its current -2.8% estimate carries significant uncertainty. Historically, its error margin at this stage is around 2.06 percentage points, far higher than later in the quarter. Other nowcasts, like the New York Fed’s +2.9% or Dallas Fed’s +2.4%, suggest the Atlanta Fed’s figure might be an outlier, overreacting to trade and spending shocks. Yet, the consistency of weakness across consumption, investment, and sentiment points to a genuine slowdown, possibly exacerbated by policy uncertainty dubbed a “Trumpcession.” REF: AtlantaFedGDPNow, GDPNowSlides

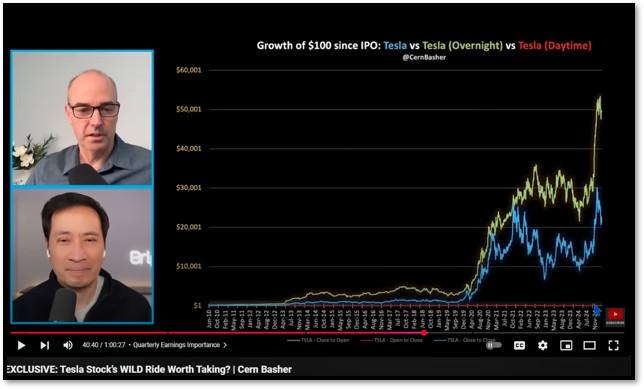

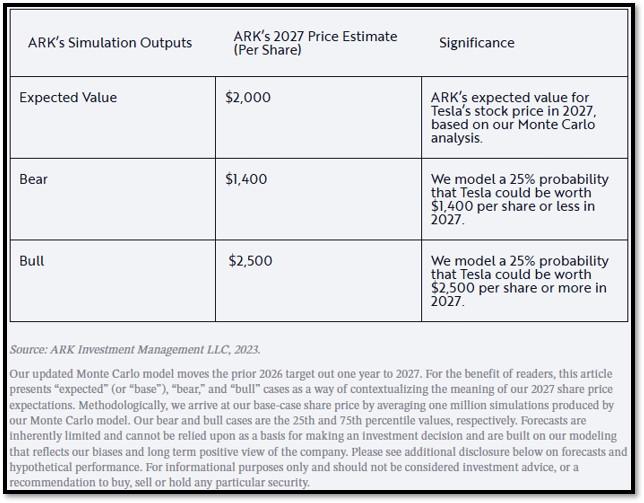

3. Tesla’s stock has plummeted over 50% from its peak, raising eyebrows among investors, yet this dip seems more like a hiccup than a collapse.

Elon Musk calls 2024 a setup for 2025—Tesla’s make-or-break year as it shifts from carmaker to AI trailblazer. Analysts like Gary Black and Dan Ives see a rebound brewing, fueled by regulatory wins, Full Self-Driving (FSD) breakthroughs, and hot new products like the $30-$35K compact vehicle and Model Y Juniper, turning this slide into a prime buying moment.

FSD is Tesla’s ace, with potential Trump-era red-tape cuts paving the way for a nationwide unsupervised autonomy license by late 2025, per Ives—a move that could unlock licensing goldmines with other automakers. Meanwhile, Optimus, Tesla’s humanoid robot, and in-house LFP battery cells signal an AI and energy storage revolution, setting Tesla apart from the pack. The compact vehicle and Juniper refresh, despite a Q4 2024 earnings dip from inventory adjustments, promise to widen Tesla’s market and juice sales growth.

Beyond cars, Tesla’s AI and manufacturing chops hint at a massive leap forward. Optimus Version 2 looms for 2026, with production lines already in the works, while cheaper batteries could shake up energy storage and margins. A possible court win reinstating Musk’s 2018 pay package by late 2025 might further lift spirits. With these forces aligning, Tesla’s not just weathering the storm—it’s gearing up to redefine the game, making today’s stock dip a fleeting blip for bold investors.

REF: ARK’s Full Report on Tesla, Tesla, Video with Cern Basher, Video with Dan Ives

Below please find an insightful analysis of TSLA with Cern Basher, of Brilliant Advice. Click onto picture below to access video. Lots of nuggets here. “Growth of Tesla stock mainly came from non-market hours.” Further below, you will find Dan Ives’ recent comments on TSLA. Click onto 2 pictures below to access videos.

IMPORTANT NOTE: Not investment advice. Please speak to your financial professional regarding your investments and investing. Investor should consider the investment objective, risks, charges and expenses carefully before investing. For more information about the company mentioned above, please visit https://ir.tesla.com/#quarterly-disclosure.

Cybercab expected to be in Austin, TX in June 2025.

Tesla’s Daily Price Charts in 5-Year View and 2-Year View below. TSLA current price is extremely close to major support levels.

4. World Watch

4A. Bits & Pieces in AI – This week has buzzed with fresh strides in artificial intelligence, blending foundational leaps with real-world applications. From new developer tools to custom hardware, AI’s footprint is expanding fast. These developments reflect a mix of cutting-edge advancements and practical uses, from robotics to business efficiency, signaling a push toward broader adoption. On March 10, for instance, Microsoft dropped over 140 new customer success stories on its blog, showcasing AI’s impact—like LTIMindtree tapping Copilot tools to zip through RFP responses and code work, proving AI’s knack for boosting innovation in corporate trenches. Here’s a rundown of the week’s highlights (Click onto hyperlinks in blue to access additional information).

- OpenAI’s New Developer Tools: On March 11, OpenAI rolled out tools to help businesses and developers craft advanced AI agents via streamlined APIs. It’s a counterpunch to rising competition from Chinese AI startups, making sophisticated AI builds more accessible across industries.

- Meta’s In-House AI Training Chip: Meta kicked off testing its first custom AI training chip on March 11. With 2025 expenses pegged at $114 billion to $119 billion, this move aims to cut costs and ditch reliance on Nvidia, bolstering Meta’s AI infrastructure play.

- Humanoid Robotics Advancements: Figure unveiled its Helix VLA model on March 10, supercharging humanoid robots with real-time vision and language processing. Think better object recognition and help with chores—robotics just got more useful.

- Mobile World Congress 2025 Highlights: Reported on March 10 from Barcelona, MWC 2025 put AI front and center alongside robotics and cybersecurity. Industry bigwigs touted its transformative juice, shaping the next wave of mobile tech. Click onto picture below to access video from euroNews.

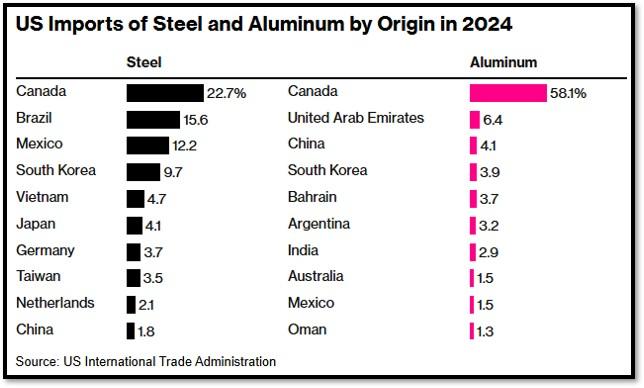

4B. President Trump imposed tariffs on steel and aluminum imports to boost U.S. production, starting with 25% on steel and 10% on aluminum in 2018 under national security provisions, and escalating in 2025 by raising aluminum to 25% with no exemptions. Aimed at countering cheap foreign metals, particularly from China, the tariffs make imports costlier—For example, adding $150 to a $600 ton of steel—favoring domestic producers and aligning with Trump’s “America First” goal to revive industrial regions and secure supply chains for defense and manufacturing.

The policy has mildly increased U.S. output—steel utilization hit 80% in 2019, and aluminum saw gains—but faces limits as domestic supply (e.g., 670,000 tons of aluminum vs. 4.3 million demanded) can’t meet needs, and global overcapacity keeps prices low. Higher costs hurt manufacturers and consumers, with appliance prices up 5-10% and retaliatory tariffs from allies like Canada adding pressure, while studies show net job losses, revealing a costly trade-off for modest production gains. Click onto picture below to access video. REF: Bloomberg

4C. Below is an updated snapshot of the current global state of economy according to TradingEconomics as of 3/10/2025. REF: TradingEconomics

- The U.S. unemployment rate rose to 4.1% in February 2025, up from 4.0% in January and slightly exceeding market expectations of 4.0%.

- China’s consumer prices dropped by 0.7% yoy in February 2025, surpassing market estimates of a 0.5% decline and reversing a 0.5% rise in the prior month. This was the first consumer deflation since January 2024, amid fading seasonal demand following the Spring Festival in late January.

- The benchmark interest rate in Germany, France, and Italy is set by the European Central Bank. ECB cut rates by 25bps to 2.65%.

- Japan’s unemployment rate was at 2.5% in January 2025, slightly above market estimates and December’s readings of 2.4%.

5. Quant & Technical Corner

Below is a selection of quantitative & technical data we monitor on a regular basis to help gauge the overall financial market conditions and the investment environment.

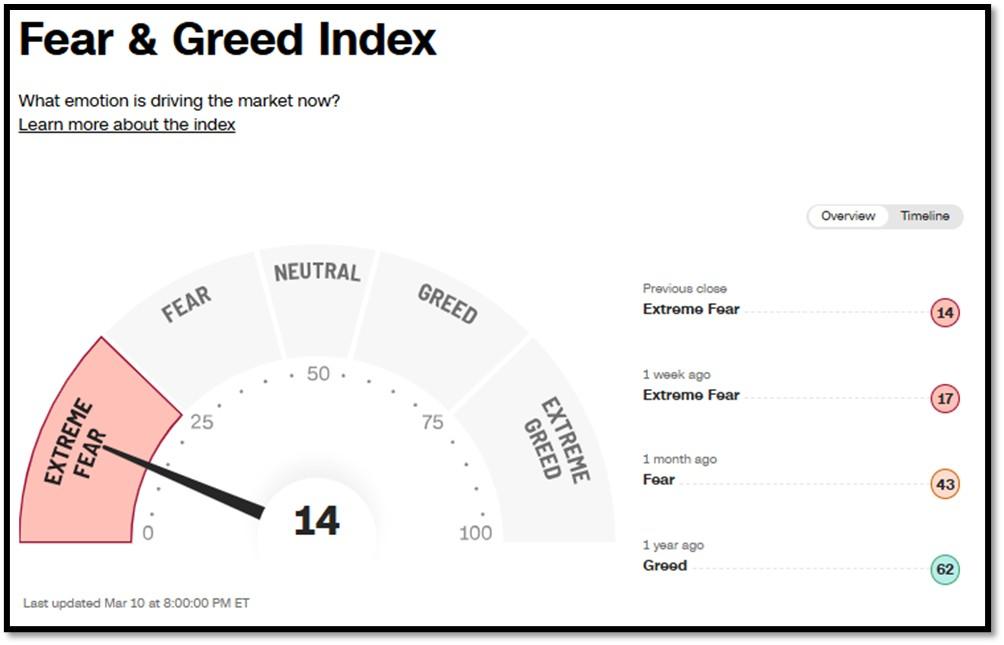

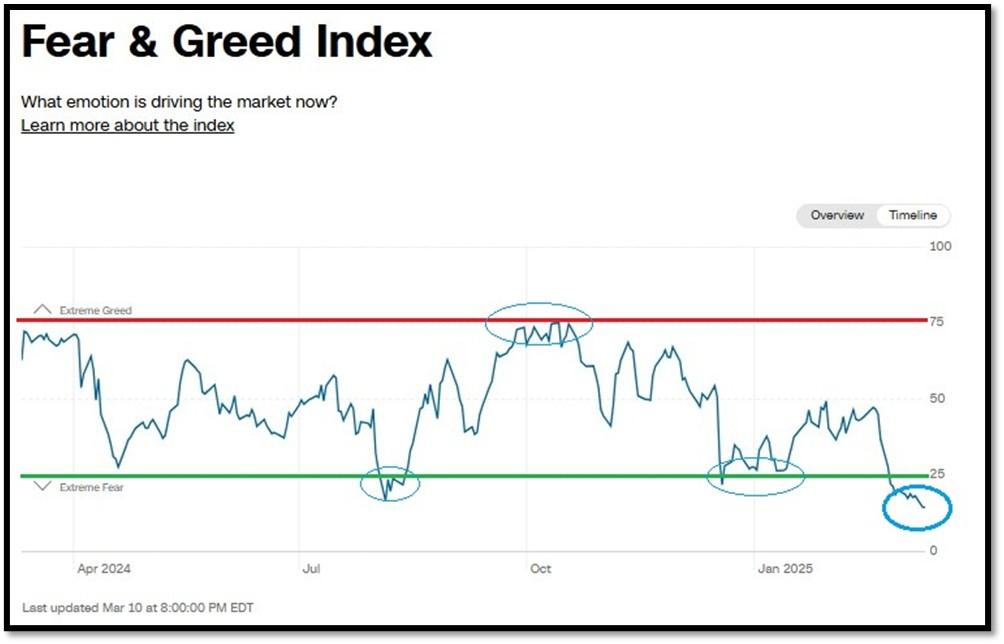

5A. Most recent read on the Fear & Greed Index with data as of 3/10/2025 – 8:00PM-ET is 14 (Extreme Fear). Last week’s data was 17 (Extreme Fear) (1-100). CNNMoney’s Fear & Greed index looks at 7 indicators (Stock Price Momentum, Stock Price Strength, Stock Price Breadth, Put and Call Options, Junk Bond Demand, Market Volatility, and Safe Haven Demand). Keep in mind this is a contrarian indicator! REF: Fear&Greed via CNNMoney

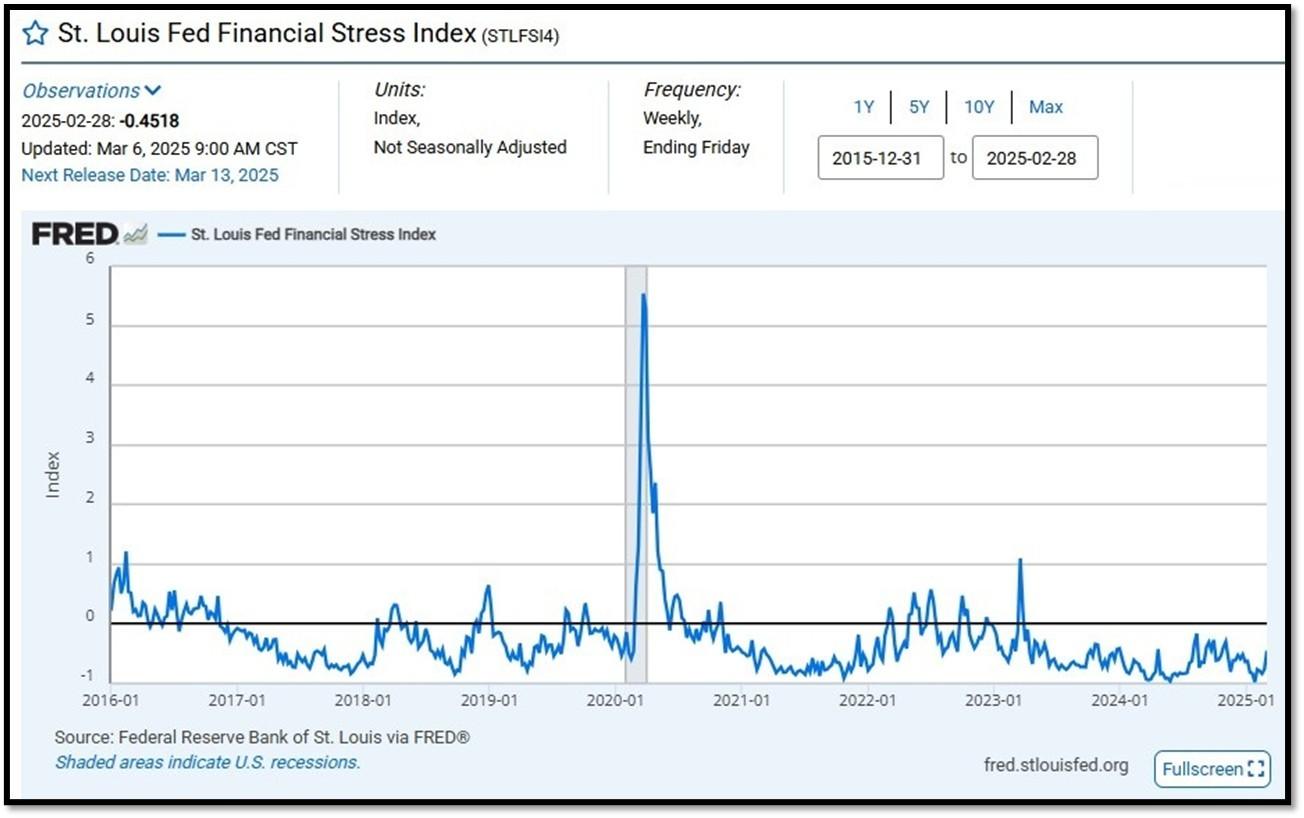

5B. St. Louis Fed Financial Stress Index’s (STLFSI4) most recent read is at –0.4518 as of March 6, 2025. Previous week’s data was -0.7601. A big spike up from previous readings reflecting the turmoil in the banking sector back in 2023. This weekly index is not seasonally adjusted. The STLFSI4 measures the degree of financial stress in the markets and is constructed from 18 weekly data series: seven interest rate series, six yield spreads and five other indicators. Each of these variables captures some aspect of financial stress. Accordingly, as the level of financial stress in the economy changes, the data series are likely to move together. REF: St. Louis Fed

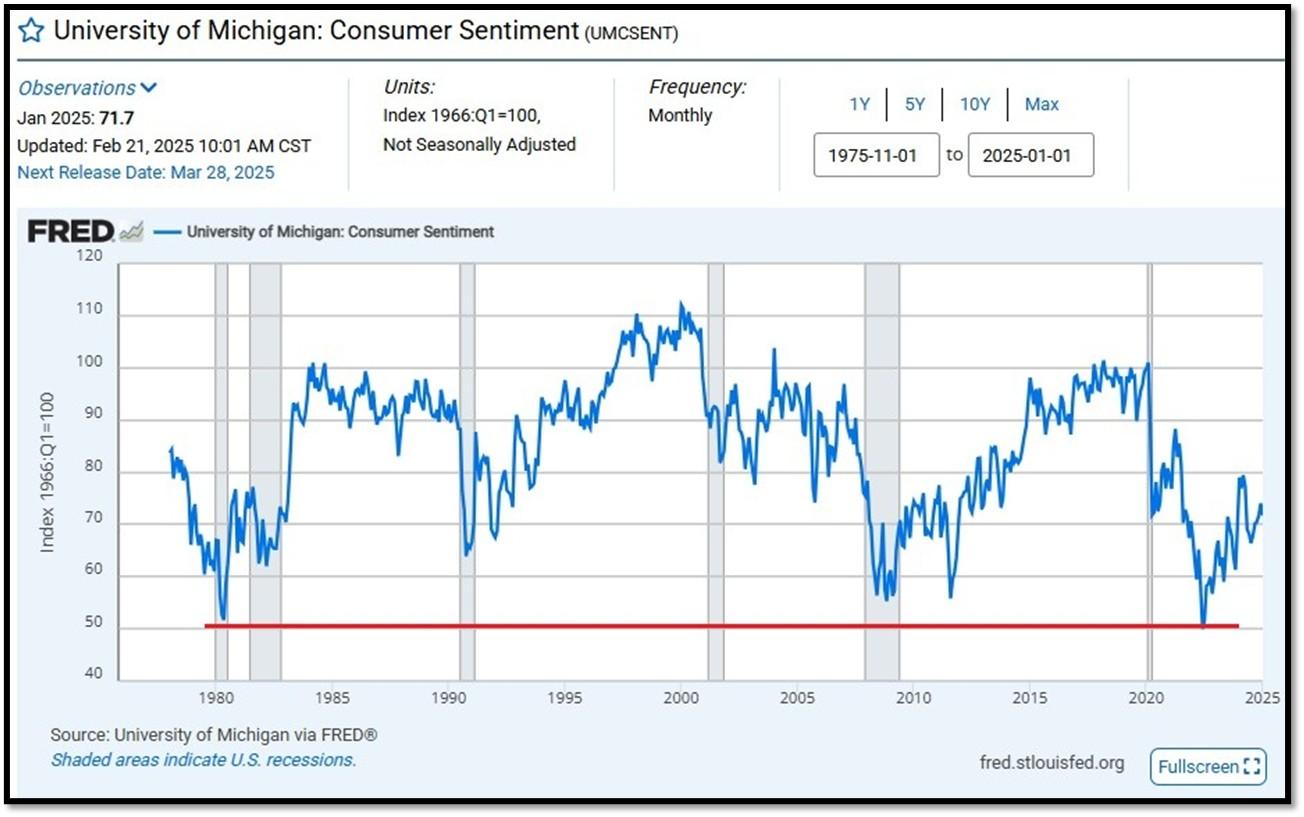

5C. University of Michigan, University of Michigan: Consumer Sentiment for January [UMCSENT] at 71.7, retrieved from FRED, Federal Reserve Bank of St. Louis, February 21, 2025. Back in June 2022, Consumer Sentiment hit a low point going back to April 1980. REF: UofM

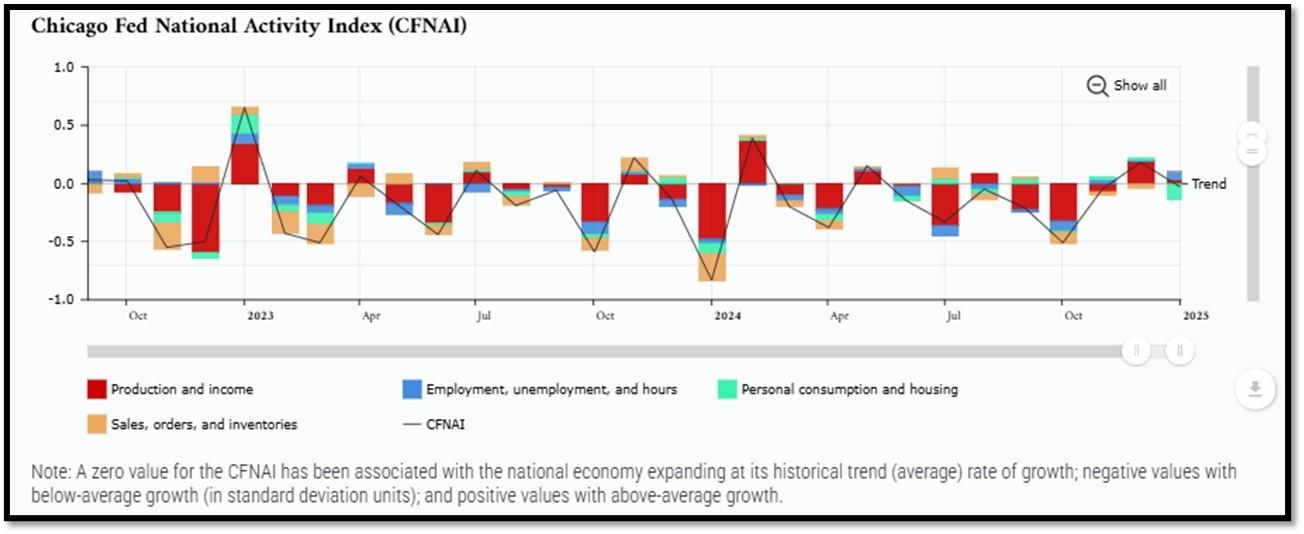

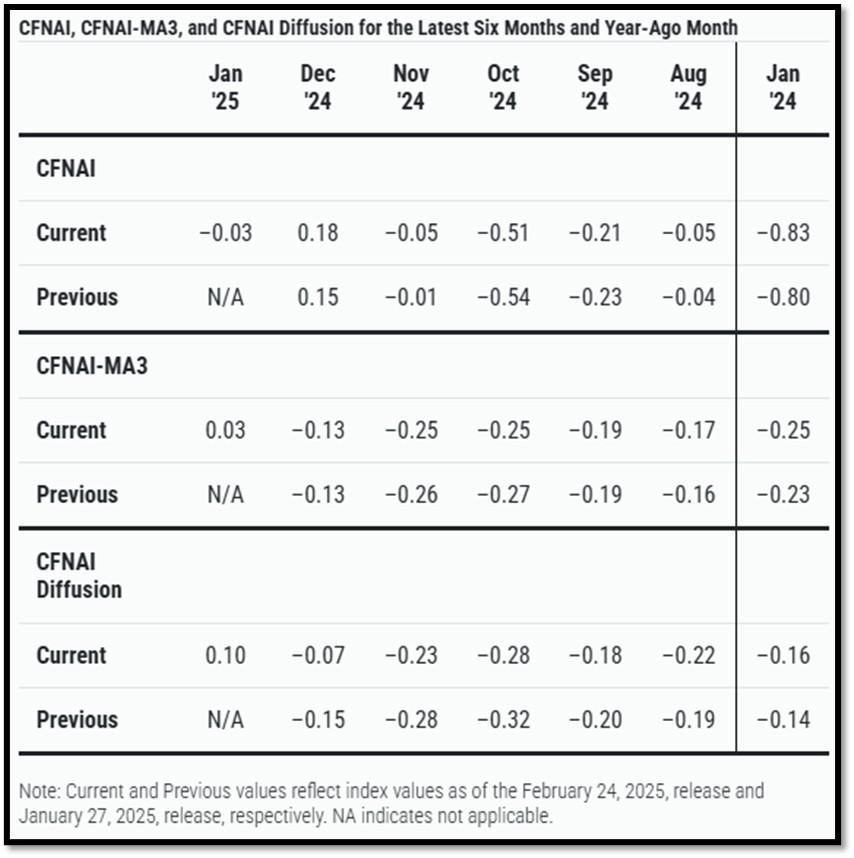

5D. The Chicago Fed National Activity Index (CFNAI) decreased to –0.03 in January from +0.18 in December. Two of the four broad categories of indicators used to construct the index decreased from December, and one category made a negative contribution in January. The index’s three-month moving average, CFNAI-MA3, increased to +0.03 in January from –0.13 in December. REF: ChicagoFed, January’s Report

5E. (2/20/2025) The Conference Board Leading Economic Index (LEI) for the US fell by 0.3% in January 2025 to 101.5 (2016=100), after a 0.1% increase in December 2024 (upwardly revised from an initially estimated decline of 0.1%). Overall, the LEI recorded a 0.9% decline in the six-month period ending January 2025, much less than its 1.7% decline over the previous six months. The composite economic indexes are the key elements in an analytic system designed to signal peaks and troughs in the business cycle. The indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component. The CEI is highly correlated with real GDP. The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. Shaded areas denote recession periods or economic contractions. The dates above the shaded areas show the chronology of peaks and troughs in the business cycle. The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers’ new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers’ new orders for nondefense capital goods excluding aircraft orders; Building permits for new private housing units; S&P 500® Index of Stock Prices; Leading Credit Index™; Interest rate spread (10-year Treasury bonds less federal funds rate); Average consumer expectations for business conditions. REF: ConferenceBoard, LEI Report for January (Released on 3/2/2025)

We have experienced a “rolling recession” since June 2022 and are only now emerging from it. However, authorities are not labeling it a recession due to high employment data.

5F. Probability of U.S. falling into Recession within 3 to 4 months is currently at 32.85% (with data as of 03/10/2025 – Next Report 03/24/2025) according to RecessionAlert Research. Last release’s data was at 27.33%. This report is updated every two weeks. REF: RecessionAlertResearch

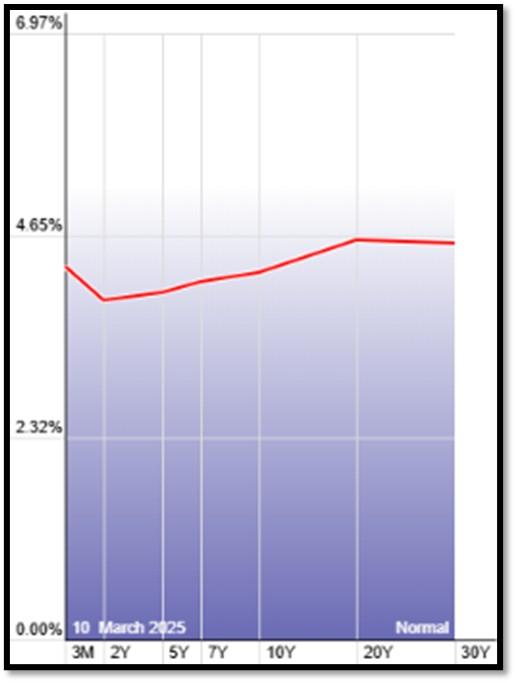

5G. Yield Curve as of 3/10/2025 is showing Normal. Spread on the 10-yr Treasury Yield (4.18%) minus yield on the 2-yr Treasury Yield (3.86%) is currently at 32 bps. REF: Stockcharts The yield curve—specifically, the spread between the interest rates on the ten-year Treasury note and the three-month Treasury bill—is a valuable forecasting tool. It is simple to use and significantly outperforms other financial and macroeconomic indicators in predicting recessions two to six quarters ahead. REF: NYFED

5H. Recent Yields in 10-Year Government Bonds. REF: Source is from Bloomberg.com, dated 3/10/2025, rates shown below are as of 3/10/2025, subject to change.

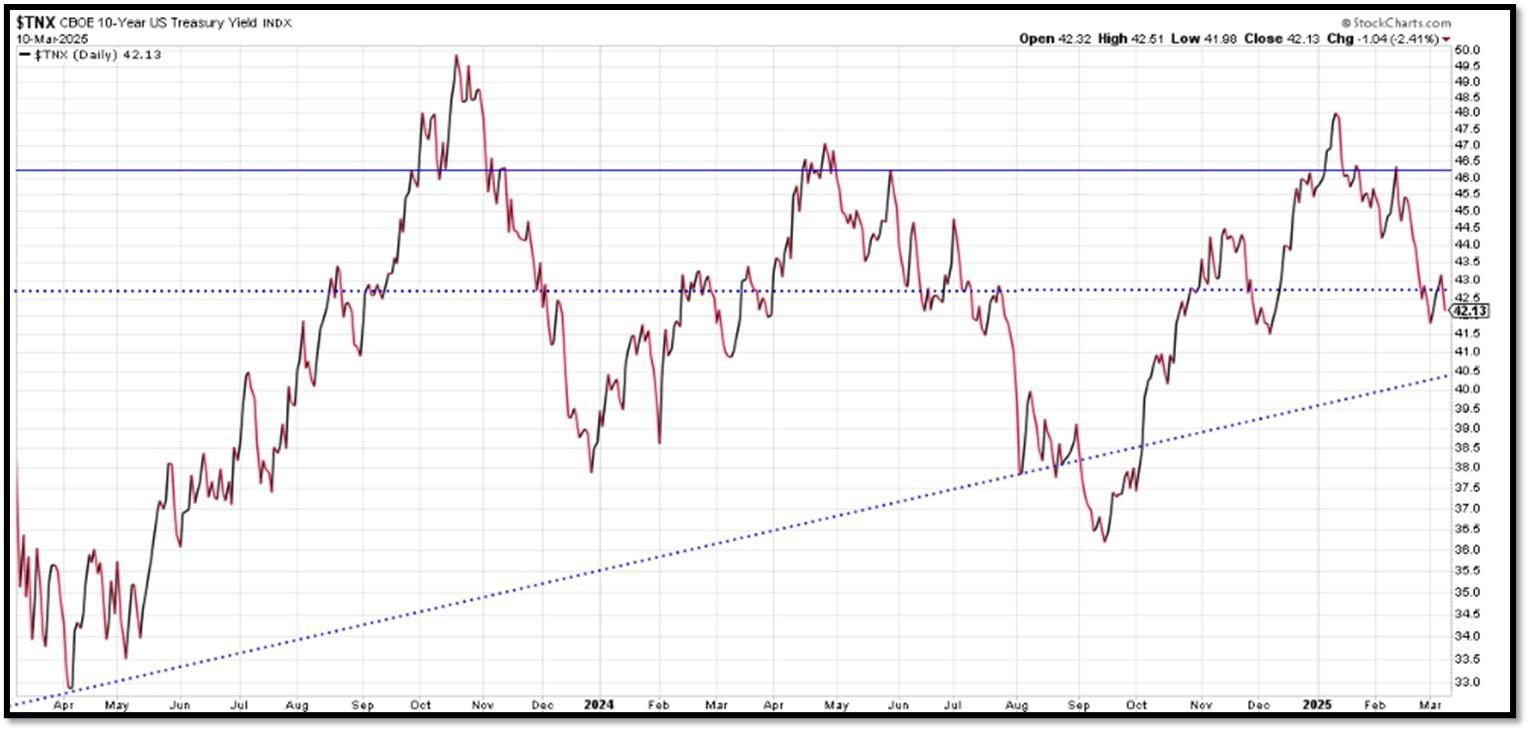

The 10-Year US Treasury Yield… The 10-Year Yield is indirectly related to inflation. I expect the 10-Year Yield to drop further as dis-inflation kicks in. REF: StockCharts1, StockCharts2

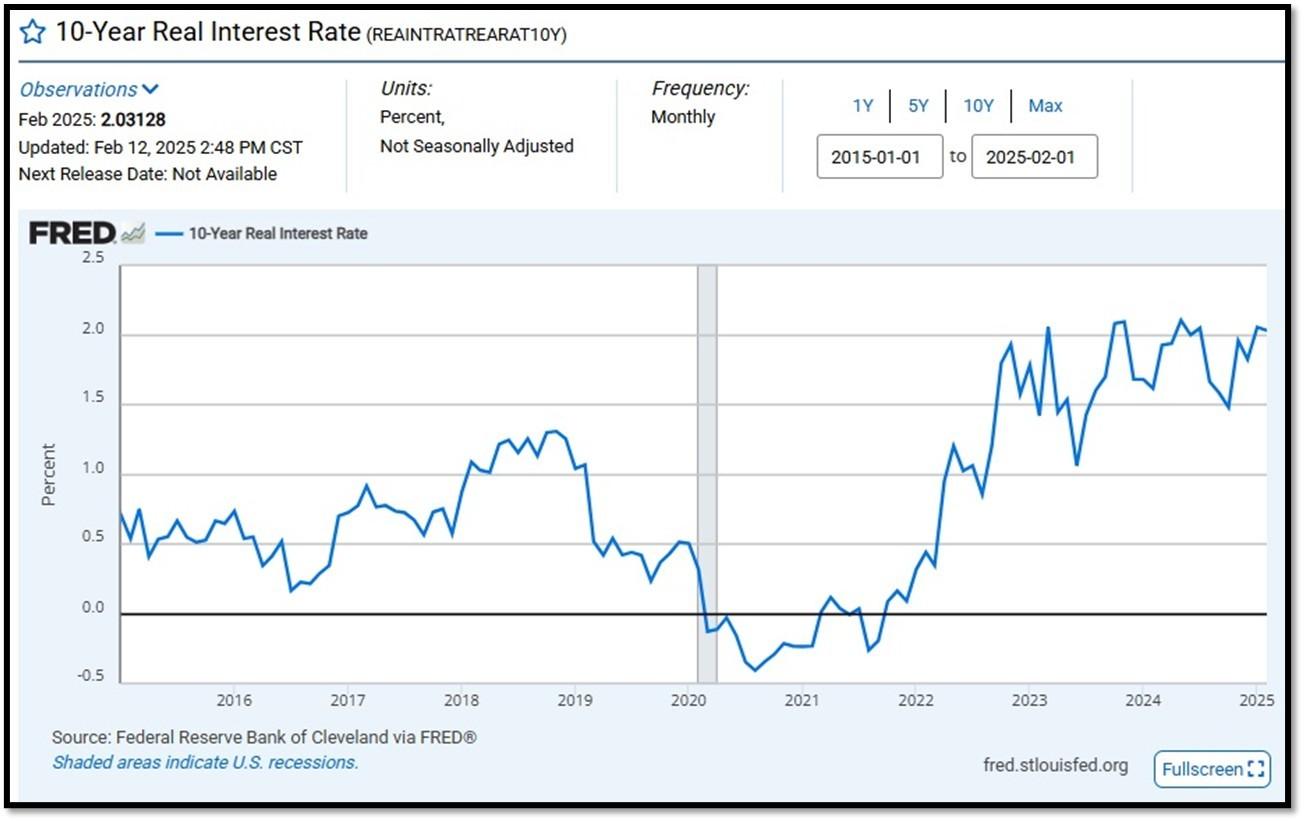

10-Year Real Interest Rate at 2.03128% as of 2/12/25. REF: REAINTRATREARAT10Y

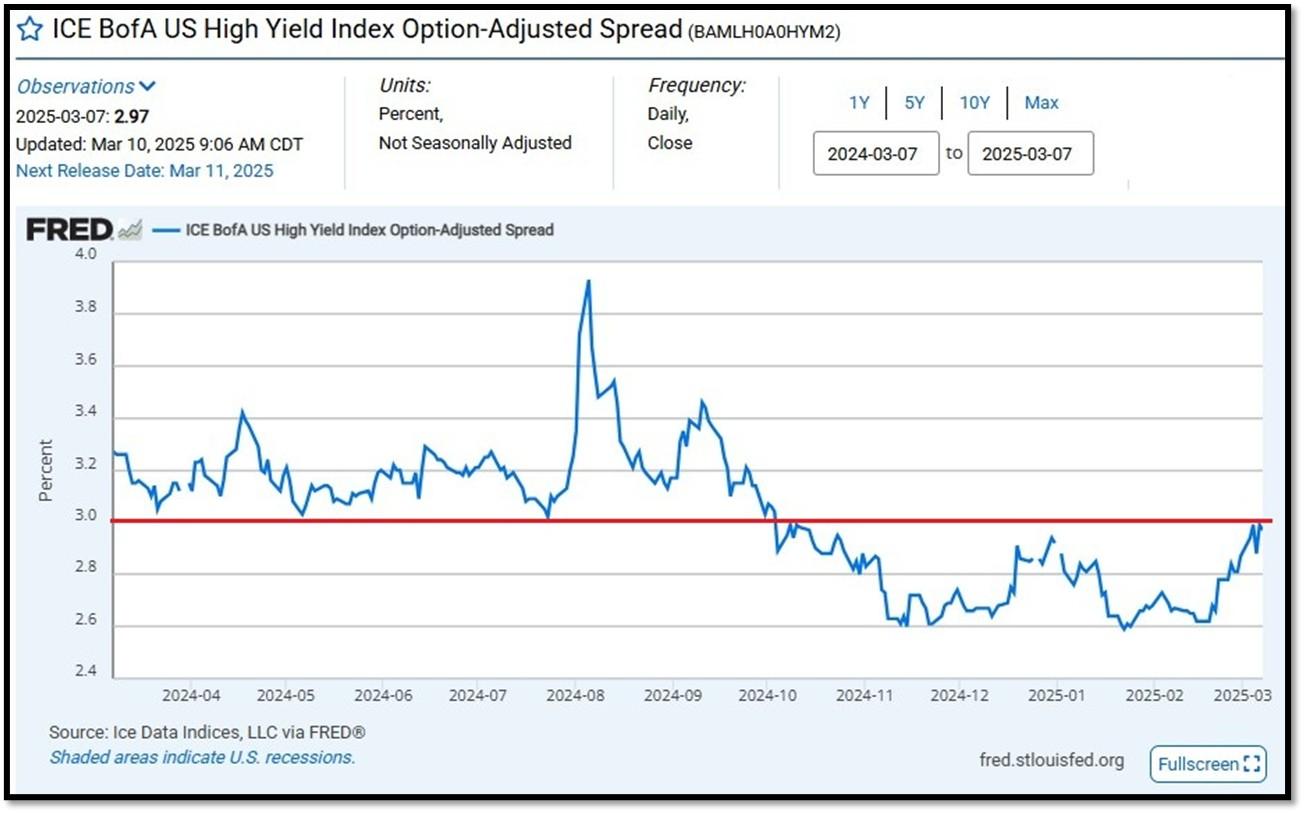

ICE BofA US High Yield Index Option-Adjusted Spread (BAMLH0A0HYM2) currently at 2.97 as of March 10, 2025. This is a key indicator of market sentiment, particularly regarding risk and economic health. At its core, the spread reflects the extra return investors demand to hold riskier corporate debt over safer government securities. High-yield bonds are issued by companies with lower credit ratings (below investment grade, like BB or lower), meaning they carry a higher chance of default. The spread compensates for this risk. When the spread is narrow—say, around 2.5% to 3%, as seen recently—it suggests investors are confident, willing to accept less extra yield because they perceive lower default risk or a strong economy. Narrow spreads often align with bullish markets, where cash is flowing, growth is steady, and fear is low. REF: FRED-BAMLH0A0HYM2

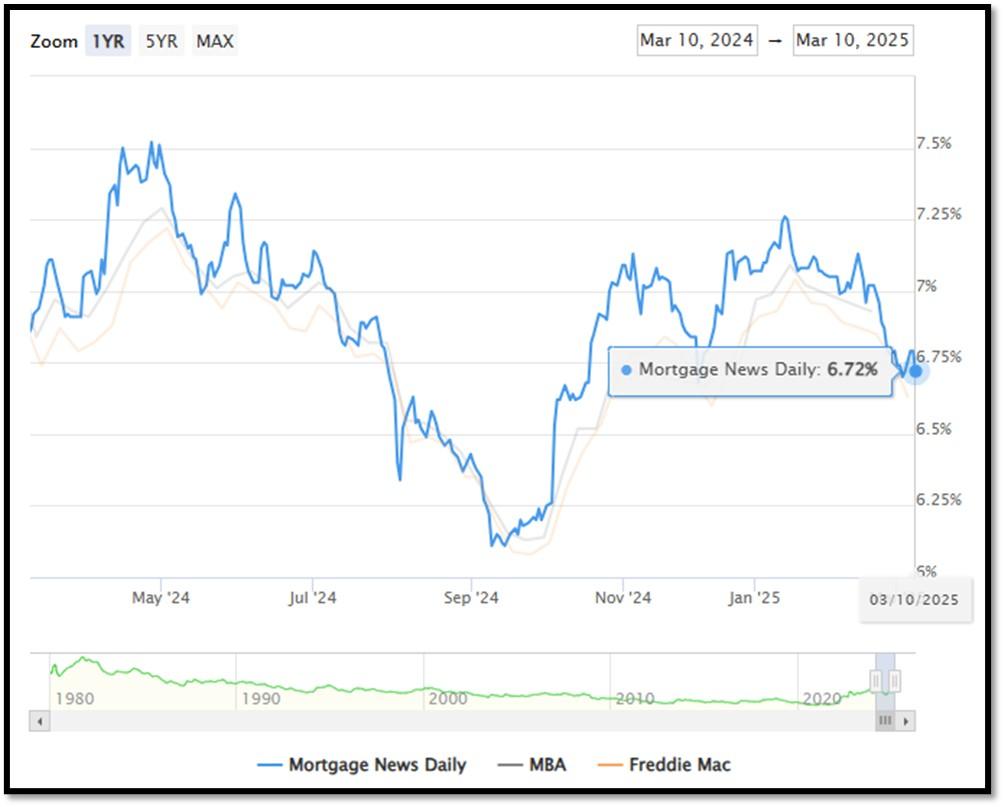

5I. (3/10/2025) Today’s National Average 30-Year Fixed Mortgage Rate is 6.72% (All Time High was 8.03% on 10/19/23). Last week’s data was 6.74%. This rate is the average 30-year fixed mortgage rates from several different surveys including Mortgage News Daily (daily index), Freddie Mac (weekly survey), Mortgage Bankers Association (weekly survey) and FHFA (monthly survey). REF: MortgageNewsDaily, Today’s Average Rate

The recent spike in the 30-year fixed-rate jumbo mortgage to 6.72%, compared to Freddie Mac’s rate at 6.63% and the Mortgage Bankers Association (MBA) rate at 6.93%, highlights key differences in the mortgage market. Jumbo mortgages, which exceed the conforming loan limits set by government agencies like Freddie Mac, typically carry higher interest rates because they are riskier for lenders. These loans are not backed by government entities, which increases the risk for lenders and, consequently, leads to higher rates. In contrast, Freddie Mac and MBA provide averages for conforming loans, which meet federal guidelines and have lower risk due to government backing, keeping their rates lower.

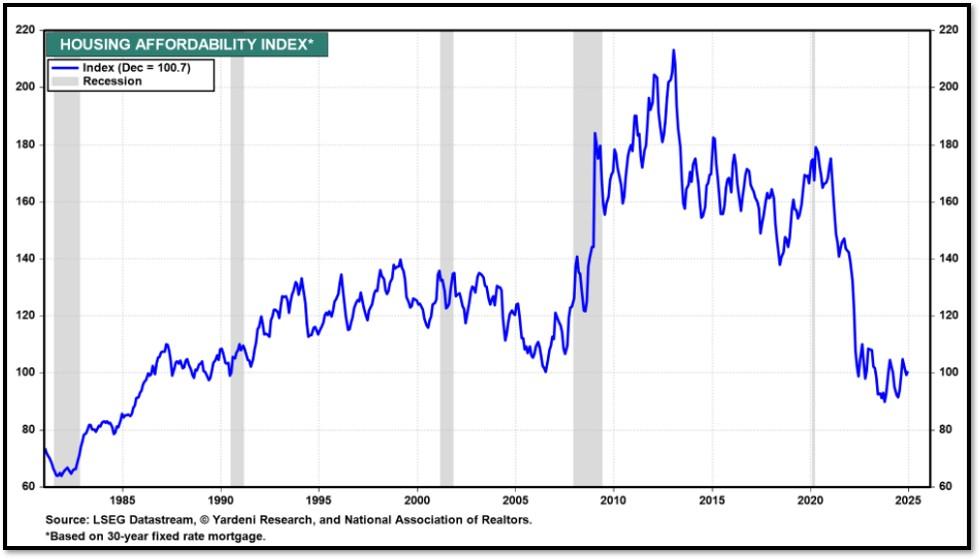

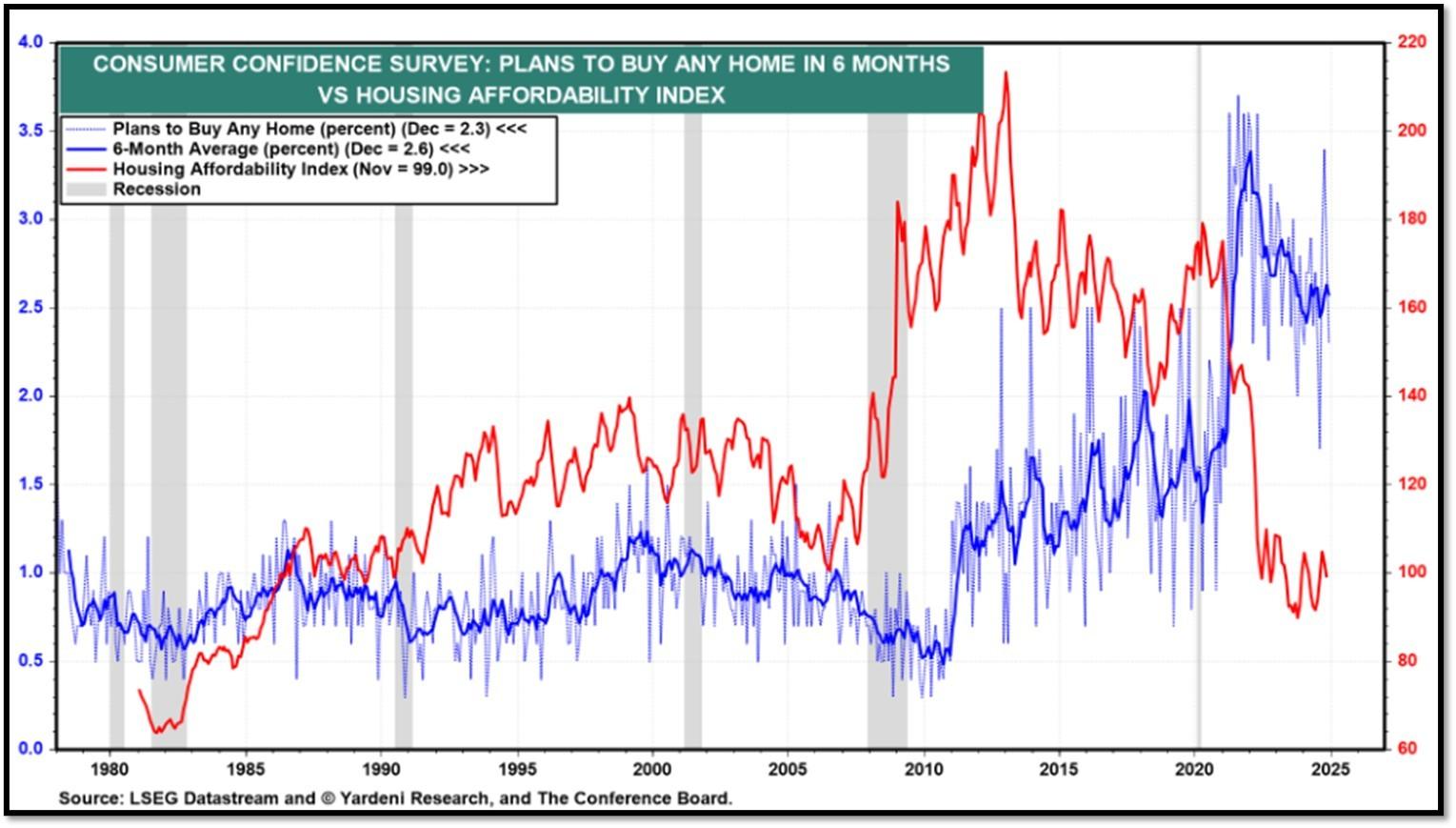

(2/10/25) Housing Affordability Index for Dec = 100.7 // Nov = 99 // Oct = 102.3 // Sep = 105.5 // Aug = 98.6 // July = 95 // June = 93.3 // May = 93.1 // April = 95.9 // March = 101.1 // February = 103.0. Data provided by Yardeni Research. REF: Yardeni

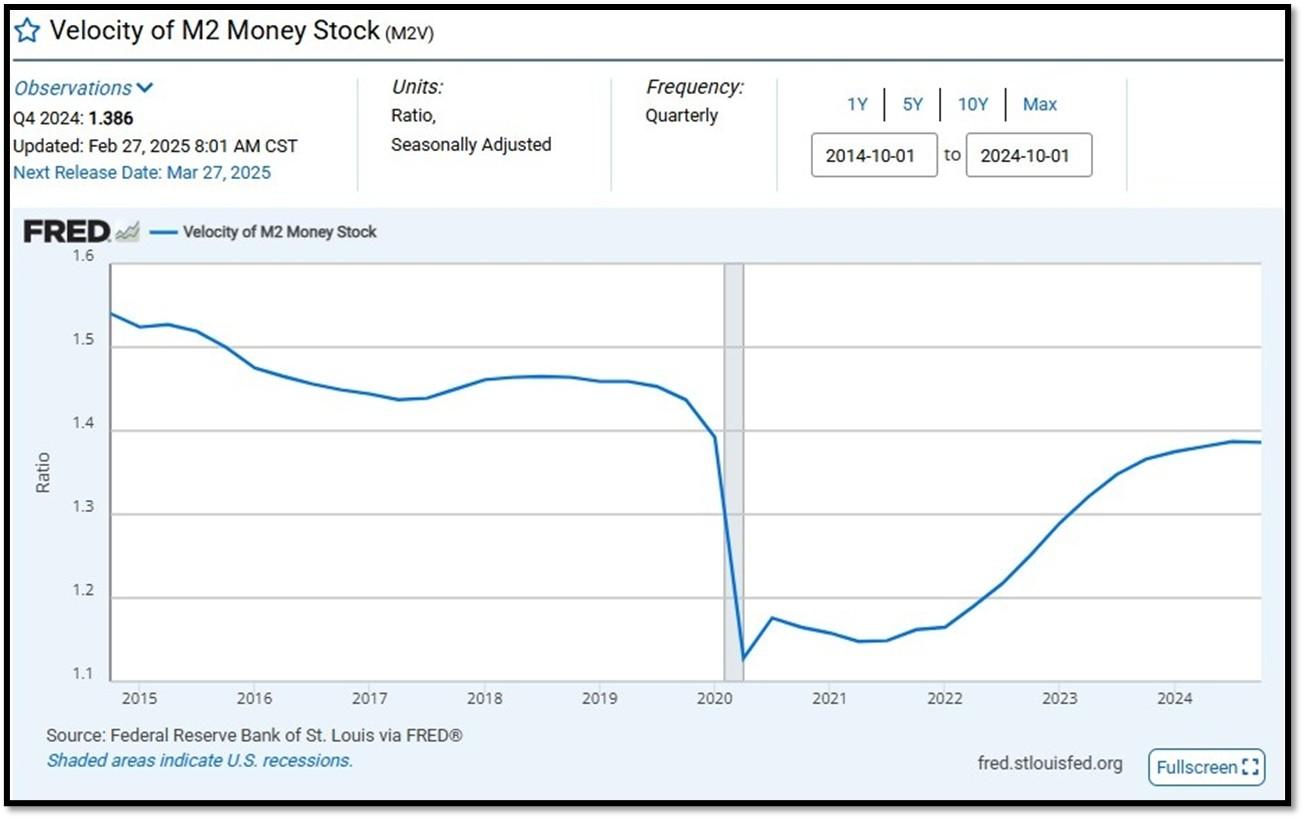

5J. Velocity of M2 Money Stock (M2V) with current read at 1.386 as of (Q4-2024 updated 2/27/2025). Previous quarter’s data was 1.390. The velocity of money is the frequency at which one unit of currency is used to purchase domestically- produced goods and services within a given time period. In other words, it is the number of times one dollar is spent to buy goods and services per unit of time. If the velocity of money is increasing, then more transactions are occurring between individuals in an economy. Current Money Stock (M2) report can be viewed in the reference link. REF: St.LouisFed-M2V

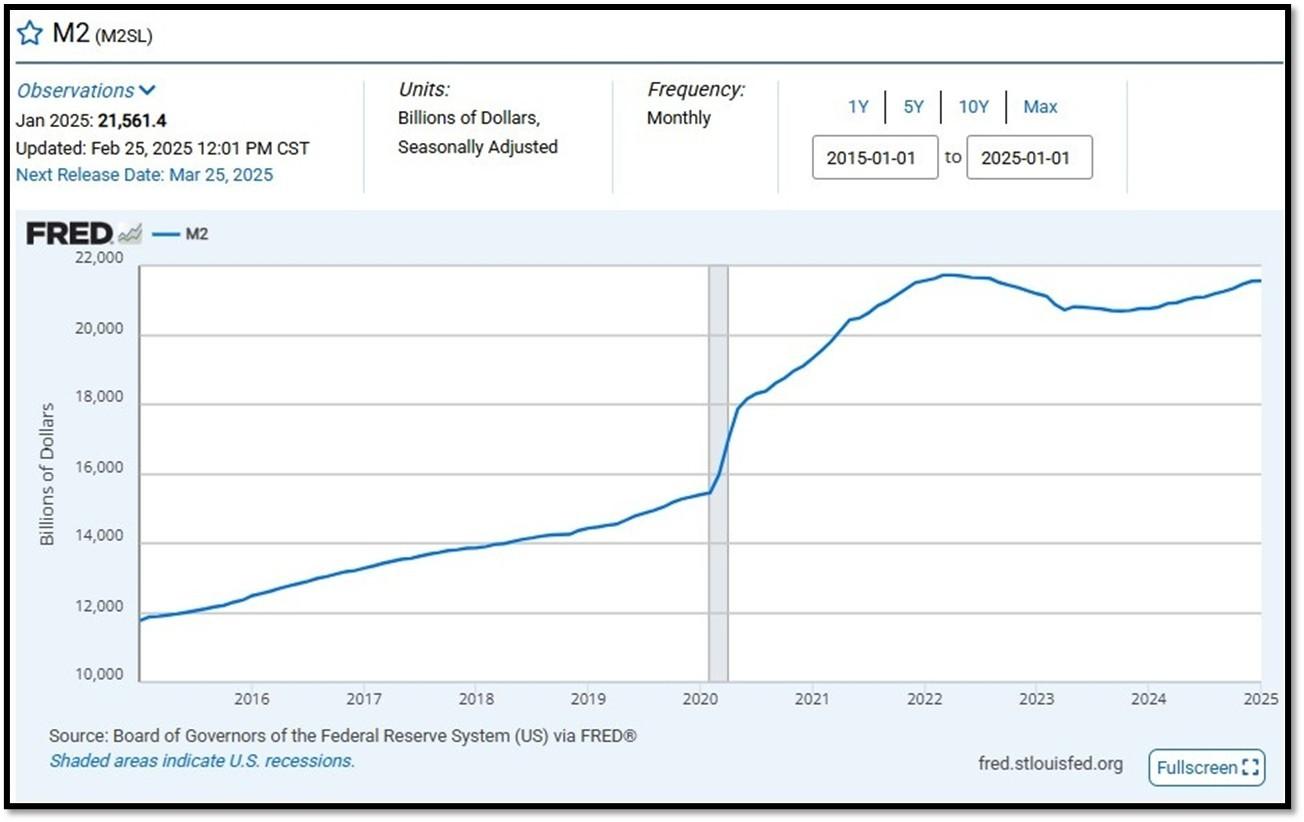

M2 consists of M1 plus (1) small-denomination time deposits (time deposits in amounts of less than $100,000) less IRA and Keogh balances at depository institutions; and (2) balances in retail MMFs less IRA and Keogh balances at MMFs. Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1. Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; Updated on February 25, 2025. REF: St.LouisFed-M2

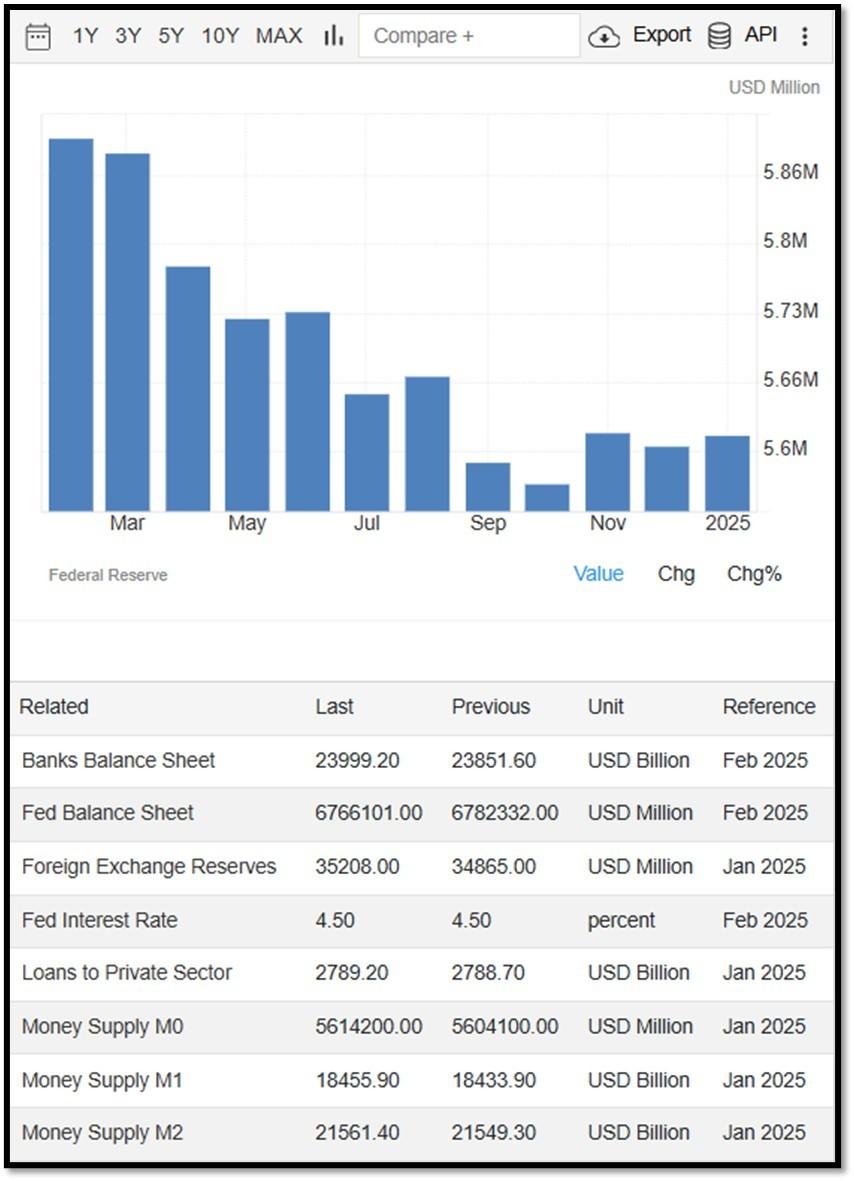

Money Supply M0 in the United States increased to 5,614,200 USD Million in January from 5,604,100 USD Million in December of 2024. Money Supply M0 in the United States averaged 1,171,888.65 USD Million from 1959 until 2025, reaching an all-time high of 6,413,100.00 USD Million in December of 2021 and a record low of 48,400.00 USD Million in February of 1961. REF: TradingEconomics, M0

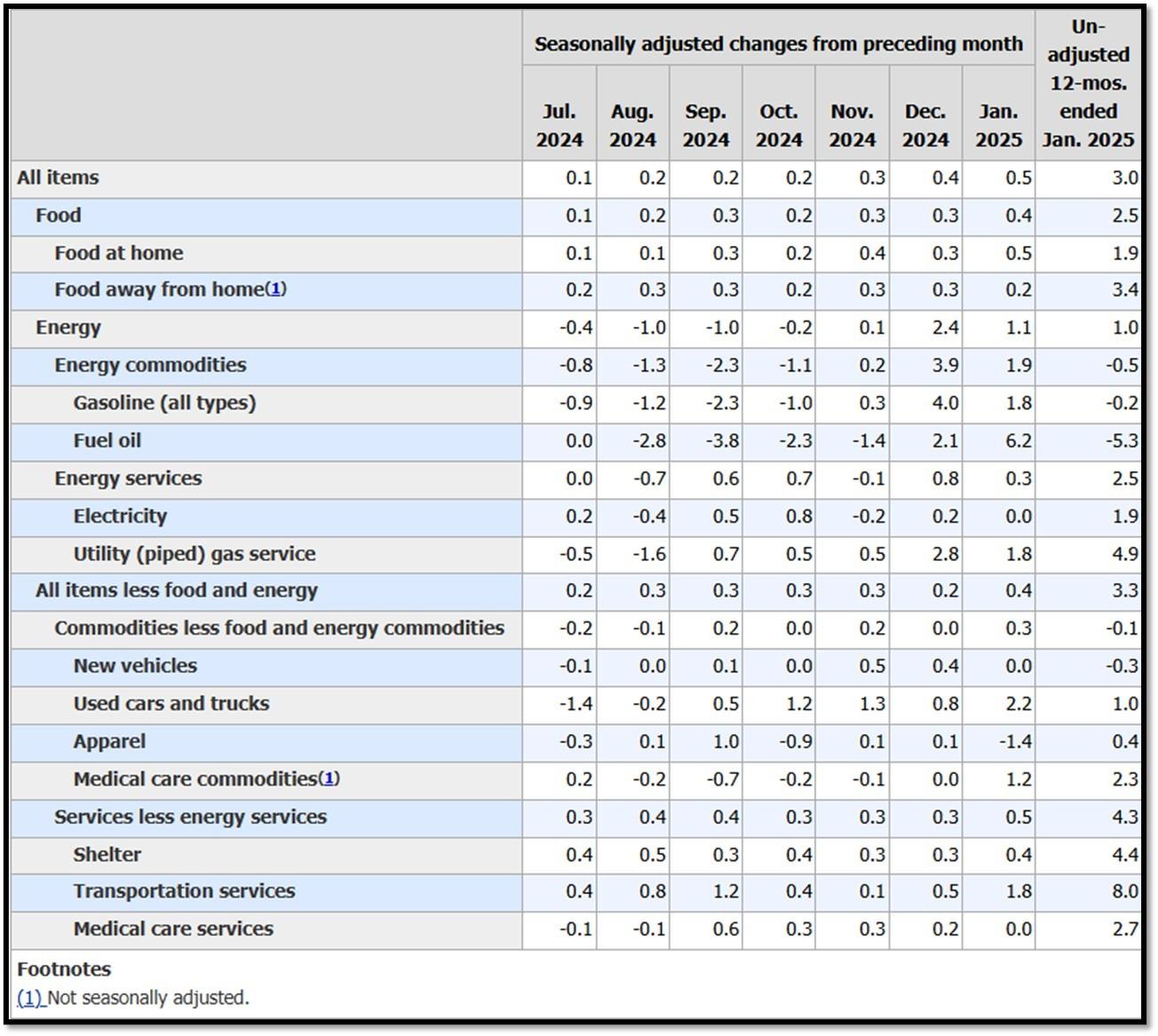

5K. In January, the Consumer Price Index for All Urban Consumers rose 0.5 percent, seasonally adjusted, and rose 3.0 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.4 percent in January (SA); up 3.3 percent over the year (NSA). February 2025 CPI data are scheduled to be released on March 12, 2025, at 8:30AM-ET. REF: BLS, BLS.GOV

5L. Technical Analysis of the S&P500 Index. Click onto reference links below for images.

- Short-term Chart: Trend Neutral to Bearish on 3/10/2025 – REF: Short-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Medium-term Chart: Trend Less Bullish on 3/10/2025 – REF: Medium-term S&P500 Chart by Marc Slavin (Click Here to Access Chart)

- Market Timing Indicators – S&P500 Index as of 3/10/2025 – REF: S&P500 Charts (7 of them) by Joanne Klein’s Top 7 (Click Here to Access Updated Charts)

- A well-defined uptrend channel shown in green with S&P500 still on up trend. REF: Stockcharts

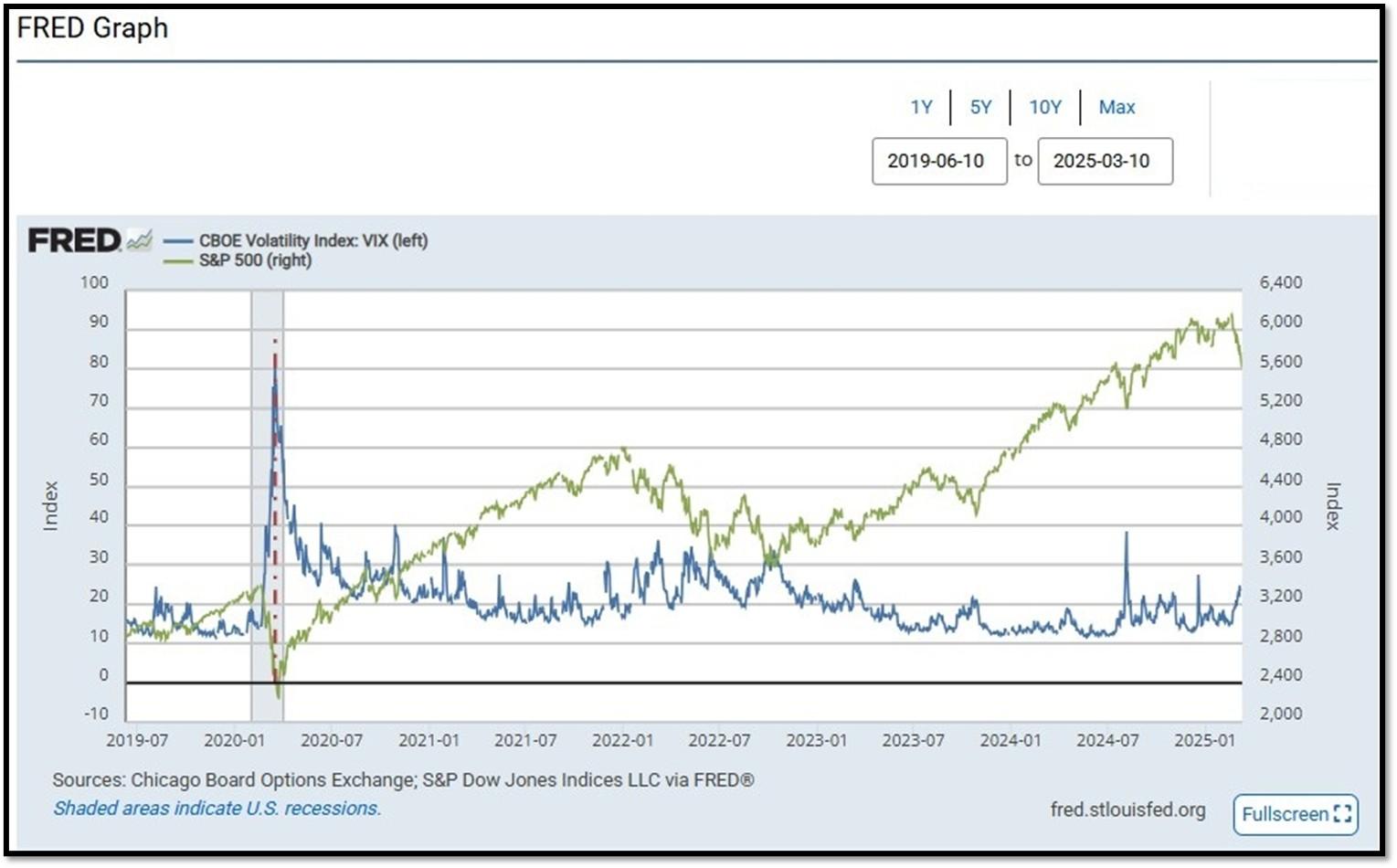

- S&P500 and CBOE Volatility Index (VIX) as of 3/10/2025. REF: FRED, Today’s Print

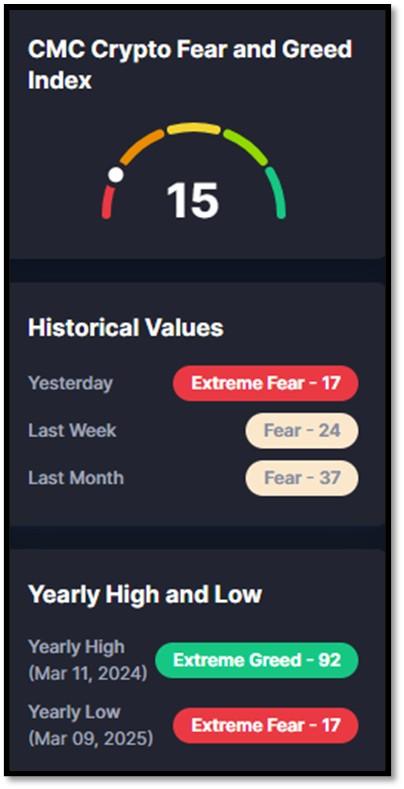

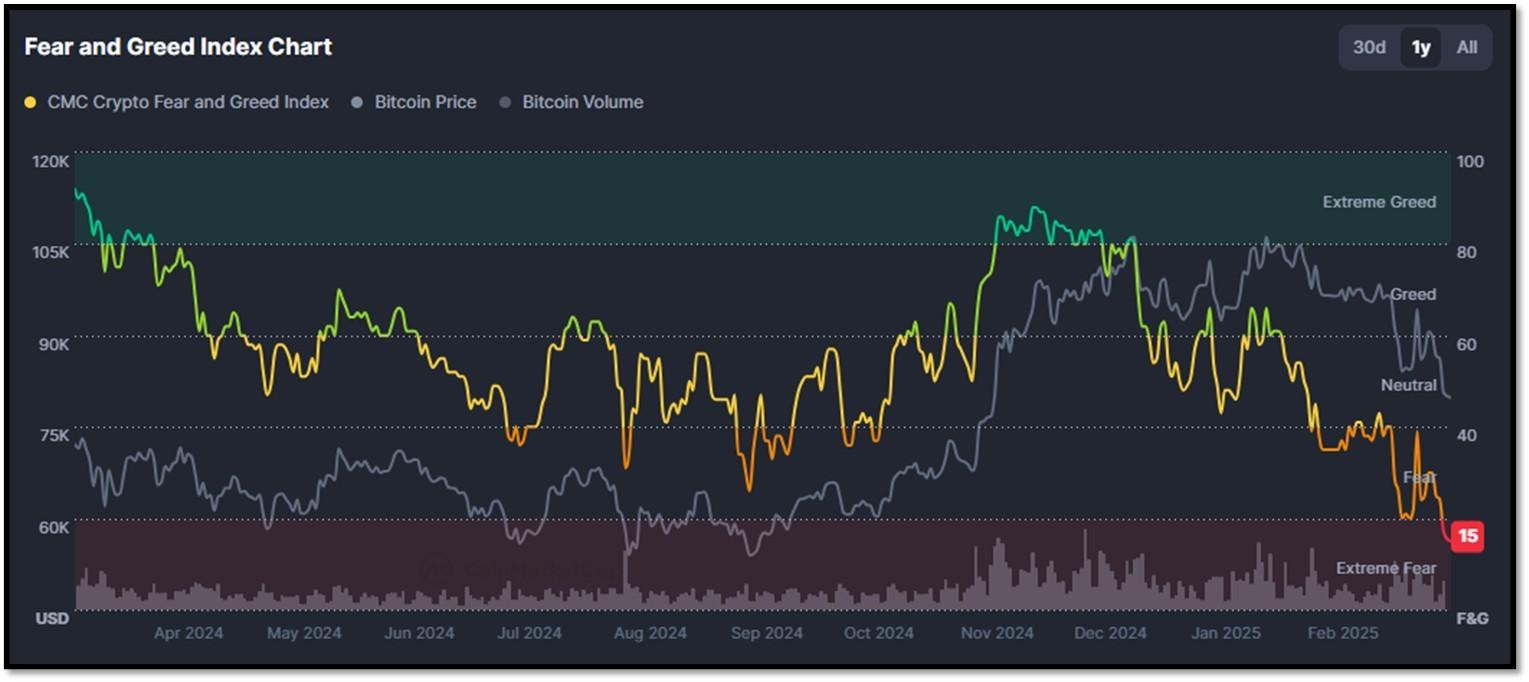

5M. Most recent read on the Crypto Fear & Greed Index with data as of 3/11/2025 is 24 (Fear). Last week’s data was 29 (Fear) (1-100). Fear & Greed Index – A Contrarian Data. The crypto market behavior is very emotional. People tend to get greedy when the market is rising which results in FOMO (Fear of missing out). Also, people often sell their coins in irrational reaction of seeing red numbers. With the Crypto Fear and Greed Index, the data try to help save investors from their own emotional overreactions. There are two simple assumptions:

- Extreme fear can be a sign that investors are too worried. That could be a buying opportunity.

- When Investors are getting too greedy, that means the market is due for a correction.

Therefore, the program for this index analyzes the current sentiment of the Bitcoin market and crunch the numbers into a simple meter from 0 to 100. Zero means “Extreme Fear”, while 100 means “Extreme Greed”. REF: Coinmarketcap.com, Today’sReading

Bitcoin – 10-Year & 2-Year Charts. REF: Stockcharts10Y, Stockcharts2Y

Len writes much of his own content, and also shares helpful content from other trusted providers like Turner Financial Group (TFG).

The material contained herein is intended as a general market commentary, solely for informational purposes and is not intended to make an offer or solicitation for the sale or purchase of any securities. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. This information is not intended as a specific offer of investment services by Dedicated Financial and Turner Financial Group, Inc.

Dedicated Financial and Turner Financial Group, Inc., do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.

Any hyperlinks in this document that connect to Web Sites maintained by third parties are provided for convenience only. Turner Financial Group, Inc. has not verified the accuracy of any information contained within the links and the provision of such links does not constitute a recommendation or endorsement of the company or the content by Dedicated Financial or Turner Financial Group, Inc. The prices/quotes/statistics referenced herein have been obtained from sources verified to be reliable for their accuracy or completeness and may be subject to change.

Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. The views and strategies described herein may not be suitable for all investors. To the extent referenced herein, real estate, hedge funds, and other private investments can present significant risks, including loss of the original amount invested. All indexes are unmanaged, and an individual cannot invest directly in an index. Index returns do not include fees or expenses.

Turner Financial Group, Inc. is an Investment Adviser registered with the United States Securities and Exchange Commission however, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Additional information about Turner Financial Group, Inc. is also available at www.adviserinfo.sec.gov. Advisory services are only offered to clients or prospective clients where Turner Financial Group, Inc. and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Turner Financial Group, Inc. unless a client service agreement is in place.